CBOE to list Six Bitcoin ETFs

The Chicago Board Options Exchange (CBOE) has applied with the Securities and Exchange Commission (SEC) to list six Bitcoin exchange-traded funds (ETF) as the enthusiasm around blockchain and cryptocurrency skyrockets. It wasn't too long ago that the CBOE listed it's Bitcoin futures along with it's other Chicago couterpart, the Chicago Mercantile Exchange (CME).

Here is a list of the six funds:

- First Trust Bitcoin Strategy ETF

- First Trust Inverse Bitcoin Strategy ETF

- REX Bitcoin Strategy ETF

- REX Short Bitcoin Strategy ETF

- GraniteShares Bitcoin ETF

- GraniteShares Short Bitcoin ETF

These ETFs will not only give more exposure to Bitcoin itself, but also the greater cryptosphere. Note that each of the ETF's offer downside protection: GraniteShares Short Bitcoin ETF, REX Short Bitcoin Strategy ETF, and First Trust Inverse Bitcoin Strategy ETF.

This is great for one, more institutional investors will fell comfortable moving money into cryptocurrency now that they have downside protection. Even myself now considers using this downside protection somewhere down the line to hedge against the inevitable crypto winter.

2018, Year of the Altcoin

As great as Bitcoin is, we've seen many altcoin's surpass it terms of technology and scalability. Even just looking at Litecoin, which was created in 2011 by Charlie Lee, it provides superior technology (faster block time, more transactions per second, etc.) Litecoin currently has implemented SegWit (Segregated Witness), Lighting Network, and has been testing out atomic swaps. For those wondering, atomic swaps are on-chain swaps where it is peer to peer exchange. So instead of exchanging through an exchange like Coinbase, two people can swap coins on-chain. On September 20th, 2017, Litecoin and Decred did the first on-chain atomic swap.

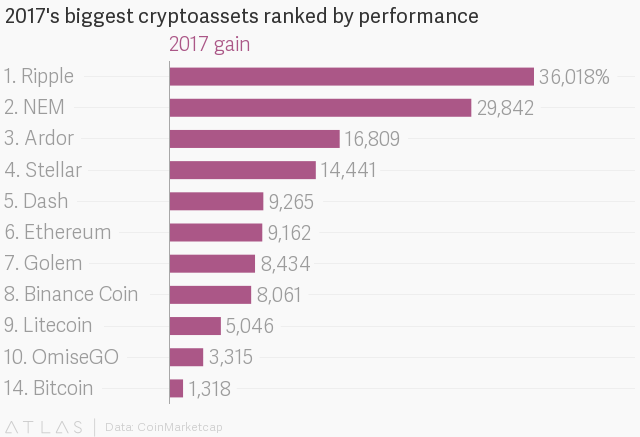

This is just one of the many examples of altcoins that do a better job as a currency and as a store of value. If you invested in Litecoin and Bitcoin at the start of 2017, there is a clear winner, Litecoin. Litecoin provided a 5,000% return, whereas Bitcoin saw around 1,000% (it's funny how a 1,000% return is deemed bad.)

Year to date returns courtesy of Quartz

Ripple bar none was the best performing cryptocurrency year to date (36,018%), that was around on January 1st, 2017. There are altcoin's out there like Raiblocks (XRB) that have crushed it, but haven't been trading a full year yet. XRB started off in March 2017 at $0.008 and is now over $27, a whopping 340,000% return. Raiblocks is focused on instant, feeless, scalable transactions. It uses a structure similar to IOTA, called Block-Lattice.

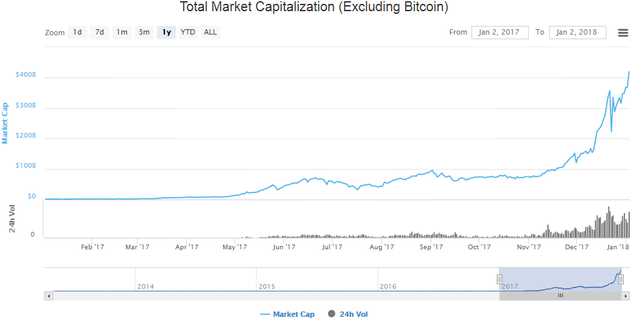

As of writing this the cryptocurrency market cap just broke through it's former All Time High (ATH) of $654 billion. I expect the next move up to be fast towards a Trillion as we leave current valuations behind and new people flood into the crypto markets with holiday bonuses and extra cash.

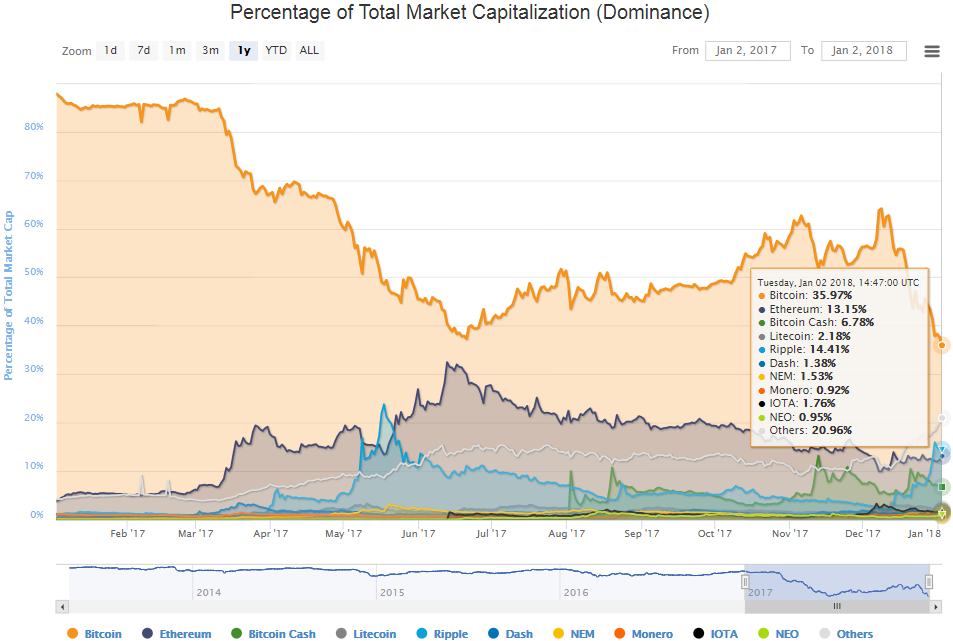

As you can see above, Bitcoin dominance over the total cryptocurrency market cap is at an all time low, around 35%. This trend will only continue, and it is healthy for the market, as Bitcoin price movments will have less effect over the total market. It would be nice to see more Altcoins get strong fiat pairs (USD, EUR, KRW, JPY, etc.), this way to break free of the vicious Bitcoin market cycles. It is important to understand that most altcoins trade against Bitcoin, so when trading or investing focus on satoshi's (Sats) and not dollars (although dollars do play a psychological effect).

With the NASDAQ planning to launch Bitcoin futures in the second quarter of 2018, it's hard not to be bullish on the cryptospace in general. The more exposure and mainstream attention this space gets, the faster it continues up.

Food for thought

We are witnessing a paradigm shift in the way we spend money and transfer assets and value. The Internet of Value (IoV) is here and it's going to blow people away at how big this becomes. If you are going to invest, invest what you can afford to lose and always do your own research. I cannot stress how important that is. I can't tell you how many texts I've gotten over the past few months saying: "Just bought Ethereum, when do you think it will double?" You will get burned so quick if that is your mentality coming into crypto.

Do yourself a favor, watch a video, documetary, read a book, article, guide to learn. The more you learn, the more you'll make. If you don't know something, google it, read up on it. There are plenty of Reddit threads and forums out there that will explain obscure topics that may not be covered by Forbes, CNBC, Bloomberg, etc.

If you liked this content, please upvote, comment, share, and resteem it!

Follow me @investoranalysis

Thanks!

Check out my website and my Contributor site, Influencive.

Disclaimer: The views expressed in this article are solely the author or analysts and do not represent the opinions of the author on whether to to buy, sell or hold shares of a particular crypto currency, cryptographic asset, stock or other investment vehicle. Individuals should understand the risks of trading and investing and consider consulting with a professional. Various factors can influence the opinion of the analyst as well as the cited material. Investors should conduct their own research independent of this article before purchasing any assets. Past performance is no guarantee of future price appreciation.

- This author has a stake in Ripple