LEXIT: The First Online Marketplace For Trading IP And Entire Companies!

INTRODUCE

Lexit is a new blockchain based marketplace that is aiming to provide entrepreneurs with the ability to incorporate processes, concepts, ideas, and technology from discontinued projects into new and successful contexts.

This plasform has the objective of consolidating the Mergers and Acquisitions (M&A) market, helping entrepreneurs and big companies to incorporate processes, ideas and technology from failed projects or new companies into new and prosperous projects. In other words, they are building a market in which it is possible to make and exchange intellectual property and commercial companies.

What is M&A?

M&A - "Mergers and acquisitions is a general term that refers to the consolidation of companies or assets through various types of financial transactions. M&A can include a number of different transactions, such as purchase of assets, consolidation, mergers, acquisitions, tender offers and management acquisitions."

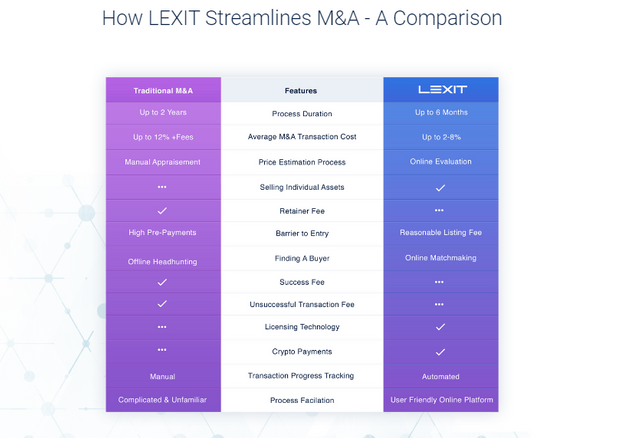

The global volume of mergers and acquisitions is enormous and despite the growth, there are still complexities and challenges in the industry that Lexit tries to solve with the help of blockchain. The truth is that the industry is due to distraction and Lexit is taking a leading role in this, because there has never been a blockchain project that aims to reinforce the multi-trillion dollar market.

What is solution?

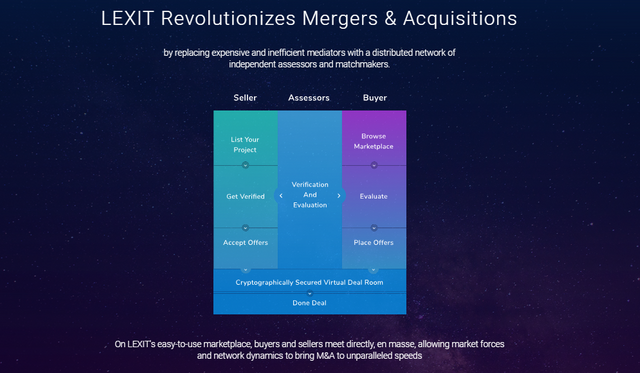

There’s now a solution to solve these existing problems. LEXIT is the name. LEXIT will salvage the traditional M&A industry by bringing new ideas and approaches. The first step towards problem-solving is decentralizing the already-centralized M&A industry.

Through the backing of the blockchain, LEXIT is offering transparent and secure transactions. It features a Deal Room where confidential meetings and business agreements are signed. If you’re yet to utilize the prospects of Intellectual Property (IP), the LEXIT platform allows you trade on IP while integrate current technologies and ideas in bringing abandoned (discontinued) projects back to life.

How LEXIT Mergers & Acquisitions Blockchain Marketplace Works?

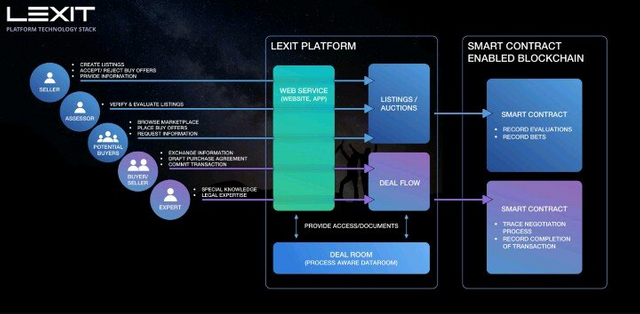

To start off with, the “seller” makes use of the web interface within Lexit to create his/her listing. This is done after a thorough check so as to ensure that the person/ company performing the sale is legitimate.

After the listing has been made, potential buyers can use the same web platform to search for assets that they would like to purchase. In case there are several offers from different buyers, sellers have the option to go through the “transactional history” of each buyer and then choose who he/she would like to do business with.

At this point, it is also important to mention that the app interface guides “both parties through the necessary steps for closing a deal”. This is usually done via the use of experts that have knowledge in regards to things like due diligence, value estimation etc.

Finally, once all of the groundwork is completed, Lexit allows for the finalisation of a deal via the creation of ‘data entries’ that record all of the individual aspects involved with each and every transaction.

Comparison the traditional M&A with LEXIT

FEATURES OF LEXIT PLATFORM

The aim of Lexit is to fulfil two primary functions including:

Marketplace:

It will serve as a marketplace wherein users will be able to come and offer their IP’s, company branches and startups for sale. Through the use of an advanced “filter mechanism”. Potential buyers will be able to scan through the available opportunities and then pick the ones that they desire to invest in.

Native Ecosystem:

To help make the entire exchange experience more seamless, the company has developed its own ecosystem to make the marketplace functional and accessible (to all those who wish to make use of it). For starters, Lexit will make use of incentives and bonuses that will be used to encourage participation. In addition to this, the company will also provide ”legal assistance” to its customers for the preparation of ‘M&A and IP transactions’.

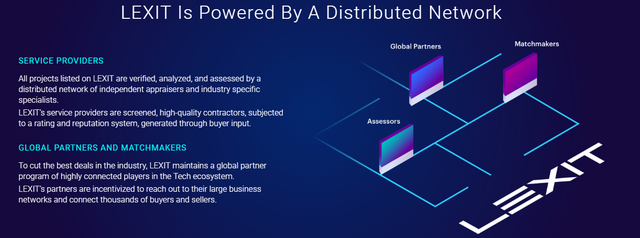

LEXIT Is Powered By A Distributed Network

Service providers

All projects listed on LEXIT are verified, analyzed, and assessed by a distributed network of independent appraisers and industry specific specialists.

LEXIT’s service providers are screened, high-quality contractors, subjected to a rating and reputation system, generated through buyer input.

Global partners and mathmakers

To cut the best deals in the industry, LEXIT maintains a global partner program of highly connected players in the Tech ecosystem.

LEXIT’s partners are incentivized to reach out to their large business networks and connect thousands of buyers and sellers.

THE LEXIT ICO AND OIO TOKEN

ABOUT ICO

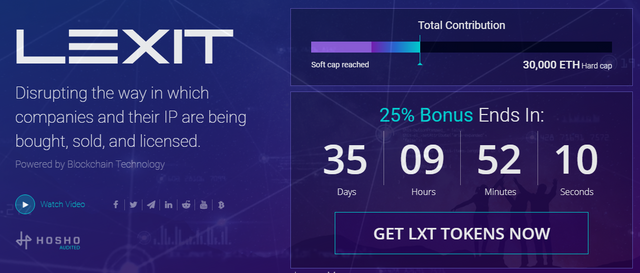

Price in ICO: 1 LXT = 0.00083 ETH

Min. investment: 0.01 ETH

Accepting: ETH

Distributed in ICO50%

Soft cap: 2,000 ETH

Hard cap: 30,000 ETH

BONUS

75% Bonus Tier 1: Jun 19th-Jun 25st 1 LXT = 0.00047 ETH

60% Bonus Tier 2: Jun 25st-Jul 2nd 1 LXT = 0.00052 ETH

40% Bonus Tier 3: Jul 2nd-Jul 9th 1 LXT = 0.00059 ETH

25% Bonus Tier 4: Jul 9th-Jul 16th 1 LXT = 0.00066 ETH

10% Bonus Tier 5: Jul 16th-Jul 25th 1 LXT = 0.00075 ETH

LXT token

Why Tokenize It?

Introducing a token (LXT) to the LEXIT marketplace environment allows us to base evaluation and matchmaking services on a distributed and competitive network of independent, yet screened assessors - creating market dynamics which promote fast, transparent and fair deals.

Token Distribution

Sales: 50%

Reserve: 29.5%

Team: 10%

Advisors: 4.5%

Partners: 4%

Airdrop and Bounties: 2%

CONCLUSION

LEXIT will use a distributed network backed by the blockchain technology. The platform will feature a marketplace that will be a link –up channel for buyers and sellers. The deal room is there for business agreements and sub subsequent transactions.

There’s no better way of empowering people that giving them financial dependence. LEXIT will reward prospective users using its token. In summary, LEXIT is a digital upgrade to traditional Mergers and Acquisition (M&A). The platform will solve existing problems in the industry and put M&A back to the path of glory.

For more information:

Website: https://www.lexit.co

Whitepaper: https://uploads-ssl.webflow.com/59f21153ffa06300013c0c6d/5b3e5e84aa9722a12cd6e3df_07-05LEXIT_White_Paper.pdf

ANN Thread: https://bitcointalk.org/index.php?topic=2494585.0

Twitter: https://twitter.com/LEXITco

Facebook: https://www.facebook.com/LEXITco/

Telegram: https://t.me/LEXITco/

Author: sonpham111

Profile link: https://bitcointalk.org/index.php?action=profile;u=1827271

@sonpham111, you are interesting to read!

Thank you for kind words