BTSE Exchange General Review

"WHAT IS BTSE?"

BTSE, as pronounced "bitsie," is a multi-currency digital asset exchange network that revolutionizes and provides a one-stop solution that bridges the gap between existing fiat markets and the digital asset environment.

Introduced in 2018, BTSE seeks to offer an exchange utility token that is specifically crafted to improve user experience in the exchange and across the BTSE community. BTSE Token (BTSE) is a cryptocurrency developed by the BTSE cryptocurrency exchange. In addition to being a tradable asset, the holders of BTSE are also qualified for discounted BTSE trading fees. BTSE can also be utilized to buy a variety of BTSE services and products. BTSE is the foremost exchange token operating on Liquid, a Bitcoin sidechain settlement platform for traders and exchanges, which features Confidential Transactions and Confidential Assets to optimize on-chain anonymity.

The establishment is run by a team of experts headed by Chief Executive Officer, Jonathan Leong, co-founder of the company, Brian Wong, COO Joshua Soh, and CTO Yew Chong Quak. The Executive Team brings combined vast expertise in the financial technology and systems infrastructure sectors and have expertise dealing with high-speed trading networks. Based in Dubai, BTSE is authorized by the Department of Economic Development, the Government of Dubai, and functions in compliance with the regulations laid down by the Central Bank of the United Arab Emirates. As a regulated network, BTSE can offer trading solutions for both cryptocurrency and fiat currencies. BTSE periodically monitors the market to satisfy user demand and has lately become one of the world's first futures exchanges to provide Monero (XMR) futures.

"TRADING EXPERIENCE"

Getting to use BTSE is a rather pain-free process, as the key sections of the exchange platform can be reached from the header menu.

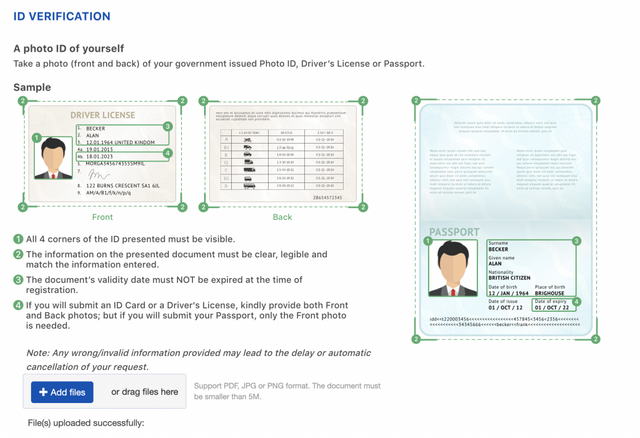

Spot and futures trading networks provide all the features that you would imagine on a sophisticated trading platform, including advanced charting tools and a wide range of order choices, including stop and take profit orders, trailing stops, as well as index orders. As a controlled trading platform, BTSE demands all users seeking to deposit/trade fiat to pass KYC verification.

"BTSE KYC"

As it is, BTSE's two major competitors, BitMEX and Deribit, do not (in the meantime) have any KYC specifications, but neither do they offer fiat trading options.

That said, unverified users could deposit Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Monero (XMR) in addition to three separate stablecoins — Tether (USDT), True USD (TUSD) and USD Coin (USDC). Verified users may deposit any of these cryptocurrencies, including nine separate fiat currencies, such as USD, EUR, GBP, and CNY. BTSE also provides a direct conversion tool between USDC, TUSD, and USD, costing only 0.3 percent to turn these stablecoins into fiat. For those who are skeptical about their trading skills, or merely looking to evaluate the exchange functionality before investing some real money, BTSE provides a test-net trading network that uses fake money to test the market. Remember that this needs re-registration because real money and test trading platforms are different systems. Generally, the BTSE Exchange System is much more user friendly than BitMEX and can be classified as one of the most futures trading platforms that are beginner-friendly.

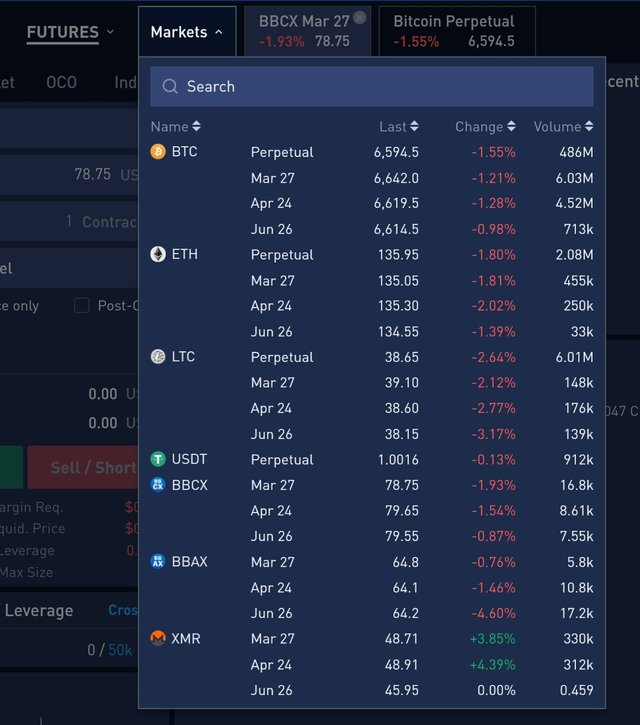

"BTSE COINS AND CONTRACTS"

BTSE splits its trading platform into two sections: spot and futures exchange. For the spot exchange, BTSE currently provides 6 distinct markets,

while On the BTSE futures exchange, users could select from about 7 distinct futures contracts, such as those for BTC, ETH, LTC, USDT, XMR, BBAX and BBCX.

All available futures have a variety of expirations, whereas BTC, ETH, LTC, and USDT also have a perpetual contract alternative. They can be exchanged with up to 100x leverage, or an initial margin as small as 1%, by industry standard.

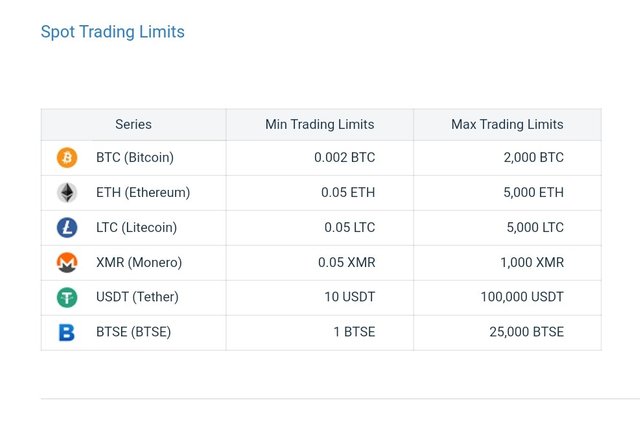

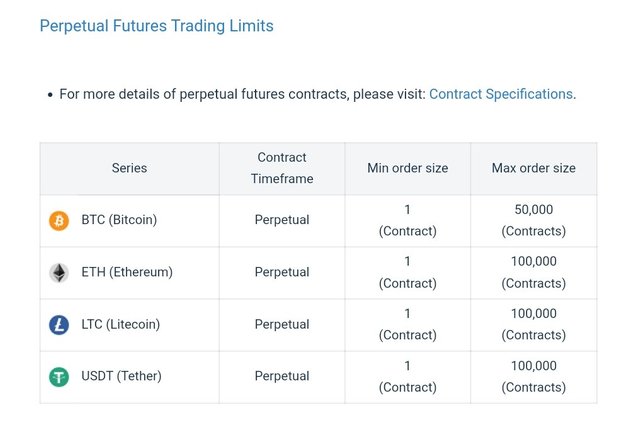

"TRADING LIMITS"

In contexts of trading limits, BTSE sets the minimum spot size at 0.002 BTC, 10 USDT, 0.05 ETH, 0.05 LTC, 0.05 XMR, 1 BTSE, while the threshold is set at 2,000 BTC, 5,000 ETH, 100,000 USDT, 5,000 LTC, 1,000 XMR and 25,000 BTSE

For futures, BTSE places a minimum order size of 1 contract, while the maximum order size is set at 50,000 for BTC futures, 200,000 for BBCX, and 100,000 for all other contracts.

Ultimately, BTSE provides one of the biggest ranges of cryptocurrency futures in the industry— with a wider range than its two main competitors, BitMEX and Deribit. BTSE's spot trading network is generally well over $10 million in daily volume, most of which is due to its BTC / USD pair. That being said, BTSE's futures exchange is far more prominent, with its Bitcoin perpetual reaching more than $50 million in 24-hour volume regularly, while its Ethereum perpetual sees about $2 million exchanged every day.

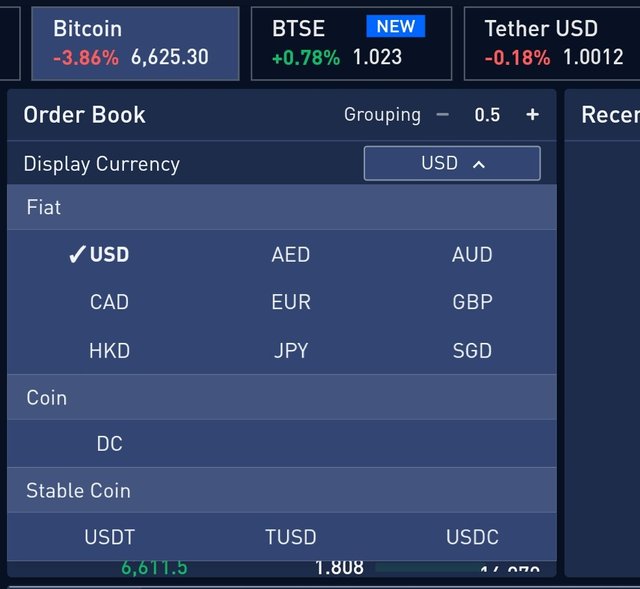

"THE ALL IN ONE ORDER BOOK"

BTSE has also newly launched a groundbreaking new feature to its exchange called the "All In One" Order Book, which incorporates all trading pairs in a unified order book for different assets. BTSE's All-In-One Order Book is the first of its kind in the field to completely feature crypto, fiat, and stablecoins, which ensures that you can easily change quote currencies selecting from all accessible currencies on the BTSE Exchange. This is very helpful in a few respects. Like one thing, by trading your assets specifically for the currency you want to invest in, you avoid the mid-phase of the conversion to your account base currency first, and then from your base currency to the currency you would like to obtain. This would be far more efficient because BTSE brings more assets to the exchange.

You could exchange any currency with any other currency in one move and thus save time and also exchange fees. Another advantage of the All-In-One Order Book is that by adding all trading pairs in one order book, we also merge the liquidity of those trading pairs. This ensures that our traders now have much greater liquidity in their transactions. Not only that: if you are buying or selling a smaller pair, such as XMR / SGD, you can have the same liquidity as if you were trading bigger pairs, such as XMR / USD or XMR / BTC. This way, even for small pairs, users can get decent pricing.

"BTSE TRADING FEES"

BTSE employs various fee arrangements for its spot and future trading networks. For spot trading, BTSE utilizes the industry-standard maker/taker fee formula, which has takers pay more than market makers.

Perpetual Futures and time-based futures have a zero percent maker fee, while the taker fee is a fixed 0.06 percent, regardless of the market.

"SECURITY AND TRUSTWORTHINESS"

Since its introduction in 2018, BTSE has been lauded in the industry for its efforts to bring institutional security to ordinary investors. As a controlled network, BTSE may be held liable for its shortcomings, unlike most other margin exchanges. The brains behind this initiative also have experience operating with trading systems and have partnered with major firms such as Goldman Sachs, IBM, and SingTel. It is, therefore, obvious that BTSE would do everything in its power to avoid being jeopardized. Concerning alternative security options, BTSE includes support for Google Authenticator as a two-factor authentication method. Upon setting up 2FA, the Google Authenticator would need to be used to sign in, withdraw funds, and alter the API keys. Users are also provided with the choice of setting a whitelist of IP addresses. Only login attempts from these IPs will be enabled, rendering it nearly impossible to use a breached account. Beyond that, BTSE also includes a range of back-end security features that enable guarantee that user data and funds remain secure at all times. For one, the exchange claims to hold 100% of customer funds in cold storage, which can only be opened using several keys. BTSE is also one of the only exchange networks to self-host, which ensures that there is no need to panic about weak third-party protection that could lead to an information loss. The BTSE Exchange Help Center is structured to respond only to general questions about the use of the network.

In addition to this, BTSE now has a dedicated education service known as the BTSE Academy, which offers a range of material designed to help traders develop their skills and expertise, in addition to daily news and general trading lessons.

HOW TRADE ON BTSE

To start to using BTSE is relatively easy. Here's a beginner guide to the basic steps you need to take before carrying out your first trade on the BTSE exchange.

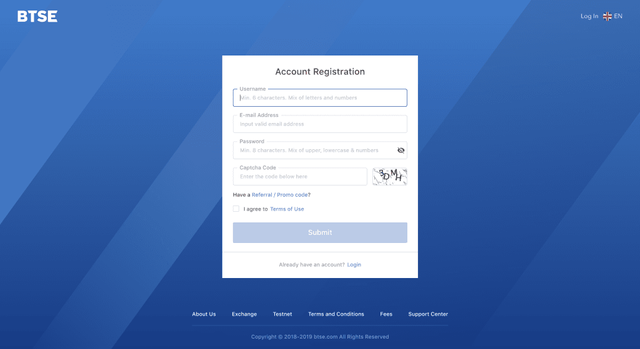

1. SIGN-UP AND CREATE ACCOUNT

To commence, you will have to create an account first by heading to btse.com You need to choose a username, your email address, and a relatively secure password.

Upon registration, you will have to choose your base currency. This is the currency you want to spot trade with, though futures are always bought and sold in USD. You'll also get a confirmation email that has a link to authenticate your account. Email authentication will be needed before cryptocurrency deposits are enabled.

2. DEPOSIT FUNDS

As soon as your email is authenticated, you will create your deposit address for one of the four platform-supported cryptocurrencies under the site's "wallets" section. These can be used to top up your balance with the cryptocurrency you have chosen.

Bear in mind that if you want to trade fiat currencies, you also require identity verification. This can be performed by going to the' verification' section of your account settings page.

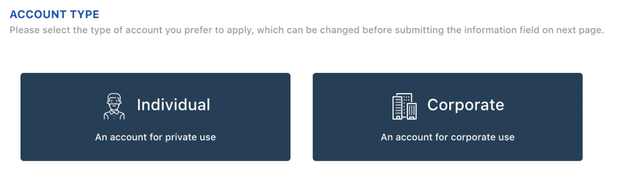

Here, choose the kind of account you wish to open (either personal or corporate). You will be needed to provide some basic personal details and legitimate identification and address. Usually, BTSE analyses KYC documents within an hour, but can also take longer.

Upon verification, fiat deposit guidelines will be available on the site's "wallets" page.

3. START TRADING

When your deposit is verified, you're free to start trading.

To begin, choose either the "spot" or the "futures" option in the top BTSE banner to access the trading interface.

You will now be able to select the market you want to trade under the header bar and next to the "Find Markets" button.

After your target market is chosen, you can enter your order choices using the panel on the left.