ICO Analysis: Marketcaps Valued less than Capital Raised!

This is a repost as the first one got flagged. Apparently someone has beef with @dan and wants to silence what is said about EOS

The other day I was running some analysis on where to concentrate some of my investments. While running some numbers, looking at various projects/tokens, their performance, current positions and outlook, I came across something that is currently being highly overlooked.

There is a lot of speculation in crypto projects, this isn't at all surprising or non-obvious. Most projects do not deliver on their intended value yet - most never will. Some of the currencies are, arguably, already delivering, but I'm mostly going to focus on crypto assets and utility tokens, like EOS.

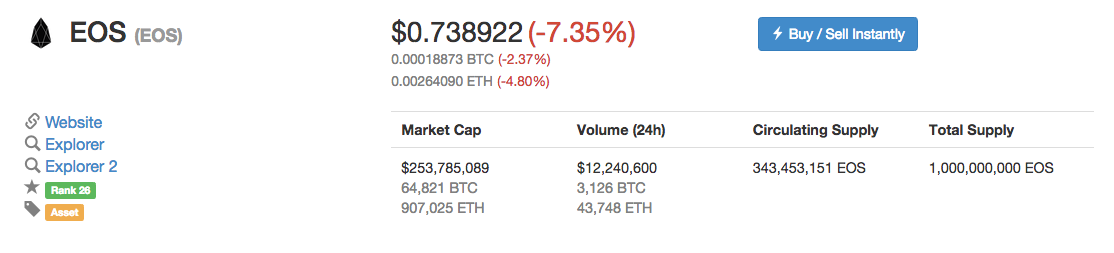

Through my analysis, I began to notice that there are a few projects where the marketcap sits below the amount of money that has been raised by a particular project. Now, I will say, there are only a handful of these projects, but the one that stood out from the rest was EOS!

EOS' Ether Treasure Chest

To date, from my calculations, EOS has raised just under $500 Million USD, given a $300 average ETH price. It's worth noting that ETH currently sits around $280, so feel free to run the numbers against that if you like (~$450M USD). You could also argue that this money could never be withdrawn at this current price, and that's true, because it would crash the ETH price significantly! More on this below.

You can see a list of all the withdrawals that have happened on the EOS ETH contract here:

https://etherscan.io/txsinternal?zero=false&a=0xd0a6e6c54dbc68db5db3a091b171a77407ff7ccf&valid=true

Note this does not include about 11k ETH currently sitting in the contract ICO contract

Learning from the Past

Let's talk, for a moment, about typical stocks and companies. Does anyone remember back in 2002 when Kmart filed for Chapter 11 bankruptcy protection? The company's stock fell at least 60% overnight and even further overall.

Then, not long after that, someone made the observation that Kmart was sitting on some of the most prime real estate in the country (about 17B in assets at the time), valuing the company far greater than the current stock price and marketcap. People were kicking themselves for not realizing this obvious analysis. The FUD got the best of them. Overnight the stock soared, after taking into account the current value of the real estate portfolio. Kmart was able to avoid bankruptcy through debt financing.

Not too long after all of this, Sears and Kmart merged - the rest is far less interesting.

The lesson to be learned here is that the value of the company far exceeded the current stock price and marketcap because the company had assets and revenue streams that exceeded it's current value. Speculation can wreak havoc on wise investment decisions.

Now, when applying this same analysis to some of the current crypto projects, I've been able to target a few that are sitting at current marketcaps below their on hand capital reserves. This is where EOS comes into the picture.

EOS Outlook and Speculation

The current marketcap for EOS sits right around $250M USD. That's 50% less than the current amount of capital on hand. And represents a 100% return on investment if the marketcap is brought to parity with capital on hand.

But, that's only on circulating supply!

This is where things get interesting and speculation plays into any investment decision.

If you take the total supply of EOS that will be distributed through the ICO, assuming that additional token purchases were basically valued at nothing (not happening), you'd have a current or final marketcap at ~$73M USD.

But, that's not even accurate or realistic, so let's take some real numbers and put them to work. Firstly, 10% of the tokens will be held for block.one and cannot be distributed.

How does the EOS Token distribution work?

- The EOS Token distribution will take place over 341 days starting on June 26, 2017 at 13:00 UTC. One billion (1,000,000,000) EOS Tokens will be distributed according to the schedule below:

- 200,000,000 EOS Tokens (20% of the total amount of EOS Tokens to be distributed) will be distributed during a 5 day period beginning on June 26, 2017 at 13:00 UTC and ending on July 1, 2017 at 12:59:59 UTC (the “First Period”).

- 700,000,000 EOS Tokens (70% of the total amount of EOS Tokens to be distributed) will then be split evenly into 350 consecutive 23 hour periods of 2,000,000 EOS tokens each beginning on July 1, 2017 at 13:00:00 UTC.

100,000,000 EOS (10% of the total amount of EOS Tokens to be distributed) will be reserved for block.one and cannot be traded or transferred on the Ethereum network.

So, that leaves a total of 900M tokens that will be distributed through the ICO. Using the same assumption that no one buys any more tokens at a meaningful value, this would put us at a ~$81M USD marketcap. If you invested today at a $250M USD marketcap, you'd take about a 200% loss on that investment.

However, again, this is still not realistic. It's not realistic to think that people wouldn't purchase tokens from the ICO contract when they could be sold on exchanges for a higher price. Arbitrage can be a great investment play. Even if it's just a 20% return, most investors will jump on this opportunity. Granted, if too many investors are strictly practicing this investment strategy, the token price will slowly drop. But, in the meantime, more ETH is being added to the EOS treasure chest.

Let's assume though, that this is what happens and investors are less interested in holding and only looking for quick arbitrage opportunities. At some point, this will equalize, but it could still be at a lower token price yet.

To date, 354M EOS tokens have been distributed. That leaves 546M EOS tokens still remaining to be distributed. Assuming each of these take on a 20% arbitrage play, the marketcap at the end of the ICO would be 8.739899877E-19. Far less than a penny!

So, again, this is entirely unrealistic. Therefore, as mentioned previously, it's safe to assume that there would be a point where the marketcap levels off. Where this happens is difficult to say, but given the fact that EOS has around $500M USD in ETH in their treasure chest, it's unrealistic to think that it would drop too much further, at least until this realization becomes common knowledge.

Further, while arbitrage opportunities are taking place, EOS is still increasing it's holdings on ETH making that $500M USD number even higher.

Let's take a more fair assumption here just for fun. Let's say the marketcap levels off at $100M, which is a very conservative estimate IMO. If the arbitrage activity of this started right away, this is what would happen.

- In 4 days, the marketcap would be sitting at 100M, each day with a 20% loss. (250M, 200M, 160M, 128, 104M). Again, this is unrealistic because, with these drops we'd see demand to purchase EOS tokens, but let's just assume this for now.

- During this time, EOS would accumulate ~15k ETH.

- Now, with 269 days left in the ICO, assuming things equalized, EOS would sell the remaining tokens, raking in ~615k ETH

- Totaling up the ETH sold to ~630k ETH, or ~175M USD

This would give EOS a total treasure chest of ~675M USD. Now, as stated above, this is unrealistic for a few reasons. Firstly, it's not going to drop that fast, even if it does go down that far. So, much more would be made from EOS while it dropped.

I think it's a fair assumption to think that EOS will end up, from very conservative estimates, between $700M and $800M USD. Assuming a gradual decline to a $100M USD marketcap.

If we assume that it stays around $250M USD, as it presently sits, EOS would end up with an additional ~380M USD, leaving them with ~$880M USD.

If EOS increases the marketcap and/or fluctuates between the current marketcap and slighly higher marketcaps before the end of the ICO, the total could easily be closer to ~$1B USD.

IMHO, I think that's a more realistic scenario. So, let's go with the $1B USD ICO outcome for the rest of this analysis.

It's not a Treasure Chest. It's a War Chest

With $1B USD on hand, EOS is positioned like no other. There hasn't been an ICO to date that's come close to these numbers.

But, what's more important here than anything , is the position of EOS in the competitive landscape with Ethereum, the market leader in smart contract platforms. While there is little doubt that things have become a bit tense between @dan and Vitalik in recent months, this is only sure to escalate after the launch of EOS and the competition increases.

Given that likely outcome, the $1B in Ether that EOS will be sitting on becomes a weapon against Ethereum. EOS will control around 20% of all Ethereum tokens in existence.

Now, you can play out all kinds of scenarios in your own head as to what could be done with that kind of control.

If Ethereum POS gets implemented, a 20% staking play by EOS would amount to, probably, the single greatest controlling entity on the network. Or, EOS could continually dump ETH on the markets driving down ETH value, putting FUD in full force with investors, all while positioning itself as a better alternative.

I do not think that @dan would be the type of person that'd take a very strong upper handed position with all of this, mostly because he and block.one have a vested interested in the greater good of the overall smart contract ecosystem. However, much of this will not completely be in his own hands. There are many people and entities involved and if competition gets too fierce, some of this will happen.

EOS started out their ICO with a major focus on a fair token distribution, putting tokens into as many people's hands as possible and setting a token price, high enough, with a distribution model designed to prevent, mass accumulation of EOS tokens within single stake holders. This is critical.

But further, Ethereum, attributing much of it's success to the ICO boom, has ended up with massive quantities of their tokens sitting within very few hands. I'd venture to say that well over 50% of ETH tokens sit with less than 20 entities.

Conclusion

Given all of this analysis and speculation, the capital on hand with block.one, and the current marketcap of EOS, I think we're pretty much seeing what will be the bottom.

Block.one and EOS have more money than they need to execute on the vision, hire whatever talent they need, and market it in their wildest dreams. Like all startups and projects, it's mostly going to come down to execution from here. And as most most people on Steemit would probably agree, @dan and the rest of the EOS team are well capable of executing.

Finally, if this wasn't as obvious from the initial comments. EOS has 2x as much capital on hand than the current marketcap, making it very undervalued.

Nice post! Check out this one

https://steemit.com/ico/@astrocrypto/stop-spending-stupid-money-on-ico-s

great post sir

I always respect your ideas about this platform....

what a creativity!!

Awesome post.

Congratulations @jacobt! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!