Weiss Ratings Fell Under Cyber Attacks! This Was Their Response:

https://weisscryptocurrencyratings.com/ratings/thank-your-for-feedback-heres-our-response-130

Here's the Article if you don't want to click the link.

Thank your for feedback! Here’s our response …

By The Weiss Ratings Team | January 24, 2018

Dear Friends,

Wow! What a day! After a cyberattack last night, we’re seeing a barrage of criticism on the Web, especially from disappointed Bitcoin and Ripple fans.

Understood! Many see strictly our letter grades and not our logic behind them. Others misunderstand our primary goal: To help investors reduce risk and find the coins with the most upside potential. That means we not only consider fundamentals like adoption and history, but also investor risk-and- reward metrics based on price action.

Some prime examples:

Why don’t we give Bitcoin an A? Actually, thanks to Bitcoins strong adoption, brand, and security, it does merit an A … but only on our Fundamental Index.

Problem: That’s just one of our four major metrics. Meanwhile, Bitcoin falls short in two other important areas: Our Risk Index, reflecting extreme price volatility and our Technology Index, reflecting Bitcoin’s weaknesses in governance, energy consumption and scalability. As soon as the metrics on these improve, an upgrade for Bitcoin is likely.

Why doesn’t Ripple get a higher grade? Like Bitcoin, it gets an A for fundamentals, but it scores poorly on our Risk Index due to repeated price crashes. Its Technology Index gets clipped due to heavy centralization and control by its creators.

How come Dogecoin is rated on par with the likes of Ripple? This is indeed surprising. But the numbers are the numbers, and they include surprising facts: Dogecoin’s usage is greater than that of Bitcoin Cash. Its usage is also greater than that of Dash and ZCash combined. Of course, that alone is not enough to bump it up above a C. But it certainly does pull it up from the D range.

Thank you very much for your input! We take it very seriously. After all, ratings are not a science. They are, and always will be, a work in progress.

The Weiss Ratings Team

What do you think?

The article explaining how they made their ratings can be found here:

https://weisscryptocurrencyratings.com/ratings/the-weiss-cryptocurrency-ratings-explained-15

If you don't want to bother with the link, this is what it says:

The Weiss Cryptocurrency Ratings Explained

By The Weiss Ratings Team | January 24, 2018

The new Weiss Cryptocurrency Ratings are the first by a financial rating agency. They are based on a groundbreaking model that analyzes thousands of data points on each coin’s trading patterns, technology, and usage.

The new world of cryptocurrencies has delivered astonishing profits to investors and holds great promise for the future. Millions of new investors have rushed in. Hundreds of self-declared experts have appeared to advise them. But the market suffers from lax standards, murky operators, marketing hype, and periodic market crashes. It desperately needs the clarity that only robust, impartial ratings can provide.

We’re proud to be the first financial rating agency to bring that benefit to investors – to help avoid the hype, while identifying the few solid and promising cryptocurrencies that truly merit their hard-earned cash.

Despite early growing pains, cryptocurrencies and blockchain technology are emerging as a potentially powerful force that could affect investors and consumers in profound ways. Indeed, the unprecedented speed of the changes is a telltale sign of a global paradigm shift — in e-commerce, banking, communications, social networking, Big Data, the Internet of Things, possibly even essential pillars of government and society.

Depending on how institutions and the public interact, the paradigm shift could be disruptive and revolutionary, fostering greater extremes of boom and bust, aggravating income inequality and creating more political divisiveness. Or, the shift could be constructive and evolutionary — with transparency, full disclosure and objective standards for all stakeholders. This latter aspect is where Weiss Ratings proposes to make a contribution.

Weiss Ratings’ 46 Years of Experience

Weiss Ratings, which began in 1971, is the nation’s leading independent rating agency of financial institutions. Today, Weiss Ratings assigns letter grades to about 55,000 institutions and investments, including nearly all of the nation’s insurance companies, banks, credit unions, stocks, ETFs and mutual funds.

Unlike Moody’s, Standard & Poor’s, Fitch, and A.M. Best, Weiss Ratings never accepts compensation of any kind from the companies or entities it rates. Its revenues are derived strictly from individual investors, consumers and other end users of its ratings.

Weiss Ratings’ strict adherence to objectivity and independence has consistently paid off in the form of accuracy — both in warning the public of dangers and leading the public to the best returns.

The U.S. Government Accountability Office (GAO) found that the Weiss Ratings of life and health insurance companies were first in warning of future financial difficulties three times more often than A.M. Best and many times more often than Moody’s, Standard & Poor’s or Duff & Phelps. Similarly, a follow-up study by Weiss, using the same methodology as the GAO, found that Weiss Ratings was also the leader in correctly identifying the truly safe companies that do not experience any financial difficulties.

With respect to the profit performance of Weiss Stock Ratings, The Wall Street Journal reported that Weiss ranked #1, ahead of all major rating agencies and research companies covered, including Goldman Sachs, Morgan Stanley, Merrill Lynch and Standard & Poor’s. Barron’s, meanwhile, wrote that “Weiss is the leader in identifying vulnerable companies.”

Weiss Ratings does not claim to have more knowledge or data than other ratings agencies. Rather, it has achieved this performance accuracy by combining three strengths: (1) robust, intelligent computer models built by our team of analysts and software developers, (2) analysis of vast amounts of data, and (3) above all, independence.

Now, Weiss Ratings is applying these strengths to cryptocurrencies. In addition, to adapt its model-building know-how to cryptocurrencies, Weiss Ratings has drawn heavily from consultants that specialize in blockchain technology and the cryptocurrency ecosystem.

The end result is letter grade for each cryptocurrency that’s ultimately designed for all stakeholders in the cryptocurrency space, beginning with individual investors who are new to cryptocurrencies but willing to take the obvious risks.

For these investors, the Weiss Cryptocurrency Ratings provide unbiased guidance free of any conflicts of interest. They are designed to help lead investors to the potentially rich rewards, with lower-than-average cryptocurrency price volatility, and sustainable technology.

Looking ahead, the Weiss Cryptocurrency Ratings should also become a vital selection tool for consumers holding cryptocurrencies to buy goods and services, for merchants accepting payment in cryptocurrencies, and for projects seeking to raise money via cryptocurrencies.

Weiss Ratings’ overall goal is to help the public avoid both the hype and the fear – to invest and do business with more confidence and, at the same time, more awareness of the possible dangers.

The Weiss Ratings Scale

Investors should interpret the Weiss Cryptocurrency grade scale with these terms:

A = excellent

B = good

C = fair

D = weak

E = very weak

A plus or minus sign indicates the upper third or lower third of a grade range, respectively. In addition, an F grade is assigned to cryptocurrencies that have failed or are subject to credible allegations of fraud.

Important Caveats

Before acting on, or reacting to, any single grade, investors should be aware of the following five caveats:

Caveat 1. Do not misunderstand the Weiss Ratings scale. Other rating agencies use a scale from triple A to single C. In that scheme a B grade is “junk” and a C is close to failure. In contrast, Weiss Ratings’ B is “good” and C is “fair.” Based on a study of the Weiss Ratings by the U.S. Government Accountability Office, an institution is not categorized “vulnerable” unless its grade is D+ or lower.

Thus, cryptocurrencies do not have to achieve an A grade to merit interest by investors. A “B” or even “B-” also qualify as the investment rating equivalent to “buy.” At the same time, investors should not be overly alarmed by a “C” rating. It is a passing grade; and for investors, implies the equivalent of “hold.”

Caveat 2. No safe cryptocurrencies. At this early stage in their evolution, there is no such thing as a “safe” cryptocurrency. All investors in the sector must be willing to accept wide price volatility, undefined regulatory risk, frequent market irregularities, and deficiencies in platforms such as currency exchanges.

Caveat 3. Frequent ratings changes. The metrics used to evaluate cryptocurrencies can change more rapidly than those of other investments. Therefore, when using Weiss Cryptocurrency Ratings, investors should expect frequent upgrades and downgrades.

Caveat 4. Opinion. Although Weiss Cryptocurrency Ratings are based on objective analysis free of conflicts of interest, they should not be interpreted as be-all-end-all evaluations. Every grade issued by any rating agency is ultimately an opinion, to be used by the public in the context of opinions from analysts, developers and users.

Caveat 5. Incomplete. No ratings model, no matter how well designed, can evaluate all factors; and this is especially true in new, unchartered sectors like cryptocurrencies. For example, to fully evaluate the blockchain software programs of each new cryptocurrency, teams of expert blockchain developers would need to audit and thoroughly test the code. Although that effort would be an important step forward, especially for developers and certain institutions, it is beyond the scope of this project. Instead, to help guide investors to cryptocurrencies with the most robust technology, the Weiss Ratings evaluates each blockchain technology by using a series of the proxy metrics described below.

The Model

The Weiss Cryptocurrency Ratings model is built from the ground up with five basic layers:

Layer 1. Current data on each currency’s technology, performance and trading trends

Layer 2. Proprietary formulas that convert the data into comparable ratios.

Level 3. Proprietary sub-indexes that aggregate the ratios to measure key factors and features considered critical to the potential success or failure of investments in each cryptocurrency

Level 4. Aggregation of the sub-indexes into four key indexes, each meriting a separate letter grade

Level 5. Aggregation of the four key indexes into an overall letter grade

Thus, each Weiss Cryptocurrency Rating represents the pinnacle of a pyramid built from tens of thousands of calculations that feed up to a final grade.

Disclosure of Model Components

To be consistent with the transparency that has become the hallmark of the cryptocurrency space, Weiss Ratings’ intent over time is to disclose as much as possible about its model.

However, decades of experience in the financial marketplace indicate that, once armed with the specific formulas or processes of a ratings model, some rated entities seek to game the system: They try to manipulate data they can influence or control with the goal of achieving an unfair advantage. To help avoid this outcome, disclosure must proceed in phases, beginning with a broad description of the four key indexes in the Weiss Cryptocurrency Ratings model. These are:

The Cryptocurrency Risk Index. A composite of sub-indexes that measure (a) relative and absolute price fluctuations over multiple time frames, (b) declines from peak to trough in terms of frequency and magnitude, (c) market bias, whether up or down, and other factors.

The Cryptocurrency Reward Index. A composite of sub-indexes that evaluate (a) returns compared to moving averages, (b) absolute returns compared to a benchmark, (c) smoothed returns compared to a benchmark, and other factors.

The Cryptocurrency Technology Index. A composite of sub-indexes calculated by a manual analysis of publicly available white papers, public discussion forums or announcements, and open source code to evaluate the protocols underlying each cryptocurrency. Factors considered include the level of anonymity, sophistication of monetary policy, governance capabilities, the ability or flexibility to improve code, energy efficiency, scaling solutions, interoperability with other blockchains and many more.

The Cryptocurrency Fundamental Index. A composite of sub-indexes that evaluate transaction speed and scalability, market penetration, network security, decentralization of block production, network capacity, developer participation, public acceptance, plus other key factors.

Each of these indexes is appropriately weighted, compared and then evaluated in terms of how it interacts with the other three indexes systemically. The end result of the analytical process is the Weiss Cryptocurrency Rating.

Overall, Weiss Cryptocurrency Ratings provide a well-rounded, solidly-grounded opinion based on hard facts and steeped in four decades of ratings experience. They can serve as much-needed cryptocurrency GPS for investors.

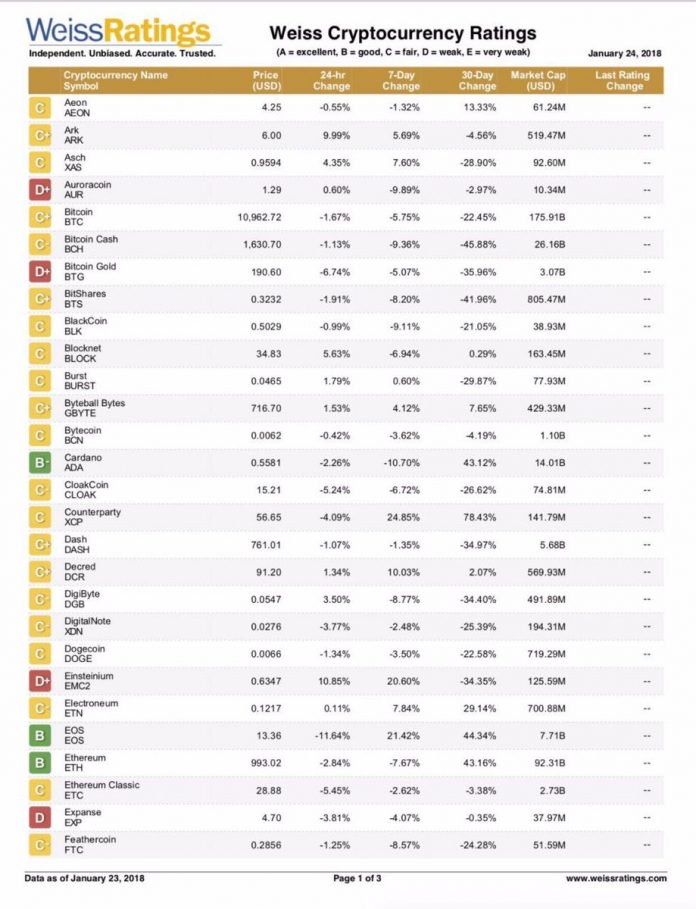

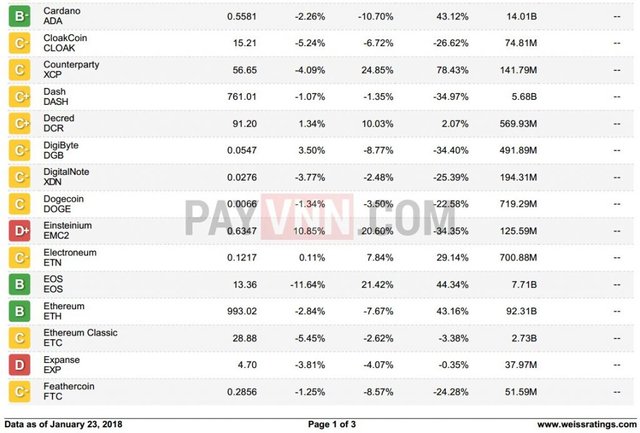

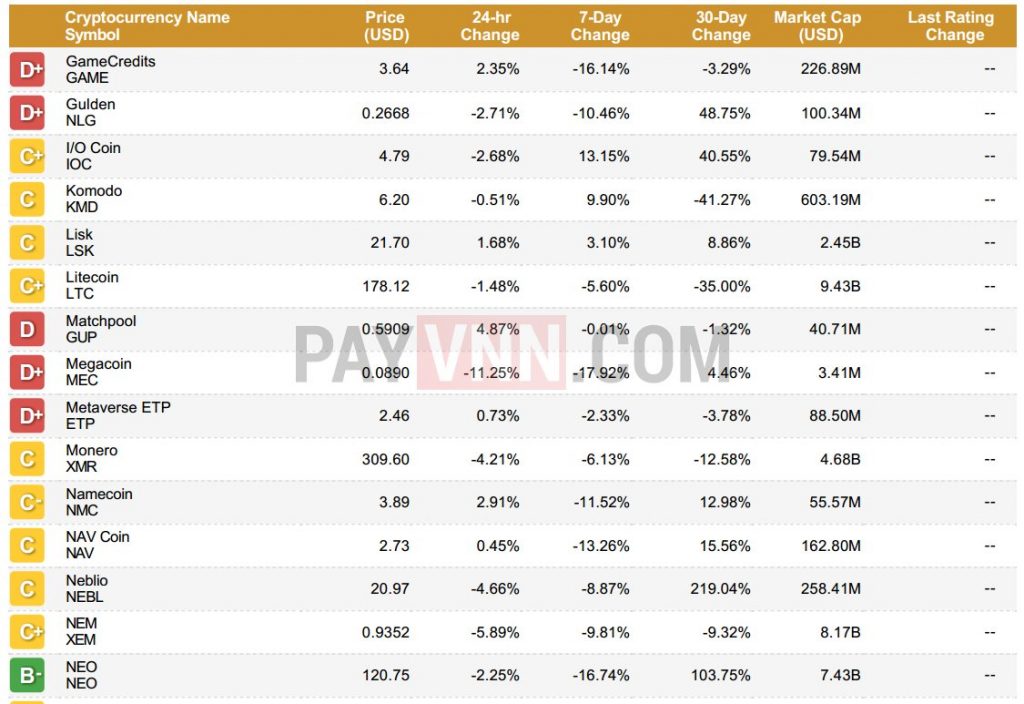

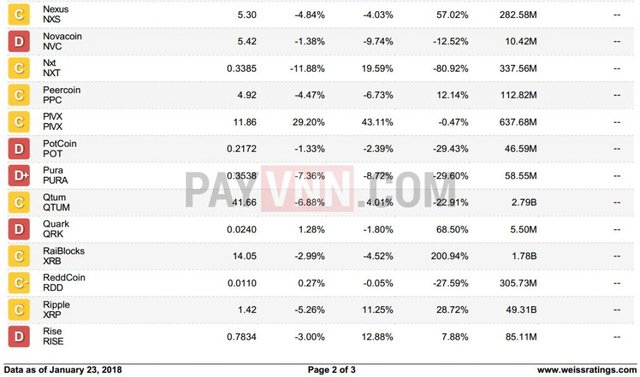

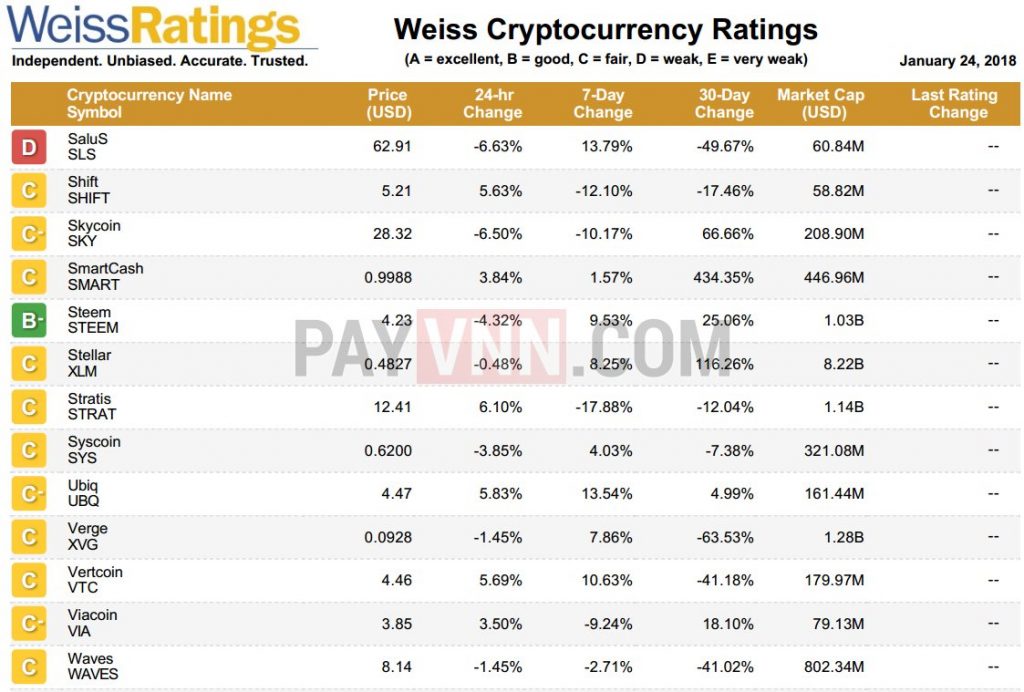

I really had to dig to find these rating sheets, so I apologize for the watermarks.

Take this with a grain of salt, the weiss ratings system has a history of being wrong on multiple occations, but it's interesting to see the analysis of how they made the ratings.

What do you think? Do these people know what they're talking about or is this just spreading ash? Let me know in the comments.

Note: I am not a financial expert, nor do I have any thoughts on the matter, just found this online and wanted to share all this information with those of you who might be interested in seeing it.

Congratulations - You were randomly selected to receive a 100% up-vote from @fivefreeupvotes

That’s awesome!

Hey @squares,

Thanks for posting your opinion :)

I believe they are planning a part 2 for this list, so there's much to be expected.

Check out the post I just made on the increase of price of Steem after Weiss' ratings release and don't forget to follow :)

https://steemit.com/steem/@vismonkey/steem-s-amazing-price-increase-january-24-2018

Followed!

I'm taking all this with a grain of salt but I'm really curious how they're gonna rate scam coins like Bitconnect or if they rate them at all.

Followed!

I will follow you too!

I think they are really good at the guessing game. Crypto is still very new and very volatile so it's impossible to predict where these things are going to go. That being said, it's still a good way to get educated guesses.

Yea, I agree with that. I just wonder what this is going to do to the market long term.

Thank you @squares for making a transfer to me for an upvote of 1.42% on this post! Half of your bid goes to @budgets which funds growth projects for Steem like our top 25 posts on Steem! The other half helps holders of Steem power earn about 60% APR on a delegation to me! For help, will you please visit https://jerrybanfield.com/contact/ because I check my discord server daily? To learn more about Steem, will you please use http://steem.guide/ because this URL forwards to my most recently updated complete Steem tutorial?

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://weisscryptocurrencyratings.com/ratings/the-weiss-cryptocurrency-ratings-explained-15

Good bot.

snitch

I'd like to add that there's a TON of coins missing from this list. Not entirely sure why you would even release such a thing without posting at least the majority of what's out there.