A Brief Rundown of the Senate Committee Hearing on Cryptocurrency

There's a lot of confusion about what came out of the Senate Banking, Housing and Urban Affairs Committee hearing this morning. Some have reported the statements to be completely positive towards cryptocurrency, while others have been sounding the doomsday bell over perceived aims to destroy the market. As one would assume, the answer isn't so black and white – let's take a look at what actually happened.

The Lead-up to the Hearing

For those that aren't involved in the cryptocurrency trading space, the governmental rules pertaining to the market are sporadic, schizophrenic and mercurial. In the United States, cryptocurrencies are regulated mostly by a randomized set of rules, each of which applies only in select states. It's an untenable system that is begging for some sort of standardization. It's important for the entire blockchain space to come forward and work with the government towards a less onerous regulation environment.

Otherwise, we are likely to see rules that continue to make very little sense – without any blockchain support on the pro-regulation side, we'll have laws put in place by people who don't understand the technology. Blockchain is not going to go away, but each market that it is restricted from starves the entirety of the ecosystem.

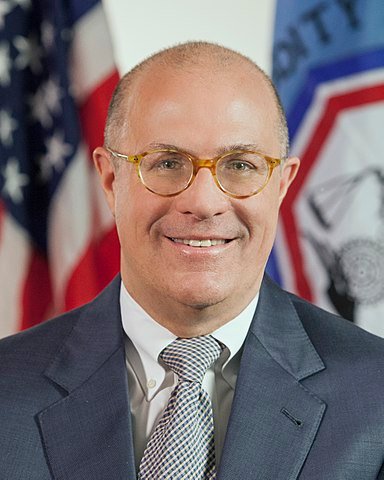

The exponential increase in Initial Coin Offerings over the past year, coupled with several high profile scams, have brought us to a place where the SEC feels the need to get involved. The two major speakers were Commodity Futures Trading Commission (CFTC) chariman J. Christopher Giancarlo and Securities and Exchange Commission chairman Jay Clayton

The Security and Exchange Commission's Position

The dichotomy between the two speakers was readily apparent. Jay Clayton served as the public stand-in for the hearing, showing a great amount of skepticism towards cryptocurrency and the blockchain markets. He made it very clear that his belief was a dire need for additional regulation governing cryptocurrencies, and ICOs in particular.

He did admit that the cryptocurrency market, to quote, “...can provide investors with new opportunities to offer support and capital to novel concepts and ideas.” Proving that he is not entirely against the fundamental idea of cryptocurrencies. He did however add that he believes all ICOs should be considered securities – a type of financial asset with no physical value. These usually cover items such as bonds and stocks, which makes Mr. Clayton's statement factually correct. Further, oversight in relation to ICOs in particular should be welcomed – they are one of the major foundations of the cryptocurrency space, and are currently suffering from trust issues.

Jay Clayton, and by proxy the SEC, hold the position that investors need additional protections. It's hard to argue against this stance, looking at the market as is. At the same time, he didn't seem particularly well read in the topic at hand, so a neutral-to-good position is probably the best we could have hoped for.

The Commodity Futures Trading Commission's Position

J. Christopher Giancarlo had a contrasting viewpoint. He showed a great willingness to both adopt cryptocurrency as a legitimate industry, and to hold back from any damaging regulations that could cripple the nascent market. He referenced the US Government's original stance on the Internet, avoiding undue regulation. As a result of that policy, the Internet as we know it was born. He even made mention that the blockchain system and transaction transparency inherent in the system could have helped prevent the 2008 financial meltdown.

Also in contrast to the other speaker was Giancarlo's direct experiences with cryptocurrency. His niece has owned Bitcoin for sometime, and the CFTC have involved themselves at all levels of the blockchain infrastructure through aggressive research laboratory projects. He spoke from a position of knowledge, and pointed out the obvious; The government may be able to drive cryptocurrency underground, but they can't destroy it.

So Where Do We Stand?

Ultimately, we should hope that J. Christopher Giancarlo's statements have more of an effect on the market going forward. His positive stance and strong support of cryptocurrency are an unexpected breath of fresh air in a government that rarely seems to understand emerging technologies. Where Clayton's neutral approach seemed almost indifferent, Giancarlo seems ready to fight for the future of blockchain technology.

If you found this information useful - or if you just enjoyed my style, consider following me! I regularly post primers that describe, in plain English, the technology and use cases of prominent cryptocurrencies.

good article friend If you follow me, I'll be happy.Thanks :)