And just like that, the Derivatives Market is opening up to Bitcoin

First it was LedgerX, now it is the CBOE.

In news out yesterday, it was revealed that the CBOE plans on launching Bitcoin Futures Products.

This would mark the second major derivatives market set to be unveiled in late 2017 or early 2018.

LedgerX got regulatory approval to launch the first ever regulated Bitcoin options market just a few weeks back.

More about that can be read here:

https://steemit.com/cryptocurrency/@jrcornel/bitcoin-options-are-on-the-way

Then yesterday it was revealed that pending review by the U.S. Commodity Futures Trading Commission, the CBOE Futures Exchange plans to offer cash-settled bitcoin futures in the fourth quarter of this year or in early 2018.

From none to 2 derivatives markets, just like that.

The Chief Strategy Officer at the CBOE had some encouraging things to say regarding their reasoning for doing this.

According to John Deters (chief strategy officer):

"We've really come to the conclusion recently that cryptocurrencies are here to stay."

Did you hear that naysayers?

Cryptocurrencies are here to stay!

According to Deters, bitcoin futures will be available to both institutional as well as retail investors.

If you are not familiar with what a "derivative" is exactly, it can be defined as:

"something that is based on another source."

In this situation it refers to:

"an arrangement or instrument, (such as a future, option, or warrant) whose value derives from and is dependent on the value of the underlying asset."

In this case the underlying asset would be Bitcoin.

But wait, there's more...

Possibly the biggest part of the news announcement yesterday was who they will be partnering with.

Two names that you likely have heard about quite a bit.

CBOE announced that they have entered into a multi year exclusive global licensing agreement with digital currency exchange Gemini Trust, allowing CBOE to use Gemini's market data to create bitcoin derivatives and indexes.

Who is Gemini you might ask?

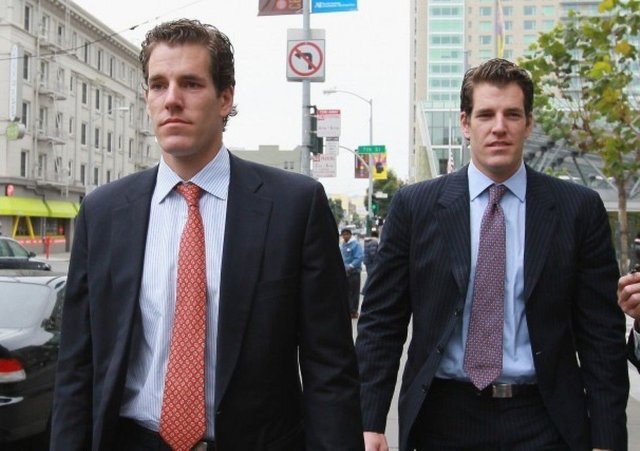

Well the more important question might be who runs Gemini... and that would be none other than Cameron and Tyler Winklevoss.

That's right, the brothers that lost out on Facebook but have had their noses in Bitcoin ever since, (including their failed/delayed ETF launch), are looking like they have positioned themselves right near the top of the Bitcoin derivatives markets.

I wrote a little about their history and involvement with Bitcoin a few months back, it can be read here:

https://steemit.com/life/@jrcornel/facebook-failures-or-bitcoin-geniuses

Enter Winklevoss twins.

Cameron Winklevoss had this to say specifically regarding the coming derivatives markets:

"We believe that derivatives are the logical next step in the evolution of the bitcoin market. In order for bitcoin to continue to grow, you need to incorporate it into the existing market system."

I couldn't agree more.

Derivatives markets will open up Bitcoin to a whole new world of investors, potential a lot of the institutional variety, which tend to have pretty deep pockets.

Stay informed my friends!

Sources:

Image Sources:

http://lifecareer.com/how-to-make-a-career-in-derivatives/

http://moneymavens.medill.northwestern.edu/2009/02/cboe-and-cbot-a-story-in-two-floors/

Follow me: @jrcornel

Cryptocurrency just going to gear up..Thanks for sharing those helpful information.

Of course it is. I think the stock market is kicking themselves asking why their stocks can't rise in price at the rate Bitcoin has been for years and continues to.

This post received a 2.5% upvote from @randowhale thanks to @sumayia! For more information, click here!

I think so too.

http://money.visualcapitalist.com/all-of-the-worlds-money-and-markets-in-one-visualization/

Great news for Bitcoin

Looking forward to this! GBTC is the only product in the US today I know that allows you to be in bitcoin without buying bitcoin...but the premium is over 70%. Ain't nobody got time for that kind of crazy premium. It's about time we get some competition.

Yea, overall I think it is positive for Bitcoin and the crypto space.

Interesting news indeed @jrcornel. Thanks for the update.👍

Just the word, "Derivatives," carries a negative connotation with it - to me. It's almost like another name for FIAT currency. It's fake, it's paper, it's "based" on BitCoin - but it is not BitCoin.

This is what has happened to the Gold & SIlver markets: right now, there's something like 200 paper silver contracts out there on the market, for every 1 oz. of bullion held in reserve. This enables market manipulators to destroy the value of silver, whenever they feel like dumping massive amounts of paper contracts out onto the market - it crashes the prices of precious metals.

I fail to see how this is "good" for BitCoin. This is going to be a way for the central banksters to manipulate the value of BitCoin, which may just end up devaluing the true value of blockchain technology. It undermines everything cryptocurrencies are about: proof of stake, trust in an assets true value, transparency, and authenticity - all of these things are destroyed by the derivatives markets.

That being said - there does have to be some kind of a way for cryptocurrencies to "meld" with the mainstream marketplaces. Hopefully more and more people will be exposed to the true value and potential of the blockchain for making the markets honest again, and helping to provide a much more accurate tool for price prediction - and less room for speculators to jack the prices of assets around.

I have faith in the blockchain, though. It is resistant to hacking & is resilient by its' very nature. If this helps more and more people become aware of its' superior qualities, then this is a good thing. I just hope we don't end up with a situation where the banksters can crash the price of BitCoin, at will.

Upvoted and Resteemed.

Probably a mixed blessing depending on one's position on the market -- not to mention one's market position! The way I see it, institutional involvement usually involves control and manipulation. No doubt this news is fabulous for the brothers Winkevoss, but for the rest of us, I suppose it remains to be seen. :/

That is true. If nothing else it brings more players to the market which at the very least would hopefully create liquidity. So, even if the prices don't increase, more participants would be a plus.

The LedgerX things was nice and all, but CBOE....that is huuuuuuuge. CBOE is what any trader thinks of when they think of derivatives. Well, at least in my world.

Exactly my thoughts as well. To be honest I hadn't heard of LedgerX before that announcement. Also LedgerX is geared mainly at institutional money while the CBOE will bring derivatives to institutional money and retail money.

This type of progress is good for the long term growth bitcoin. If the mainstream financial sector treats cryptos seriously we could be looking at a second boom with all that additional capital added to the crypto space.

Exactly. We already had the first wave a few months back... now we need the next one.

Not sure its a good sign...

I have a couple theories as to what you mean, but elaborate.. :)

When the sharks are in, they can manipulate the market. Many people will loose, because option are a zero number game. That might harm the reputation of honest decentralized operations.

I do not believe that this is good news for Bitcoin. This will open the door for money that was destined for bitcoin to flow into other investment vehicles, and just like in the gold and silver market they can create paper (derivatives) shares of bitcoin that will not be backed on a 1:1. This will mark the end of honest markets for Bitcoin. Just my 2 cents

The bitcoin market is honest today? With forks, ICOs, exchanges doing weird stuff...feels like it's the wild wild west.

By honest I meant that currently the Bitcoin market is complying with the laws of supply and demand. With derivatives markets players can satisfy the demand with unlimited supply of paper derivatives if they are not back by a 1:1 ratio.

Fair point. The wild west will get wilder!

My thoughts exactly. They'll take a cue from the COMEX precious metals markets and BTC price discovery will soon join the ranks of manipulated markets of specs vs. pros. we know who wins this war.

Derivatives are a bad move if we want to keep a legitimate exchange medium. It brings an ability for market manipulation, just like what is happening with the COMEX, as you mentioned. Seems main stream has found a way to gain some control over this cryptocurrency.

That is certainly possible. I think the counter argument to that would be if that money wasn't buying Bitcoin yet, why would they buy it in the future?

@tutial and @jrcornel I believe you are both right. While options open the market up to manipulation, those looking to manipulate will likely want to hold the underlying asset first in order to benefit/hedge their positions. At the least, the market is opening up to institutions who would otherwise not enter the space. Bullish, in my view, for the short/medium time-frame, and who knows on the long time-frame. Only time will tell!

Like any other "alt" investment vehicle, the underlying narrative is that a fiat rebalancing event would also reset the manipulation.

@maven360 I agree with you. This news are bullish for the price of Bitcoin in the short/medium time-frame. But, I do not believe that the introduction of derivatives is compatible with Bitcoins goals of decentralization. Derivatives will grant a central authority the means to satisfy demand with paper derivatives at unknown backing ratios.

@tutial True. Derivatives will place liquidity into the wrong places from a value perspective. However, distributed ledger tech has the potential to completely rewrite our current understanding of derivatives in the process.

So while CBOE/COMEX type derivatives will be self-serving, blockchain has the capability of offering futures on any time increment (1 millisecond - 100 years) with self-policing smart contracts that don't require a central authority. I won't pretend to know exactly how this will look, but the prospect is a positive one in my book!

Also, if market makers decide to over-manipulate a particular crypto, who is to say a different crypto will not emerge that does not allow futures trading? In effect, said crypto will likely become the new "decentralized" crypto that is immune to manipulation.

One approach to the coming flood of futures trading is to simply place "stink bids" in the market surrounding options expiration dates and let the max pain volatility be your best friend.

Still too early in the game to determine. Ball is now in the court of the SEC and figures like Jamie Dimon. We will see what the minions have to say!

Thank you for the update, we can all look forward to a brighter and prosperous future with bitcoin.