Inside A Crypto Pump & Dump Organization, Part 1 - The Setup + Discord Invite Links For The Inquisitive & Foolhardy!

If you have a pulse, you're probably aware that the cryptocurrency markets are well known for one outstanding feature in particular - volatility.

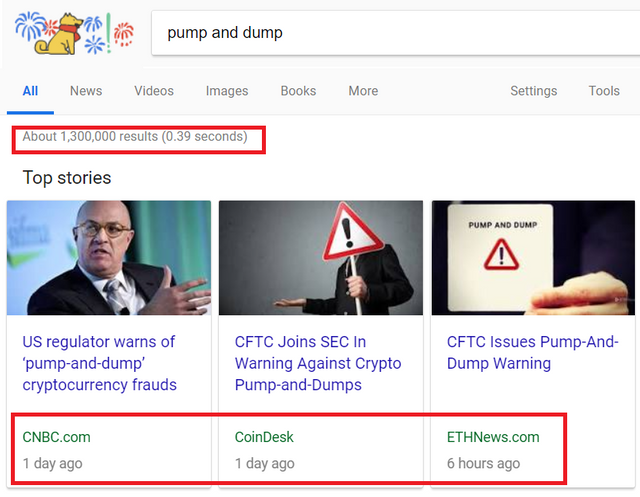

Unfortunately, cryptocurrency is starting to get a reputation for the "wrong" kind of volatility, and the government may yet again be "here to help."

What contributes to volatility under normal circumstances? Well, truthfully a number of things that cryptocurrencies have do. Rapidly expanding markets based on new technology are inherently volatile, especially one so regularly fraught with regulatory peril as cryptocurrencies are. On top of that, thinly traded markets with slim order books and low market cap assets create a perfect brew for facilitating volatility.

However, there is another source that is definitively affecting the market you might not be considering - organized trading groups, typically derisively referred to as "Pump & Dump" operations.

Typically, one can pump a stock either by distributing "information", or with overwhelming volume. The operations I'm aware of in the crypto-sphere are mostly engaged in the latter.

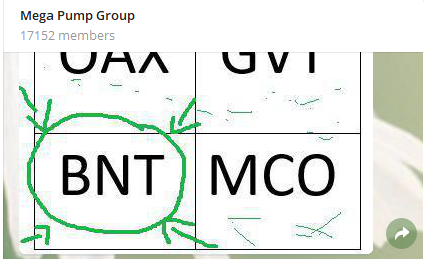

The way these groups work is that a signal goes out to all the members of the group to purchase the same thinly-traded alt-coin at a major exchange. Times are chosen to maximize impact from members being present and market activity. Usually, Binance is the popular target as they have a functional interface that includes the option to buy and sell at market, something that is surprisingly missing from some other major exchanges such as Bittrex, and is borderline mission-critical when attempting to execute fast trades in a suddenly clogged market.

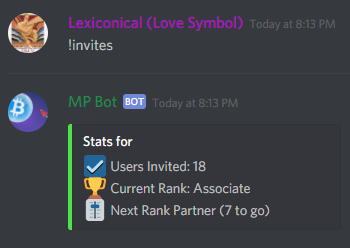

There are two types of pumps, ranked and unranked. In an unranked pump, the signal theoretically goes out to all members at exactly the same moment, and the battle for gains comes down to speed in trade execution, latency, etc. In a ranked pump, the signal is time-delayed to different groups of users based on their contribution to the Discord group (generally in the form of users invited). The competition is fast and furious either way, as the advantages given are measured in halves of seconds.

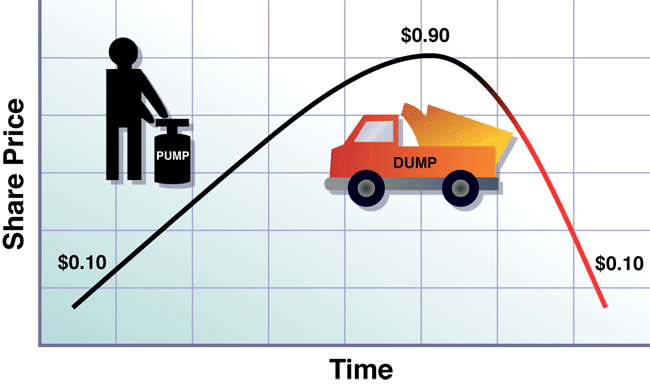

Results can be impressive, painting 1m candles showing gains as high as 50%. The gains are given back just as quickly, with the market typically equalizing to very near the original price. Unless you are very fast and early, you may end up a bagholder.

Below, I'm going to paste a series of links to the various Pump groups I've been invited to. I'm going to be very clear here and say I DO NOT ENDORSE ANY OF THESE GROUPS. I provide the links so that anyone interested in how these groups operate can do their own investigation. If you follow any trades from these groups, which I explicitly suggest you NOT do, you are at your own risk.

Note that following these links to join these Discord groups actually helps me bring additional information to my readers, as they employ a ranking system based on # of users invited which cordon off access to channels based on how much you have promoted the group. It is very difficult to determine who is profiting from these operations without access to the early-information channels for promoters, but as I stated before, I am not trading pumps and do not intend to.

- First, the group noted in my expose above, "Mega Pump".

- Second is "International Pump Industries"

- Third is "Fair Organized Pumps".

- Fourth is "Fair Pumps". I'm noticing a trend of overcompensation here.

- Finally, we have "Ultimate Unranked Pumps"

AGAIN, THESE LINKS ARE ONLY SUGGESTED FOR OBSERVATION/CURIOUSITY. TRADE AT YOUR OWN RISK. I DO NOT SUGGEST TRADING PUMPS.

As you can see, much like an earlier, unregulated stock market there is no shortage of these trading groups to be found.

Stay tuned for part 2. I'll discuss the several pumps I have directly observed in real time, which paints a critically different pictures from the conclusions you might draw if you only checked the results charts. The results that these are not money printing operations for most of their users may surprise you.

We also have a Radio Station! (click me)

...and a 5000+ active user Discord Chat Server! (click me)

Sources: Google

Copyright: ClayTrader.com, WealthDaily.com, Discord

Thanks for this. I've come across one TG channel that does this and reading through the posts there as they prepped people for the next pump, I couldn't help but thinking what a risky idea it was. I doubt it really does the overall market much harm doing the volume play like this, since if you happen to set a stop-limit order that crosses that price you just get lucky, and otherwise the market goes back to what it had been pretty quickly without your ever knowing anything happened. It's the people participating who are at most risk.

I also thought, well they are telling people they have to be ready in 7 days, now 6, now 5, etc. and then will be told what coin they are buying at the last minute. But of course you know that the PnD organizer is buying up that coin the entire week! They need the week to buy enough slowly without making the price move up any before their pump signal goes out. They are going to be the real winner, dumping as soon as they send out their "buy now" command to their followers.

I look forward to seeing your next post. Somehow I suspect you discovered something similar.

And then of course there is also the misinformation PnD, which those who can leverage the mainstream media or large audiences of their own tend to do. That one tends to be slower moving, but just as deadly for your crypto balance sheet.

Great topic.

"It's the people participating who are at most risk."

I've have to agree. This will mostly hurt those scooped up in the great search for bagholders, ie the slowest members of these groups.

Incidentally, replying myself here to note ironically I've already received another invite to a new group since posting this article. Here's another link for anyone else wandering down this rabbithole.

https://discord.gg/fjcDsar

Thanks for the info! Been wanting to hear more about these types of operations for a little while now! Following you!

All this sounds exciting but...........

I not sure that I would make download from there site.

How safe is it ??

You don't download anything from them (and you are right to be wary).

The above are just Discord links that will give you access to their Discord channels. No downloads.

Interesting bit of information, I'm glad you brought this topic up to light for me and others to have a think about

I took a look at one of the groups you sent me an invite to... This does seem pretty insane in terms of the economic value... It's like casino-roulette style market-trading lol.

I would be deeply suspicious of "joining" an organization that deals in this kind of stuff... How the hell do you know you're not going to be at the tail end of the signal, buying the high right before the price collapses...

I suppose if these groups were made of tens of thousands of people, and the operation lasted a few weeks; it could be.... interesting?

But if its just a couple a whales running the show and they're just looking to loot other people's wallets; it's like how would anybody be interested in this?

I have a hard time understanding how this even works? I guess some people just want to be a part of a group when they enter the market and don't have the analytical and technical skills to make informed decisions by themselves?

It's a herd mentality towards gambling... Why would anybody be interested in this?

The idea is that it won't be gambling. Since it's an organized operation, the perception is that everyone makes money. Reality is something else. It simply appeals to greed, which reliably works on humanity.

Yeah... That's the idea...

Like you say! The reality is completely different!

All that money that the early guys giving the signal makes will be coming straight out of somebody else's pockets...

It's literally a mass market ponzie-pyramid event... Those who get in first will make the lion's share of the money, those who follow will capitalize in a decreasingly significant fashion... Eventually the table's turn and those who will be be buying will be buying in too late which means that when the sell-off occurs and they're left holding bags... Their extra money will be in those early-bird whales' wallets...

I picture it as one of those shuffling of cards rapid number crunching things that looks a little bit like this...

Unfortunately, crypto needs some regulation..

Crypto will evolve around this I’m sure. It’s scary that these people have zero regard for who in fact their ripping off. It’s a Wild West but eventually order comes and when it does these people will be totally blindsided by it I’m sure. Unfortunately they may still be rich afterwards regardless. It doesn’t matter cryptocurrency will change the world forever so we need these kind of hurdles to make it really last. The bank fiat bubble won’t collapse in a day! Honestly more worried about people like Ellen degenerate spreading false information and making jokes without doing any research. People in positions of voice and power need to grow some brains and think for themselves

The market does a pretty decent job, even at these lower market cap levels, of smoothing these over. The real victims are those who execute these pumps slowly and poorly - the bagholders are the slowest in these groups, and anyone who gets stopped out.

hmmm... it's really depressing to see this thing going on in the market i don't understand why people don't invest in the technology itself.

I guess greed would be the obvious answer...it's faster to try and manipulate than to wait for technology to mature.

very interesting, I would also caution people that this may be criminal activity and eventually they might come after you.

Yes, as I mentioned, this currently resides in a legal gray area but I would not recommend it either.

seems like fraud but the authorities are not hip to it yet.

These groups are every kind of markets. You drawn our attention very major factors dump pump. This factor control the market artificially.

This factor never been couped, because these groups are every in the world.

As long as there are people who want to make more money faster (read: always), we'll have groups such as these.

this is really famous, great post ... there are also groups where they tell novice people on the subject they buy before the dump so many people lose the risks are great unless you are a great whale post ... excellent to share friend greetings @lexiconical

I'm pretty sure that every one of these groups is going to have front-runners. It's practically immutable human nature.

I didn't realize how many of these groups there are. I've been shouted at once to join one, but would never consider such a clear act of manipulation. Looking forward to the examples you've observed.

Love the pig on a toilet picture!

I liked that one too. Can't take credit for it though.