Crypto update

24/07/2019/15:00CET

BTC is again at the 4 digit price and looking shaky, what comes next?...

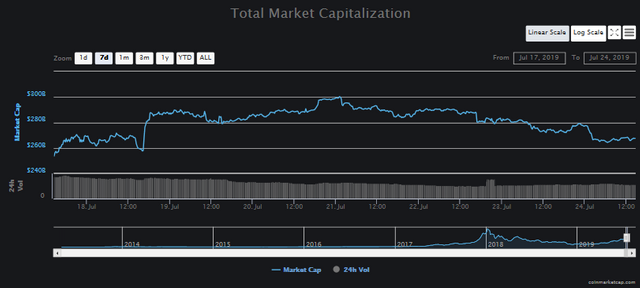

This time we start with Market caps (7D)

- Overall Crypto market cap sits at 268.2 billion after visiting 300 billion in the past 7 days

- We were back below this level not even a week ago

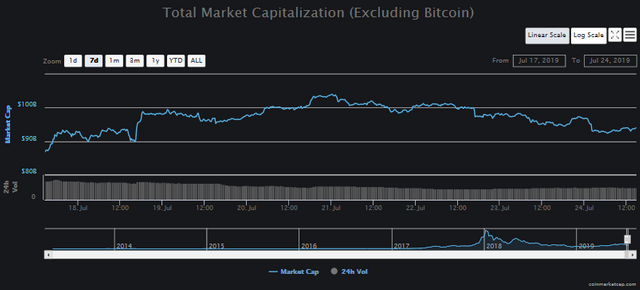

Excluding Bitcoin (7D)

- Without bitcoin we are at 93 billion after visiting almost 104 billion in the past 7 days

- The low in the past 7 days was just under 87 billion, so there has been some resilience here.

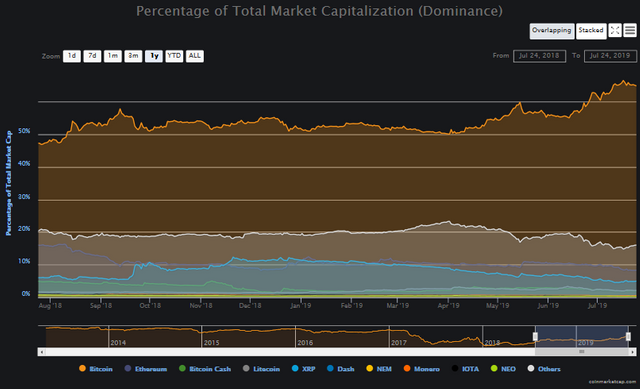

Dominance chart (1Y)

- Bitcoin dominance is just under 65% and has come down from a top of 66.5% 8 days ago.

- There is a moderate uptick in "other alts" over this same period of just over a week.

- But the large caps that have there own line in this chart are languishing at the low end in the 1 year chart

- No real sign of any Alt coin season here.

- I read and tend to believe that an alt coin season start will most probably only happen once Bitcoin breaks out to new ATH's, (i.e. >20k)

- Additionally, many Alts that are still in the running at the moment (CMC shows 2374 coins and tokens) will be left in the dust.

- Trying to be independent minded here, but hard to do with all the buzz in the crypto world right now, I tend to believe the thesis that in the next alt coin run, we will only have max 50 different coins enjoy the light, the rest will get the capital still in them sucked out of them.

- This sucking sound will be so loud that we may actually hear it. The such will go first into BTC, so watch for a pump of BTC dominance at the expense of the "others" in this chart.

BTCUSD Daily on Bitstamp

- Trading at 9769usd at press time on the back of 3 red days. A drop of almost 10%

- In the world of crypto, this is a slight consolidation. In the traditional forex world, this is a "open window and jump" event.

- Back on the 12/7 I noted some vital levels...

link

link - I have 9600 and 9100 marked as levels of interest at the moment. This is where I believe we may find our support finally.

- I think the odds are for our current price to correct down further

- There is a level around 8300 that looks interesting as well though it is not marked here but the knife catchers will be waiting at the 7500 level.

- A break below 7500

BTCUSD Weekly on Bitstamp

- Zooming out, our 21wema is at that 8110 level while the 50wma is at 7250

- Those of us who have or are taking positions at the moment, will be watching these levels with trepidation. A break below these levels will quickly see us at 6k and a retest of the lows of 3100 is not off the table.

- I do not want to be so bearish but I also want to plan for the worst while hoping for the best.

As always guys, leave comments, have fun and trade safe.

Disclaimer: This post is not financial advice. Before investing any funds do your own research and make your own decisions. Cryptocurrencies are highly speculative.

And finally: Do not invest money you are not comfortable losing.

Help me to make more content like this.

Upvote me, comment and resteem.

Thanks

p.s. guys, I want to be clear that I think this current retesting of support is a fantastic sign. It is exactly the kind of market structure; foundation if you like, which we must have to launch a crack at new all time highs.

Time to show your fortitude and confidence in the Bitcoin tech.

Absolutely, the whole market really needed this. I would love to see some little alt run whilst BTC consolidates for a bit, then the king will awake and take those gains to fuel a new run. I guess retest to 6k might be possible, but it depends too much on fud.

Posted using Partiko Android

I agree with the end of your comment @etka.

This is where I feel the limitations of TA begin to show.

I believe that TA becomes more and more powerful as a predictive tool, the more liquid and more diverse the participants of a market become.

At the moment this is not the case with Bitcoin or cryptos in general.

In fact a strengthening case can be made that no markets exhibit these 2 traits which could lead to the conclusion that TA is becoming more and more irrelevant as we get into the 2,3, and above sigma events rattling the market.

My memory is drawn to the VIX volatility spike we had at the beginning of Feb 2018. Over a 5 sigma event! i.e. exceedingly rare and unexpected.

My feeling is that we are entereing a phase of general financial outlier events. These events will compound eachother creating cascades of extreme events. Since TA looks at patterns and tries to push forward previous patterns to have a better than even chance at predicting the future, such extreme events will negate much of the potency of TA.

Another was to put it, I will have to find another subject for my blog if I am right!