Bitcoin is not anonymous as misguided critics claim

I recently wrote an article explaining why the claim that bitcoin is a volatile asset is a misconception and that in the future it should converge towards a price in which that volatility becomes small. In this article I will focus on one the other claim that goes hand to hand with the volatility question, which is anonymity. It is frustrating to read comments like Ajay's Banga, the CEO of Mastercard, claiming that bitcoin is junk due to it's volatility and anonymity.

- “I think cryptocurrency is junk….The idea of an anonymized currency produced by people who have to mine it, the value of which can fluctuate wildly – that to me is not the way that any medium of exchange deserves to be considered a medium of exchange,”.

There are many reasons why the myth of Bitcoin's anonymity persists, it could be because it is a digital-only asset and not having a physical medium scares people, the bad reputation it got from the Silk road, the fact that there are no banks or financial institutions as middle-man or that there is not a government that has full control on Bitcoin. However it is a myth, Bitcoin is pseudonymous not anonymous, which means that everyone can know a transaction was done between party A and B but not know who they are and this difference is huge.

All the information of the Bitcoin network, including all the transactions ever made are recorded on Bitcoin's blockchain which is stored on millions of computers across the world. This means that anyone around the world with a computer and internet connection to be able to download the latest instance of Bitcoin's blockchain has visibility on all the transactions ever recorded. For every transaction there needs to be a sender and a receiver and in the case of Bitcoin there needs to be a wallet sending Bitcoins to another wallet . It is true that anyone can have as many wallets as he wants, creating a wallet is simple and no paperwork is needed therefore the real owner of the wallet remains unknown. However, it is very easy to follow the trail of any transaction.

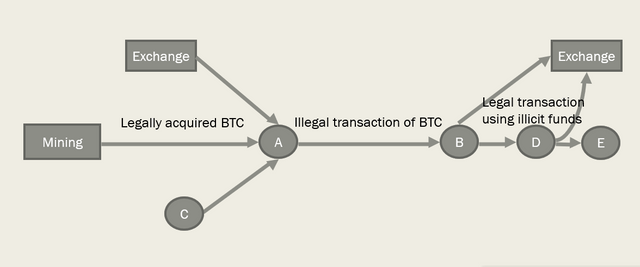

Let's say that Wallet A sends Bitcoins to Wallet B in a transaction that is identified as an illegal transaction, even if the authorities don't have the means to seize the Bitcoins or demand the name of the owner of the account like they would do to a bank, still they can have access to all the transactions that led Wallet A to own those bitcoins also they have real time access to any movement that Wallet B makes.

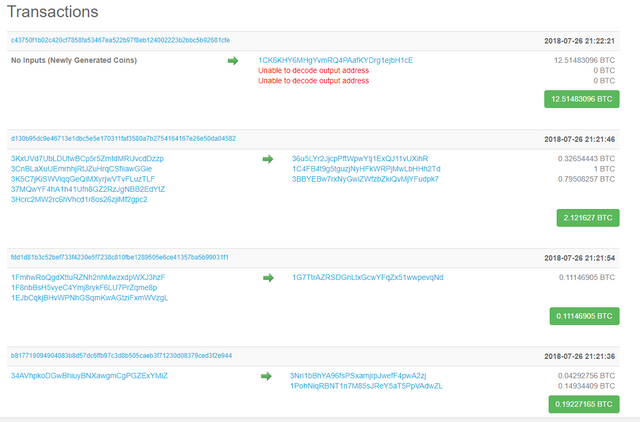

Example of random transactions on the blockchain

What can we do knowing this?

Well, lets start with Wallet A, the one that sent the bitcoins. How did that wallet acquired the bitcoins? Well it is possible to look at all the incoming transactions for that particular wallet, track who sent those bitcoins to that unknown wallet and also track any other wallet that has had any interaction with Wallet A, if the funds are coming from another unknown wallet then repeat the process until hitting a wallet that can be identified. So for example if Wallet A received those Bitcoins from an exchange then it is as easy as looking at the exchange, how did that person bought the BTC? At some point there needs to be an interaction with the banking system for the owner of wallet A to fund with $ or any other currency to buy the bitcoins. If instead of buying the BTC on an exchange, Wallet A bought the BTC with cash from another user then it is a matter of tracking the wallet that sold the Bitcoins to wallet A (lets call that wallet C) on first place or follow the cash trail (good luck with that), it also defeats the purpose of using Bitcoin to avoid using cash if it was first bought with cash (or credit card). The only option left for acquiring Bitcoins is through mining, this information is also available and can be tracked down as well.

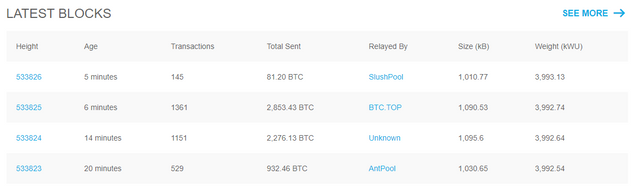

Accounts that mined the latest blocks

Now for Wallet B, that is the recipient of the Bitcoins, in this case there are two things to look at, repeating the same exercise than with Wallet A tracking any other wallet which that account has been in contact and also keep track of where is that wallet going to spend the Bitcoins. The whole point of the illegal transaction or money launder is to be able to use the money, now it is a matter of waiting for the wallet to spend the Bitcoins so either he is going to cash out which can only be done through an exchange or selling it to someone else in exchange of cash which then is a matter of finding who is the new buyer of BTC, which we can call Wallet D.

This looks a bit confusing and it is, however it would be the equivalent of following money trails (which the FBI and such are used to do) through banks, shell corporations, offshore accounts, etc. The difference is the full transparency that the blockchain provides with historical information of every transaction ever done including the sender and recipient.

Illustration of the example above between wallet A and wallet B

What to do then?

Since it is a new technology there are still a lot of aspects to figure out, however it is incorrect to say that Bitcoin is anonymous, as opposed to pseudonymous. There is a big difference and as explained above it doesn't help circumventing the law or is beyond scrutiny. It is possible to do illegal transactions, which the same can be said with cash, bank accounts or a mastercard, but it is also extremely transparent when it comes to tracking back the transaction and identifying the malicious actor.

Instead of complaining and trying to dismiss bitcoin like Ajay Banga, there are more productive things to be achieved and many options to use Bitcoin to combat the illegal market. The governments and corporations can play along, learn how to track transactions, look up the wallets that are linked to illegal transactions, track the owners and there are many measurements they can take such as blacklisting wallets related to illegal transactions as a way of preventing the illegal money to be moved.

Bitcoin does not facilitate illegal transactions or obfuscates them. It does facilitate transactions, which is the reason why regular people which also includes some malicious actors prefer using Bitcoin as a payment method, but again this is because it is better for payments. This is the equivalent of saying that the car is bad because it helps criminals escape from crime scenes faster, which it doesn't, it facilitates transportation which some people use for bad reasons. It is easy to get carried away and dismiss the technology but as governments and people in general get smarter and understand better how to use Bitcoin it will improve and make the payment ecosystem more transparent.

Links

https://steemit.com/cryptocurrency/@mvaisberg/bitcoin-is-not-a-volatile-asset

https://www.ccn.com/mastercard-ceo-attacks-cryptocurrencies-again-branding-them-junk/

https://www.blockchain.com/

Twitter - https://twitter.com/Mvais3