Cryptocurrency Update (1/18/2018) What do you think about current markets? Is the sell-off in crypto over?

What do you think about current markets? Are you optimistic?

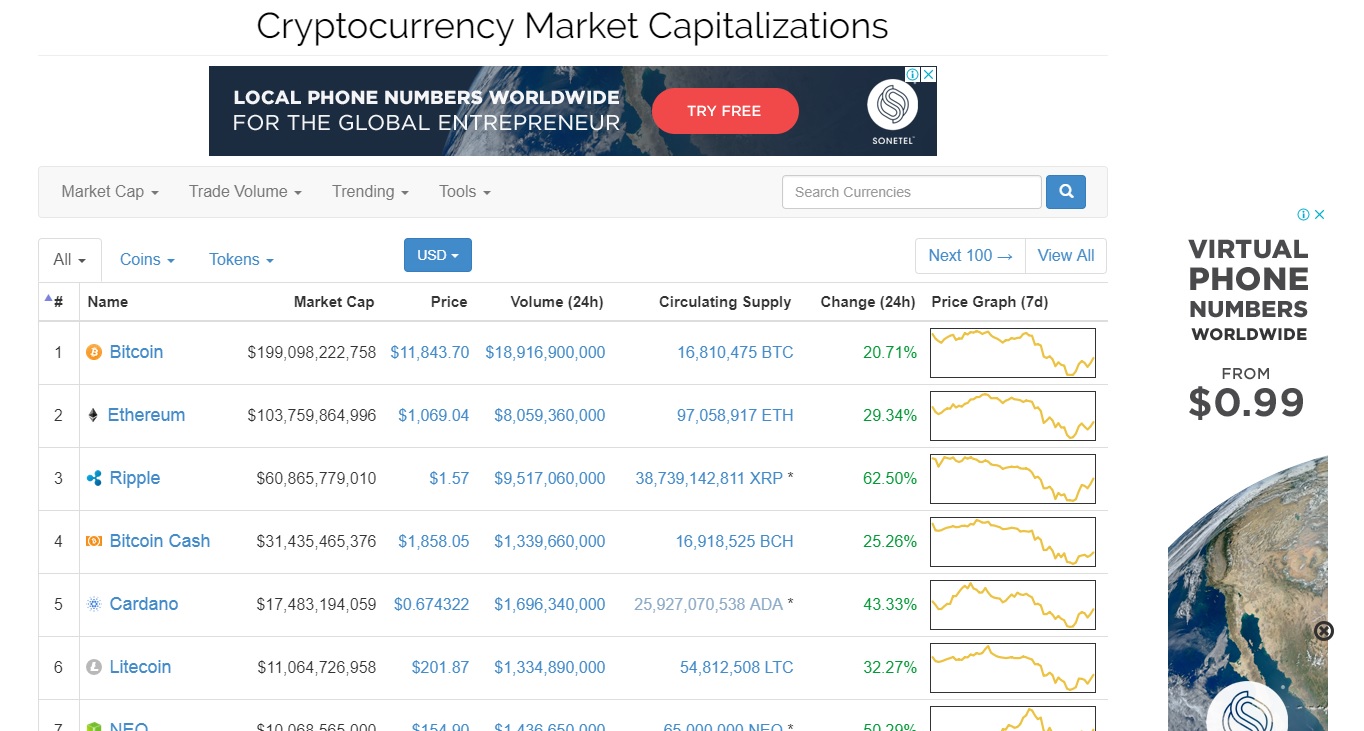

We have a lot to talk about on the daily update because we're not just gonna be recapping over the past 24 hours. we're gonna be talking about the past few days of all this crazy sell-off in the market and the recent rebound we've seen. so the real question is here is whether or not the markets selling off well we'll dive into that throughout the video a lot of

that is while we were doing some price analysis on the market leaders and

jumping through some really interesting headlines.

First and foremost the Nasdaq is launching two new ETFs this week. They've actually launched them already that will allow institutional investors as well as retail investors in traditional markets to invest in a bundle of different stocks that are based in the blockchain space or at least making strides and innovations in the space a lot of that is while there was a pretty big headline coming out.

That supposedly the South Korean government announced that officials within the South Korean government utilized the supposed South Korean ban to their to their advantage in regards to insider trading so we have a lot to talk about here guys let's go ahead and dive into it so first and foremost as we can obviously see the markets have taking a little bit of a rebound this has been an absolutely insane week for crypto currencies and

because of that we really need to kind of gain an assessment on where we are right now so as we take a look back here going over here to the global charts you know when we were riding up here in this area we were talking about how look you know the altcoin run-up we've had over the past month and really over the past three months has been fantastic it brought a lot of valuation to people holding crypto currencies people and you know increase their portfolios I know for myself as well I increased my Bitcoin comparative to a very high degree during this run-up and much like back in April May and June we had a fantastic run up a lot of opportunity in the market and to be fair on a lot of projects that really didn't deserve the valuations but it was a way that you could trade an invest in project take a little bit more risk in the market and really see a high return but as we talked about for the past week or two before I left for my trip and really the last time we've really gotten to cover these markets to make the guy emphasized is that there was really two things to look for first and foremost we were obviously entering towards the end of the run-up. if you were taking high levels of risk at the peak of this run-up guys. I mean to be fair it's kind of on yourself we've were obviously seeing signs that the market was in a ridiculous phase you saw the average top 100 coins up you know 10 20 30 % on a daily basis some up 50 or 80 percent and

coming out of nowhere adding billions of dollars in valuation when markets get to that level and they do it for so long even in a new market like this for

crypto currencies you have to step back and realize that you're you can't live in la-la land forever things eventually come to an end the punchbowl tips over and you know the valuation will drop instantly and that's how we saw Ripple and so many players in the market instantly losing 30 40 50 even 60 percent of their valuation and luckily bit connect losing up to 90 plus percent so if it connects down for I'm very excited that that was drained out in the market and I was I was gonna do a detail documentation

on that in the future but I just never got around to it but now that we've seen

crypto markets in general take a flush in valuation we're in a much healthier

position Corrections are healthy for the market it's not the end of it all for

crypto currencies no I don't think we're gonna get drawn out towards you know a two-year bear market like we saw after Bitcoin went to a thousand and 2013 some people been saying that I personally don't see it the volume has not come in yet for something like that you would need a mass sell-off from the whales in the space but I think they have a big incentive not to do so what we're seeing now more than anything is going to be a

switch from Bitcoin and altcoins so as we talked about guys we had a very

very clear target what was that that was for altcoin dominance outside of the top 10 to make it to 25 percent well let's go ahead here and take a look at the past 7 days, if we give it a second here to load let's go back here and look at the peak of the all coin run-up where did it go to 25 percent very big even level in the dominance guys again. whether or not it was a self-fulfilling prophecy because we were all think about it and everything like that it came true guys the peak the run-up ended right at 25% 25% is a very big mark that's a quarter of the market and that showed that there was a lot of resilience in the altcoin space there was a lot of optimism for a you know dozens of other projects in the space outside of the top ten to bring a new level of competition and innovation now of course it's obviously a lot of crappy cryptocurrencies that fall into the other 1,400 passed the top 10 but at the same time because of the fact that there's so many other crypto currencies you have much more room for valuation growth so what's my take on all coins here or at least the other coins out of the top 10 to be fair with you all as much as I think there's a lot of opportunity and a lot of candidates I think we've had the crazy run-up in December in into early January I think it's time to take a cool-down in this space and Bitcoin dominance remaining so low right now I think you could easily

see go on the up and up with Bitcoin as we'll take a look at here the technical analysis side of things being so low

there's a lot of upside for institutional investors or large-scale

investors to still lock in profits onall coins and step back into Bitcoin

remember was something I talked about both of the event in Limerick and in Dublin is that there is a Bitcoin actsas a pool of liquidity it acts as a pool

liquidity to invest in other projects and you think about it whenever you

trade any kind of altcoin usually trading a Bitcoin comparatives unless

you're trading on COO coin or one of the other exchanges that allow you to trade in aetherium pairs Bitcoin is a massive pool of liquidity it's a digital gold / a pool liquidity that goes in and out so when when Bitcoin Rises all coins usually drop when Bitcoin goes down all coins usually rise and we see it's a continuous cycle so you got to play the cycles correctly we've already had the great run-up in alt coins and now it's most likely time for Bitcoin to see some upside and yes we won't be probably up double digits every single day but that's ok sometimes markets need to take a more secure position and stay more on the cool side and honestly I know just because we're not making double digits every day we shouldn't be complaining I think we've made you know a wonderful amount of returns and this market so far and I think there's still a lot more upside to go both for Bitcoin and other all coins so let's go ahead here and take a look at the market leader here Bitcoin itself as many of you know we had a pretty dramatic sell-off the volume. Really started to kick in on the 16th

and 17th and I know many of you out there are curious about my stance on

Bitcoin do I think the bitcoin is going to 8k is it going to touch on the

200-day well to be fair folks you know we were really stepping towards that

here we had a drop past the 100-day I didn't hold there for quite some time in fact for two two whole days there was a period where we were staying under the 100-day however as of now it's looking

like the price has come up the wicks ended off from very long and in fact the closing on the price was close to the hundred day seemed to catch support on there and now right now is still holding

there I'd be fair we've already had a 50 percent correction in Bitcoin this is

the area where you know for example back in eighteen and nineteen K you don't want to be greedy up there you want to be greedy at the lower level so you want to look to add to your position standing

in for you believe in Bitcoin and generally in crypto currencies because

remember bitcoins gonna stick around it's going to be that pool of liquidity

for altcoins whereas all coins a lot of are still overvalued and some of them are rebounding quite sharply not not a surprise after all the sell-off you want to look to see the cheap or opportunities what in this market is down 50% Bitcoin it's down 50% here generally around 50% at 11,500 it's a much better deal for investors and bulls than up there at 19,000 so again I think it's very important to look at something of these levels we found supported the 100-day this is a common level of the past where Bitcoin will correct over we've had these dramatic sell offs before it's no surprise now for those of you out there who might be a little bit more on the bearish side and more levied towards the idea of Bitcoin going down to touch the 200-day no problem it could very well do that but I would recommend to keep in mind the idea that we might not get a full correction down to 8,000 or 8,500

it might not just happen so maybe you know for example my case I know what I'm going to be doing if I do ever make any

capital allocations towards crypto right now I'm gonna be focusing on Bitcoin and I'm gonna do I'm gonna apply this strategy I'll have my first 50 percent around this area in regards to my additional investment and the other 50% one out I'll either add it when it touches it makes contact with the 200-day or close to the 200-day maybe around the $9,000 range and if I on't get it around there I'll make the other addition around 12,000 if it seems like we're really starting to recover off of the 100-day that's my general strategy on it but again the main indicator right here to watch is the 100-day just like how the 50-day was our indicator up here once we got the close below there guys it was obviously clear the Salaf was coming through that we were gonna get a correction down to the X moving average and if it becomes apparent like that on Bitcoin you could very well see the same

thing and regards to going to the 200-day from the 100 all righty so let's

go ahead here let's take a look at etherium so if your room right now again

has been holding quite well in regards to the its previous run up in this whole altcoin bull run you know a lot of these coins in the top ten are still holding their dominance in the market we can see that a theorem has only really seen about a 10% correction from its peak at 10 million Satoshi's and to be fair with you all I'm not taking a really a good long-term position necessarily I don't want to be negative on it in the long term and a short-term case I'm not very bullish on a theorem I think the price is a little overextended here and what I would really like to see and think regards to a traders perspective in our goods to price is to see it come down in

fund support on this previous level at 7 million Satoshi's it'd be a nice 30

percent correction from the peak at 10 million not to mention you've got the

moving averages racing right here and curving around that area so if you see a good few days to sell off and Bitcoin killing it and altcoins will probably you know feel the pain as well outside of aetherium you could really see a theorem make a full 30 percent correction and I think

that'd be extremely healthy for it after this crazy route down from around I

think I get the lows and stuff it was it 20 something million Satoshi sir

something around there H maybe 30 million or 3 million but again you need

these kind of correction guys it's healthy and I'm not negative on a theorem long-term just my personal perspective in the short term alright so let's go ahead here take a look at ripple ripple finally having a nice scalable correction from its highs at 22,000 Satoshi she's down to about 10,000 and a little bit low there with all the crazy sell-off but we made final contact with one of the moving averages we talked about hopefully seeing ripple

come down and make contact with the 50-day we got that now here's the thing in regards to Ripple guys you know a lot of you would say you know seeing as we make contact with it it's on the lower end it's cheaper you now it's roughly a little bit uh maybe a little bit above a 50% discount is it time to buy to be fair with you all I'm not gonna be trading Ripple you already know kind of at a moral sense I don't like to train invest in ripple but

a lot of that as well to be fair we're still very very overextended guys we're

still up 10x from the bottom for ripple ….. Continue ….

Bear in mind that craziness going on all right so keep

learning stay safe trade smart guys and

again I'll be back here soon…

I don't think the sell off is completely over, due to some technical analysis ive done on the bitcoin usd price chart. But I think this small raise in prices will lead to one more drop, that won't go as low as the lowest price this month. Shortly after that we could see a new all time high in the market cap. Hopefully somewhere around 900 billion dollars.

Thanks for your comment .. i discuss here from my view point ..