Are You Waiting to Buy Cryptocurrency?

This past weekend the whole cryptocurrency space lost around $40 billion dollars which represents about a 20% pullback. It could have been caused by the China ICO scare (which now appears to be more of a temporary stop until regulation gets put in place instead of an outright forever ban). It could also have been triggered by some whales with deep pockets who understood the three-day holiday weekend means those wishing to buy crypto won't be able to get their fiat money in quickly, so if they drive the price down with massive sell orders, they can turn the market and buy up more cheap coin before the banks reopen. It could also just be a normal correction based on the massive bull run we've had this year.

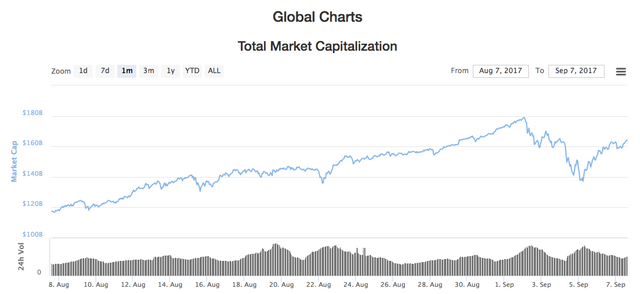

As I was thinking about it this morning, I took a look at the marketcap chart for the last month:

That 20% pullback that so many people were freaking out about... looks like a small blip. We've already recovered more than half of what was lost!

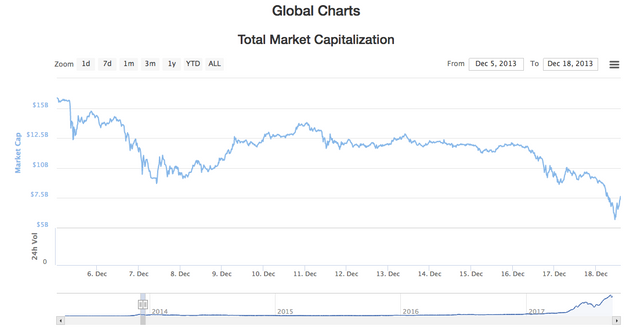

I've been involved in bitcoin since early 2013. Many others were involved even earlier. There's been an ongoing discussion about how an increased total marketcap will decrease volatility. When people see swings of $40B in a weekend, it's understandable to think that's crazy talk. However, when you think about it in terms of percentages, I don't think it is. Compare, for example, what happened in the end of 2013:

That was over a 60% drop in less than two weeks! I remember it clearly because I didn't sell. I HODL'ed. Yes, I could have sold and bought back in, but often things go up faster than they go down, and if you can't time it right (and very few people can, consistently) you end up losing more value than if you just held. Because I held, I was able to pay off my house this year.

So that brings me to my main question for you:

Are You Waiting to Buy Cryptocurrency?

Are you waiting for a big pullback? Are you second guessing buying in because "You could have bought when it was so much cheaper"? Are you letting psychological quirks like loss aversion keep you out of the game? What if this past weekend was your last best chance to buy in cheap?

I think there's a better way than constantly second guessing yourself or being concerned with the daily price. Instead, work your ass off to get out of debt, get some liquid savings together including diversified traditional retirement investments, and then free up some money to invest. Then, when you invest, do so rationally based on arguments you can get behind for the long-term.

When I first bought bitcoin, articles like this really impacted my thinking:

The Target Value For Bitcoin Is Not Some $50 Or $100. It Is $100,000 To $1,000,000.

That was written by @falkvinge in 2013, and I still think his argument is sound. He was right on the money with his 1000x return claim six years ago. He was thinking long-term.

So for me, it's not about small gains here or there, buying and selling with each dip or bump. To me, it's a rational course of action to transition into the new cryptocurrency economy uncontrolled by governments and freely traded by individuals as they see fit. Yes, there will be regulatory battles and issues with privacy and control. That said, I'm confident the free market of ideas and technological advancement can and will stay a step ahead of bureaucrats and regulators. They will do so by innovating new truly anonymous cryptocurrencies as needed (and many already exist today).

No one can predict the future, and it's still very possible we could see another major crash. That's where the whole "Don't invest more than you can afford lose" advice comes in. Also don't invest if you might be tempted to pull money out at the wrong time because of an unforeseen expense. Your car will eventually break down. Your roof will eventually leak. Your AC unit will eventually need replacement. These aren't unexpected events, they are things we can and should plan for. Your cryptocurrency holdings, if you can manage it, should stick around long term if you really want to change your financial life.

I'm not an expert. Don't act on my advice but learn on your own. I blog about my own irrational trading moves. That said, I'll continue to share my opinions and stories because when we combine enough stories together from various sources, we can hopefully gain some knowledge.

Related post from 3 months ago:

The Big Question: Should You Sell or Hold During a Market Correction

I've heard some say you shouldn't buy any cryptocurrency you're not willing to hold for at least two years. What do you think?

Personally, I think cryptocurrency projects like STEEM and BitShares which have active development going on and provide a very real service (not just a promise of a service sometime in the future) are great buys. That's why I'm highly invested in them.

Luke Stokes is a father, husband, business owner, programmer, and voluntaryist who wants to help create a world we all want to live in. Visit UnderstandingBlockchainFreedom.com

Buy EOS and BTS; hodl for 2-3 years; take 10% profit at each doubling; convert to BTC. Be happy. :)

Sounds fun, but in the future people may see no need to convert to BTC. In the future, currency may be like language, a form of expression, something we can seamlessly convert to and from.

Fully agree :) To me it's not a matter of short term investment or easy money, it is simply the future in all its forms, covering multiple functionalities.

The one crypto-mantra I keep repeating is this: inflationary fiat can't compete with deflationary cryptocurrencies over the long haul.

Every time you get emotional about gains/losses, just keep this in mind.

Agreed.

Great post! The ongoing market frenzy, maybe some fomo (fear of missing out), some cool trading activities.. i thinking similar, but because i'm learning every day of all the opportunities, some Steemians give me new insights or just by researching, i hop from time to time if i see a better investment. And nothing is easier in the cryptoworld. But i'm basically an long term HODL'er and will calm down until i'm more familiar with the market.

Valuation is another thing which cannot be applied so easy like in stock market from what i know and the concerns by Buffett are legitimate because there is so much buzz and guessing about and so less fundamental valuation of this market. And so i think it's high risk with also high return. The volatility like you draw in the historic chart has decreased. I think we'd recently a wave of people like me who are very serious about investing in the market and did also word of mouth to others because of the discover of that fascinating technology and also pure enthusiasm. I thought about that after a comment in one of my posts by @yoganarchista which was a good point. The latter is also a bit dangerous because it could be lead people without any knowledge in the market who are not aware of the risks. A friend asked me recently

"Would you recommend to buy some cryptocurrencies?"

(it was at the alltime high of Bitcoin about $3.000 not long ago) and i said to him"No, i cannot recommend that, i'm invested but i would do no financial advice because it's always high risk! I can just say for me it's a great opportunity but i'm always looking into a crystal ball what's happens next day, week, month or year.. long term i'm very optimistic but you must decide for yourself.

That's very important for me, whether im enthused by that great shift happenening in my lifetime or not.Now you may say

"That's unfair! You hold him back from one of the greatest opportunities in lifetime!"

.. Yes that could be such chance or was already for some people in the past, but i'd recommended just that he has to decide for himself and i cannot responsible for that. And i thought about that after i'd said it to him, but i would do the same next time.As you can read in one of my recent articles i bought in at the dip and just hopped out 2 days later because i saw a better opportunity, in the end not really because it was partly based on the same currency, Bitcoin and for me it's always important to be part of that great development or in the market. Waiting on the sidelines is nothing for me because it's not necessary in my point of view in the current situation. I'm constantly trying to evaluate the crypto market, find measures with the help of sites like https://coinmarketcap.com/ and wrote about in my latest post.

Thank you!

Nice post. Though I follow you, I missed that one.

Yeah, I've told friends about investing as well. Some jumped in at the all time high in 2013/2014 and then sold for a lost. So sad. For now, I basically give the same advice you did, but I emphasize long-term thinking. The day to day price doesn't matter on that timescale.

yes i think of something like a hickup if we look 5 years later on the chart. I follow a german with the name Horst Lüning on youtube and he often said:

"Wir leben in exponentiellen Zeiten."

"We live in exponential times."

And i think that's so true and also fascinating and a bit scary at the same time because of the singularity theory because nobody knows exactly where this will lead us. Today i heard in radio about a new book which begins with a positive sentiment in the beginning because of the freedom with the information age, the social media platforms like Steemit and all the comfortable technology we use and shifted then to a dystopy where we all bear many tiny cameras with us and were just glassy human and ended with the question:

"What remains in the end if we gave everything of us, our innermost part, our privacy to technology?"

My 6 year old son looked at me with big eyes and i looked back the same.. and surpringly he said..

"nothing"

i only nodded, it was a bit scary experience, i felt it in my stomach, man 😲 but i'm optimistic that we do it to improve our lifes!

Where i'm also always a bit distracted is when it comes to implants or upgrades of the human body like shown in the video at 1:27 (he speaks english)

Is that just logical step up for us.. the funny thing it automatically leads to other topics, so i stop here. The thing is just, it's a very fast development and we surprise ourselves every day i think, just exciting times for me.. and it is already in the mainstream media.. ARD is a channel supported by state of germany.

Heh. Interesting video (though I could only understand the English part). I think many are afraid of transhumanism because it's unfamiliar. As soon as everyone has a chip or an enhancement, it won't be that big of a deal. This computer is an enhancement as is my smart phone and the glasses on my head.

Times are changing, but that's one of the few constants we can rely on. We'll change right along with them.

"Instead, work your ass off to get out of debt, get some liquid savings together including diversified traditional retirement investments, and then free up some money to invest." Well said! That's what I did for 45 years. Now I have what I want. The point to add is this: "Learn about saving and investing so you can invest wisely."

Warren Buffett sums it up: "work hard, spend little, save alot, invest wisely"

Don't save what is left after spending; spend what is left after saving.

Congrats on your success! Great quote.

I'm stackin for years to come 😬

You always be stakin. If you went against your brand, I'd be surprised! :)

Great article. I don't do any trading, I just try to buy on the dips which is crazy enough to follow. How low this time around? Should I buy on this dip? etc, etc.

Drops are a great time to buy!

Amazing post :-) Thank you very much. Upvoted and following.

Defnitely HODLing. I only ever purchase to hold long term, the two year rule you mention is very sound advice for anyone. 20% dips don't rattle you as much that way!

Time to buy