56 % of Capital inflow provided by institutional investor.

The first-ever crypto investment report released July 18 by digital asset management fund Grayscale Investments reveals that the majority of capital inflow this year is coming from institutional investors.

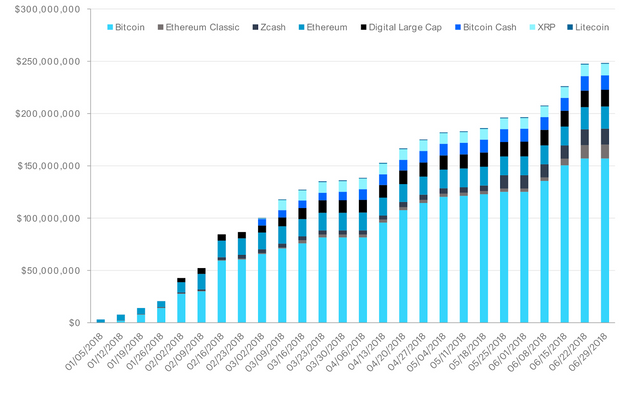

Grayscale has been overseeing investments into crypto for five years, launching a Bitcoin (BTC) Investment Trust back in September 2013 and then expanding to other single-asset funds — including Ethereum Classic (ETC), Zcash (ZEC) and Litecoin (LTC) — as well as diversified offerings, notably its Digital Large Cap Fund.

According to this week’s report, institutional capital accounted for 56 percent of all new investments into Grayscale products during the first half of 2018.

Despite the undeniably bearish picture for crypto markets during this time, Grayscale remarks that “counterintuitively,” the pace of investment has “accelerated to a level that we have not seen before.”

Total investment through June 30, 2018 was almost $248.4 million — the strongest ever fundraising period since 2013. $9.55 million in fresh capital has been incoming every week on average, with $6.04 million — 63 percent — going to the Bitcoin Investment Trust.

Coins mentioned in post: