What will it take for Crypto to moon?

img src

Ironically enough, I'm participating of some sort of speculation just by making such assertion. Yes, without a doubt the indicators chart analyst talk about are hard numbers, they are not comparable to tea leaves if we are to be honest. But, I've also seen a chart completely betray common sense. "Was that not a bull flag?"

The important question here to me is quite different than "What Elliot wave are we on?" as I have little to no interest in that information these days. To me the focus should be one word, one ugly word: regulation.

As long as we don't know anything, and I do mean anything about how regulation laws are going to play a role in the near future, we might not see the big players, and I do mean big, come out from hiding.

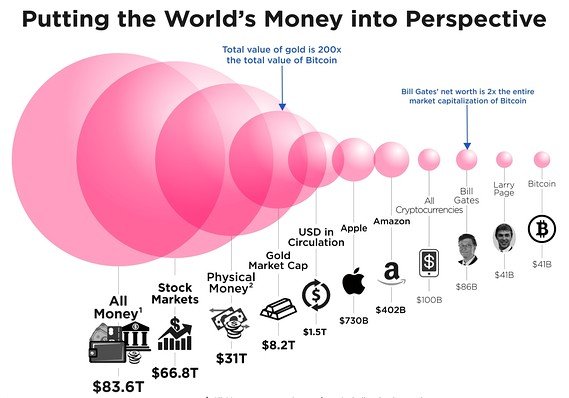

Perspective

This is also not new knowledge, or at least it's not new to those of us who are curious enough to dig a little deeper into how the economy works. Cryptocurrencies in all, for all their grandiose might, sheer volume, technological advancements, are still a tiny and I do mean tiny portion of the money of the world.

This is relevant to know, because we think at times, wrongfully so, that we have big money in crypto, but we certainly don't. Yes, there are whales, yes there are accounts holding massive amounts of tokens, but they are pennies and I do mean pennies in comparison to the money that is out there so to speak.

Not really mass adoption

I'm not talking about everyone using BTC, or any altcoin to buy their groceries with, I think that time will come, but we are still far from it. What I'm talking about is a somewhat "safe" ecosystem for the giant players to feel comfortable enough to take big bites of the pie.

More financial products are needed, and I'm not only referring to ETFs (Exchange Traded Funds) which is what everyone seems to be focusing on at the moment. To me something that has to exist, something that cannot be missing from the picture is a true pegged asset. An asset that can hold, legally, the 1 to 1 with the strongest currency in the world, the US dollar.

As I typed that last line I'm aware I've just offended the purists among us, but truth be told none of them would complain if the market skyrocketed in valuation as much as they might say otherwise. However for this to happen, laws and regulations need to be clear.

The currency cycles

The crazy bull runs followed by excruciating bear markets in my view are nothing but a small number of players manipulating everything. In other words, the market's volatility is so intense, so wild, because there are little to no traditional investors participating of the markets, they are almost made up entirely of speculators.

Am I saying the bull runs are over? Of course not, quite the opposite, but what I am saying is that when the next one comes, and it will, it will be followed by another painful bear cycle sure to shake off all the naive minds who entered the space screaming "moon" to the winds.

So how do we moon?

Short term, we are probably close to it again. Long term, regulation and law clarity. As much as that might anger early adopters, I don't see any other way it could happen, but I'm open to being wrong. After all, I was one of those who did not understand why cryptocurrencies were valuable and here I am contradicting myself a few years later.

let me ask you, What's your position on regulation?

I'm personally okay with big institutional money staying away.

I'd like to see the world's middle class drop $10K each into a crypto portfolio.

People who are actually using it to transact with each other, which is what gives it its usefulness and therefore value.

If the big money gets in first, Joe Mainstreet won't get a look in.

matt.. remember this 20th.. remember... put it on your calendar.

It's locked in and only a couple of days away.

Let's see what happens.

I disagree that regulation is needed at this stage. Existing laws can deal with fraud and scams but otherwise the government needs to get out of the way and allow the space to develop and mature. What is needed is enforcement of anti-trust law against incumbent tech companies who are trying to strangle and control Crypto. Hence JPB Liberty’s Crypto Class Action. https://www.jpbliberty.com

Posted using Partiko iOS

oh, ima read into this, thank you for sharing brother...

Here in my country (and Europe in general) things are getting murky, not only because of the copyright laws (first round approved yesterday in very harsh terms that almost any platform cannot guarantee) unless the "monopolies". About crypto, the same word "crypto" implies "hidden" and that's why the image of them is so tainted in many places? why not renaming them all together to virtual coins or digital coin :/ dunno, I don't know when that's going to happen, to moon, I see lots of dreamers hoping so, but I know this is an endurance test... just like those people who first mined bitcoins and left and well... let´s not be those

digital coins / currency sounds better in my opinion. Virtual tends to make people think of fake or artificial. Those are almost as bad as hidden if not worse.

Yes, I agree... digital coin would be a good option, but well you get the idea, that "crypto" implies "hidden activities" LOL

If I was a big investor I will definitely care about regulations, a little bit of assurance that my investment would not go down the drain, I will also be more conscious of the level of security in place of my investment.

Its no doubt that we can do without regulations but, surely we can do better with it.

I may write a more extensive post about this, but I'm convinced we should be actively seeking regulation. I see a very similar cycle happening to online poker, where we celebrated our unregulated state, and did everything we could to fight regulation happening at all rather than participating in the process.

So when regulation came, we hadn't made ourselves a seat at the table, and it was essentially written by the land-based casinos and anti-sportsbetting organizations, which had gone to that effort. So it was incredibly disastrous to the industry, and it's still not showing very many signs of recovery 12 years later (in the US).

There are some ways in which cryptos are more technically resistant to that than poker was, but not all. If we're participating in the process there's at least some chance we could get regulation that is tolerable.

we might be too naive if we hold on to the idea that we can "fight them back" for ever.... Maybe, i don't know, but neither does anyone else.

"As long as we don't know anything, and I do mean anything about how regulation laws are going to play a role in the near future, we might not see the big players, and I do mean big, come out from hiding."

I think you absolutely nailed it. To moon, you've got to reassure the big money that they are safe to come out of hiding. That is dead on, in my opinion.

For the moment, before that happens, the focus must always be on use-cases. Steem has a lot of them, and more real people using it, and acquiring it, than any other blockchain.

When the big money does come out of hiding, they are going to notice this. :)

Rodney, one of these days you will succumb and get on discord. You know that right?

Ha ha ha. I laugh, but I actually know that lol. :)

Hi meno. The only regulation that I want to see is on security with the exchanges. For me more need to be done to guarantee the safety of everyone's investments.

This is my post link.Maybe useful for bitcoin users.

https://steemit.com/bitcoin/@dhanu1998/what-is-a-bitcoin-etf-how-conventional-etfs-are-exchanged

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

You got a 25.61% upvote from @ocdb courtesy of @meno!