markets-update-crypto-values-drop-to-lower-vantage-points

The price of cryptocurrencies across all markets has been dropping in value quite a bit over the past 48 hours. BTC/USD markets started tumbling on March 5, after the price reached a high of $11,650 during the evening trading sessions. Following the peak, the value dropped to $10,600 on March 6 losing $1,000 in value. Further, the next day on March 7 after the U.S. Securities and Exchange Commission (SEC) warned about unlawful trading platforms, BTC/USD values slid once again losing another 20 percent.

Cryptocurrency Markets Have Been in a Downward Slump

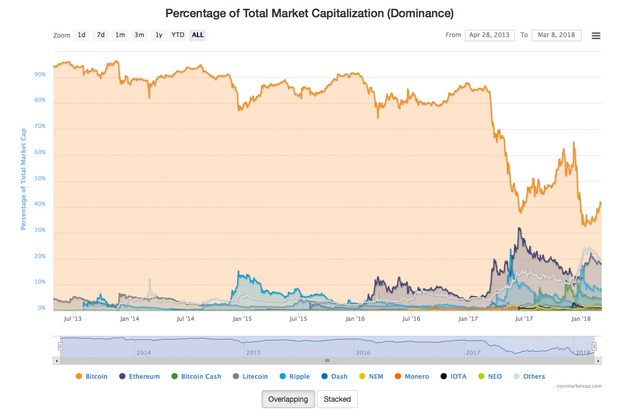

Cryptocurrencies have lost some fiat value over the past few days as the entire market of over 1,500 digital assets has shaved billions off the overall market capitalization. Currently, the aggregated valuation of all digital assets is roughly $400 billion at the time of publication. At the moment BTC/USD markets are averaging $9,200, after coasting along at above $9,800 a few hours ago. Volume is a touch higher than last week with $9.3Bn in 24-hour global trade volume. BTC dominance amongst all 1500 digital assets within the crypto-economy is roughly 41 percent today.

Right now the Japanese yen is still dominating global trade volumes by 48 percent. The is followed by the U.S. dollar (27%), tether (USDT 12.4%), the euro (4.9%) and the Korean won (3.8%) The euro has made a jump from fifth position to fourth, knocking out the Korean won this week. The top five exchanges trading the most BTC this week are Bitfinex, Binance, Okex, GDAX, and Upbit. The Japanese exchange Bitflyer and the European platform Bitstamp are right behind Upbit with strong volumes as well. According to Shapeshift statistics, the pair swapped the most today is ETH for BTC.

Prices earlier this morning have managed to get closer to the $10K region. But a few hours later markets dumped to $9,079 per BTC after meeting resistance.

Technical Indicators

Looking at BTC/USD charts show some consolidation is forming in this region and BTC price movements are strongly correlated with nearly every other digital asset. MACd is meandering downwards after bulls managed to bring the price closer to $10K during the March 8 morning trading sessions. However, markets have dropped to just above the $9K zone just a few hours later. RSI and Stochastic levels are below the 50.00 indicating some more consolidation and possibly some lower prices in the near future. Both Simple Moving Averages (SMA) have a large gap in between them with the longer term 200 SMA well above the 100 SMA. This means bears have a tight grip ride now and the path of resistance may continue to the downside.

Today BTC/USD market prices are averaging roughly $9,700-9,900 over the past 4-hours. At approximately 12 pm EDT BTC/USD market prices slid again to a low of $9,079.

Buying volume and order books suggest a different story and bulls could manage to move past the sudden 15 percent drop over the past three days. Resistance past the $10K mark isn’t too bad, but there is a monster-sized sell wall leading all the way up to $10,500. Past that point bulls have to still push past the resistance at $10,800, and from there it may be smoother to forge northbound. On the back side, order books show some pretty good support up until $9,300, and things start looking thinner. After the Displaced Moving Average (DMA) at $9,100 broke, a decline to the $8-8.5K range is now looking more viable.

The Top Cryptocurrency Markets In General

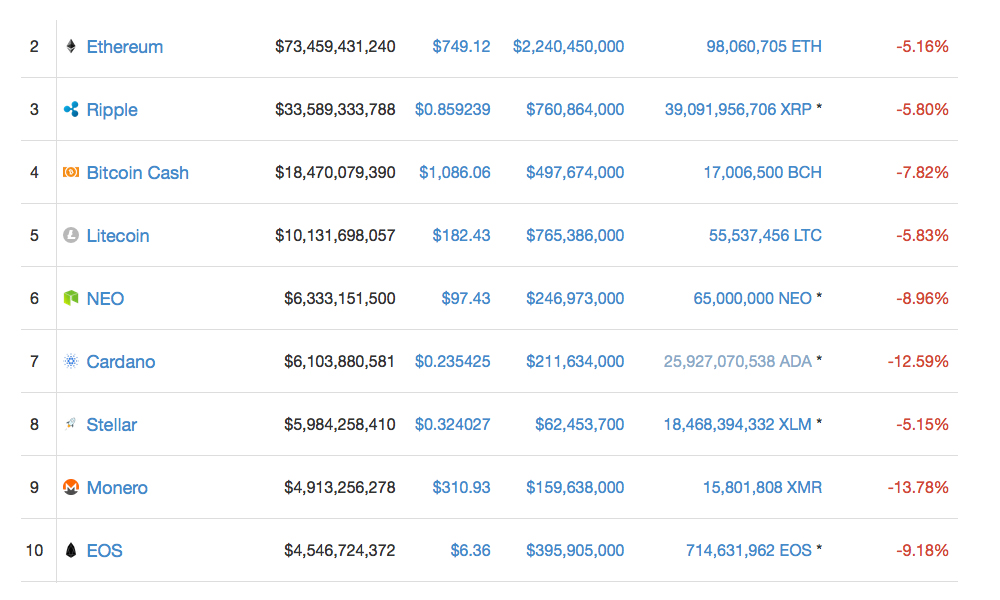

Twenty four hour volumes for the top 100 cryptocurrencies are all seeing percent losses minus four assets. Most coins are seeing losses between 2-20 percent today. Ethereum (ETH) markets are down 5 percent as one ETH is averaging $749 per token. Ripple (XRP) prices are also seeing losses, and at the moment its values are down 5.8 percent. An XRP is roughly $0.85 cents at press time and holds the fifth highest trade volumes today.

The fourth highest valued cryptocurrency market capitalization held by bitcoin cash (BCH) is seeing losses around 7.9 percent. One BCH is averaging $1,084 per coin, and its markets have the 7th highest trade volumes today. Lastly, the fifth position is occupied by litecoin, but its prices are also down 5.8 percent as one LTC is $182. Of course, the second highest trade volume during the past 48 hours of trading belongs to tether (USDT) the digital asset that holds stability with the price of USD. Tether has $3.2Bn in 24-hour volume today, and the currency is worth a penny more than a U.S. dollar due to demand.

The Verdict: Short-Term Bearish Sentiment and Uncertainty

Optimism has definitely declined considerably recently as multiple outside forces have affected the cryptocurrency ecosystem. The SEC warning about unlawful exchanges shook up markets quite a bit yesterday. Another factor shaking up market optimism is the Mt Gox trustee for the Tokyo courts who has been selling millions of dollars worth of both BTC and BCH. The community is concerned because the trustee has a lot more BTC and BCH to sell and no one knows when he is going to dump the coins on the open market. Further regulatory actions from governments all around the world have been stirring markets considerably, and crypto enthusiasts and traders are uncertain about what the nation states will do.

Where do you see the price of BTC and other digital assets heading from here? Do you think cryptocurrencies will see more gains? Let us know in the comments below.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://news.bitcoin.com/markets-update-crypto-values-drop-to-lower-vantage-points/