3 Ways To Invest in CryptoCurrency

One can hardly argue that 2017 is the band-wagon year for CryptoCurrency. But most people have stepped into realms unknown unprepared. Here's to hoping this article will help sort them out. Sorted by risk level in ascending order.

1. Veteran CryptoCurrencies (less risk)

These are the "oldies" in the market - Bitcoin, Etherium, IOTA, Ripple to name a few. Generally on the top 50 coins in Coinmarketcap. These are the no-brainer cryptocurrencies that have already proven their worth. People are talking about how great they are on YouTube. People are making vlog entries and articles about it. These are your safest bet. But even then, there is still a level of risk involved such as hacks, or buying on sheer FOMO (fear of missing out) without due diligence. Then there are problems like network congestion issues like what Bitcoin and Ethereum is facing right now. Because they are the first, they are likely NOT the best performance-wise. Still they are the go-to cryptocurrency and support is well established on many of the coin's price levels.

2. ICO stage (risky)

These are legit cryptocurrencies but on the first stages of their development. You are their investor and you put faith into them to truly follow-through their goals. There are real goals in their roadmap with real development time allotted into the system or apps. They have yet to prove themselves and this in turn is why this is riskier than the "oldies". Here are some note-worthy checklist to do your "due diligence" that everyone is talking about:

- Have you read the whitepaper?

- Does the roadmap have realistic goals?

- Is the team (advisor, R&D, and leaders) comprised of competent individuals with great track record?

- Does the coin have an actual use case?

- Is the coin 10 times better than the top 50 cryptocurrency or is it just slightly better?

- Are you yourself a firm believer of the coin?

The main reason to invest in these ICOs is to get the chance to x100 x200 x500 your investment through a long-term hold or through x5 x10 on whale dump short-term hold. This is possible because you are an early adopter to the "new technology" the cryptocurrency has to offer. Imagine if you were invested in the ICO stages of Ethereum, let alone Bitcoin! This is what you are looking at when investing into ICOs.

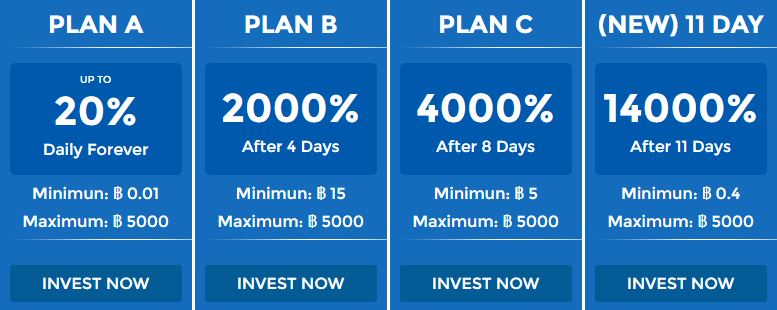

3. HYIP CryptoCurrencies (extremely risky)

Before cryptocurrency was a thing, there were already ponzi schemes all round the Internets. These are generally labelled as "HYIP" or High Yielding Investment Programs, by their community of investors. These are people who know these platforms are scams but invest anyway. HYIPs have now been adapted into cryptocurrency. These are now called "Lending Platforms".

Lending Platforms tend to have unrealistic daily returns and unrealistic roadmap. They even have the audacity to mention a target price of their coin by the end of some month, quarter, or year. Ring a bell?

Obviously, if you haven't figured yet, this investment strategy is very risky. I do not recommend investing into these platforms. Because if you do invest and do NOT play it right, you will burn.

You may ask - if these are scams, then why are people who know they are scams still invest? Plain and simple - there is more money to be made than the normal long-term hold of legit cryptos like BTC, LTC, ETH, etc. In this scene, you have the chance to x10 x20 x30 in a very short amount of time.

Here are some note-worthy tips to invest in these platforms:

Look for an HYIP monitor. These are sites that monitor lending platforms healthy status. Nowadays, these are called ICO-review sites. A good example is icoreview.site. Even the non-crypto traditional HYIP monitors still list lending platforms and give out information of the paying status, e.g. allhyipmonitors.com

Assume every lending platform is a scam. You need not even do any due diligence in this market. They are simply scams. Anything that guarantees returns, especially 1+% daily, is not sustainable long-term.

Do not put all your eggs in one basket. What this means is you diversify. Put 20% into a lending platform. Put another 20% into another platform, and so on. This way, you don't lose all your investments should the owners decide it's time to go on vacation on the Bahamas. After all, this is risky business.

Never introduce these platforms to your friends or anyone unless you are a schmuck and don't care if they lose money.

Invest only into HYIPs with HUGE hype and ONLY during the pre-ICO or ICO stages. Obviously, the more hype, the more buyers there are. The more buyers there are, the higher the coin's value resulting to more gains. If you invest after the ICO, you better got it pretty darn low or you're pretty much risking your money for some scraps.

Never do a lend! I cannot stress this enough. If you lend your coins, you basically lock in your profits for a very long time and defeats the purpose of investing into these very risky platforms. Which are short-term bigger gains. If you lend, you would have been better off buying your LiteCoin or Cardano.

Never become a whale in these platforms. Especially if you are not a promoter or making use of referral systems. The owners of these sites tend to do selective withdrawals and even worse, account lock-ins. They let smaller investors withdraw but not whales. Unless you have 1000 people under you through referrals, don't be a whale or kiss your money goodbye. If you do referrals like many YouTubers (Crypto Biz, Trevon James, etc), HYIP owners love you for that and you get rewarded. Spread FUD as a YouTuber and you get the same treatment as the rest.

Sell your coins as soon as you made significant gains, do an immediate withdrawal, and never look back. If you see the value of the coin go up just after you have sold, you tend to feel regret then buy back in. But really, who's to say you failed when you have already 10x your investments? Better safe than sorry. Don't let greed do you harm.

If this blog post has entertained or helped you, please consider to follow, upvote, resteem and/or consider buying me a beer:

BTC: 1GNqY5CsYrkHvDf9Jj3bwSXhHogbvmXBmF

ETH: 0x6c2F7128363332965b92A6c71eee0276FF27E0cD

LTC: LbLb9DcNvKzp2ywtYCctiv5NfpzvSwg7Ve

Legal Disclaimer: Everything in this post is of my personal bias. Make of it what you wish. It is not an advice nor recommendation to buy or sell anything. It is meant for informative and entertainment purposes only.

If I was going with any of them it would be the oldies. I'm not much of a gambler because I don't have much to gamble with.

true. well established ones should always be the choice. great investors are those that invest on the least risk through long-term investments.

Resteemed by @resteembot! Good Luck!

The resteem was payed by @greetbot

Curious?

The @resteembot's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.