The short-sighted investment strategies of today, and investing in profit-sharing projects like: Pink Date

The future from here in crypto is going to be in platforms, dApps, services, etc. We already have the frameworks for an endless plethora of businesses, now we just have to make them, or find people who can. So I’ve set out to find the most promising new businesses in this field in hopes that my early investment could be a part of something huge in the future. I fully believe the next massively adopted service is just in its infancy now, and in only a matter of years (months?) we could see it flourish with how quickly things are moving now.

Initial findings have been slim, it’s not easy to predict the future after all. You can study the teams up and down, pretty much get a doctorate in their various whitepapers, and listen to them talk all day about everything they’re going to accomplish. I’ve been around long enough though that I generally end up going with my gut. Of course everything I listed is going to influence how my gut will react, but in the end it’s not always pure logic.

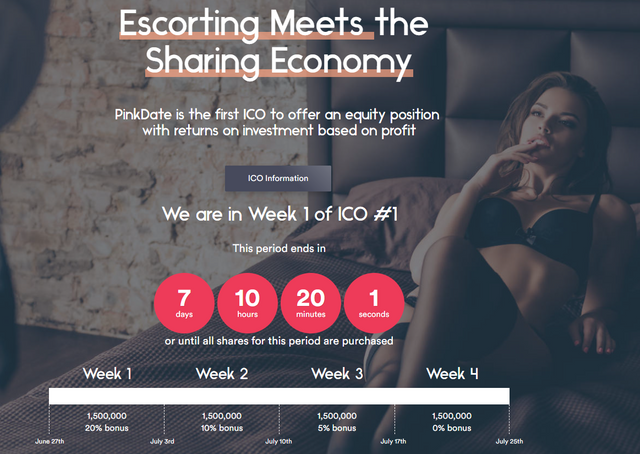

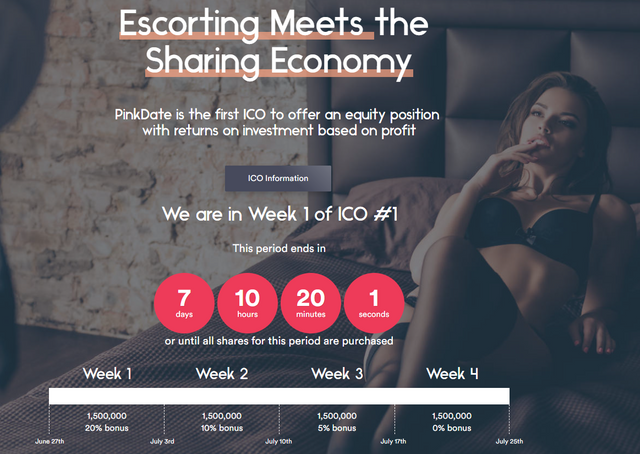

My most recent big project I’m looking into is called Pink Date (https://pinkdate.is/?pk_campaign=inv&pk_kwd=dcef9e53) . I’m interested in it because it seems like a simple solution to a very old problem. It’s the first world-wide escorting service that combines screening, booking, and payment in a single platform. I know this field may seem off-putting at first but from a purely financial perspective, the market is enormous. There are 42M escorts world-wide, pulling in an estimated $186B in revenue. If Pinkdate can only pull in 2% of that market it’d be a Fortune 500 company.

This takes me back to just buying and holding tokens, you could do this with Pink too, but you don’t have to rely on a bunch of other people to constantly be demanding it in order for you to see profits on your token purchase. They’re using smart contracts to automatically pay out 50% of all quarterly PinkDate profits split between their token holders.

If they could eventually get that 2% of the market, and you were lucky enough to invest, you’d be making $57 a year for every token you bought.

In the aforementioned scenario that would be like spending $1000 now, and you’d be making over $400k/yr just sharing in PinkDate’s profits for just holding the tokens. This might be an extreme example but it highlights the kind of profit sharing potential that exists here. In a more short term analysis the predicted dividend at end of year 3 is estimated to be around $0.40/share. That's based on a plan to roll out to a target number of cities with a target number of escorts performing transactions on the app. The details and (quite conservative) assumptions are laid out in the white paper if you want more information. They also lay out that a $0.40 dividend would put a reasonable share price (at even a low P/E of 20) at $8.00. That would be a 14x return from the current ICO price.

Even if you’re the skeptical type like me, it’s a good idea to hedge your bets. Some may question the legality of this just like I did. In the end I see no qualms with this morally; and that’s a whole lot more important to me than the legality. The future is in the technology, not the currency itself. Getting in and owning a portion of a business now can pay off much more than just buying the currencies used on them.

Congratulations @ranowhale! You received a personal award!

Happy Birthday! - You are on the Steem blockchain for 1 year!

Click here to view your Board

Congratulations @ranowhale! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!