A former Silk Road vendor’s take on the Haven Protocol / XHV - Or: How to be your own Offshore Bank

“With Haven, the built in native smart contract allows value storage in terms of fiat currency without having to convert out of Haven. Colloquially, this is akin to having a Swiss bank account in your back-pocket. This contract is referred to as Offshore Storage.”

-tl;dr

Intro

A couple of years back I used to dabble with what you might call “dealing drugs”. I’m not particularly proud of that, but its a fact, and it provides some important context to this post.

You see, I had a tiny presence as a vendor on Silk Road 1, and I had a short stint on SR2 as well. Or so I thought, until I got busted — it turned out that my definitions of tiny presence and small stint probably might be understatements. But I digress..

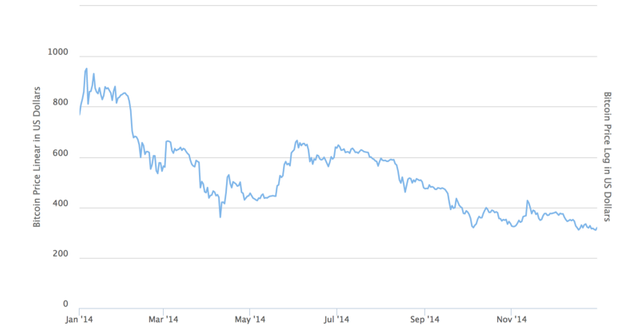

One lesson learned, first in a good way, and later in a very, very bad way was that cryptocurrencies (which for me, back then, meant Bitcoin and only Bitcoin) fluctuates in price. Massively.

In the early hay-days of Silk Road, the original SR, with DPR, Doctor X, and all those other funloving cats on the SR1 forums (shoutout to each and every one of you who passed through) those fluctuations were for the most part extremely positive. Sell a gram of weed, and by the time you’ve converted your BTC to fiat you get the money equivalent of 5 grams, sometimes way more.

It was beautiful.

However, all good things must come to an end. A theory I, myself, has proven to be true on numerous occasions.

It wasn’t long before the first negative fluctuation hit, which put me in a position where I owed more money for the drugs I had sold, than the actual sales themselves had brought in.

You can probably imagine that, as a drug dealer, that is not an ideal situation to get yourself caught in. That applies to all types of vendors, of course. But situations like that have a tendency to be extra stressful to drug dealers, for some reason.

This little backstory sets the stage for my initial review of

The Haven Protocol

Last night I was browsing through my list of cryptocurrency personalities on Twitter when I noticed someone mentioning a new coin ticker I hadn’t seen before: XHV

https://twitter.com/cryptomocho/status/983426131163598848

A short Google search led me to their website, where the following description stood out to me:

“Haven is an untraceable cryptocurrency with a mix of standard market pricing and stable fiat value storage without an unsustainable peg or asset backing.”

Now, it was about 4 in the morning and I was high as fuck so I had to read that sentence about 17 times, with long pauses of staring blankly into the air in between, before it dawned on me, to my amazement:

Cats and dogs have, like, a kind of rivalry or something…

It felt like a Eureka moment. Shortly after that, I remembered my initial task of trying to comprehend what this Haven Protocol is all about so I kept reading down the description on their website. That was when a second, and third, paragraph turns the “whooooaa-duuuuuude” level in my head to 11.

Here are two usecases for which Haven is specifically suited:

Point of sales/payment gateway systems where goods can be bought with Haven and stores can immediately lock the fiat value in to protect from price fluctuations.

And

“Storing large amount of money outside of the traditional banking system. Privacy focused cryptos are perfect for this but without a reliable way to maintain value through fluctuations the process of holding could be costly. Sending Haven offshore quite literally, makes money disappear until you want it back at which point the value remains intact.”

Ok, I’m intrigued…

How the fuck can you create a currency that follows BOTH market pricing, and allows for pegging to USD, for instance?

I realize that I won’t be able to sleep until I figure this out, so I take a dive into the dreaded old buzzkillin’ whitepaper for more info. To my luck, as I neared the section where ol’ Bob and Alice usually demonstrates some highly advanced cryptographical procedure, and confuse me to the point of insanity while doing so, the Haven Protocol Whitepaper was easy on me. For the first time in my life, I only had to worry about Bob was doing, Alice didn’t even show up! Here’s what Bob’s up to in this adventure:

“Bob decides he wants to put 200 of his Haven into offshore storage. The offshore smart contract determines the current market value of that Haven (in USD for now) based on a weighted average of volume across supported exchanges. If the current value is $1 USD then the contract will record a value of $200 USD worth of Haven at Bob’s request. The 200 Haven that was sent is then burned and the total money supply decreases.

If the price of Haven then moves to $2 USD and Bob decides to access his Offshore Storage, he will be returned 100 Haven (100 * $2 = $200 USD as per original value). If the opposite occurs and the price of Haven halves to $0.50 then 400 coins will be minted and sent to Bob.”

Now this is brilliant in its simplicity, but a couple of obvious questions come to mind. Particularly with regards to inflation, how can a smart contract mint new coins on demand and not affect the market value of XHV?

For instance, say there is a smart contract that requires 100.000 new coins to be minted, and lets say that only 1.000.000 XHV are in circulating supply, does that not have a negative effect on the price? In my head, the price of the currency would drop by 10% in the above example, right?

Well, maybe not. First of all let me remind you that these contracts also burn coins, so if there is a steady increase in price based on the hard cap of 18.4 million coins (before the “tail emissions” as the whitepaper calls the coins that can be minted from smart contracts). This is explained in the first scenario, where Bob only gets 100 Haven coins back at a value of 2$ per coin as opposed to the two hundred 1$ coins he submitted to the smart contract.

With this in mind, it is easy to imagine that a whole bunch of the initial smart contracts will — if the coin catches on — have to burn coins when smart contracts are redeemed, and not mint new ones.

However, market fluctuations will inevitably cause the need for smart contracts to be able to mint new coins as well, adding more coins to the current circulating supply which will have a negative effect on the price, no?

Enter Quantity Theory of Money

So this is the part where my head started hurting a bit once more, but the whitepaper states that:

This ’mint and burn’ method draws on the quantity theory of money described in monetary economics in order to avoid inflation and changes in currency valuation based on the movements in the total supply. The theory states that

MV = PT where:

M = Money supply

V = Velocity of money

P = Average price level

T = Volume of transactions

An increase in the money supply should, with a constant velocity and volume of transactions (assumptions of the economic model), cause an increase in the price level (inflation). The problem with this is that the money supply of Haven will always be unknown. Although there are 18.4 million coins (before tail emission) that will be mined, the ’mint and burn’ lets the money supply fluctuate freely. Velocity of money is also cryptographically unfeasible to determine as the Haven blockchain does not reveal the amount of Haven transferred nor the wallet addresses they are transferred to.

Ok, so after picking the pieces of my brain off the floor once more, and reading the section 100 times I still couldn’t really grasp what they were trying to tell me here.

I got really hung up in the part where it seems (to me) that the whitepaper introduces a problem with that is caused by the fact that the money supply and velocity will be unknown with the Haven protocol, and it took me a few moments to realize what the paper is trying to tell me.

It turns out that this is actually one of those good problems to have, I’ve heard Marlo Stanfield mention those in the past.

The quantity theory of money is actually describing the process of inflation, so introducing a problem into this theory will counter its effect. If you cannot know how many coins there are in reality, and you cannot monitor the amount of transactions, you will have no way to determine some of the necessary metrics that comes in to play when a currency is inflated.

Conclusion

It was a rough night, but my brain made it — at least half way — through. I had all the information I needed to decide that this was my new favourite coin for both storing and transferring value.

Today, after some needed sleep, I’m still caught up in the promises of this coin and I’m already mining it and considering whether to invest or just to count on the mining rewards. The entire project seems gives me sort of a flashback to the day I discovered Bitcoin back in 2011, now that discovery lead me down a slippery slope — as described initially, however my captain Hindsight-like superpowers have taught me a few lessons, also I meet a lot of young aspiring Captain Hindsight’s every day, reminding me how “you shouldn’t have done that” so dont worry about the aforementioned flashback, I’m starting to get the picture.

But it makes me wonder, because I did, once upon a time, possess a great number of bitcoins that magically went down the drain long before my arrest. At least kind of, they were really never mine, just a few of them. And only for a short while, but in the long run after combining my two main skills; using drugs and having bad luck, I wound up having to pay way more money for the drugs than I actually ever made from selling them online. Keep in mind that, when transferring bitcoins that stem from illegal drug sales, the withdrawal process is a bit more cumbersome, and it might take a while longer to be able to make the actual crypto-to-fiat conversion — leaving you extra vulnerable to a negative fluctuation. That was something that proved to become quite an obstacle, with increasing risk as sales-volume grew, while the price of BTC did a nosedive.

2014 — Not exactly my favourite year.

I wonder if this new coin might be a final solution to all such problems…

Now, to be clear, my intention in this post is not to shill Haven for any illegal purposes. I’m just explaining, based on my own experiences, how the major fluctuations in crypto prices can lead to major challenges for salesmen of any type, and with that in mind — Haven seems to have one of the most fascinating approaches to solving such challenges and I’m looking forward to following this project as I move forward.

To finish off this, which is my first Medium article, I’ll leave you with a little story about the beauty of cryptocurrencies.

Way back in 2011, or something, I tipped a random-online-dude approx.10 bitcoins for some helpful advice he gave me on a forum, I rediscovered this coincidentally, years later, around the time when was moving steadily towards 20.000$ and when I noticed that I smiled and wondered if the guy had been HODL’ing his shit.

With that in mind, I shamelessly direct you to Trade Ogre where you, at the time of writing, can purchase XHV for just over 1$, and if you after making a purchase feel like tipping me a couple of bucks I would not mind a few XHV in my address:

hvxyCxSYVGLSysjcLhRUhEfpHX3p9wXjpGNFC7iR84DPewEuZ3BxoYAaC7uUVvMxxVVBWwsxWkzPLPfFqwtVxveE7S9tdCbok4

And trust me, any transfers will be HODL’ed for about 3–5 years at the very least as I’m heading back to jail some time within the coming months to pay the final price for my past mistakes. So if you can spare a few bucks right now, perhaps you’ll in a few years time discover that those bucks turned out to be a huge pile of money helping me get back on my feet upon release from jail. And if so, unless you think that I’m a huge asshole of course, you might just take some joy in that discovery :)

Btw, in case you enjoyed the article, but you do not plan to buy any XHV, I can assure you that any tips to any of the below Wallets will not have a single outgoing transaction for the next 3–5 years, either. And with the below currencies you can actually fact-check that statement, because the do not possess the same unique features of Haven, the Offshore Bank Account you can walk around with in your pocket ;)

BTC: 14iKgia5wtdjmLXs7QiJui3Sb6KVP6XebL

ETH: 0x913c1CD95Dc971B304C5217831102E350230efaB

BCH: qq5tjpm0jv460tvk4pa050pwc6u2aj46gs2tce2rd4

NEO: ARdd2cqCSajpzkSZGFtSqAPvBLYcquD7WH

If you’re not into crypto, stop hesitating and do something about it, but in the meantime please feel free to upvote this article.

For more info on Haven Protocol check out the following links, and please contribute to this project in any way you can if you find it as promising as I do.

https://www.reddit.com/r/havenprotocol/

https://medium.com/@havencurrency

https://twitter.com/HavenProtocol

https://github.com/havenprotocol

P.S. I have this twitter account: https://twitter.com/K_Uuuger — I’m not sure what to make of it yet, but if I keep writing shit I’ll probably promote that shit on twitter so if you love people promoting their shit, follow me… I guess.

Oh, and last — but not least:

Congratulations @krugercrypto! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPHi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@KrugerCrypto/review-a-former-silk-road-vendors-take-on-the-haven-currency-xhv-7c422b39c559

Yup, that is the Medium version of my post, had to wait a bit for the Steemit registration so I put it up there first :)

Hey @krugercrypto, the markets are pretty crazy right now. Crypto is back to a weird space but I know long term it's still what we're all hoping it will be! Cheers

Coins mentioned in post: