How To Get investment Income From Safinus platform

The Mechanism of Investment Income with Safinus Platform

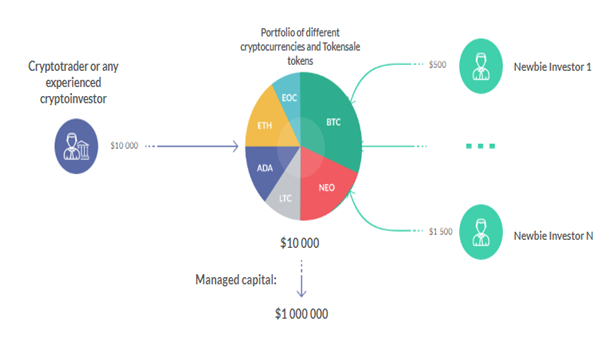

Safinus is a unique portfolio incorporation mechanism. That allows experienced investors and cryptofunds to create a portfolio of token cryptocurrency and ICO on an internal Safinus exchange, which new investors can join in just a few clicks. This platform will provide portfolio ratings and provide transparent reports on each portfolio.

The problem of cryptomarket now

- The absence of regulatory frameworks in most countries leads to additional difficulties for cryptofunds to convince investors, especially beyond their borders, that their funds will remain secure.

- Difficult to get new investors especially outside

boundary operational area, due to regulatory cryptomarket regulations by region. - The amount of communication costs exceeds the profit, so many small investors are neglected.

- The existence of regulations that discourage small investors to invest so that the amount of funds managed cryptomarket decreases and profit results come down.

All the problems mentioned above may be a hindrance to the future development of the crypto market. The solution recipe for this problem is the Safinus platform. This platform connects new investors and portfolio managers (experienced private investors and crypto funds), removes all the barriers that stand in the way of receiving high profits while providing all the necessary conditions for mutually beneficial cooperation.

Safinus Investment Mechanism

- An experienced investor or trader (trader and fund) creates a portfolio of cryptocurrency and buys an SAF token at www.safinus.com during the period of sale of SAF tokens that have been published from 12 July 2018 to 12 August 2018. To create a portfolio, Investors must do the following: Register on the platform, fill in the required information, create a portfolio, describing the strategy to be used to manage the portfolio assets, then fill in their SAF balance token to create a portfolio.

- Investors deposit personal funds into portfolios and distribute them in various cryptocurrency and ICO tokens. The portfolio maker decides on the initial amount of funds to be invested into the portfolio by itself. The greater the initial number, the higher the investor's confidence in the portfolio, due to the fact that the portfolio manager is risking his own personal funds.

- Investors must establish criteria for joining a portfolio. That is, the creator of the portfolio can set criteria in which investors can join the portfolio. The criteria are to set up a fixed commission to join and leave the portfolio, establish a commission from the investor's earnings and set a minimum period for investors to join the portfolio.

- Investors should specify the selection of portfolio.That is Investors should study the ranking of portfolios made on the platform, which will be based on transparent, Blockchain verified revenue and volume of funds managed. After that, Safinus automatically evaluates the platform portfolio in USD based on exchange rates from popular exchanges (Poloniex, HitBTC, Bittrex). If the portfolio holds an ICO token that has not been added to the exchange, its value will be based on the purchase price and will not change until the token becomes available for trading on the exchange. Portfolio value is calculated daily. therefore, investors will always have up-to-date information related to portfolio value and income.

- Investors will quickly merge with Safinus in just a few minutes and investors can also join with some portfolios they like at the same time.

- Portfolio manager revenue. They will earn commissions for each portfolio made individually. There are two types of fixed commissions for investors who join and leave the portfolio (generally ranging from 0% to 5%) and the percentage of the investor's earnings from the portfolio (typically ranging from 10% to 30%). Earnings are fixated either when the portfolio goes out, or once a year (depending on what happens first).

- Investor's Income. Investors get discounts from portfolio valuations based on their investments. Example: Portfolio brings cryptocurrency worth $ 9,000. then An investor decides to join the portfolio, investing $ 1,000. Now, the total portfolio amount is $ 10,000, therefore, investors now have 10% of the portfolio. Based on that, if 1 year the portfolio value will double by $ 20,000. Investors may decide to leave the portfolio, improve their earnings. This can be achieved with just a few clicks. Due to the fact that he is entitled to 10% of the portfolio value, he will continue to receive $ 2,000 (before commissions and fees).

Conclusion

Safinus will provide significant advantages, structured on the basis of individual capital portfolios. All managements are only by investors, within a few years the profits will double. Investment in Safinus has no limit on either capital or investors from various countries.

Website) https://www.safinus.com/

Whitepaper) https://www.safinus.com/whitepaper/

Telegram) https://t.me/safinus

Twitter) https://twitter.com/SafinusICO

Facebook) https://www.facebook.com/SafinusPlatform

Medium) https://medium.com/@safinus.com

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.safinus.com/whitepaper/