Common Bitcoin Metcalfe Models, Explained

People love to trash CNBC for just about everything, but at the end of the day, they have power and what goes on the air will gain in popularity.

It was in November of last year that Tom Lee, cofounder of FundStrat (an institutional equity research firm) went on the air and proclaimed the following:

"If you build a very simple model valuing bitcoin as the square function number of users times the average transaction value, 94% of the bitcoin movement over the past four years is explained by that equation."

And with this, Metcalfe's Law went from obscure to famous, almost overnight, in terms of being used as an initial method for valuating the price of one Bitcoin.

Lee's CNBC quote states two common variables being used, namely:

- Number of users and

- Average transaction value

Translated, this is:

- Unique addresses

- $ volume per address (to get this number, you simply divide estimated USD transaction value for the network into the number of wallets)

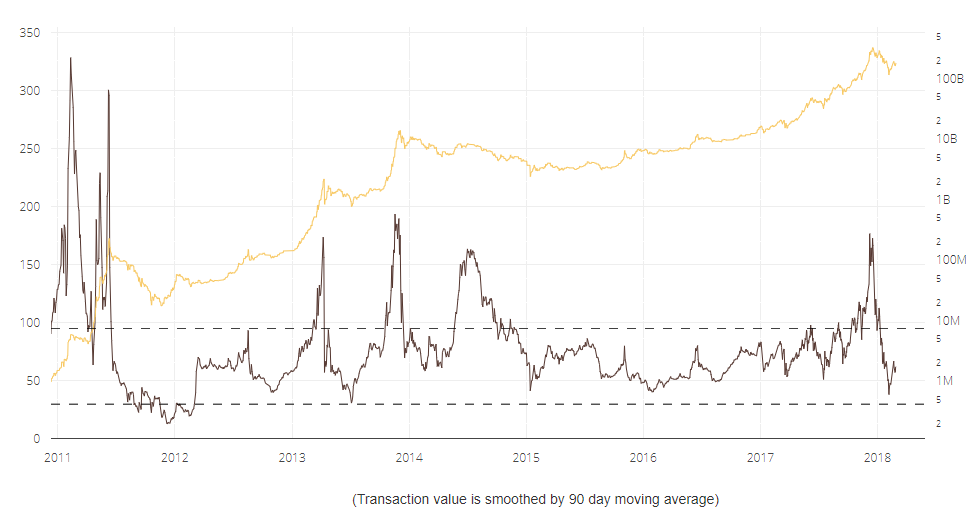

The result is a model which demonstrates a relatively high R square (0.932 at the time of the last publishing). You can then do as you please when it comes to plotting regression lines or anything else in terms of deciphering what future values will hold, based on the past. Here is the last snapshot I have of the model:

So what is this model doing, at the end of the day? It is measuring activity / buzz / movement in the overall ecosystem.

But the numbers can, in a way, be deceiving. Here, you are essentially removing a number of other variables that could be crucial to determining true value, and in essence, inflating the value of the network itself.

Regardless, if the correlation is high, you can evaluate any other derivative components in order to identify appropriate buy and sell triggers, so I am very, very far from claiming it is useless. The results truly were an eye opener, leading to create my own strategies centric on a network-driven approach.

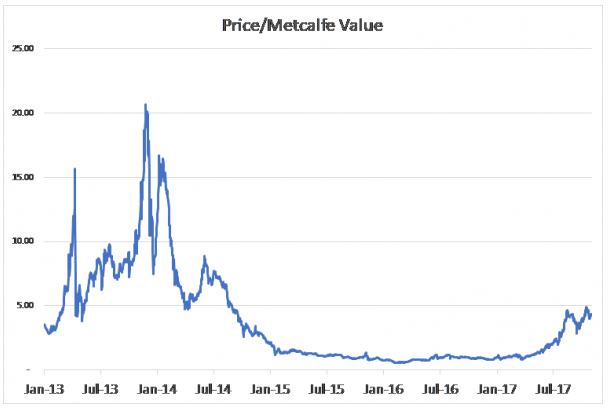

But you can see how the dynamic shifts so much, starting in 2014. This is what any model using these base values will do, including the now infamous NVT ratio. Over time, "pressure points" of values will need to be adjusted. You cannot rely on static numbers for "overbought" (sell) or "oversold" (buy) signals. You will end up selling too early or buying too late.

Why?

Liquidity.

Saturated markets create price friction. And while the prices themselves are a reflection of the network value, they move differently based on resting order flow. This is why less liquid markets (think penny stocks) are so volatile compared to blue chips. Less resting order flow, less friction, and markets and move much more easily.

Liquidity changes in markets themselves, all the time. Trading ranges consist of high liquidity. Extensions do not. This is why tops and bottoms are generally much more volatile than areas where prices get "stuck"

This needs to be normalized in order to compensate for over/underinflated values. This is typical any market.

By using USD transaction volume, you are in essence dragging in the exchange rate of bitcoin. By extension, you are also dragging in market liquidity as a function of what follows.

But assumptions can go awry, and as demonstrated in the last market dip, both models would have had you buying in very early, experiencing unwanted drawdown in the process.

But this normal. I think it is important to mark out the weaknesses in any strategy because without it, we can't move forward. So long as the model demonstrates an ability to track prices over extended periods of time, which they do, interpretive adjustments can be made to better utilize them.

Fundstrat appears to initially realize this, but still appears to be using static numbers. In the case of the NVT ratio, normalization should be sought after as well (currently uses a 90 day moving average).

While attempting to track the value back to USD, we are forgetting what creates that number in the first place. But once the structure is in place, moving forward is a relatively simple process.

Finally, here is another attempt, this time by Stephen Pawaga, diving price/metcalfe value - note the same characteristics from the early days of low liquidity:

Its in the variables. There is so much to these networks, and it has been frankly astonishing how well these base values have held up over time, in relation to price.

Onward and upward.

Please upvote if you have found this useful. Thank you!

Very nice! If you keep this stuff up, I think you'll do well here. It takes a while to get noticed and a lot of excellent content can seem "wasted" while you wait, but without great content no one will ever really take note of you, so I like to consider early posts with little payout as an investment in the future.

It can be tough at first, but keep it up and see what happens! Glad I came across this, I'll see what else you've been up to!

ok I'm no trader or economist, so my comments reflect how much i may have understood your post.

That equation for valuing bitcoin seems almost superficial. it's seems more like an explanation for what modifies the underlying value of bitcoin, not creates that value. It's more like mapping transactions and use of bitcoin.

I always figured the actual value of BTC, if there's any at all, is based on the cost of energy required to mine it. As an underlying value, this reflects more on what I think value is: the cost of labor. I'm classically a marxist on this. If value is from labor, what labor is there for BTC? Instead of the cost of a worker straining their biological muscles by work to create a commodity, the 'energy' on BTC would be the energy used by computer power to mine the coin.

This theory, if true, would mean that if energy were completely free, or near free, that absence of cost to mining BTC would drastically reduce the value of BTC. If it's price were high, that would only reflect speculation modifying an otherwise cheap underlying value.

What are you thoughts on this? Does BTC's value come from the cost of energy required to mine it?

So there are 3 primary models that have been used to value a bitcoin:

The first and the last have been the best way to go. Energy aside, if people are supporting the network via transactions and security (mining), we can tie a value back to it. In a social network, if nobody is online, the network has no value, as the people are the commodity. Much is true here, where the coin is the commodity, as a general premise. # 3 suffers from the opposite of what #2 does, but still comes closer than #2. We lose sight here from a macro not a micro perspective. Chris Burniske is the source of #3.

3-0.01