Atomic Wallet Enhances Security Features for Coin Sharing

The world has witnessed the rise of blockchain technology, just as it has witnessed the worst blockchain fraud case. Reportedly, at the end of first quarter this year, there were approximately 24 million blockchain wallet users worldwide. Yet, along with its popularity came its vulnerability to fraudulent activities. On 2014, Mt Gox, an exchange platform for cryptocurrencies, was hacked for the second time with over 850,000 bitcoins. On 2016, Bitfinex, one of the popular exchanges, lost 120,000 bitcoins or 72 million USD in today’s value. Just January this year, the Tokyo-based exchange, Coincheck lost 500 million NEM coins or 550 million USD as it was worth back then.

So to speak, the blockchain technology is far from being perfect, although its system features are considered more secure than the traditional financial systems. As with any other new inventions or innovations, there is always a room for improvement. In the case of crypto currency exchange platforms, an area of improvement comes in the form of Atomic Swapping and Distributed Orderbook (DOB). Proudly, the Atomic Wallet, an emerging custody-free exchange platform, is set to reshape the landscape of crypto currency transfers and exchanges.

Atomic Wallet’s Primary Feature 1: Distributed Orderbook (DOB)

Crypto currency exchange is still exposed to custody risk, since token holders generally entrust the handling of their assets to a single entity which is an exchange platform. Although the platform itself is blockchain-based, still the hackers are able to circumvent the system by manipulating the wallet addresses for instance or by disguising as token holders to enter into the exchange platform. The aforementioned historical cases of hacking are proof enough that the blockchain exchange platforms are not entirely free from fraudulent activities.

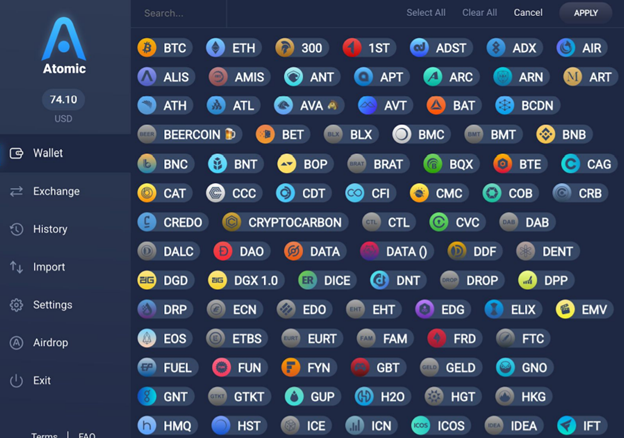

Given this shortcoming, Atomic Wallet introduces the distributed orderbook (DOB), which is essentially a distributed list of buy-and-sell orders involving various financial instruments. The interface is organized in such a way that registered users will be able to conveniently browse through the online listing. In the future, developers are foreseeing the availability of the orderbook with updated information offline.

Atomic Wallet’s orderbook is distributed across different nodes, which allows multiple verification methods and eliminates the custody-risk present in other exchange platforms. The goal of blockchain technology, after all, is complete decentralization. In other words, no single entity, blockchain-based or otherwise, should monopolize the database in order to avoid abuse or misuse of information. A centralized system is also at a higher risk for fraudulent attacks. With Atomic Wallet’s DOB, apart from distribution of orders, transparency is being practiced as well. No obligation is created when a maker places an order until there is a confirmation. Pending the confirmation, the system allows a transparent display of the order information to other interested traders, thus practicing indiscriminate trading.

Atomic Wallet’s Primary Feature 2: Atomic Swapping

Atomic Wallet levels up the conversion of one crypto coin to another via Atomic Swapping. In the present system, swapping can be a costly transaction, especially with those other exchange platforms that impose high charges. Add to that, there is the issue of wallet incompatibility if different coins are involved. Atomic Wallet not only permits seamless or frictionless swapping, but also secures the entire transactions.

The process starts when the initiator wishes to trade or swap Coin 1 for Coin 2 with another trader (called the participant) and thereafter creates a contract called the secret. The secret, containing the initiator’s desired price, is not known to any participant at this point. The participant, on the other hand, creates his own contract for Coin 2 and to do so, he needs the encryption of the initiator’s secret. While the both parties have furnished their respective contracts at this time, coin transfers are only facilitated when the defined time has expired, usually an hour or so. The fact that the swapping is dependent on time earns the term, “atomic”. This gives the participant enough allowance to redeem the initiator’s contract, and unless he does, no tokens are moved.

One reason why a participant fails to execute his part in the trade is neglect, which can be unintentional. In Atomic Wallet, it is easier to track multiple orders and their respective statuses. In this way, the incident of neglect is substantially reduced and if there are any contracts unaccepted by the other party, it can only be a conscious decision.

Again, all these swapping activities are done on a platform that makes use of a distributed orderbook, which is safer and more transparent.

Token Sale

Atomic Wallet has its own coins called the Atomic Wallet Coin or AWC. It can also be used to swap with other coins. To participate in the sale, here are the details one needs to know:

Ticker: AWC

Platform: ERC20

Total Supply: 100,000,000 AWC

Tokens for Private Sale: 35,000,000 AWC

Price: 0.3 USD

Tokens for Public Sale: 30,000,000 AWC

Soft Cap: 5,000,000 USD

Hard Cap: 22,500,000 USD

For more information and details on the project, find them by visiting their official website or reading their whitepaper. Be updated as to the current events happening during the ICO by visiting their social media pages.

Bitcointalk Thread: https://bitcointalk.org/index.php?topic=4437510.0

Website: https://atomicwallet.io/

Whitepaper: https://download.atomicwallet.io/atomicwallet-whitepaper.pdf

Telegram: https://t.me/atomicwalletchat

Facebook: https://www.facebook.com/atomicwallet

Twitter: https://twitter.com/atomicwallet

Medium: https://medium.com/@atomicwallet

Author: Instaco

Author Link: https://bitcointalk.org/index.php?action=profile;u=2050406