Ripple: Sending Value as Fast as we Send Information

For over 20 years now we've been sending information around the globe in a matter of seconds via the internet. But when we send value (money) we still use a system called SWIFT, that was made in 1973. Let that sink in for a second, 1973, almost 45 years old. SWIFT currently handles about 95% of the global money transfers. Transferring money internationally currently takes 2 to 5 days and is a very cumbersome process that has many intermediaries. Not only that, the sender and receiver have no clue where their money is or when it will arrive. Currently false-positive transactions occur about 6-8% of all the transfers done. For each false-positive that happens there is a penalty cost for the bank. This leaves many banks with tied up capital because they do not know the transfer costs and penalties they will incur. My most recent experience with an international transfer was a disaster. I was sending about $1,000 to a bank in Europe, I entered all information correctly, and wasn't allowed to send it. My bank said the receiving banks info was wrong, so I changed it to the info my bank said was correct. Three days later, I get a message from customer support from the European bank stating that they cannot accept my transfer unless I have my bank change the info within the day. I called my bank, but for whatever reason they weren't able to change the info and they were trying to make me eat a $25 fee for cancelling the international wire on top of the $45 for the transfer in the first place. This whole fiasco took 10 days for me to recover my funds. It's 2017, I should't have to wait 10 days and have a lack of transparency of where my funds are and how long until the transfer is done.

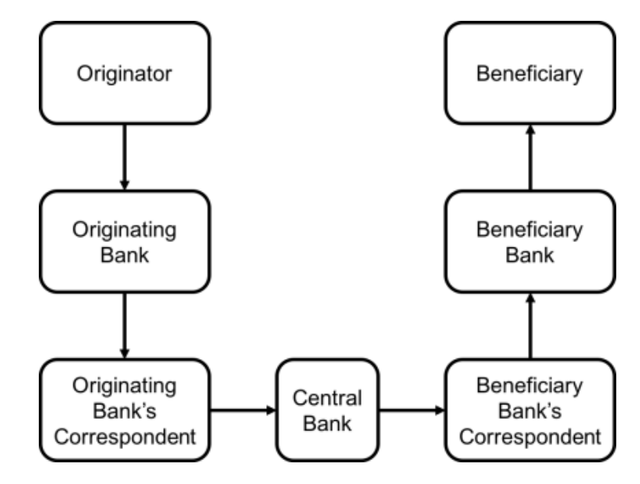

Below is a diagram of the current process for transfers.

Now enter Ripple into the equation, which was founded in 2012. Ripple is a blockchain start up that is looking to change the way we send value as we know it, creating the Internet of Value (IoV). They currently have over 90+ customers, 75+ banks signed up with them. These banks include Bank of America Merryl Lynch, RBC, SEB in Sweeden, BBVA of Spain and Mexico, UBS, MUFG in Japan and the 47 bank consortium in Japan that implemented Ripple in March. Ripple has been working with Strategic Business Innovator (SBI) Holdings and Thailand's Siam Commercial Bank (SCB) to bring a blockchain remittance program between the two countries. There are currently 40,000 Thai's that work in Japan and this payment corridor sees about $250 million per year. With this program, what use to take days now takes two to five seconds to transfer the funds. The blockchain also allows the Japanese Yen to be converted right to Thai Baht. This isn't the only corridor SCB is working on, they are also working on Asia Pacific, Europe, and North America too. Ripple's Blockchain, the Ripple Consensus Ledger (RCL) has been used in previous projects including a pilot program between Spain and Mexico for BBVA, Spain's second biggest lender behind Banco Santander. This cut their transfer time from days to four seconds.

Global Payments Steering Group

Back in September 2016, Ripple announced the formation of it's Global Payments Steering Group (GPSG). The GPSG has six founding members, Bank of America Merrill Lynch, Royal Bank of Canada (RBC), Santander, Unicredit, Standard Chartered, and Australian Westpac Banking Corp. Japan's largest bank, MUFG joined in early 2017, and stated it had intentions to facilitate global money transfers over the blockchain by 2018. Here is a quote from Ripple's website on GPSG:

"The group will oversee the creation and maintenance of Ripple payment transaction rules, formalized standards for activity using Ripple, and other actions to promote implementation of Ripple payment capabilities as our network continues to grow."

Many banks had things to say about the innovation Ripple brings to the table, here is one of the quotes:

“We are committed to delivering innovations that support the evolution of global payments networks. We are pleased to join this steering group and explore practical applications for blockchain technology that will advance commerce in all regions of the world.”

—Jason Tiede, Head of Innovation, Global Transaction Services at Bank of America Merrill Lynch

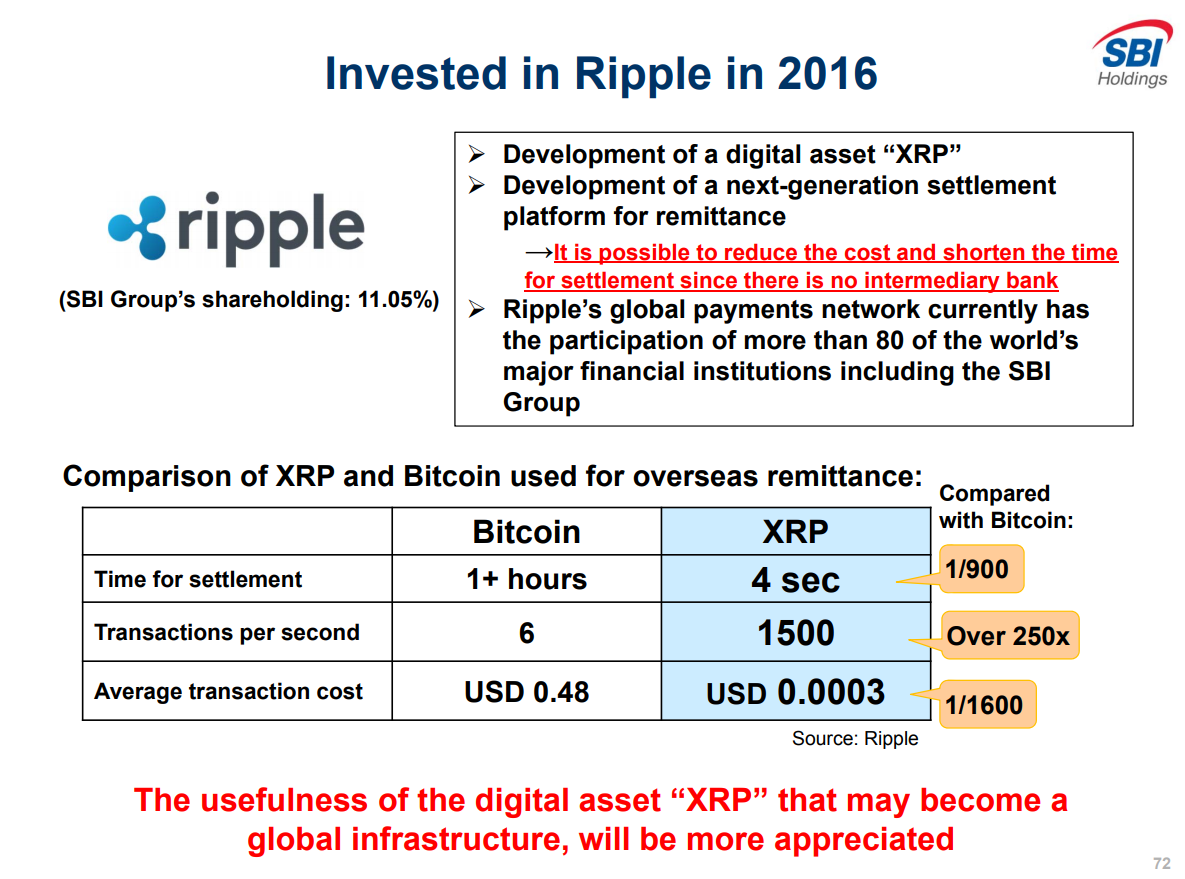

Below is the graphic showing Ripple plus XRP's advantage on speed and cost reduction. This is directly from SBI Holdings Q2 results.

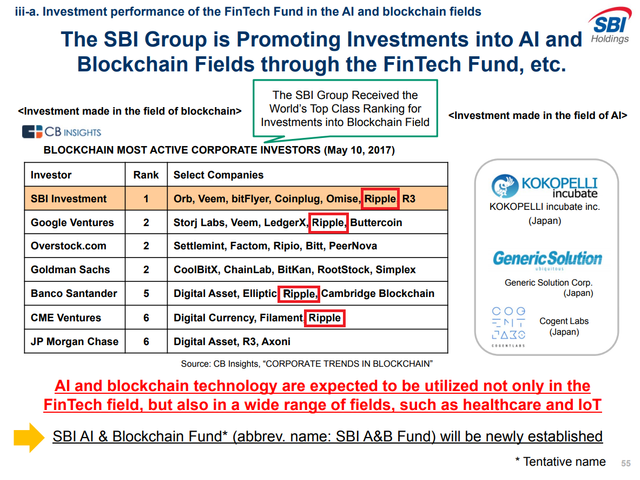

Below shows the investors in Ripple and other Blockchain and AI companies, I outlined Ripple in a red box.

Many people debate that Ripple is "the bankers coin" and it's not decentralized like Bitcoin is. But here's the reality, bitcoin is not a viable use for payment system, since it was barely able to handle six transactions before the fork. And it just went through a hard fork because the community was split on how to improve it's block size. I'm not saying Bitcoin isn't a good thing, it's a great asset, as we've seen with it's unreal returns over it's eight years of existence, but it can't handle up to 50,000 transactions per second like Visa or Ripple can.

Below is an image showing the difference in cost and time for Ripple vs. Bitcoin.

Now after all that, you may ask how does Ripple work?

Per Acarate Ripple use the consensual validation of encrypted hashes to secure messages across the Ripple network. Ripple uses a ledger called the Inter Ledger Protocol (ILP) and it is open sourced to the public. The ILP allows Ripple to connect with existing bank ledgers, keeping the barriers to entry low. Ripple uses nodes to validate the transaction, and recently just passed 55 nodes.

People have been worried that since Ripple owns a majority (61%) of the XRP, that they could use to manipulate the price of the token itself. Ripple has placed 55 billion XRP into a cryptographically-secured escrow account.

Ripple's competitor(s)

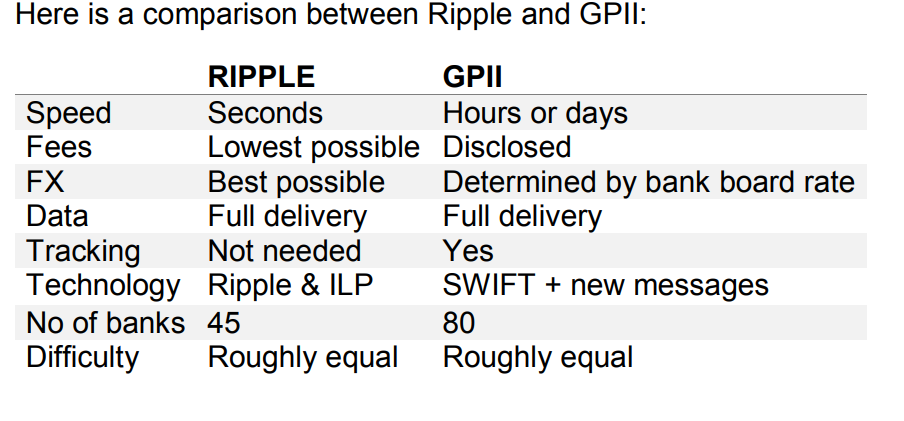

As you could imagine, SWIFT is not going to idly sit by on the sideline while Ripple gathers steam. SWIFT's response is the Global Payments Initiative (GPII). GPII uses the old SWIFT messaging and correspondent banking that are the backbone of the old cross border payments. GPII uses a new set of rules for banks to commit too, and has the ability to track payments and monitor data. For banks to join GPII, they must agree to the rules in the Service Level Agreement (SLA). SLA discourages banks from delays, opaque charges, and float (theft of value days [time value of money]). SWIFT developed a payment tracker, so payment originators can be check on the progress of their funds in near real time. Per Acarate Ripple vs. SWIFT PDF:

"Although SWIFT’s 10,000 bank members would appear to give GPII a big head start, it is far from clear how many banks will end up joining GPII. The take up rate amongst banks for SWIFT for Corporates has been agonisingly slow; ditto for trade."

Ripple currently offers a better product simply because it is faster, cheaper, and more complete process. This is partially because they have first mover advantage, being one of the first blockchain companies to go after the fin tech space where updating was desperately needed. Ripple also includes FX (currency conversion) that gets customers away from exorbitant "board rates" that banks currently use in cross border payments.

The number of banks here is incorrect, this data is from 2016, and Ripple now has over 75 banks signed.

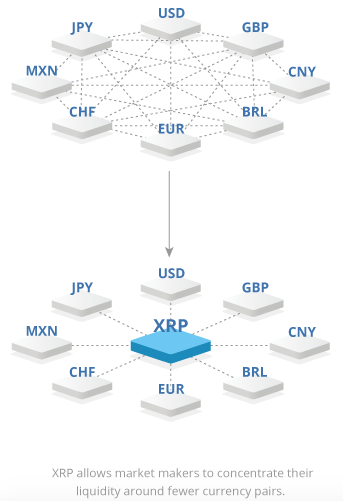

| Ripple vs. GPII | How XRP works with currency conversion |

|---|---|

|  |

In the end the consumer and the banks wins here. Nearly instant transfers of value and at fractions of a penny. Global markets in the near future will be much more liquid, thus allowing more economic activity to occur.

If you liked this post, please share it, up vote it, and resteem it!

Thank you!

Disclaimer: this author currently has a stake in Ripple. This is not investment advice, always do your own research. It is very important to do your own analysis before making any investment based on your own personal circumstances.

This is great. Thanks for sharing. I had been seeing a lot of people talk about Ripple's use by banks, but I had not seen it explained as well as this. I'll definitely be watching the future of Ripple!

Thank you very much! I could've put more info in this, but I figured I would write some more articles on Ripple in the near future.

Blockchain is definitely a tough subject to understand if you're new to it. So many people read articles and have a hard time figuring out what purpose it "serves" or what it "does".

Right. I can't say I completely understand all of the applications the blockchain can have, but I'm learning more and more each day. I'll be following you for more articles like this.

Yup, learn something new everyday.

If you wouldn't mind, could you share my articles please. Trying to grow my channel.

I'd be happy to! I hope you'll check out my posts too.

Thank you very much! And I did, are you a part time photographer?

No, I'm actually not. I just enjoy snapping a few pictures every now and then. Completely amateur. Haha thanks for checking them out.

You're welcome!

This is alot of information about XRP bro.. thank you for your reasearch...

My pleasure! I enjoy doing this... so spending the time to dig up info is fun for me. I could've put more in this, but I figured I would write more specific articles on Ripple in the future.

Congratulations @investoranalysis! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP