TIM: The BlockChain of Other People's Money

Is this fiasco a portrait of everything wrong in crypto in one place? Or…

If you are not familiar with Crypto Criterion, it is important to start by mentioning firstly that our main goal has always been to provide factual information, whilst keeping readers up-to-date with regular reports on the state of Blockchain adoption and Crypto investment. We search for credible projects and inform our readers of our findings. Our goal is to shine light into an otherwise dark tunnel that is the “unregulated crypto market”.

Projects we feel are deserving of consideration are listed on our ICO/Airdrop page with little or no comment. If however, we suspect a scam, or find inconsistencies, we may reach out to those ICOs directly in order to give them a chance to clarify any possible misunderstanding. If we feel strongly about a possible scam, we might report our suspicions on social media sites, or to groups whose mission it is to report scams. Considering that 80% of recent ICOs have been revealed as scams or money grabs, generally we do not write articles about these ICOs. The following series of articles will be an exception to our practices, because we recommended the TIM ICO in January. We were misled.

From time to time an ICO will reach out to us and ask for our opinion or help. We decline the vast majority of these requests. In such cases where we accept, if the projects tick all our boxes we report favorably. If we do not like what we find, we simply move on and leave questionable ICOs to their own futures. There are many great blockchain techs out there that are also awful investments. Understand that we are not the police.

CryptoCriterion (CC) is NOT an investment service. We analyze and report on the viability of a technology and its business model. We look to see if the technology can or will be adopted, then assess whether or not that adoption is designed solely to make the founders rich, or if it accommodates a built-in infrastructure model which allows the sharing of wealth with the token holders. We will also accept payment to review an ICO’s product, code and/or business model. We make a practice of accepting crypto for our fees, believing our risks should be similar to everyone else’s should we promote a crypto project. Reading our history you might think we hate crypto as it might appear we are always warning the community about the “Dark Side”. We are!! If you think we do not report often enough on good crypto investments, we don’t. There are very few Cryptos or blockchain projects that are also sound investments. Just look at the crypto market. Consensus valuations are the dumbest investment since Dust Bowl era carnival games.

To say 2018 has been a terrible year for newcomers to Crypto currencies would be akin to claiming that 2008 was just an off-year for real estate. It has been reported that during 2017, 80% of ICOs turned out to be scams in some shape or form. This fact alone has contributed to the huge losses in the crypto market-cap that have continued thru 2018.

Our second project at CC was EBTC. It was perfect. All the docs were comprehensive. The tech was ready, the management was sound and proven, the tests were verified and commercial models all proved out mathematically, yet EBTC turned into a nightmare overnight when disgruntled developers who reportedly put a back door into the EBTC Telegram group, assumed the Telegram identities of the CEO and admins and took the group and company over so effectively that the investors did not know what had happened for weeks. By then EBTC was done as an investment.

THIS story begins with CC’s first project. A blockchain project named Talking.im (TIM token). Talking.im began what can only be described as a confusing airdrop of 10,000,000 tokens sometime around December of 2017. As far as we can determine, none of those people who helped promote TIM have yet received their tokens, however they were told those tokens would be worth $10 each in April 2018. (ten dollars) The TIM presale began in January 2018. Depending on when you read the sale metrics, Tim was to be generating revenue in April. According to company claims TIM was already engaged in commercial activities. The founder claimed to have pending deals with several crypto trading exchanges for listing in April. The foundation published elaborate token values and appreciation models, which tied mathematically to the commercial revenues projected for the various business applications that were purported to be complete and running in March. And 9-months later, everyone at TIM denies all of the above.

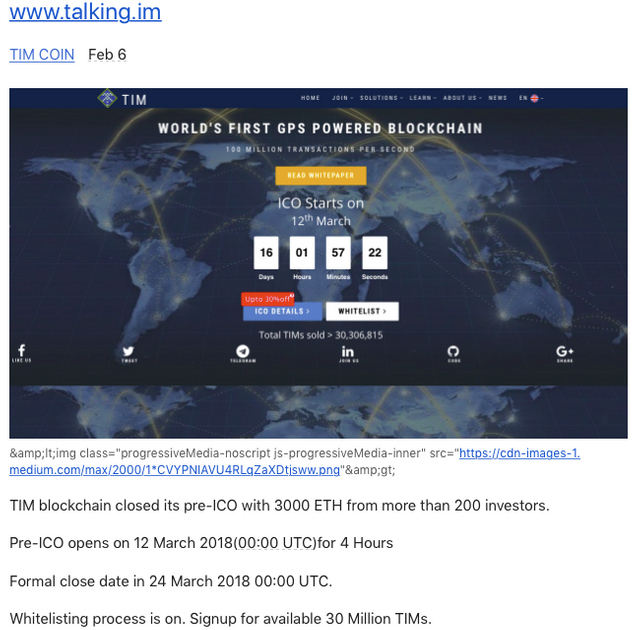

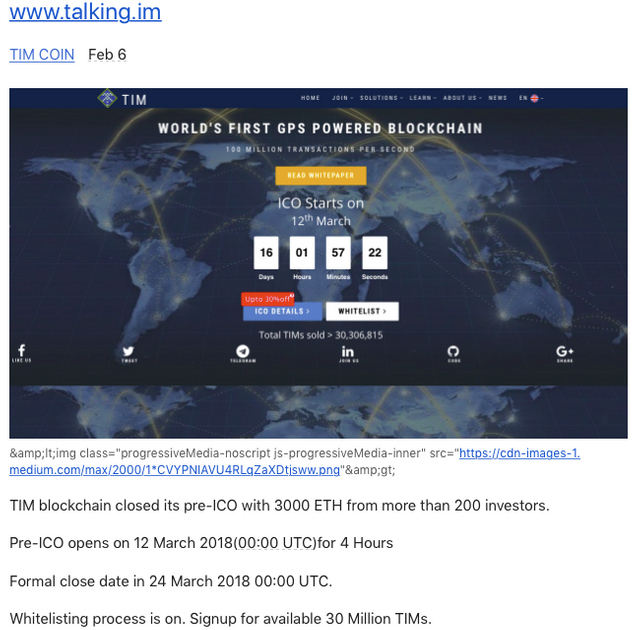

At first, we though TIM (The Internet of Money) was perfect. TIM was a geo locating crypto that would change our world. All the docs were comprehensive. The utility was massive, reaching across so many sectors it was impossible to identify all its future uses. The tech was widely advertised and promoted as ready for launch on March 24, 2018 and at the time, the founder seemed prominent and published. Fast forward the clock a little and we have since developed some serious concerns about the truth of everything TIM. The below shot is from a TIM add that was run after March 12, but before March 24, 2018. This was the first ICO. We think there may have been somewhere between 3 and 5 sales to date. All TIM/Bitpost sales follow the same pattern, advertising, a sale, advertising another sale, advertising and another sale. Between each there are countless denials and contradictions, rebranding, new technology and uses.

Tim (talking.im) claims to be a patented GPS powered geo-location blockchain technology that operates on the Ethereum network. The basic tech allows the TIM transactions to lock onto local nodes, rather than nodes thousands of miles away, like virtually all other cryptos. The local nodes provide the transaction verifications by creating a secure geo-fenced area around the transaction’s actual location. This provides an unheard of level of security (no 51% attacks) while increasing transaction speeds up to 100-million transactions per second on the Ethereum blockchain due to the proximity of the node. (speed is based on global node adoption) TIM also promises banks and financial institutions the ability to run their own nodes and verify their own transactions on TIM side chains. If you understand the import, you can easily see how (if true), TIM could displace Ripple and change our very world. So far TIM has claimed or implied existing Taxi apps, International Taxi agreements, an Alibaba agreement for direct consumer interface, Drone apps, Banking agreements, patented technology, a Bankchip and even DARPA agreements. The CEO has repeatedly claimed the TIM foundation is a rebrand/evolution of the Bitpost mail app. But the thing that grabbed us most was a forced token appreciation model that tied company performance directly to token values. We believed TIM was the first true token-backed equity security crypto. Unfortunately today the CEO denies all these claims. In the days coming we are going to prove his denials false with overwhelming evidence that he produced and promoted himself.

Tim investor funds were used to develop Bitpost and other assets. Singh now claims that not only is Bitpost not part of the foundation, that it never was and further that it and foundation other properties are private assets that he and his own separately. These denials are despite written published evidence that Bitpost was and does belong to the TIM Foundation and its investors. The Shot below is from a Tim paper published in December 2017, at beginning of the TIM pre-sale. Note the clear admission Bitpost belongs to the Foundation. (the entire paper is in our possession)

Singh has also intimated State currency adoption and other commercial enterprises when those claims furthered his needs or quelled rising investor concerns. Please read the whitepaper/s at talking.im or find many of the company’s past paid claims on Medium or thru other crypto outlet searches. The TIM team regularly deletes any evidence. If you find anything juicy please send it to me gary@cryptocriterion The TIM folk should understand we have a 100 gigs or more of fully copied papers, adds, websites, videos and other documents going back years and years and that we have included this information with numerous complaints. So delete away. Over the next week or two we will be posting volumes of this data with dissections of each. We believe we can prove that the TIM team is running an ongoing crypto scam and has gone to great efforts to delete or alter prior published information each time it conflicted with the most current story.

TIM outwardly promotes itself as a United States – State of Delaware, legally organized LLC selling an US SEC registered security token that has alternately been promoted as a Security, a Utility and then a Security again. At times it has claimed to be operating under SEC SAFE (Simple Agreement for Future Equity) regulations and also under SAFT (Simple agreement for Future Token) regulations. While all of this raises serious red flags, attempts at discussions with the Foundation officers or CEO are met with personal attacks, fake investor support, deletions of comments and (or) banning on social media (Twitter, Telegram, Facebook etc.) While this is disturbing enough, the US company, I. E. TECH LLC, seems to be only a mail-drop shell entity. It may not even exist as an actual operating company.

TIM is actually run from India or Singapore, a part of the world where crypto fraud is so rampant even the police and government officials are suspected of kidnapping, extortion and other crypto crimes. With several other investors and interested parties, we reached out many times to TIM CEO, Mr. Prabhat Singh for his answers to our concerns. Below is just one of many of his inflammatory posts on telegram channels. This post immediately preceded an organized attack on the Tim Facts channel. https://t.me/IcoFacts Concurrent with Prabhat Singh’s arrival a coordinated group posted numerous pornographic images and disgusting language.

The facts are that the TIM foundation ran and completed an ICO on March 24th, 2018, which they now vehemently deny. Tokens were distributed to investors from that sale which should have been the end of it. We believe those investors legally own or have an equity claim on the TIM foundation, IE Tech LLC, BitPost, BankChip and all assets and technologies.

TIM changed its Whitepaper back in February 2018 without informing investors who were actively investing in the sale. Then they (Prabhat and Foundation) began an organized denial that there was ever a March ICO and instead began to claim that ICO was only a tier one pre ICO sale. The images below are just 2 of scores evidencing the original ICO that seem to contradict the “Test Announcement” above. However they appear then to support our claim of fraud and manipulation.

This January 8 video and February 6 ad are just two parts of the numerous TIM ICO promotions run in December 2017, January and February 2018. The video has been conveniently deleted in #2, but they missed the text under the red rectangle and. How Prabhat Singh can claim this never happened with a straight face is beyond our understanding. If you look at the ICO sale description in the first picture from Feb 6, it already shows manipulation that is contrary to the image below from a month earlier. It should be noted that none of these subtle changes were sent to investors.

Look at the text under the red rectangle. This is the original language that the TIM Foundation advertised and has gone to great lengths to alter, delete or hide any record of. And when they failed at in that effort and were confronted by investors, they systematically called the investors frauds, scammers or accused them of photo-shopping the images. Unfortunately for them we have many - many more.

The TIM tech tests were verified. The commercial models and advertised token values were mathematically defensible; yet eight months later, we now believe TIM may be a SCAM of epic proportions. Tim may well be the Herpes of crypto scams. It never goes away and it never ends. It just morphs into a new story every few months with bigger and better lies. The TIM project may have been nefarious from the time we first looked at it, or it may be that the founder, Prabhat Kumar Singh just got greedy along the way.... You decide. If you look at the shots above, in addition to the ICO dates, Prabhat Singh, unknown by and unannounced to investors, had changed the token quantity from 20-30 or 41 million (many versions) to 110 million with a 1.1 billion token life-cap. If you look at the top of the “Test Announcement” image he is claiming that changes were made because of regulatory requirements, but he does not identify those changes or the requirements. To the contrary, he is still actively selling the March ICO sale ending on the 24th. Did I mention that he was selling tokens at $1.00 in March? But Prabhat and crew seem to have made a fatal mistake, one that repeats often in the following months. He or they regularly make incomplete changes to existing documents.(*) Note they are claiming the Pre ICO sale ended with the sale of 30 million tokens. Then claiming the pre ICO opens on the 12th for a four-hour period and then some kind of undefined sale begins and ends on the 24th. So we ask, what regulatory requirements? What sale?

Prabhat Singh claims TIM to be an enterprise of I.E.-Tech LLC, a US Company organized in Delaware and subject to US law and SEC regs. We believe he has used the implied security a US regulated ICO carries with investors to advantage his sales. The truth is that TIM is actually run from India/Singapore. With several complaints already made to the SEC and other law Enforcement we find it unlikely Mr. Singh is planning any trips to the US in the near future. We challenge Mr. Singh to produce any official notice from the SEC from February or March that required TIM to change token allotments, hard cap or Terms and Conditions in the middle of an ongoing ICO sale. We are aware of no other ICO that did the same during that period. Why February you may ask, because we found another obscure TIM company post on Medium from February announcing required regulatory changes at that time. There is and are no required changes. According to his March notice he had already sold 30,000,000 tokens in a previously advertised 30,000,000 token/$4-MIllion hard cap sale, but in addition he seems also to claim in February the SEC instructed him to, extend his sale, sell another 80,000,000 tokens and increase his sale from $4 mil to $19,000,000 without notice to investors. We believe this was the magic moment the scam was born or went into Phase II. We also suspect that TIM may have sold out so fast Mr. Singh could have decided to keep the store’s doors open. It is possible you are seeing pure and simple greed.

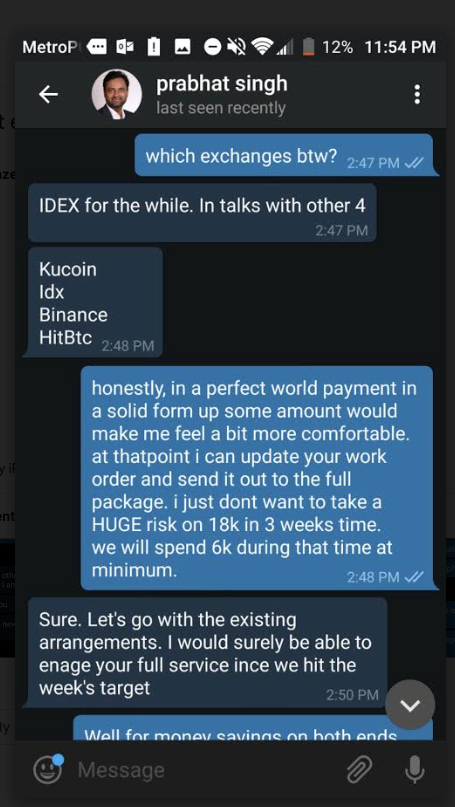

Still not convinced? Take a look at the text exchange between Jon Greenwood and Prabhat Singh below and compare the timelines to the TEST announcement shot above. At the time of the successful TEST Announcement, Prabhat was still claiming to Jon he would complete the sale and list TIM on several exchanges after he had already changed the sale’s terms, dates and metrics without notice to investors. Not only does Singh name the exchanges, he puts a date on the listings. This exchange happens a month after he claims to have been ordered to change everything, we assume, by the SEC. Below Singh is claiming to Jon that TIM would be listed in April, long after he knew it would not be. Why? Perhaps because he knew we would tell the world TIM was a scam. Additionally, while he is claiming the structure changed, he is implying that change has nothing to do with the sale that he is still advertising to be ending on March 24th. This is all very misleading and happening after he had already begun referring to the March ICO as a Phase I pre-sale ICO in other documents.

Exchanges do not list tokens in presale.

Massive amounts of factual evidence, contradictory claims and statements from the officers and agents of TIM, and also months of inconsistencies of actions support anything we state herein. The TIM Foundation itself produced the majority of our materials. While the reader is free to draw their own conclusions, we are compelled to give our opinion of these facts.

As the web of deceit grew, so did the changes. Prabhat and the Foundation began claiming that the March ICO was only a pre-sale that ended in March. Then they claimed it was only a phase 1 ICO sale that ended in March. In the weeks preceding the re-scheduled June-July ICO they claimed the TIM March ICO sale was not a pre ICO Phase I sale but a presale ran January - June. Look closely at the text in the bottom image above. Do you have any doubt what you are reading? Do you perhaps think that image is a one-off or a typo? We have many more from a variety of independent sources in case you do.

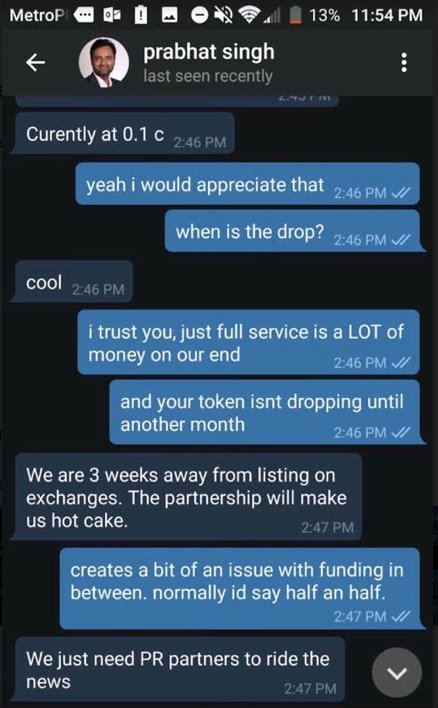

The two screen shots below are from the Wayback Machine. The image shows the aggregate changes made to the TIM web site for 2018 thru August. The size of the circles indicate the magnitude of the changes made. None of us have ever seen a calendar like this before. Also note that these thousands of changes were made during an active TIM sale without notice to investors.

The linear “annual” bar across the top of each calendar represents the totality of the changes made in each calendar year. At all times during 2018 (in black) TIM was engaged in active sales to investors, yet making hundreds and thousands of changes. Enough said? The question is; why would an ICO be making any changes at all to their Site during a sale, particularly undisclosed changes? The answer is simple, TIM representatives simply deny making changes during their sale. Another note, the circles shown above may not be all the changes made by TIM. They merely represent the changes seen from the previous snapshot. There may have been many more between shots, but there were certainly not fewer.

It is important to mention the endless and contradictory Token/Allotment and Allocation changes. They (Prabhat and Foundation) admit that 30,000,000 (3000 ETH) tokens were sold in the sale/ICO ending on March 24th, which coincidentally fits both the 30mil and 41mil ICO caps advertised for that sale. The TIM project then began to morph and develop various and contradictory token metrics ranging from 20MIL to 30MIL to 41Mil, with a life cap of approximately 8-billion, or one for each person on earth, then another for 2-billion, the June ICO for 1.1 billion and now a new ICO scheduled for September 15th. Thru all these changes TIM was still accepting investor money, which in our opinion created possibly hundreds of investor classes. Perhaps this is why we are told investors are now required to sign legal agreements waiving all prior and future claims.

TIM took numbers from other token allotment charts and inserted them into later version after version to justify their actions as having always been true. The amount of data and evidence we have would probably meet the ‘beyond a reasonable doubt” standard in any court. And we plan to show it all to you in coming articles.

In the March sale was there were 110,000,000 tokens allotted for “AFRICA.” (non ICO tokens) These were set aside for charitable work in Africa, not sale. (article link will be posted) TIM officers later changed the 110,000,000 “Africa” allotment to the “ICO” allotment and claimed the 110 MIL had always been the ICO amount. When pressure mounted from angry investors they suspended the June/July ICO in mid-June, claiming it would begin again when the markets were more favorable. They have admitted planning to sell 110 million tokens to ICO investors, yet plan to mint 410,000,000 tokens in that sale. Officers refuse to explain who will own the additional 300,000,000 tokens that appear will not be locked and will be in the control of the CEO. These tokens are shown as “will be burned.” However, no one will actually commit to burning them. The immediate effect of minting 410 mil tokens in a $19 mil sale will result in an instant investor loss of 66%.

Originally, TIM claimed it would burn 300,000,000 tokens in the TGE (token generation event) but have backed off that claim refusing to commit to an answer. They would also not explain why they needed to mint 300,000,000 tokens they planned to immediately burn. Again, officers refuse to address this matter. TIM also plans to mint/mine another 600,000,000 tokens over the next 3-years, once again, being unwilling to explain who will own them, nor will they commit to any revenue/income models that would drive demand or token values. Therefore, the token values in three years, assuming there actually is a company, would likely fall to $.015/TIM. (1-1/2 cents US per TIM)

The Foundation changed and deleted many T&Cs, made numerous changes to their White Papers and Sales Terms, then denied the prior terms outright after the March sale ended and tokens were distributed. They changed the original ICO cap from $3-$4 million in March to $19 million in July. They cancelled the June 110MIL token ICO and are now planning another $2.5 million ICO for September 15th, 2018, claiming they raised 90% ($16.5 million) in private sales, although the math does not balance.

TIM representatives ban their own investors who complain or demand refunds and have unilaterally changed Terms and Conditions retroactively. They then made a mockery of investors and announced that all prior March tokens are now worthless and there would be a new smart contract. Investors who complained have had their allotments canceled. It was recently announced that the foundation is no longer bound by any prior agreements with investors. The new Terms and Conditions give the CEO (Prabhat Singh or wife Sharmistha Singh depending on the source) God-like powers. The investors are now required to waive any right to sue the foundation, its parent or any of the officers.

When one investor asked recently why BITpost had been stripped from the Foundation, Prabhat Singh denied BITpost had ever been part of the foundation at all, stating it had always been a separate company. The Bitpost matter is pretty clear in an above image. We have numerous statements by TIM people that BITpost has been developed using TIM funds or that BITpost, Taxi, Bankchips and other apps belong to the Foundation and TIM investors. The lying is so pervasive one might simply think they don’t care if they are caught. You might find this level of deceit to be impossible. But the constant delays and changes seem to bring in new crops of investors on a regular basis who have no connection to TIM’s past. Since our group began actively exposing this scam, the TIM CEO has been attending more and more Blockchain seminars courting private investors who may be unaware of the goings on.

We have been told investors are now required to sign a binding SAFT agreement and waive all prior rights. The CEO has also stripped other assets out of the TIM Foundation and appears to have moved them to private companies owned by him and/or family members. TIM has changed its token allotments a dozen or more times without disclosure while actively selling tokens to investors. They have made thousands of unannounced changes to their Site and documents without investor notifications. They have advertised their tech as being complete and operational in December. They have claimed successful demos in January, another in March, and another in June, yet they now claim the tech is under development.

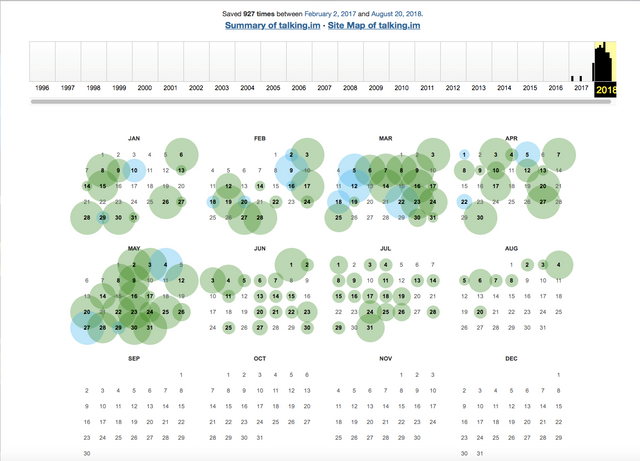

TIM officers have also used the names of prominent people as Advisors or participants without permission. (@timnarrative on Telegram) They have claimed business associations that do not exist and successful tech tests that appear to be cartoonish video productions. Below is an exchange between Rohit Chandan, a former TIM team member who quit after confronting Singh for suspected allotment manipulations, and Ravi Sarkar. (famous FinTech) Rohit is confirming Ravi is a TIM advisor, as claimed in the TIM White Paper. Prabhat Singh continued to deny he had used Ravi’s name without permission even after this and other images were posted on the TIM telegram Investor Channel. The image/s and resulting frenzy were all deleted by Singh and questioners banned. (read wayback post @timnarrative)

There is much, much more. Over the next several days and weeks we will continue to post screenshots, clips, documents and evidence of all the above claims with far more damning evidence of our suspicions that TIM is a very troubled project. Due to the sheer size of our evidence files, we must do this in parts. There is an investor Telegram channel where much of this information can be found. @timnarrative and also a TIM Telegram chat channel should the reader have questions: @icofacts

We will announce future Crypto Criterion TIM posts thru social media.

We believe it is important to follow this story and fully report it. It is time Crypto changed. To do so, projects like TIM must be fully exposed so readers might learn what these kinds of projects look like at birth. In retrospect, all the signs were there from day one. As a result of what we have learned from TIM, we have developed an entirely new way to review projects.

People invested in crypto are probably aware that the market is down, but they generally have no true understanding of what that means in scope. Since its Market Cap high of $900 Billion in December 2017, crypto investors have lost more than ½-Trillion dollars. ($500,000,000,000) The sad part, and the likely reason the SEC et al are late to the game is that $500 Billion did not come from large political contributors or famously rich investors. It came from average people like you and me investing $50 at a time hoping to find the next Bitcoin. What follows in several installments is either the story of a scam reaching biblical proportions, run by a shameless and merciless group led by CEO Prabhat Kumar Singh, or it is the story of an ICO possibly run by the most inept management team in history, or it could be both might be true. You decide.

The overarching point is this: despite all reasonable precautions, S--t Happens. Crypto needs regulation because every time sheee-“IT” happens it is real people who pay the price. We can review code and models, but we cannot stop people from misbehaving, or protect investors from themselves or from greedy operators. Until the SEC and International Law Enforcement agencies of the world start aggressively punishing and making examples of crypto criminals, bad actors will continue to misbehave without consequences while the most vulnerable among us will continue to pay a horrible price.

Posted from my blog with SteemPress : https://www.cryptocriterion.com/tim-the-blockchain-of-other-peoples-money/

| This post have been upvoted by the @UpvoteBank service. Want to know more and receive "free" upvotes click here |