A victory for bitcoin

Conclusions communicated by Forbes Contributors are their own.

While Bitcoin remains profoundly theoretical – I figure it can keep on strengthening from here. Bitcoin is volatile to the point that I need to repeat my conviction that it just has a place in your portfolio as a feature of your exceptionally theoretical distribution (connect). I additionally think it merits inspecting my 3 Rules of Bitcoin (connect).

The bullish case is that Bitcoin survived the current bearish case so well.

Bitcoin Intraday Prices Since the China ''Crackdown'

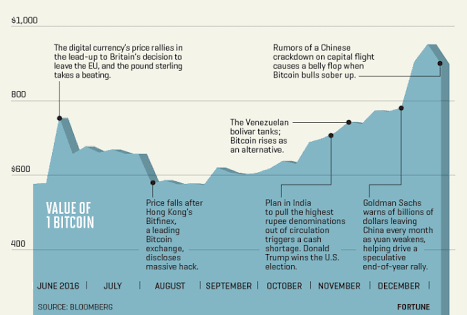

Back on September fifteenth it appeared to me as if China, as well as various open figures were endeavoring to get serious about Bitcoin (interface). It was fruitful at to begin with, as Bitcoin proceeded with its decay, dropping from over $5,000 to as low as $3,000. Bitcoin has bounced back pointedly from that point forward.

The 'evangelists' of bitcoin contend that the reality it isn't controlled by governments is correctly why you should claim it. Bitcoin is intended to be work outside of the domain of national banks and governments. Bitcoin appears to have explored this current crackdown with extraordinary achievement.

By breezing through the current test soundly, Bitcoin ought to pull in some new financial specialists. There are numerous speculators who have watched the rally in digital currencies from the sidelines since they have worries about the capacity of cryptographic forms of money to convey as publicized. It appears to be likely that some of these financial specialists will plunge their toe in the water now - making new interest for digital currencies in the close term. This extra new request should help keep costs rising. In the event that there were simpler routes for 'standard' speculators to get engaged with Bitcoin (like ETFs) the rally would be much more grounded.

.png)

The critic in me, needs to bring up that many individuals have solid motivators to prop up the cost of Bitcoin. Bitcoin mineworkers, specifically, ring a bell. Bitcoin mining stays extremely productive at these costs. In our current reality where there are no tenets (Rule #2 of my 3 Rules of Bitcoin) we need to look at that as some of this bounce back might be driven by the individuals who have the most to pick up. That impetus and danger of control is dependably an issue in daintily exchanged markets, however I think it is a significantly more noteworthy worry in the occasionally dim universe of digital forms of money.

@mrainp420 has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowpond on all your posts, simply FOLLOW @minnowpond. To be Resteemed to 4k+ followers and upvoted heavier send 0.25SBD to @minnowpond with your posts url as the memo

Ok

Upvoted you