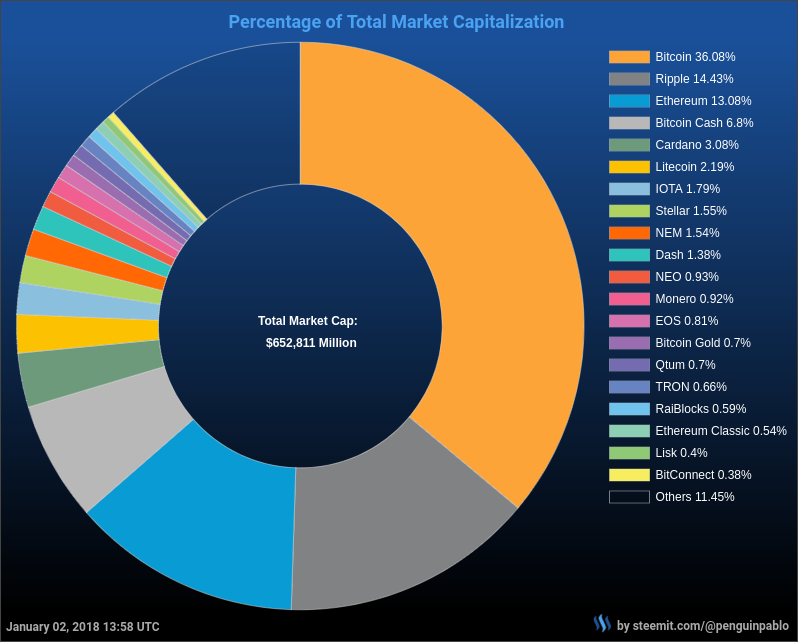

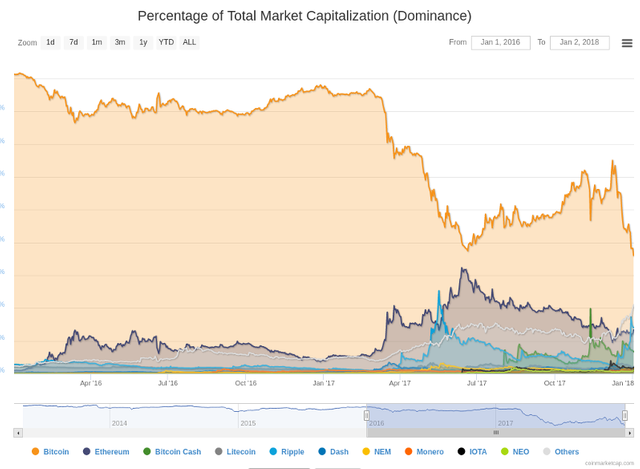

Bitcoin is at its all time low in terms of Dominance (36%)

Welcome to my Cryptocurrencies Market Overview for Tuesday, January 02, 2018.

Today in the news:

- Bitcoin’s dominance of the cryptocurrency market is at its lowest level ever.

- Ethereum starts 2018 at an All-Time high.

- Both Localbitcoins and BTC.com have implemented SegWit today to reduce the transaction fees.

- Cryptovest.com wrote an article about the current price surge of STEEM.

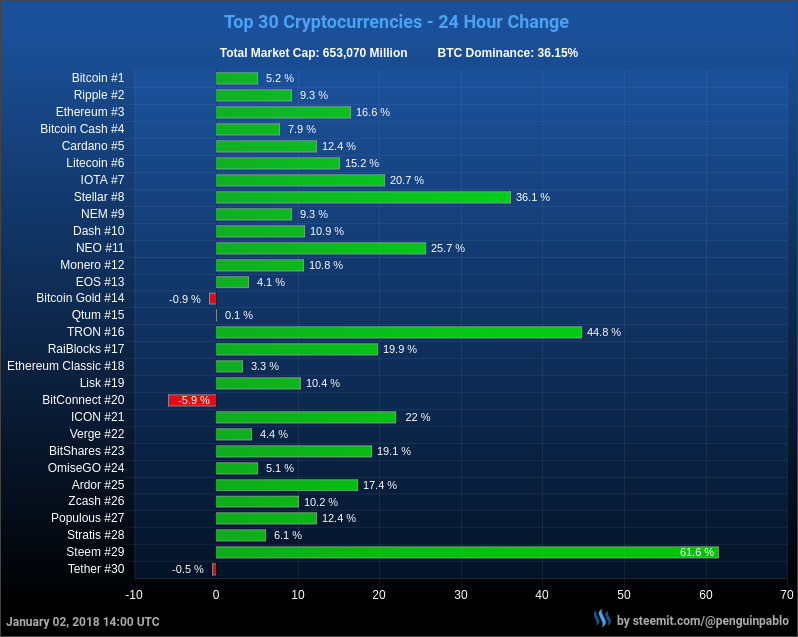

24 Hour Change

Realtime chart on my website CoinMarkets.today

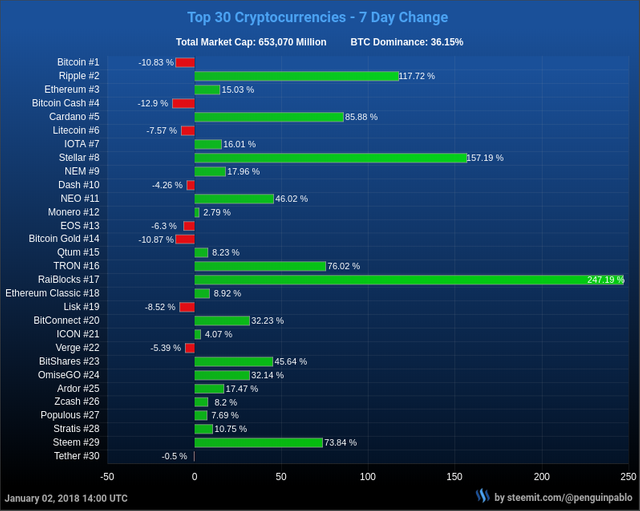

7 Day Change

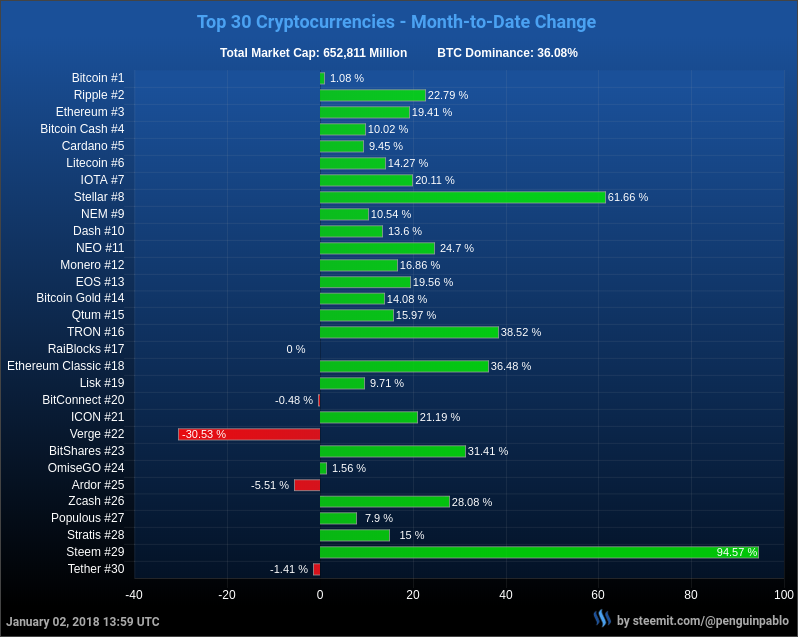

Month-to-Date Change

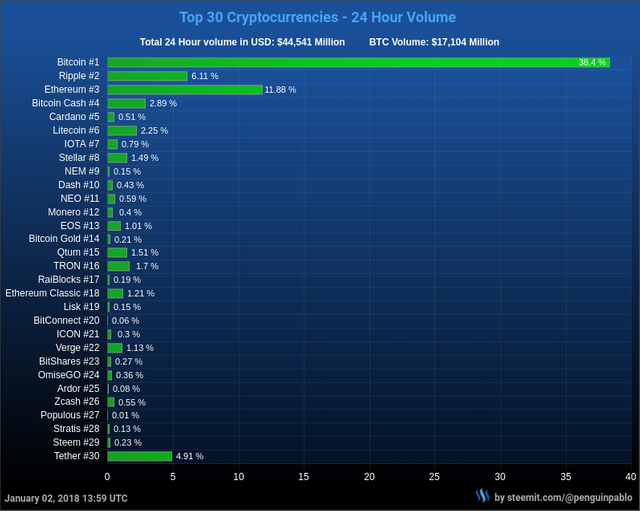

24 Hour Volume

Market Capitalization

Bitcoin daily chart

The 50-day simple moving average (SMA, the green line) seems to be a strong support line.

Feel free to use and share my charts, but please mention me as the author.

Latest Crypto News - January 02, 2018

Bitcoin’s dominance of the cryptocurrency market is at its lowest level ever

Bitcoin's dominance of the cryptocurrency market is at its lowest level ever thanks to rising interest in alternative digital coins. On Tuesday, its market cap was $231.8 billion, or around 36.1 percent of the total value of all cryptocurrencies. This is the lowest share of the market that bitcoin has had in its history.

Read more: cnbc.com

Over $900: Ether Starts 2018 at All-Time Price High

The native token of the ethereum platform, ether, has started the new year with a bang, hitting an all-time high of over $900 this morning.

Read more: coindesk.com

ECB's Yves Mersch Calls Bitcoin a 'Major Threat' to Financial Stability

European Central Bank (ECB) executive board member Yves Mersch has said bitcoin could pose a threat to economic stability if financial infrastructure institutions get involved with the tech.

Read more: coindesk.com

Steem Bursts to All-Time High, Predictions of $10 to Materialize?

The blockchain-based social media was the next altcoin to go through sudden growth, rising to $6 and viewing previously unheard-of prices.

Read more: cryptovest.com

Japan’s GDP Grows Due to Bitcoin Wealth Effect

Analysts Yoshiyuki Suimon and Kazuki Miyamoto claim bitcoin will assist Japan in a Gross Domestic Product (GDP) boost of 0.3% heading into the first three months of 2018. At the end of 2017, the cryptocurrency boasted a ¥12 trillion market capitalization, and if trends continue into early this year, that could translate into lifting Japanese personal consumption by anywhere from ¥0.2 to ¥0.4 billion, they explain, referring to the phenomenon as the bitcoin effect.

Read more: bitcoin.com

The Bitcoin Exchange That Once Dominated China Is Heading to Japan

At one time the Beijing-based digital currency exchange Huobi was once the largest bitcoin trading platform in China before the central bank stopped domestic exchanges from trading cryptocurrencies. This month Huobi has revealed its carved a deal with the Japanese financial institution SBI Group and will be launching two new cryptocurrency exchanges in Q1 of 2018.

Read more: bitcoin.com

Five Reasons Ripple is Not Like the Rest of the Pack

Ripple (XRP) on the surface looks just like yet another up and coming crypto coin. However, Ripple, for good or ill, is different. Some crypto investors believe XRP is not the asset they are looking for. So here are the five ways Ripple is different compared to other high-float, relatively low-priced coins.

Read more: cryptovest.com

The Criminal Underworld Is Dropping Bitcoin for Another Currency

Bitcoin is losing its luster with some of its earliest and most avid fans -- criminals -- giving rise to a new breed of virtual currency. Privacy coins such as monero, designed to avoid tracking, have climbed faster over the past two months as law enforcers adopt software tools to monitor people using bitcoin.

Read more: bloomberg.com

South Korea More Than Doubled Ripple’s Price in Single Week

The South Korean cryptocurrency market accounts for a relatively small percentage of global Bitcoin trades, but has nonetheless played a crucial role in bringing RIpple’s market capitalization from $40 billion to $88 billion. Ripple was one of the best-performing crypto assets of 2017, boasting a 360x increase in value.

Read more: cointelegraph.com

Putin Investigating 'Cryptorouble' as Way to Avoid Western Sanctions

President Vladimir Putin has reportedly commissioned Russian officials to work on developing a national cryptocurrency dubbed the "cryptorouble."

Read more: coindesk.com

Could that ETH flippening finally be happening?

Maaaybe!

With the power of ETH and XRP, this is the year of the flipping. Bye Bye Bitcoin.

Wait for the lightning fast network release. Bitcoin will rise high again. Till then it will survive on the first movers benefit.

If Bitcoin bounce on the 50 day moving average it could become a huge bull run, because it will be an outbreak out of an enormous triangle. If this happens the dominance will rise again too.

STEEM had a good run in 2017 but I feel like 2018 is going to be so much better. Hopefully we can see unprecedented highs due to SMTs.

Quality and informative post as usual. It's obvious that you are one of the bloggers who put in the time and effort. Unlike those who'd go for quantity and spam others' timeline with several posts a day. You are among the writers at Steemit who I feel deserve to obtain more exposure. And rewards.

Anyway, as for the post's content - less dominance by Bitcoin is a good thing for the market. It may be the first, and the one that had started it all. But other worthy projects have since come into existence, and the focus should be on them too. Especially the ones that have potential to bring about changes and improvements worldwide.

Those who buy Bitcoin for the sole purpose of speculating on capital appreciation will not be pleased. But it would be a good thing of its price stabilises within a fairly tight range, with the volatility gone. That will result in it being a worldwide currency, like the US dollar.

Absolutely. The reduction in the volatility is a big step towards having real world applications. More than just an investment Cryptos should now have real life applications.

That makes total sense since there are more tokens coming out which have utility.

Bitcoin is still going to be a big player...it has,by far, the most developers on it (probably more than all the other chains combined if you remove ETH). That said, it wasnt going to be 50% of a multi-trillion dollar market.

As the Wall Street money flows in, some are starting to look at the projects the alt-coins are involved in. This is only going to increase as time goes buy.

I would not be surprised to see BTC settle with 15%-20% of the total crypto market cap.

The more Steem rises the more people find out about it.

The more people find out about Steem, the more it rises #Loop

For Steem has more Intrinsic Value than most cryptocurrencies/blockchains

Will bitcoin regain its dominance or is 2018 the year of the altcoins?

I guess it's all good, no bubble, no censorship...everyone is able to just copy and create a fork, I heard there is a website for that now...

I think it's about time Bitcoin lost that dominance. Other coins are more useful. Bitcoin inspired most of them, but I think it's struggling now. I hope Steem will take up some of the slack

Wait for the lightning network launch of Bitcoin. With that the scalability problem will be addressed. Transaction speed will reduce and Bitcoin will roar back.

We shall see...

It is only the second day of 2018 and indeed bitcoin as a whole is losing its hold on leading cryptocurrency. I think this is important to mention because a lot of exchange pair trades and a lot of crypto involves btc. When btc no longer leads then what will happen? Would it be a good thing or a bad thing? Seems more and more certain this day will come. Thanks.

Answer to your questions depends of what you call good and bad. I think it is gonna be good.

I would clarify crypto currency in general. Indeed I believe it would be good too. Btc I think will still hold significant value in the long run because it is the most aware of crypto on the planet. Losing market share will not mean drop in price. Just my personal opinions. Thanks.