Bitcoin Struggles Above $9K as Bull Breakout Stalls

Having witnessed a major bullish breakout, bitcoin (BTC) is now struggling to find acceptance above the $9,000 mark.

The cryptocurrency crossed the long-term descending trendline (drawn from the Dec. 17 high and Jan. 6 high) in a convincing manner and closed well above the resistance at $8,459 on Friday, signaling a bearish-to-bullish trend change.

However, in the last 48 hours, BTC has struggled to hold on to gains above $9,000 over the weekend, indicating bullish exhaustion around the key resistance.

As of writing, bitcoin is changing hands at $8,940 on Bitfinex - up almost 40 percent from the April. 1 low of $6,425.

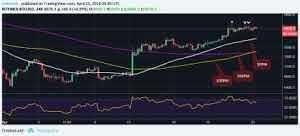

Daily chart

The chart above shows that BTC created a small doji candle on Saturday, marking indecision in the marketplace. When viewed against the backdrop of a 40 percent rally from $6,425, the doji likely signals bullish exhaustion.

Further, BTC reported losses on Sunday, confirming a bearish doji reversal pattern.

The cryptocurrency is showing signs of exhaustion near a strong resistance zone of $9,177-$9,280, indicated by the following factors:

$9,177: March 21 high.

$9,278: 23.6 percent Fibonacci retracement of the sell-off from the Dec. 17 high to Feb. 6 low.

$9,285: 100-day moving average (MA).

$9,280: Feb. 25 low.

The short-duration chart below also shows overbought conditions and scope for a pullback.

4-hour chart

The relative strength index has turned lower from the overbought territory (above 80.00) and is creating lower highs, despite BTC's price remaining steady around $8,900. The bearish divergence adds credence to signs the signs of bullish exhaustion seen in the daily chart.

However, any pullback will likely be short-lived, as the major moving averages (50, 100 and 200) are trending north in favor of the bulls