Tether ($USDT): An Accident Waiting To Happen

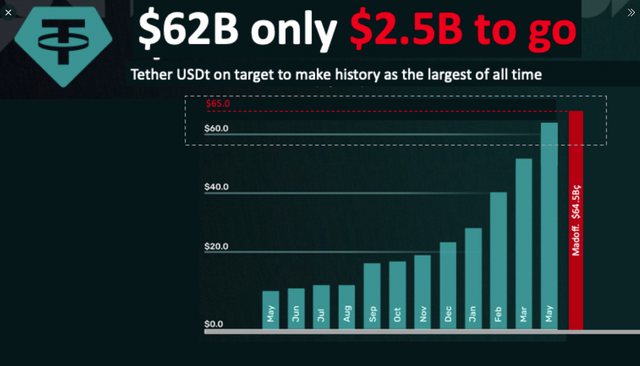

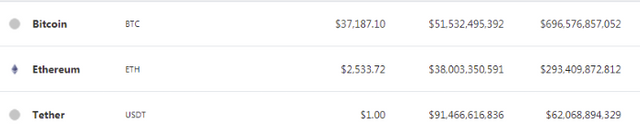

Tether. The father of stablecoins. Having reached an astonishing 62 Billion Dollar market cap is currently sitting in third place of the cryptocurrency market cap indexes, right below BTC and Ethereum.

Tether has been accused of manipulating the market in the previous bull run too. Since it was created it was considered shady, non transparent and a tool used to manipulate the market.

A typical Saturday 1 billion USDT mint.

Tether is growing too big too fast. It will be 100 billion USD market cap soon, meaning it will be 100 billion USDT in circulation, which will have to be backed 1:1 by unconfirmed and obscure assets.

.png)

Source of Image: Bitmex

Tether has its roots in Bitfinex. It was created to cover up a very shady operation of theft/hack of BTC from Bitfinex exchange that resulted in huge damages to the customers of the exchange.

In May 2015, 1500 bitcoins were stolen during a hack.

In 2015 the exchange’s customers were hacked, losing about $400,000, and in 2016 about $73 million more was stolen from its customers’ accounts.

And there was also a loan of 850 million from Tether to Bitfinex that is still under investigation by financial authorities.

In April 2019 New York Attorney General Letitia James filed a suit accusing Bitfinex of using the reserves of Tether, an affiliated company to cover up a loss of $850 million to a Panamanian payment processor known as Crypto Capital Corp. Reggie Fowler, who is alleged to have connections with Crypto Capital, was indicted on April 30, 2019, for running an unlicensed money transmitting business for cryptocurrency traders.

There are still a lot of questions about the hacked BTC from Bitfinex, that often seem to move but then stop as soon as the movement hits the news.

Some people are watching and probably it won’t be easy for the “hackers” to obfuscate the transactions.

First of all, I want to disclose that everyone has the right to discuss even mock Tether since their practices so far have been completely out of the ordinary.

Everyone has the right to question since the proof provided by Tether is just their word and nothing concrete. Tether just wants everyone to magically trust the word of those in charge.

It has a trading team backing both Bitfinex and Tether (Whalepool), apparently as part of its PR, and has provided absolutely zero evidence or any independent audit of the reserves it holds.

.png)

Source of Image: Twitter

I’ve recently read a medium publication by Bitfinex’s counsel Stuart Hoegner (@bitcoinlawyer) and wanted to provide commentary since I was reading something that was combining an excuse for everything and a manifest of finance anarchism without of course providing anything else but clear condemnation of anyone talking against Tether.

Much like the automobile, the personal computer, and the internet, what first seemed crazy is now normal.

-Stuart Hoegner

As I remember the beginning of the internet in the 90s wasn’t considered crazy at all. People were asking questions and nobody knew or understood how much it would affect us. Still, everyone was very excited and only a minority was stuck in the past and didn’t encourage this development. Seriously a very bad example just like the other two.

I don’t think that the automobile or the PC was ever considered crazy by anybody. As with the rest of the medium post in question, it is just fancy words combined, trying to create a better image on Tether and make it look like a huge innovation. Not to mention that all these arguments are textbook excuses of all scams and Ponzi schemes. Onecoin and Bitconnect had similar rhetoric.

Starting from the stone age and reaching the technological innovation of Tether (which is just a token, a smart contract running on various blockchains).

Healthy skepticism and vigorous debate are the hallmarks of credible change. But there is a difference between expressing doubts and sowing misinformation built on lies, distorted facts, and willful ignorance of objective evidence.

Any doubts or misinformation are cleared with time.

In fact, in the case of Tether, nobody is discrediting it by providing false information.

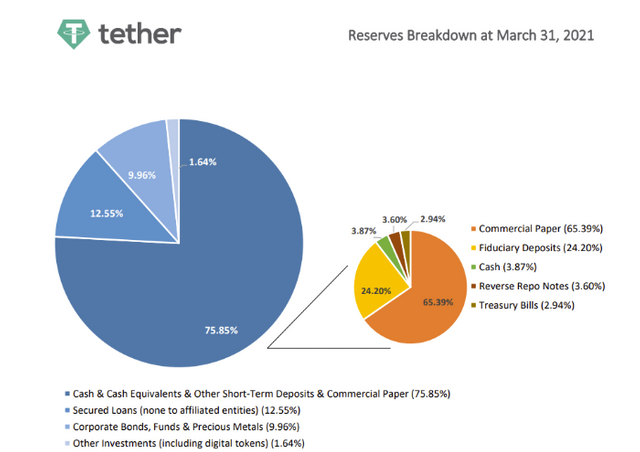

Everyone just wants to learn how the USDT is backed. Tether used to claim one time, that every USDT was backed by USD on a 1:1 basis. Then another time, this changed and we learned that every USDT is backed with assets. Then another time, this changed too as now we learn that 65% of Tether is backed by commercial paper and just 3% is backed by treasury bills!

This is what Tether produced after 5 years to clear doubts:

Source: Tether.to

Source: Tether.to This pie, by Tether standards, is transparency, as Paolo Ardoino (CTO of Tether and Bitfinex) explains:

Source: Twitter

I also suggest reading the comments below this post, as there is nobody believing anything Paolo Ardoino or the rest three guys from Tether have to say.

Also important to notice the “commercial paper” part of this pie. This part is even more confusing since it basically means debt issued by Tether for short-term (6–9 months) covering of responsibilities.

But what exactly is commercial paper?

Source of Image: Twitter

Commercial paper is a common form of unsecured, short-term debt issued by a corporation.

Commercial paper is typically issued for the financing of payroll, accounts payable, inventories, and meeting other short-term liabilities.

- Investopedia

Still, no matter if it means anything the Tether guys just claim it has sold debt to cover for short-term liabilities but has not provided any kind of proof of that. It is just their words against everybody else, once again.

Sadly, everything that Tether provides as a proof is not even close to being convincing. To resemble Tether with another historic case, Tether is regarded with the same suspicion as the Bernie Madoff fund was in Wall Street back in the day.

Nobody misinforms when asking Tether for once, to inform and allow an audit from an independent and recognized authority.

Is asking questions misinformation?

It seems to everyone that Tether is giving every reason for all these doubts to arise. It seems that Tether is dodgy and shady when providing incomplete evidence or lying about its reserves.

Seriously, nobody at all trusts Tether. It has reached a bottom when it comes to openness and honesty. Traders that deal with USDT have managed risk in case USDT fails.

Crypto’s detractors, despite a campaign of misinformation, have not been able to slow this growth because the market sees the opportunity and the value they refuse to consider. In less than 15 years, cryptocurrencies have moved from an idea to a reality and, more recently, to a force.

Other cryptocurrencies have nothing to do with Tether.

As a member of this community, Tether issues a stablecoin.

A centralized and censorable stablecoin though. This has almost nothing to do with this community since it is a token reproduced at the will of one or two guys printing them on a laptop while relaxing on a private beach.

Yes, you’ve made it and you managed to pull this scheme, however, Tether is centralized, as there are lines in the Solidity code that allow an admin to block assets.

There is no financial freedom with Tether since transactions can be blocked. It can basically be shut down by a government, it is no better than e-gold which was shut down by the US government.

Repeating the previous statement: USDT can be shut down any time the US government desires it. And from what I read, they already have quite a lot of reasons to ask for something like that.

This medium post by Stuart Hoegner has very little meaning. Tether has proven nothing with that one pager presentation. There is nothing concrete or transparent with Tether so far and I doubt that suddenly something will change.

.png)

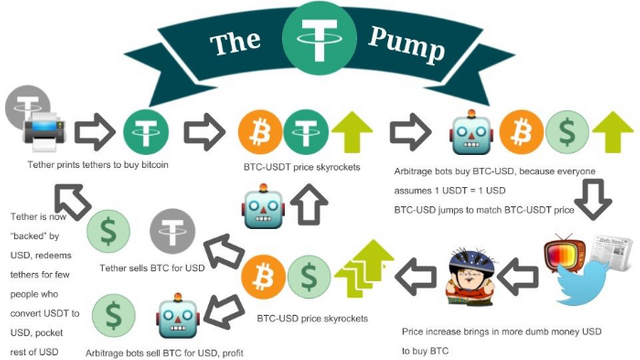

Tether effect on the price of BTC

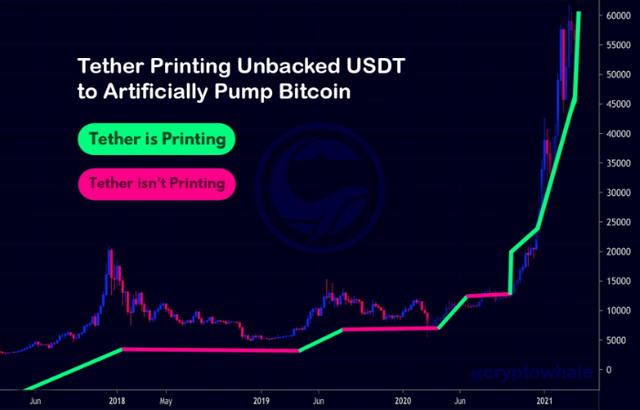

Tether has been long accused of market manipulation and “pumping” the price of BTC. The high volumes on exchanges are questionable.

Source of Image: Twitter

Tether in 2018 burned USDT and reduced the total supply by $500 million to keep the peg to the USD stable. There is growing discontent over Tether and concerns it is used to artificially create fake demand for BTC.

Meanwhile, Bitfinex and Tether are now considered illegal in New York and instructed to end all trading activities.

An investigation by the Office of the Attorney General (OAG) found that iFinex — the operator of Bitfinex — and Tether made false statements about the backing of the “tether” stablecoin, and about the movement of hundreds of millions of dollars between the two companies to cover up the truth about massive losses by Bitfinex.

-New York Attorney General

.png)

There are so many publications on USDT and Tether and everything is a big question mark. Tether feels it needs to go on the defense for the fact that so many years later it hasn’t provided any clear evidence of its reserves. It has become a joke in the crypto community and nobody takes USDT too seriously.

Vitalik Buterin called Tether “A ticking time bomb demon” in an interview a while ago ( source). It is even worse though, as when it collapses it will massively affect all cryptocurrencies, dragging ETH and every other crypto down. BTC is still the force that drives this market, and if Tether is responsible then this is also the reason nothing else has taken over BTC in market cap terms yet.

Perhaps, USDT is another reason that pushed other cryptocurrencies down a lot, since it is used massively for leveraged trading.

It used to be that every USDT is backed 1:1 on USD in bank deposit accounts. Suddenly this changed to just being backed 1:1 by undefined assets. Nothing makes sense, and since Tether has done absolutely nothing to define its reserves, everybody has the right to be suspicious. The numbers don’t add up, and anyone with basic accounting knowledge understands there is something fishy going on.

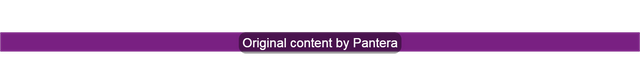

Even some of the most popular figures in the field understand that Tether is something that may not last and one day we can wake up in whole new different market conditions.

Dan Held is a BTC maxi that tries to make a case that everything is bullish for BTC. He still understands that Tether is going to be found worthless one day. It could be in a month or in a few years, USDT is not going to last forever.

And this will have dire consequences, first of all for $BTC which price is currently pegged to Tether printing. It is also very possible that Tether manipulation keeps other cryptocurrencies’ valuation at very low levels since it is mostly used for BTC purchases and trading.

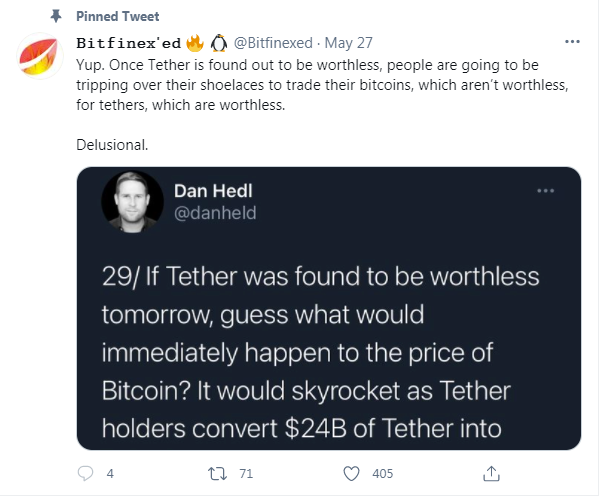

One of the main reasons Tether finds support from BTC maximalists like Adam Back, CEO of Blockstream, founder of BTC maximalist censorship.

.png)

Lead Image from: Twitter

Quotes are from: Medium

Originally published at https://read.cash.

.png)

Originally posted on read.cash

Writing on the following networks:

Noise Cash

Read Cash

Steemit

Hive

Medium

Vocal

Minds

Vocal.Media

Den.Social(inactive)

Publish0x(inactive)

I'm also active on the following social media:

.png)