You could own all the bitcoin, ethereum and other cryptocurrencies in the world or almost all of Starbucks. What crypto is worth on a scale.

This year’s hot market is imploding.

Bitcoin and litecoin and ripple and ethereum and all these other mysterious new online “cryptocurrencies” have been tumbling for a month, and many have now gone into free fall.

Don’t say we didn’t warn you. Ethereum, which was the miracle boom earlier this year, has halved in value over a month.

Admittedly that’s only when measured in worthless old “grandpa” currency — namely, U.S. dollars. But still.

Where does that leave the market now?

If you think the plunge has gone far enough and this is looking like a glorious “buying opportunity,” here’s some awkward information.

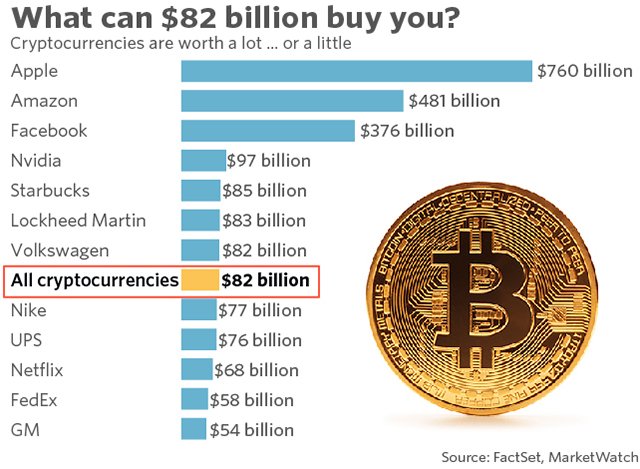

At current prices, investors — or speculators — are still valuing these new cyberinventions at a staggering aggregate value of $82 billion.

Yes, really. That includes $39 billion for bitcoin BTCUSD, -2.86% and $19 billion for ethereum, the two most popular.

Is that a lot or a little? Compared with the amount of gold in the world, or the size of the U.S. stock market, or the amount of dollars in circulation, it’s a pittance.

But put that in another context.

If you’re considering cryptocurrencies as an investment, reflect that today they have the same total aggregate dollar “value” as Starbucks SBUX, -0.25% For that same $82 billion you could buy 100% ownership of one of the world’s most recognized and respected brands, a company generating $21 billion in annual sales and $3.1 billion in free cash flow last year.

Which would you rather own?

That $82 billion is also about the same as the valuation of Volkswagen VOW3, +1.27% VLKPY, +0.65% — the German car giant that also makes Porsche, Audi, Bentley, Lamborghini and Bugatti. Volkswagen has 120 factories around the world and sells about 2.6 million vehicles a year.

Or, sure, you could own all the bitcoin, ethereum and so on instead. Up to you.

For that matter, $82 billion could also get you complete ownership of defense giant Lockheed Martin LMT, +0.10% or about 90% of the parent of the Union Pacific Railroad UNP, -0.30%

If stocks aren’t your thing, $82 billion is also enough to buy up all the farmland in the state of Ohio, according to the Agriculture Department’s numbers. Or all the farmland in the states of Pennsylvania and Kentucky combined.

Bitcoin alone is valued at more than all the farmland in Virginia or North Carolina.

The $82 billion price tag of these cryptocurrencies is also enough to buy up all the timberland — I am not making this up — in Oregon. The state has 24.7 million acres of timberland, and the current market price in the Pacific Northwest is about $2,700 per acre.

So actually $82 billion would give you more than enough to buy up all the timberland in Oregon... plus, say, 100% of the stock of Tiffany & Co. TIF, +1.56% (about $11 billion) or even Campbell Soup Co. CPB, +0.08% ($15 billion).

Fans of cryptocurrencies, as well as gold, are fond of dismissing U.S. dollars, euros and the like as “fiat” currencies. How ironic that at $82 billion, these are now four times the entire market capitalization of Fiat FCAU, +3.84% FCA, +3.87% ($22 billion) itself.

I was a Stock Broker for 29 years and I did well with my profession. That being said I am really not a fan of the Stock Market at these levels. I have Dipped my toe into some Cryptos though.

Thank you for providing information, this is very useful for me, and I just found out that.

Thank you for the information hopefully this is useful for us all.

Interesting and very well written article, i enjoyed reading, thanks @royschuh. Upvoted and followed

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.marketwatch.com/story/you-could-own-all-the-bitcoin-ethereum-and-other-cryptocurrencies-in-the-world-or-almost-all-of-starbucks-2017-07-13

When I think that a guy bought 2 pizzas in 2010 with 10 000 BTC !!

https://steemit.com/steemit/@sharoon/bitcoin-is-doing-big-changing-please-don-t-invest-till-august