Traxia Platform

Traxia is a blockchain platform, the main objective of which is trade finance for small and medium-sized enterprises (SMEs). Often, the latter does not have enough working capital to carry out full-scale economic activity, and the founders of the Traxia platform concept decided to create an alternative to the banking market for financing trade operations. The essence of the project is as follows: sellers (producers) of goods or services to replenish working capital sell financial intermediaries for a discount receivables from the buyer of these goods or services. The sale of such debt to a financial intermediary is estimated, depending on the reputation of the deal participants - sellers and buyers, as well as market stability and other economic factors, including the presence of risks - from 50 to 95% of its value. The seller from the financial intermediary receives most of this amount, and the rest - after the buyer has paid off his account to the financial intermediary, which, in turn, earns a commission in the form of a discount.

In the banking business, such operations are called factoring (from the English factor - the intermediary), and, in fact, are one of the types of short-term lending. And like any financial services, factoring is licensed and controlled by regulators of national banking markets and central banks, and the services themselves are provided by retail banks.

However, SMEs, as a rule, do not often resort to this kind of lending, and there are several reasons for this:

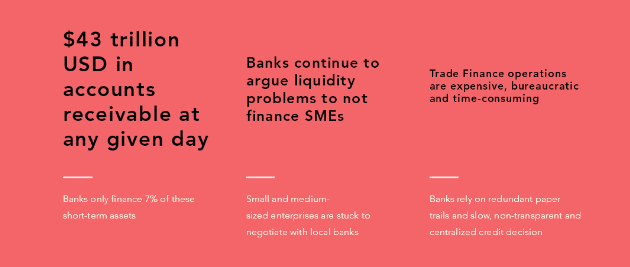

Banks are reluctant to factoring, as, in fact, this is lending without collateral. And in light of the progression of world and local financial crises, the desire to lend without collateral to banks is less.

Lack of reliable sources of information. For the correct economic evaluation of the borrower and its counterparty, as well as the subject of their contract, the market in which they work and related economies, banks still use insider information and internal standards for assessing the client's creditworthiness - the first factor does not inspire confidence, and the second does not inspire confidence reflects reality.

Banks regard factoring as more risky, in comparison with classical secured loans, a financial instrument. Therefore, they pawn their risks in an increased commission, which in the end makes factoring ineffective for the client: all profits from future payments go to the repayment of the commission of the intermediary bank, and the transaction itself is economically unjustified.

The World Chamber of Commerce in its report in 2016 called the absence of short-term operational lending a "brake", and short-term lending - the "oil" of world trade.

According to Kemper, in 2016 there were about 43 trillion US dollars a day in the world of total creditor and receivables, is not it an attractive market? And given the fact that the world banking system provides financing for export-import transactions worth about 3 trillion US dollars - 7% of the total - the prospects for growth of the alternative financing market are evident. Approximately so reasoned the creators of the project Traxia

The [Traxia Foundation]concept(http://traxia.co/) is the creation of a decentralized market for short-term financing with the ability to quickly, efficiently and inexpensively access finance for SMEs and, on the other hand, providing investors and traders with opportunities to earn money . Information companies and software developers will also not be left out, their lot is filling with reliable information about market participants and creating programs and applications integrated into the business processes of the platform. Thus Traxia is the aggregate of capital that provides alternative financing to the banking market, with the capabilities of blockchain technology.

Who will participate in the newly created Traxia ecosystem?

Vendors - companies that offer the product for sale. In the Traxia ecosystem, sellers are also business entities seeking to increase their liquidity. Sellers for their part or together with buyers, publish the terms of the transaction in the form of a smart contract, which is, therefore, a trading obligation. It is planned that in the Traxia ecosystem, sellers are SMEs

Buyers. Companies that purchase the seller's products. In reality, buyers are significantly larger companies or organizations than sellers, and have higher credit ratings, which in turn reduce potential risks for investors. And the issue of a joint smart contract further minimizes such risks, which has a positive effect on the reduction of the commission of the financial intermediary (respectively - on the growth of the seller's earnings), and on the attractiveness of the market as a whole.

Investors - individuals and companies that earn on the purchase and sale of financial products and assets.

Providers. In the Traxia blockchain they are developers and suppliers of technologies, applications and programs developed to support and operate the platform, as well as those information products that will be integrated with it in the process. Providers create a platform for systematizing the process of downloading and identifying information about the market, its players and operators, their interrelationships with business and credit histories. Such information is formed from public sources, which are widely used by modern web resources, from the infrastructure of the blockchain, being accessible and transparent for the participants in the transaction financing - investors, buyers and sellers. Each of these participants associates its actions with the blockchain, signing the transaction with a separate personal digital key, which was assigned to it by the provider. Providers are also responsible for technical integration into the platform of listing agencies and other data providers. The scope of providers is also providing access to payment gateways so that participants can regulate exchange rates.

Listing providers - suppliers of information about the market, its players, assets and securities, with appropriate ratings - in accordance with the requirements and rules of the exchanges on which these assets are traded. Listing providers in the Traxia platform correspond to the current rating agencies.

Provider (suppliers) of liquidity - large financial organizations: funds and banks and other institutions whose purpose is to initially acquire assets with subsequent resale to smaller investors. Liquidity providers earn on the price difference.

Tokens

The internal currency of the project is Traxia Membership Token (TMT). This is a token, issued by the Traxia Foundation (registered and operating in the legal field of Switzerland). The TMT token purchased on the exchange gives access to the Traxia ecosystem used by the participants every time they make a specific transaction.

ICO

The development team of the Traxia platform emits 1 billion TMT tokens. The current token price is $ 0.055. The upper limit of fees is indicated as $ 15.1 million. At the moment, a bonus of 10% and $ 10 million are already collected. Exit to the stock exchanges is scheduled for June 06, 2018.

For sale, 400 million (40%) of TMT tokens are offered

200 million oksen (20%) is reserved for liquidity support

Also, 200 million (20%) tokens are intended to reward the development team of Traxia

Tokens are offered for BTC, ETH and ADA.

Minimum contribution = 0.01 ETH

The sale will last until June 06, 2018, if all tokens will not be sold earlier.

More detailed information about the project, its team and ICO conditions can be found on the project's resources:

Website

Token sale

White paper

Facebook

Twitter

Telegram

Ann Threads BTT

By: larrybabs

https://bitcointalk.org/index.php?action=profile;u=1249538

0xf52B863523F0B4be22AA3e92A0AE62698bb947ca

@larrybsbs you're on the @abusereports naughty list!

If you do not stop, your account will be rendered invisible on Steemit. Bad Steemian! Bad!