Three Cryptocurrency Trading Success Factors That Helped Me Grow My Trading Business

This year has been an emotional rollercoaster for my childhood friend Gary. The crypto market hasn’t exactly been kind on him.

He started trading cryptocurrencies in November ’17 and relied solely on trading signals provided by his network.

This fetched him decent profits in the first half of 2018 and he never really bothered looking beyond this.

But the problem was just waiting round the corner:

As the market became somewhat stable after mid-August, the trading signals provided by the forums he frequented and fellow traders started missing the mark.

He felt confused and lost. He had never really spent time learning the basics or put a trading plan in place. Not only did he not know where to start, he felt overwhelmed with all the “work” he’d have to do now.

When Gary came to me for advice, I shared with him the 3M framework that I’d been using ever since I started trading. After discussing the framework over a couple of beers, he decided to put it to work and make an effort to better his trading game.

Today, Gary Rakes in $2200+ Every Month

He is a successful trader with a positive portfolio of coins. In less than 6 months, he went from relying on trading gossip and biased speculations to being a self-reliant trader with a winning system.

I share this so that you know he didn’t start pulling a couple of thousands by magic.

The growth he experienced hasn’t come by accident; it’s come by doing, thinking smartly, failing, learning…and never stopping.

How You Take a Trading Side-Hustle to Big Profit

This is your inside look at how I and then Gary grew our trading game with the 3M framework. The framework helped us understand two things that are of critical importance in the crypto trading world:

Focus

Discipline

When you’re starting something that involves putting in money – whether a side-hustle or trading business – you need heaps of both focus AND discipline.

… If you’re in the nine-to-five cage with hopes of a brighter, freedom-filled future, this article lays out a path for you to consider.

… If you’ve already made the leap to the side-hustle stage, you can pull specific triggers with focus and discipline.

… If you’ve already established a trading business – but crave the results you know you’re capable of – there’s something for you, too.

… If you want growth, pay attention.

3M Framework Works Because it Encourages Two Things: Focus and Discipline

If you want to be a successful cryptocurrency trader, you need to approach trading as a full-time or part-time business.

I often come across beginner traders who tell me that trading cryptos are their hobby. And I always shake my head.

When people think of something as their hobby, they do it in their leisure time with no real commitment to learning. Hobbies are meant for unwinding. Trading cryptocurrencies shouldn’t be your hobby because it can turn out to be a very expensive one.

There are some traders who think of trading as their job. This also is a wrong way to define trading cryptocurrencies because there is no guarantee of a paycheck.

When it comes to crypto trading, you cannot half-ass it.

If you put in the work, you’ll reap the benefits. Trading is a business and incurs expenses, losses, taxes, uncertainty, stress, and risk.

As a trader, you are essentially a small business owner and must do your research and strategize to maximize your business’s potential.

The First M: Money Management

When I started out, I believed that the more orders I placed, the more money I will earn.

This is true only if the majority of them are winning trades. But in cryptocurrency trading, there are no guarantees.

You take large risks when trying to place several orders in a day based on trading signals. Gary too believed that he had to stay connected to the market to take advantage of every breakthrough.

Instead, you should fix your entry and exit points before entering into a trade and use a stop-loss and take-profit orders to gain profits.

KEEP YOUR RISK LEVELS IN FOCUS

Whenever you’re trading cryptocurrency, you should be ready to lose the amount you’ve invested. This is accepted as a rule in cryptocurrency trading. Set a risk level each time you need to get into a trade.

This is very important for your mental health as well. Otherwise, you’ll keep chasing your trades, fixing lost ones and missing out on good ones.

The Second M: Method

Finding a consistent and simple method of cryptocurrency trading is important.

When I first started out, I preferred buying and selling at breakouts. As I got stronger at technical analysis, I refined my trading strategy to use indicators such as MACD and OBV when trading altcoins.

Whatever method I would choose, I would first test it on a consistent basis and see if it gave me an advantage.

I’ve found that, due to market sentiment, some methods work well with some cryptocurrencies while falling flat on their face with others. You need to check whether a given method will work for the cryptos in your portfolio or not.

You also need to make sure that the method you choose really goes with your own trading style.

For example, Platinum Crypto Academy’s own Aaron likes to trade on support and resistance because he very well understands the thought process of the groups that influence these points of inflexion. His trading style is all about understanding the psychology of the other players in the market.

BACKTEST WHENEVER YOU CAN

Backtesting allows you to apply your trading ideas and method to historical data.

Once a plan has been developed and backtesting shows good results, the plan can be used in real trading.

The key here is to stick to the plan. Taking trades outside of the trading plan, even if they turn out to be winners, is considered poor trading and destroys any expectancy the plan may have had.

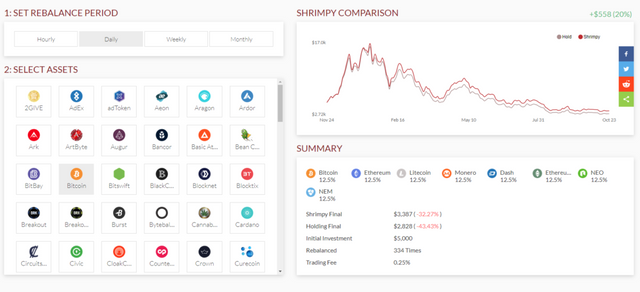

You can easily run a rebalancing test with the help of Shrimpy.

The Third M: Mindset

Professional traders know that emotions can ruin any trading system.

You need to be self-disciplined and keep your emotions in control. Greed and fear are two emotions that every trader experiences and has to learn to overcome.

Greed makes you increase your trading amount hoping for bigger returns IF the trade wins. You sideline your trading system and don’t close your positions at stop-loss or take-profit levels.

Fear prevents you from making money when trading cryptocurrencies. Fear can paralyze you and prevent you from making good decisions. Once you’re in the grasp of fear, you will start closing your positions early and lose out on your profits.

Once you know what you should be expecting from your trading system, have the patience to wait for the price to reach the levels that your system indicates for either the point of entry or exit.

If your system indicates an entry at a certain level but the market never reaches it, then move on to the next opportunity. There will always be another trade.

CONTROL YOUR EMOTIONS

You need to start keeping your emotions in check through self-discipline.

Good traders follow their trading system all the time. And while it isn’t easy to do that, once you’re confident in your trading plan, you will less frequently steer away from it.

Describe all your trading tools including the indicators that you’ll be using in your trading plan and try to follow your crypto trading strategy.

Ask yourself: “What am I afraid of?”

To make this simple framework work for you, you need to honestly assess your strengths and weakness.

That’s what Gary did at the start of September. His answer informed his decision-making process and helped him focus on making money by managing risks and documenting his strategy.

Once you master this framework, you’ll be able to use, modify, and improve it as you go. Just like I did at the start of my trading business.

Trading is nuanced and requires as much art as science to execute successfully, which means that there is only a profit-making trade or a loss-making trade. Take small losses often and quickly rather than wait for the big losses.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Richard Baker

Live from the Platinum Crypto Trading Floor.

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Congratulations @pca! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard: