How I lost $100,000 in the crypto bear market and tips for you to not make the same mistakes I did. Steemit Introduction.

Hello Everyone and the Steem Community.

Yes…it is sadly very true, I really did lose $100,000 in one week during the crypto bear market. Details with proof are below but before I get to that, let me introduce myself to you all and provide a little history of how I got to where I am today.

I am Steemkarma4u. I’d like to keep my real name anonymous for now due to the sheer fact of some personal information I will be sharing. But my goal is to spread and share some good knowledge and Steem karma around to you all.

I am a 28 year old male from San Diego, California and this is my first Steemit post and introduction. I want to share my experiences with you all and add value to the Steemit and cryptocurrency community.

I was first introduced to bitcoin back in 2013 when a friend of mine told me that there was a site called sealswithclub.eu where we could use this digital currency to play online poker for “real USD” after it was banned in the United States in April 2011. In the beginning I did not really care for what bitcoin was or what it was about and only sought to grow my account as a bankroll to play online poker using BTC. At that time, I believe the price was around $25/BTC and I was playing the 1-2 BTC buy-in tables, which were equivalent to 25NL and 50NL games on Fulltilt poker and Pokerstars.

I was actually doing quite well and accumulated up to a few hundred BTC at one point in time and still did not understand its true value. But as a few months went on, the value of BTC started to jump to $100+ (around Apr 2013) and I realized that the value of BTC was rising exponentially and maybe it wasn’t worth the risking of losing it by playing online poker. Of course, like any poker player, thinking I was good, I continued to play and maybe lost about 100 of my total BTC (that’s about over $250K now :( who knew?)

Long story short, before getting to the good stuff, I stopped playing online poker using BTC and started to treat the remaining coins I had left as an investment, but was also trading it in and out of USD on Coinbase. Yeah, I know, wtf right? I was dumb at the time (probably still am if you read my title…) and didn’t really study that deeply about BTC to know what exchanges were at the time. I finally did some digging and found BTC-E and started to trade there. I didn’t gain much and actually lost some more BTC trading at the time and basically cashed out into fiat (aka USD) after the first big crash of 2014 from Silkroad and Mt. Gox incidents. I ending up leaving the blockchain world for a few years and did not come back till really late 2016 and early 2017, when I was trying to grow my personal portfolio and saw growing interest again in the crypto space

Fast forward to July 2017 (my bloodiest hellish month EVER!!). In the past couple of months I have been learning a lot about blockchain technology and all the crazy development happening around it. I spent countless hours and late nights just absorbing all the news, technical analysis, and projects that were booming up. I thoroughly enjoyed learning it all and was very excited for the crypto space. I truly believe in the future of this technology and the cryptocurrency space. Decentralization is a huge thing and this technology has so much potential, possibility and for sure the ability to better the lives of many, many people throughout the world.

Now, I would like to share with you my experiences in trading over the course of this year and how I lost $100,000 in just one week of the recent crypto bear market. It is definitely very painful and has caused me a long week of heart and brain aching f**ckery. But I have managed to find myself again and remain mentally sane enough to write this and share with you all some tips and mishaps I went through and that hopefully you will never have to go through or experience.

The hardest part is that I knew the bear market would be coming from the news, charting, technical analysis and other learnings that I’ve gained up until now.

I know, right? How dumb and much of an idiot can I be that while knowing we are in a bear market and expecting it, I still lost this much money!! I am so angry at myself, but finding the strength to move past it. I thought I was prepared, but sadly sometimes the bears get the best of us...

Up until this point I got into Ethereum and have been accumulating ETH since $9, $23, $49, and $112. And of course some of the BTC from the fiat that I had previously. My portfolio is about 90% ETH and 10% BTC at this point though and I moved all my coins from Coinbase and BTC-e into Poloniex (It was a dumb move and I’ll explain why later).

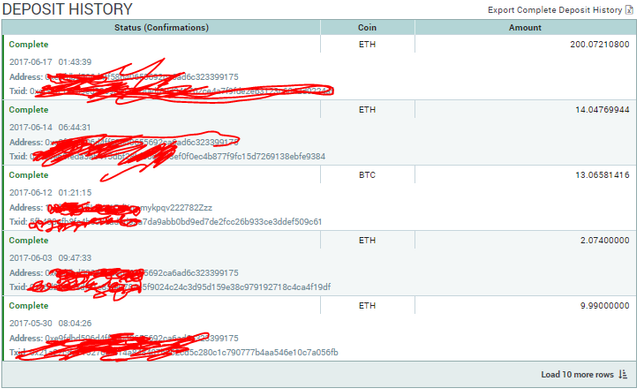

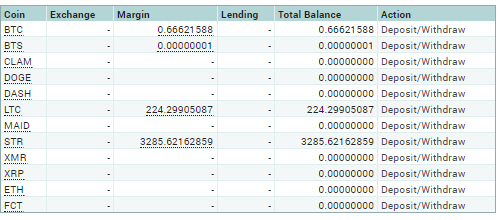

I can’t expand all my history and fit it here but here is a portion of what I was holding.

Ok… now let’s get into it…. -_-

I’ll discuss a few of these topics in minor detail and provide some examples in hopes to help you all from repeating the same mistakes that I did.

Diversify Your PortfolioMargin TradingSwing Trading/Normal Exchange TradingHODLing (Holding On for Dear Life)Technical Analysis / News

Disclaimer - This is not trading advice and I am not a financial agent of any sort, I am simply recollecting my experiences with you all to help you avoid mistakes that I’ve made and show you lessons that I’ve learned. You should always only invest or put into the crypto space what you’re willing to lose.

Diversifying your Portfolio

Regardless if you are a long term investor or a day trader, it is a very good idea to have your portfolio be more than just one type of coin, in the instances that one goes south and you panic sell or if you are in need to quickly liquidate your coins you can have some hedge/collateral.

If you want a well balance account as a day trader you should definitely have these type of holdings by splitting your total account up. It will make more sense after you read the rest of this article and put the pieces together.

- Long Term (HODL coins) – Don’t touch these under any circumstances, accumulate as much as possible until you’re ready to cash out for good. (6 months+, years or the future moon you want to see and believe )

- Short Term Coins – A separate balance of coins from your long coins, it could be the same coins, but a separate balance for trading only (this can be weeks or months, see below for short term trading tips)

- Margin balance– I don’t recommend, but see below for more detail. This balance and portion of your portfolio should be separate of #1 and #2 as well and only as much as you’re willing to lose.

Margin Trading

Don’t ever margin trade. You could lose it all and more, like I did. If you must, please stick with these rules and not get too greedy.

- Don’t margin trade :). I was 6-6 in my first bets on longing ETH (easy when the marketing was booming) and got really attached but it will definitely catch up to you.

- Have a separate balance that you’re willing to lose for Margin ONLY. Don’t Margin trade with your whole portfolio of coins.

- Always set a stop-limit on your margins.

- Cut your losses early, if you see it swinging the other way, take your loss early.

- Don’t over marginalize your account to the point where you’re not starting with atleast 100% of margin maintenance/collateral value. This will give you room to wait if you decide to not follow rule #4 otherwise if you’re threshold is too low, your margin will be called.

- A little contradictory to above but have patience to let your margin go the correct anticipated way if you truly feel that you have made the right call. Many times I’ve caught myself taking a loss too early because the ratio’s suddenly had a small pump or dump the other way. It’s not a matter of minutes, but hours and sometimes even days. If you follow #5 you may be able to wait it out, but not if you over marginalize.

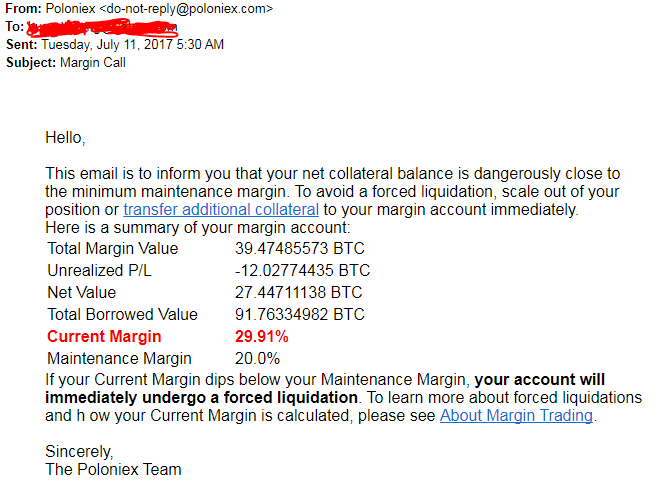

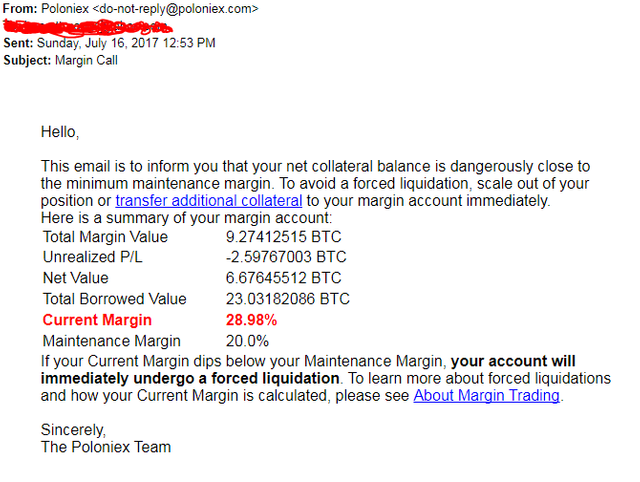

Below are a few (of many) examples of my terrible margin trades that got called and you can definitely see my account diminishing between the two and till the very end I still did not learn and was gambling with what I had left. I was basically not following rule #4,#5, or #6, as a matter of fact, actually I just realized that I did not follow ANY of the rules at ALL :( . I did it ALL wrong, and I’m such a f**king idiot for that and clearly regretting it now.

I was so tilted from the bear market and my portfolio being down 30+% (because I didn’t have a good diversified one) that at this point I was just trying to chase it back and not realizing the hell hole of an oblivion that I was digging myself into, and thinking to myself, I SHOULD HAVE JUST SOLD NEAR THE TOP AND STAYED IN FIAT!!!!!!!!!

I did not really have separate balances and decided to transfer almost all of my exchange balance to my margin balance and risked it all.

My margins above got called from shorting the market. In short (get it?), what basically happened was I was so confident that the BTC/ETH ratio would fall to around 0.8-.077 (which it eventually ended up doing too bloody f**king late), but there were momentary pumps that went the other way and I kept thinking it would go down, but didn’t have enough buffer by over marginalizing, not taking my losses early, and many efforts buying and selling my margin the other way and making it worse, flip flopping back and forth, so I got owned. I got PWNED very hard.

After multiple attempts and failing you think I would have learned, but NOPE! I also did some stupid long/shorts on Dash and LTC and got them wrong too, although I will say that it did end up hitting the ratios I had initially thought they would. My margins did not get called, but I took some hits on them as well and again the trade history is too much to post here, but I think it total they were around another 7-8BTC. So again, how much of an idiot am I? I was clearly on tilt and saw no end to it.

So please take into account the guidelines I mentioned above for Margin Trading.

Now, onto the next topic that is more okay to do..

Day Trading/Swing Trading/Exchange Trading

When you’re swing trading and making normal short term trades, it is easy to lose money and lose sight of what you’re doing if you do not have a concrete trading plan. These are some of the things that I’ve learned that can help you become a better trader.

- Have a separate balance from your Long Term HODLings to use for trading.

- Study the charts and news of coin before getting into it.

- Have clear targets of your price point ranges of when to enter and when to exit/take profit or cut your losses.

- Set your bids and stop-loss for those targets.

- Don’t chase every coin, start with as many coin as you can manage in the beginning. I personally don’t do more than 5 at a time.

- Don’t chase only the big double ups, take your W’s 10-20% at a time.

- Keep track of your gains by percentages % and not $ dollar value.

- Take your profits and be okay with what you set out to earn for the day.

- Don’t chase pump and dump coins.

- Don’t trade on tilt or emotions.

Again, I would love to share my list of trades, but it would be too much to post on here. So I will just quickly talk about what I did (I did find one to post though).

On top of losing a shit ton on Margin, I was basically hedging myself into LTC and Dash during the bear market. It was holding up quite strong in the beginning of the bear market, but it eventually bled as well. I panicked and went in and out of trades and saw my portfolio bleed some more and continued to Margin trade ‘til the very end (as seen in above pic), chasing and rushing to get back to where I was. I also panicked at the end and made poor decisions to not HODL which I will discuss a little more detail in its own section.

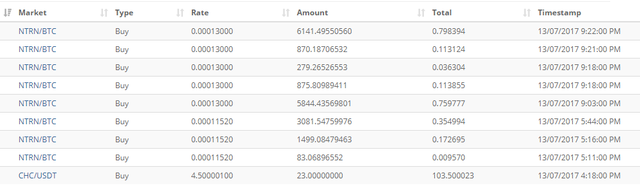

Here’s an example of what NOT TO DO.

This was one of my last ditch trading efforts being on tilt and trying to do god knows what I was doing. I was going to buy some chain coin back when it was 30 cents and it pumped like crazy, and I missed it. Amongst my tilt and dumbassness I bought Neutron (I’m obviously not as smart as JIMMY NEUTRON) which was rumoring to be the next pump. Bought it around 28 cents and I think it pumped to like 40, but I had no set plan, no stop-loss, hoping it rides to the moon, and now it's basically worth 0. Another 2 BTC down the drain. I know! I’m an idiot, let me just rot away……. I will hold it now and hopefully 30 years from now they will be worth something, although I think there is a higher chance that this currency just dies out before something every happening. Don’t chase pump and dumps!

HODLing

My advice for this topic is quite simple.

Before you even look at the charts and possibly see a panic occurring worse than you thought, decide whether you will HOLD onto your coins until the dump is done and you see green again, or sell right away at that moment because I can promise you if you don’t, you will make the same mistake that I did, which is basically giving in near the very end and selling at the bottom, then all hell just breaks loose from there like some of the examples above.

It’s also usually best to not sell during/in the middle of a giant red candle. A lot of the times these are some quick dumps and market manipulations. If you sell, it will be hard to catch back up and you will basically sell at the bottom and buy at the top. Needless to say, it’s the opposite you should do.

In any case, if you do decide to HODL, please just get away from the computer, mobile device, and stop refreshing your exchange every minute. This will help keep your sanity, prevent you from losing sleep, and prevent the risk of an in the moment emotional bad trade.

You tend to forget all your fundamentals in the heat of the moment. Just like anything else in life, when you get angry or emotional, you’re just not thinking the same way as if you were clear conscious. Believe me….I would know…...

Technical Analysis / News

Technical Analysis and News are definitely two of the most controversial points in trading cryptocurrency. You will get quite different reactions from both sides that believe in only one or the other. The TA people will say, “I only trade chart patterns, I don’t look for or care about the news.” Then you have the News people who will say, “If TA people are so great, they would never lose money and make money on every trade.”

I think it is great to have a good balance of both. Technical analysis skills are definitely very helpful and they can teach you how to read charts, analyze them with tools, and provide you a trading plan. I truly believe it gives you an edge if you master these skills.

News is also important. It is important to keep up to date with the development of the coins you are investing/trading in. You will hear the term a lot “Buy the news and sell the event”, but just like TA, it’s not always all true.

This is where it is good to have TA skills in your back pocket because combining it together with news can you help clear out all the FUD (fear, uncertainty, doubt) and noise that would prevent you from making the best possible trading/investing decisions.

I definitely believe that it does more good than harm to take the time and have a good combination of both types of knowledge. And hey, more knowledge is never a bad thing. There’s a reason why “knowledge” has “edge” because more information gives you the edge and a step up.

Below are a couple of sources that I get my information from aside from your coindesk, cointelegraph, bitcoin magazine, and reddit, so many news sites… I’ll split them up between Technical Analysis focus and News focus.

These are in no particular order of best to worst ranking. I could do a review of them if you guys are interested in another post, let me know but I’ll leave some quick comments.

Fact: I’ve watched more than 15+ videos from each of these individual channels.

Technical Analysis & Charting

- High Altitude Investing – Dalin Anderson (I’d recommend his VIP course, this guy is GOLD) I actually learned about shorting ETH at 360 from him…but of course I didn’t listen

- Ryan Le – Crypto grinder ( This guy is very real and pretty good)

- Brandon Kelly Crypto Trader - (Very good simple basic charting, good heart #1 bitcoin group in the world!! founder)

- Node Investor - (great TA good reviews)

- Scrembo Paul - (great TA good reviews)

Keep in mind that many traders have different types of Technical Analysis and tools / charting patterns that they like to use. It is good to watch multiple sources and understand how they bring it together and piece it together yourself.

News and Tech information

- Crypt0 – Omar Bam (Very genuine and in the market)

- Boxing Mining - (very genuine and informative)

- Ivan on Tech - (great understanding from programmer POV)

- Crypto Tips – Heidi Ann (Need to give the females some love in this space! Good info and reviews of projects)

- Ameer Rosic - (Genius, outside of the box thinker)

- Crypto Currency Market – Tai Zen (Gets ahead of the game)

- CryptoBud - (Also provides some TA, good mixture)

- Suppoman Udemy - (Careful, use to be good, but seems like pump and dumper lately)

It is also a good idea to check the news from multiple sources, if it is mentioned multiple times across the channels then it is likely to be important. These people are deep in the game so I’m sure they have some credit to their sources. But in the end, make sure you absorb all the information yourself and piece it all together to make the best judgement for your trading plan.

So at the end of it all, this is basically all that is left of my holdings now. So far gone. But I will not give up and will follow up my trading tips above and hope to make the big comeback one day and a few percentages at time, and be able to tell you all that I did it.

I know that this picture probably doesn’t add up to the $100,000 that I lost, I can’t show all my trades, but I have no reason to lie. I am not out for anything but simply trying to help others that may be in a similar boat or for people to be able to not make these mistakes that I did at all.

It took a long recovery period for me to able to admit to myself that this happened. Reflecting on the fact that I even let it happen still angers me, but I have to find a way to move on. I am lucky to have a very supportive family and girlfriend who is helping me cope through all this, but I still cannot help but feel guilty about the money I lost that would have gone towards our future together.

I don’t care who you are, $100,000 is a lot of money, and I am in no way by any means rich. That was a HUGE HUGE part of my total net worth. I could have definitely used that money to improve on a better living drastically for myself and my family.

Hopefully you all can take away some valuable tips from my growing pains. I know you may be thinking this is quite a contradiction, why listen about trading advice from a guy who lost $100,000? But to my only defense in this story, I did make it in the first place before losing it all.

I’ve found that writing this out and trying to help others has been therapeutic for me to cope with my losses and give me the strength and courage to climb this next hurdle.

If you like what you have read and if this has been helpful to you, please follow me and upvote me so I know and can be inspired to continue sharing more details of my experiences to any specific event and any additional questions you may have for me.

Thank you for taking your time to read my story,

Steemkarma4U

If I have helped you in anyway and you would like to donate to me. I thank you ever so dearly. Every bit is appreciated and it definitely adds up for me.

These are my addresses that you can send BTC, ETH, and LTC to.

BTC: 1LVbBZ9w5LaXe1DdKtmmykpqv222782Zzz

ETH: 0xe9fdbd506d4ff58640655692ca6ad6c323399175

LTC: LSzfMMXiCuzx2ak9sw32sjgrSdMsXaBNAs

This post received a 2.6% upvote from @randowhale thanks to @yunkzilla! For more information, click here!

Thank you!

Good God ! That was a great read!! Thanks for sharing that!!.

There are a lot of people in your same shoes. You have gained 100,000 dollars of genuine experience. You gotta think, at least you aren't one of the people who had bunch crypto, and lost there wallet/password.

It could always be worse.......

Thanks @Flatrider ! awesome stuff you got.

Please, buddy, take your own advice (If the last screen shot is your true holdings.) GET YOUR REMAINING COINS OUT OF THE MARGIN EXCHANGE... It's your second main point: don't ever margin trade.

That being said, I am new to cryptocurrencies, a couple on months now, so I may be reading your post with a different lens. I started buying coins with hard-earned, hard-taxed paper money.

I appreciate you sharing your story and will follow you to hear more.

Remember, regret is an idle emotion, just wasted energy... Those coins are gone, like ex-girlfriends, or Goose in Top Gun, 'you gotta let 'em go.'

Thanks vapor, it is and I assure you I did. I realized that as well, but the good thing was I didn't even think to margin trade with what I have left..

I appreciate your support, let me know if you have any questions and I'll provide updates.

I appreciate it!

You cant lose if you dont sell. Harsh times. Welcome.

Short and good answer!

Very true, tried to catch some swings too late and bad margins. Thanks!

You have new follower!

Thanks I followed you back! Are you from Japan? I've recently just went there.

I'm from Japan mate! Hit me up the next time you're in the country 🍻

Thank You for sharing this ! Extremely informative I will definitely take note of this

Thanks Orlena! I'm glad that it was able to help you.

Oh, you could have reversed your position. If you were long you could have sold some to save your margin from being liquidated. I learned this the hard way also. I have done the same mistake, but this time was able to save myself from liquidation. You don't need more collateral, you just have to adjust your position on your margin. Yeah it's going to set you to some unreachable amount, but at least you still have a chance to gain back close enough to where you don't liqudate.

I feel for you tremendously man, I support you, because we're no Eskimo brothers in this blood bath. #yunk

Thanks @yunkzilla , I actually did that a few times and was going back and forth and just seemed impossible to catch up. And because I couldn't catch up with too little margin to spare I had to close or get called.

But thank you for your kind words and eskibro love. #yunkyunkyunk.

I had a similar problem. Now that i have been around a minute and lost some. I have stopped following all the guys you mentioned. Do not follow anyone who doesn't show you their portfolio profits and earning. They make most of their money from youtube. Once they get a huge fan base they can begin to take advantage of having an army of followers that will buy what they say to buy and sell what the say to sell. Good luck in the future my friend.

Welcome to the Community, Steemkarma4u!! Wish you much luck! Cheers! Follow me at @khunpoom

Hey Thanks! Cheers.