Elliott Wave Theory in 10-15 Minutes

"If you put twelve Elliott Wave practitioners in a room, they would fail to reach an agreement on wave count and the direction in which a stock is headed."

It is true that the process of counting waves can posses a multitude of problems and one could come up with a thousands ways how to map a run. As long as you are able to place the logic and rules the Elliott Wave Theory entails onto your findings then the final product should give you a clear understanding to the picture you are trying to develop.

I am no expert but i do believe that everybody should get a basic understanding to this principle and a few others i will also be posting. SO with this i will now leave with a few basic ideas and rules behind this tested concept.

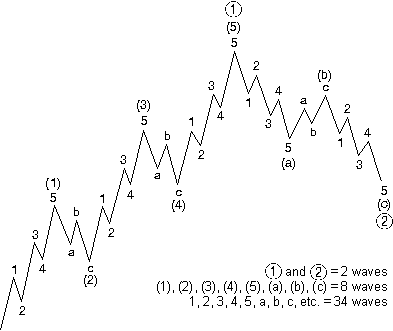

Elliott Wave impulse patterns happen in 5 waves, numbered 1-5 respectively, followed by 3 corrective waves ABC

Waves 1-3-5 are impulse waves and 2-4 are corrective waves

Impulses could be in an uptrend or downtrend depending on the market

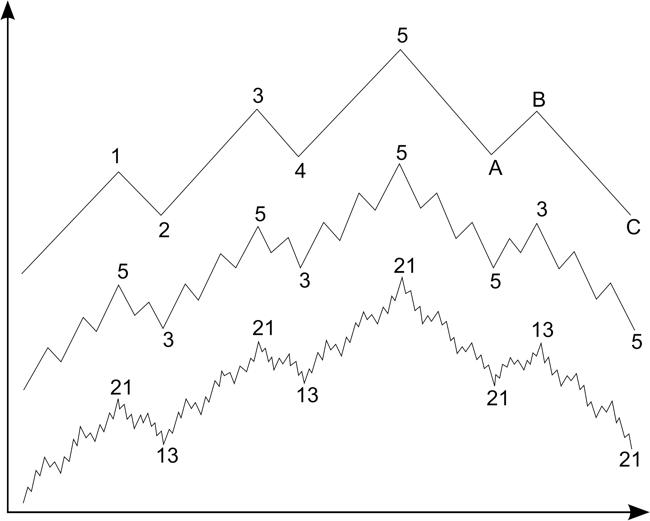

Elliott waves have sets, supersets, and subsets. and that could even be broken further down.

The Process of going through a full set, 1-2-3-4-5-A-B-C on a 1 hour chart will be part of a bigger overall trend or WAVE pattern on a higher time interval, such as a daily, and that bigger trend will be the a superset with Wave 1 containing waves 1-2-3-4-5 from the smaller set, and corrective wave 2 will contain waves ABC from the smaller set.

You could also zoom into smaller time intervals to see even smaller sets I call Sub-sets, or zoom out to really large time intervals for an even bigger trend.

note:

The higher the time interval the stronger the trend.

meaning, that just because the 1 minute is bearish doesn't mean the overall trend on the daily is.

Now that we could get a basic understanding to how exactly these things set up.

BTW THE WAVES NEVER EVE SET UP THAT NICELY ON A CHART THATS WHY THERE IS A MILLION AND ONE WAYS TO DRAW A SINGLE TREND!

Now lets get into some rules..... Well not just any rules it is the THE RULES..... THE THREE RULES

WAVE 2 CANNOT RETRACT 100% of wave 1

WAVE 4 CANNOT RETRACT INTO WAVE 1's TERRITORY , OR IN OTHER WORDS OVERLAP

WAVE 3 CAN NEVER BE THE SHORTEST

these rules only imply for impulses, corrections are...... well a much more complicated and twisted sorts of a mess that needs much more time to understand.

Some other notes: When Wave 3 is the longest impulse wave, we could assume wave 5 will just about equal Wave 1 and has the potential to go even further.

-i play conservative so I never shoot to sell over a 1-1 extension, I'll take the where I can-

-we will get into extensions later too-

Wave 4 and 2 are inversely related. If Wave 2 is a sharp or long correction, wave 4 will be long and drawn out. If wave 2 retracts 75% wave 4 will not retract as much and vice versa.

After a 5 step sequence we could assume in a BULLISH market an ABC correction will end between the .5-.786 FIB level

with .618 being the GOLDEN AREA.... we will get into Fibonacci later !

Happy Trading !

Am a physicist by profession so the wave got me 😂 never knew it's another wave you're talking about.

Well it actually add to my well of understanding.