What Would Happen if Singapore Regulates Bitcoin?

At a gathering, Ravi Menon, the overseeing executive of the Monetary Authority of Singapore (MAS), the nation's national bank, expressed that the nation does not expect to direct bitcoin and the cryptographic money showcase for the time being.

Generally, Menon had an indistinguishable conclusion from European Central Bank (ECB) President Mario Draghi, who as CCN revealed, clarified that the ECB isn't arranging administrative structures for the cryptographic money showcase starting at yet. Draghi underscored that the ECB trusts the bitcoin showcase needs to develop for the organization to consider controlling it.

Menon expressed:

"We've adopted the strategy that the cash itself does not represent the hazard that warrants direction. Cryptocurrencies are frequently manhandled for unlawful financing purposes, so we would like to have AML/CFT controls set up. So those necessities apply to the action around digital currency, instead of the cryptographic money itself."

In spite of the fact that Menon cleared up that there will be no strict directions for the Singaporean digital currency showcase starting at yet, he reaffirmed that the MAS will keep on being "liberal" with cryptographic forms of money and bitcoin. All the more essentially, Menon noticed that later on, if the MAS and the Singaporean government sees the need of directing the bitcoin advertise, it will give administrative structures to organizations and financial specialists.

As Menon clarified:

"Our approach is to take a gander at the action around the digital money and after that make an appraisal of what direction would be reasonable."

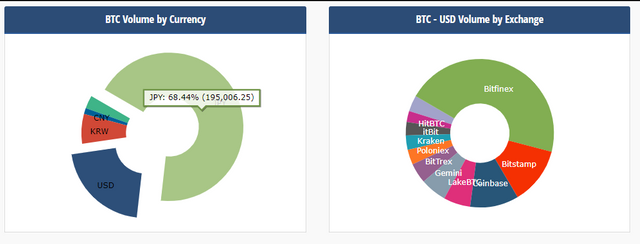

On the off chance that Singapore controls its cryptographic money and bitcoin trade markets, there exists a very likelihood that alongside Japan, Hong Kong, and South Korea, Singapore will develop into a noteworthy bitcoin advertise. Thusly, Asia will probably rise as the cryptographic money powerhouse locale, considering that Japan is responsible for no less than 68 percent of bitcoin exchanges and that the South Korean Ethereum showcase stays as the biggest Ether trade advertise on the planet.

In the long haul, if the MAS chooses to control its bitcoin showcase, the Japanese government's guide towards setting up a national program for digital money trades will in all probability be actualized. Cryptographic money trades will get licenses to work as directed budgetary specialist co-ops and will be dealt with decently as genuine monetary organizations inside the nation.

At the point when Will Singapore Regulate Bitcoin?

Upon the burden of an across the nation restriction on cryptographic money exchanging by the Chinese government, as an official of a Hong Kong-based over-the-counter (OTC) bitcoin exchanging stage TideBit uncovered, an extensive number of dealers moved from the Chinese market to neighboring markets, for example, Hong Kong and Japan.

TideBit COO Terence Tsang expressed:

"The boycott did not prevent them [Chinese investors] from purchasing cryptographic forms of money. Over the most recent couple of weeks, we have seen a ton of terrain clients opening up accounts at TideBit. Despite everything they need to play the diversion. I see a developing need in that they will come to Hong Kong or Singapore to purchase digital currency," he said.

Later on, if the Singaporean government controls its bitcoin advertise, there exists a high likelihood that brokers from locales like China and Russia with questionable bitcoin directions will relocate to the Singaporean market to exchange and utilize bitcoin. Furthermore, driving bitcoin organizations, for example, India's second biggest bitcoin trade ZebPay are as of now situated in Singapore, because of the nation's well disposed controls for new companies.

nice post

go Singapore!