Institutions Not Rushing Into Cryptocurrency

In spite of years of hearing about it, institutions are slow to enter the cryptocurrency market.

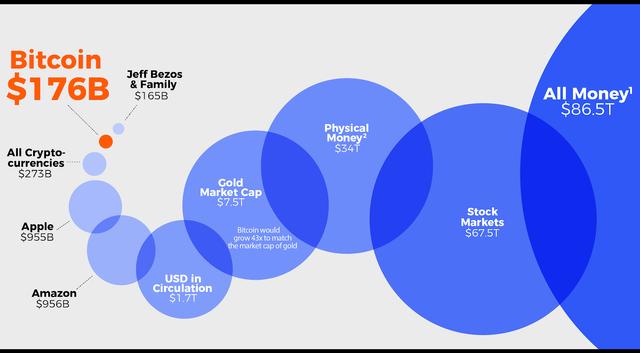

We are still sitting far below the all time high in total market cap at roughly $250 billion. The high is still about 3 times where we are now.

For this to be a viable market to major buyers, there needs to be a lot more growth as compared to today. This requires a large scale expansion.

The truth is that cryptocurrency is still a bit player in terms of traditional finance. The top money managers control a multitude more than the entire market cap of cryptocurrency.

Many are disappointed by the fact that institutions have not piled in. Actually, this is probably the best thing for the industry.

Bitcoin was created to be for average people, not for Wall Street banks. As more cryptocurrency is created along with utility for it, the industry will expand.

It is imperative for the money to spread out horizontally among hundreds of millions of people. If this can be accomplished, there is a chance that the network effect takes hold.

At the core is a technological revolution that can radically alter how society operates. Institutions are not venture capitalists. Money managers have different requirements.

While they value growth and profit, there are other factors that are equally as important. One is liquidity, something that many cryptocurrencies cannot provide.

Thus, in the medium term, it is unlikely that any institutional money finds its way into cryptocurrency. Instead, the industry is going to be dependent upon growing organically, reaching millions of people with its solutions.

If this can be accomplished, enormous amounts of wealth can be accumulated by everyday people, who then can fund even greater expansion.

Only then will the institutions take notice and bring their trillions to the table.

Will see after the halving )