Are crypto currencies a ticking time bomb?

Initial coin offerings, a means of crowdfunding for blockchain-technology companies, have caught so much attention that even the co-founder of the ethereum network, where many of these digital coins are built, says it’s time for things to cool down in a big way.

Charles Hoskinson [who helped develop ethereum] said in an interview “People say ICOs are great for ethereum because, look at the price, but it’s a ticking time-bomb,”

“There’s an over-tokenization of things as companies are issuing tokens when the same tasks can be achieved with existing blockchains. People are blinded by fast and easy money.”

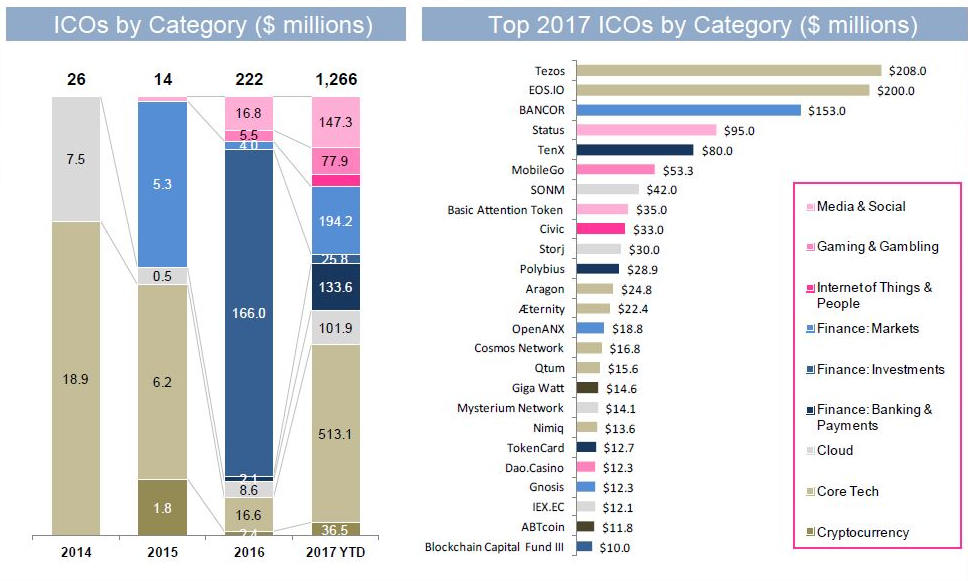

According to Autonomous Research: 'Firms have raised $1.3 billion this year in digital coin sales, surpassing venture capital funding of blockchain companies and up more than six-fold from the total raised last year. '

Ether surged from around $8 after its ICO at the start of the year to just under $400 last month. It’s since dropped by about 50 per cent.

Startups raising money through ICOs usually skip the safeguards required in traditional securities sales, like making sure they’re dealing with accredited investors and verifying the source of funds. That could lead to lawsuits in the future, as digital coin buyers can sue the issuer claiming they didn’t know the risks of buying those assets, Hoskinson said.

Ripple Chief Executive Officer Brad Garlinghouse had a similar view regarding regulatory risks. Teams listing companies offshore and selling their coins to investors outside the US are naïve to think there are no investor protection laws elsewhere, and also expects that the SEC will eventually say cryptocurrencies are securities, he said in an interview last week.

Besides the growing concern about an ICO bubble and regulatory concerns, ether trading outages stemming from the jump in transactions, companies cashing in on the money raised in crowdsales, yesterday’s $7 million CoinDash hack and even false rumors that Buterin had died, have all contributed to the tumble in the price of ether. Concern about bitcoin potentially splitting in two is also sending jitters throughout the crypto world.

Still, like Ripple’s Garlinghouse, Hoskinson thinks once the currency ICO bubble deflates, cryptocurrencies will continue to be an avenue for companies to raise money, but it will be done in a regulated and more constrained environment.

Regardless of regulation ICOs are here to stay,” he said. “After it collapses they’re going to pick up the pieces and say how do we do things differently.”

Credit: http://economictimes.indiatimes.com/articleshow/59663527.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Images: http://economictimes.indiatimes.com

This ICO bubble is reminiscent of the dot-com bubble.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://sg.finance.yahoo.com/news/ethereum-co-founder-says-crypto-174033087.html