$500 Million Dollar Crypto Hedge Fund On Its Way

Mike Novogratz is starting up the largest cryptocurrency focused hedge fund in the world.

Yes you read that right, not only will it be cryptocurrency focused, but it will be the largest of its kind in the world.

By quite a large margin actually.

Only two other hedge funds have raised tens of millions of dollars for the purpose of investing in cryptocurrencies, Polychain Capital and MetaStable Capital.

This fund is looking to dwarf those by raising close to $500 million.

Some Specifics:

The fund will be called the Galaxy Digital Assets Fund.

Novogratz will put up roughly $150 million of his own money and is looking to raise roughly another $350 million from family, accredited investors, and other hedge fund managers.

Although he can't comment on much of the specifics publicly just yet due to SEC rules, he is anticipating the fund will be fully capitalized and ready to go by January of 2018.

Why does the name Mike Novogratz sound familiar?

Mike Novogratz was formerly the CIO at Fortress Investment Group LLC before it closed shop back in 2015 and was later bought out by Softbank Group earlier this year (Feb. 2017).

He has a long history with macro trading, including spending time with Goldman Sachs.

Which is partly what makes his interest in cryptocurrency so interesting.

What is a macro guy doing getting involved with something that is so, well, abstract?

Why cryptocurrency?

Novogratz first become interested in cryptocurrencies when he lost one of his best employees a few years back to blockchain technology.

He thought, this is the start of something big if I am losing one of my really smart and talented employees to something that can pay him even more than I can.

Not long after, Novogratz made his first investments in Bitcoin and Ether.

His Ether investment was one he would end up making a fortune on.

He said he bought roughly $500k worth of Ether for under a dollar and sold the majority of it over $300. The bummer for him was that he said he originally was planning on buying $2 million worth but couldn't get enough orders filled because of a lack of liquidity.

Novogratz's predictions for the future are the really exciting part.

He thinks Bitcoin and cryptocurrency are likely going much much higher.

Check out this quote by Novogratz:

"This is going to be the largest bubble of our lifetimes. Prices are going to get way ahead of where they should be. You can make a whole lot of money on the way up, and we plan on it."

Woah.

He thinks prices are going way up from here.

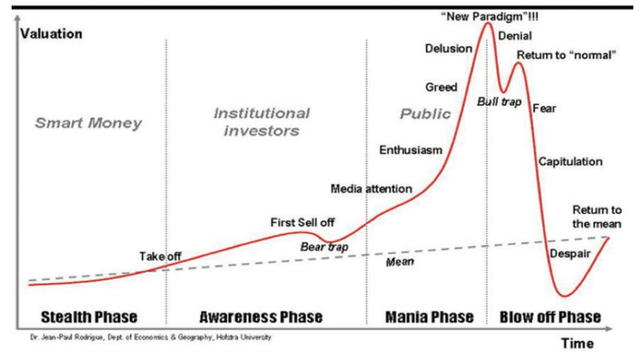

Bubbles in general are formed around life changing technology. From railroads, to the internet, to blockchains. Every single one of those brought great innovation and massive price increases for a whole host of players.

The wheat eventually gets separated from the chaff, but not before outrageous prices are often reached.

Higher prices are coming?

Personally, I think we are part of a bubble as well, one akin to the dot-com bubble.

Great technology is coming (akin to the internet) and it is going to get way ahead of itself in terms of prices just like the tech stocks did in the 90's.

The question everyone wants to know (including myself):

What stage of that cycle are we in currently?

I would venture to say we have a few years left of substantially increasing prices ahead of us, before there is a great reckoning.

Lets read that last quote of his one more time...

“This is going to be the largest bubble of our lifetimes,” Novogratz said. “Prices are going to get way ahead of where they should be. You can make a whole lot of money on the way up, and we plan on it.”

He's certainly putting his money where his mouth is, $150 million of his own dollars, and $500 million total.

Stay informed my friends.

Sources:

Image Sources:

https://www.fosterswiss.com/fondo-de-inversion-hegde-fund/fondos-de-inversion-hedge-fund-offshore/

https://www.coindesk.com/fortress-cio-mike-novogratz-explains-bullish-bitcoin/

https://bitnewsbot.com/institutional-investors-move-into-bitcoin-and-ethereum/

Follow me: @jrcornel

Thank you for posting @jrcornel.

It sounds like cryptocurrency hedge funds are the way to go.

I have heard those familiar with the tech bubble have the same view.

However.......it has been said that until there is more adoption of cryptocurrency there cannot be a bubble. Apologies that I cannot remember the percentage they were looking at.......It was Clif High's report that stated we are at one percent adoption now.

Thank you for your support.

All the best. Cheers.

what do you mean we're in a bubble?

thats some great news @jrcornel

Agree!

they need the money.

I always visit your blog because you inspires me. Do what you do. Thank you very much for sharing inspiring content.

Good post indeed which shows that cryptcurrencies are here to stay no matter the hates coming from fear mongers who are afraid of what blockchain technology will do to their monopolistic control of our finances. As I always indicate in my blog post, we need to be united in our support of blockchain technology especially our steem ecosystem because the future is very bright.

I gragree nice Post! keep it up !!

;o)

I would add one more thing.

Hold onto our coins. I believe said fear mongers are going to be on a shopping spree. They want to put the coins in their possession since they cant defeat it any other way. They have the fiat currency which is the on ramp into the crypto world.

hmmm, yeah, kind of disconcerting that hedge fund managers are getting involved, I just cringe at thoughts of manipulation, but hopefully the decentralization makes it more resilient, but i still don't understand enuff to know

Looks like he shot himself in the foot if he wants to ever get hired by Jamie Dimon...

Profit to had over the next couple years or more and some awesime tech so come with it

I imagine the tech will keep moving forward at a fantastic pace.

It will be a wild ride.

Yes glad to be in early

And the guy did what I did- he bought $500k of ethereum under $1 (my avg price was about $0.70, though I only bought $200k).

Did i just read buying $500k of Ether under a dollar and selling each at $300 ?

Anyone else find his sense of market timing unbelievably god-like? Just saying.