The Crypto Mega-trend of 2018: Security Tokens ( Everything you need to know )

^ VIDEO ^

.

.

When I first found out about Ethereum, there was a visceral feeling of excitement, knowing that this technology was going to be the catalyst for a major shift in our world.

Similarly, now there is a new cryptocurrency movement emerging in 2018, something that will change the landscape of the cryptocurrency market forever.

.

Coming back from the CryptoInvest Summit in LA, there was one resounding theme throughout the conference.

.

There is going to be a major shift in the crypto space this year. A shift many of the panelists at the conference think is so big that it will surpass the combined market cap of the current 450B crypto market which consists of 99% utility tokens.

This massive upcoming shift we're about to see in 2018 is Security Tokens.

So, what is a Security Token, and how does it differ from the current landscape of Utility Tokens and Currency Coins?

Let's break it down

Currency Coins

are simple and straightforward. They are coin used either as a digital store of value, or as an online peer to peer payment network, like Bitcoin, Litecoin, Dash, and Nano.

Utility Tokens

are tokens that allow you to interact with a platform or app. For example, the token could be used to fuel smart-contracts like on Ethereum, or it could be used to buy computing power like on Golem.

Currently, many Utility Token ICO’s are using around-about methods to sidestep regulation as much as they possibly can. Because of this lack of regulation, retail investors are at a greater risk of fraud. We have already seen close to $1 Billion worth of capital having been frauded from investors, including the $600M scam performed by AriseBank.

Security Tokens

are the legally compliant tokenization of anything that has the future expectation of profit. Security Tokens (ST's) allow for the tokenization of real estate, stocks, bonds, assets, companies, and investments that produce dividends.

In addition to the aforementioned sectors that are already baked into our economy, ST's will open up a staggering amount of new economic investments by tokenizing product creators and service providers. We will be able to tokenizing artists upcoming work, musicians albums, movies, professional services like dentists offices and lawyers firms, and absolutely everything else that drives a revenue in exchange for our share of the future profit in the form of dividends, payouts and token price appreciation.

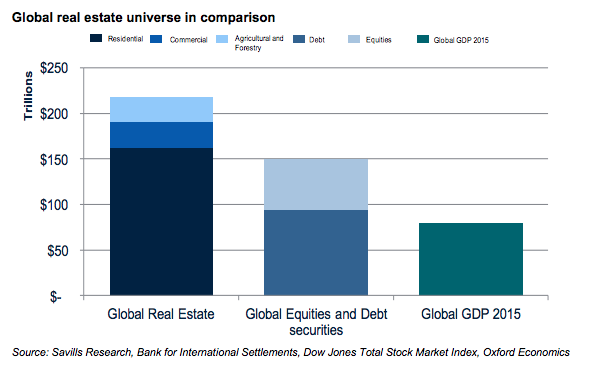

Very Conservatively, we’re looking at a potential security token market well north of $100T. The global real estate market by itself is worth $217T. The entire utility and payment token market cap is currently less than $0.5T.

Institutional investors & hedge funds have been slow to enter the speculative cryptocurrency space. With the tokenization and optimization of the investments they are already familiar and comfortable with, that will rapidly change. Security tokens are the catalyst to the influx of big money.

So why do we need security tokens?

Currently, the assets that ST's are in the process of tokenizing are either centralized on fee intensive platforms or are illiquid and difficult to physically transfer or subdivide. Security tokens would allow for these trades to be done faster, cheaper, with less paperwork and across a transparent and traceable global decentralized market that operates 24/7.

If that answer was sufficient for now skip ahead to "What are the roadblocks"!

Otherwise, let's dive in-depth to the benefits of ST's!

Higher Liquidity

Where can you currently trade fractional percentages of real-estate or assets near instantaneously with low fees? Answer: Nowhere! Security tokens will allow all the assets of the world, like real-estate to be micro-owned and traded globally, instantaneously online. Lack of liquidity can account for in surplus of 20% of the cost of the asset. pg 12. That's enough of a reason to switch over right there!! With no liquidity, your $500,000home is now worth only $400,000. If you have ever sold a house, I'm sure you can relate. "Do I keep my house on the market as is another month or should I drop the price another $30,000?". When we are able to subdivide ownership, the minimum investment can be infinitely less, increasing liquidity dramatically. An upcoming example is a platform that allows you to purchase tokens of a home that is then rented on Airbnb, you earn both the rent in dividends and hold the appreciate asset of the token. When you want to sell, it is available to be sold on a global market. A tokenized time-share global economy could be near, but that's a whole other topic.

Less expensive to launch

The cost to tokenize is drastically cheaper, easier and faster to tokenize than to run an IPO. The cost to run an IPO can cost 10-12% of the total funds raised. Additionally, it takes less than half the time to tokenize than to launch an IPO. 5 year from now, when all the regulatory facets are worked out, it will be a no-brainer for any company to opt-in for tokenization over traditional IPO methods.

The rest of the answers brought to you by an exerpt by Anthony Pompliano:

“# Lower Fees

Many fees associated with financial transactions are derived from payments owed to middlemen (bankers, etc). Security Tokens remove the need for most bankers which reduces fees, and smart contracts may one day decrease the reliance on lawyers as well. These smart contracts will reduce the complexity, costs and paperwork with managing securities (collecting signatures, wiring of funds, mailing of distribution checks, collection of W-2s, Sending K-9s, etc).

Faster deal execution

The more people involved in a deal, the longer it usually takes to execute. When Security Tokens remove middlemen from investment transactions, they enable accelerated timelines for issuers to successfully offer their security. Additionally, immediate trade settlement on the secondary market for Security Tokens will become an attractive advantage for issuers & investors too.

Free market exposure

Most investment transactions today lack exposure to a global investor base. For example, it is hard for investors in Asia to invest in private US companies or real estate. With Security Tokens, asset owners simply market their deals to anyone with an internet connection (within regulatory limits). This free market exposure should lead to a significant change in asset valuations since any asset that is not exposed to a free market is mispriced.

Larger investor base

When asset owners can present deals to anyone with an internet connection, the potential investor base is drastically increased. For example, would you rather show your investment opportunity to only US accredited investors & institutions or every potential investor in the world? Competition is healthy and a long-term net good for financial markets.

Automated service functions

Lawyers are less middlemen and more service providers in most transactions. With Security Tokens, issuers will begin to use smart contracts to automate the service provider function through software. This doesn’t mean that lawyers will disappear, but rather that their role will be more advisory based.”

Great, now we understand why Security Tokens are parsects better than the models currently put in place. However, it is important to note that technology evolves quickly but regulation does not. Putting in place the correct framework for the immense world of securities could easily take a multitude of years.

Can security tokens and utility tokens co-exist?

100%! just as Ethereum and Bitcoin can co-exist, as they serve individual functions, Security Tokens and Utility Tokens can co-exist as their purpose is unique to their category.

So I understand security tokens now, what projects exist out there to invest in?

Now would be a great time to say I am not a professional financial advisor, and that everything contained herein is for educational purposes only. You are responsible for your own investment decisions.

With that being said, here is how I look at the ways to invest.

There are three aspects currently:

-The platforms

-The tokens

-The Exchanges

Let’s look at our current ecosystem to first get a better understanding of a "safer" investment style: Ethereum exists as a platform and fuel for Dapps built on Ethereum to operate like Omisego, Golem, Basic Attention Token ect. For Golem to run, it costs a micro amount of ETH, giving Ethereum value. Approximately 44 of the top 100 cryptocurrencies are built on Ethereum. That is a lotof value living on Ethereum! Even if 50% of the applications built on Ethereum fail, Ethereum will still have a very large value and utility.

Primarily, I would much rather bet on Ethereum and the other platforms like Neo than an individual app for this reason. If the app fails, Ethereum can still be "successful". However, if Ethereum fails, the app must be re-built from scratch.

Let's compare this to the security token sector:

Just as Ethereum is the leader for operating UT's, Polymath and Securitize are two platforms that are clear leaders in the creation, deployment, and operation of security tokens. The difference here is Polymath and Securitze also help launch the tokens on their platform in a turnkey fashion taking them from a-z with KYC, legal, actual token launch and more, giving them even more inherent value .

What is the utility of their token?

In comparison, The utility of the Ethereum token is to fuel dapps, the same goes for the security token platforms, they fuel the ST's. Additionally, the third party team members for Polymath (legal team ect.) are also incentivized using the tokens, increasing the value. Just like 99% of platforms, the more robust and active the ecosystem, the higher the demand for the tokens, the higher the value.

Anything else?

Another really good way to place safer bets is in the front-running exchanges. Exchanges like Binance are pulling in around $1Billion annually, but they unfortunately cannot list security tokens due to legal implications.

Currently the liquidity on security tokens is next to nil. Tzero is an upcoming exchange that is built exclusively for the legal trading of the upcoming $100T security token market.

To note:

Polymath and Tzero are not competitors, they are in symbiosis, similar to Ethereum and Binance.

Hope this acted as a good kickstart and/or deepening on your knowledge of Security Tokens!

If you found it added value to your day, give it an upvote and a resteem if you're feeling extra generous :)

This piece will be in constant flux as more information/comments come in.

I will be hosting a livestream in my community and on Twitch with Carlos Domingo, the CEO of Securitize and Managing Partner of SPiCE (The first security token used as a VC fund.) in this coming week, join the group to listen in!

Awesome post.

The big question is will this be permissionless? Because if it isn't, we're looking at totalitarianism on a global scale. The privacy implications of having everything be traceable are quite frightening.

Check out what https://tokenmagic.io is doing about security tokens. We just acquired our broker dealer license. Resteemed and Subscribed on Youtube.

Security tokens going to be a big deal. In the end it will replace the Nasdaq. Congrats @hilarski with Token Magic.

Just sent you a request on LinkedIn. Let's connect. I'd love to have you on our groups livestream and podcast. We have a direct audience of over 250,000

you share great knowledge . it's really know about all coin . i wait more information for another idea.

Great post!! I just left a meeting with my blockchain/crypto group and we spent a good chunk of our time discussing security tokens. Invisioning investing on the ground floor of say your favorite musical artist or favorite athlete and growing with their career would be amazing! You could literally launch careers without agents, managers, etc. Wish I had me some Kanyecoin 😂

Great post! Really well explained. I have subscribed on YouTube.

Right on, Thank you!! Followed you back on steemit :)

Hi Jeff,

Interesting read!

Being not an expert at all: am I correct that

No, investment funds are actually utility tokens ironically enough

In order to be a security token it MUST be legally compliant with regulations and have already gone through all the red-tape and hurdles.

Hope that answers it :)

Wow, that means security token is going to help alot in cryptocurrency.

It's a welcome development .

Security tokens are a HUGE deal.In the future everything is going to be tokenized, including real state and stocks, all 24/7 With no borders or exchanges.All priced by the almighty $BTC

Yes, I fully agree with you: security tokens will be the future of crypto, and I think that you highlighted all the advantages of tokenized assets. Personally, I believe that one particular type of security token will play the most important role in the future of crypto, which is the equity token. It will allow token holders to participate in a fair way in future success of startup companies and generates a return on investment.

Excellent article. Very well explained. One of the best I read so far on Steemit.