Bitcoin Cash Price Analysis: Explosive Buying Pressure for BCH/USD Could be Around the Corner

Bitcoin Cash price is moving within consolidation mode but demonstrating inherent breakout characteristics.

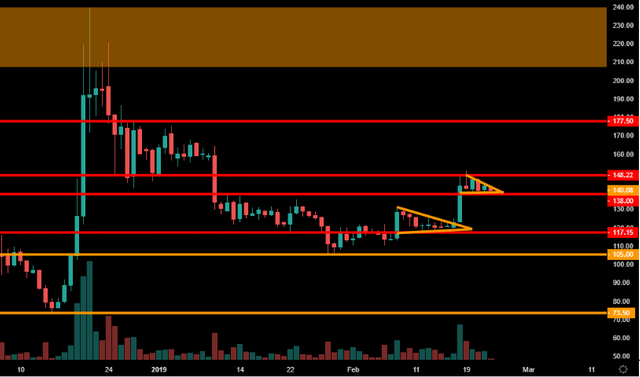

BCH/USD has formed a bullish pennant pattern, which is subject to the bulls capitalizing on for further moves to the north.

BCH/USD: Recent Price Behavior

The Bitcoin Cash price has been trading in consolidation mode for the last few sessions. This came after a chunky move to the upside. On 17th February buying pressure started to take root, with BCH/USD picking up the pace intensely during the next day. The price managed to jump a whopping 25% over three days. BCH was one of the clear outperformers during this period, leading the gains versus several of its peers.

BCH/USD had started its bull run back on 8th February, after being down around the $112 level. The price had shot up by around 16% in just one session, testing the 2019 high area produced in January at the time. However, there wasn’t enough bullish momentum to carry the price through to break that high area ($130 territory). Bitcoin Cash then entered a consolidation state of trading, which led the price to form a bullish pennant pattern. The explosive breakout from this came on 17th February.

The price has further consolidated between the 19th and today, 23rd February. Once again, the BCH/USD price behavior has formed another bullish pennant pattern. The structure appears very much set up for another breach to the north, should the bulls manage to capitalize on this again.

OKEx Lists Bitcoin Cash on its Customer-to-Customer Market

Malta-based cryptocurrency exchange OKEx recently announced it ad added support for bitcoin cash and XRP on its Customer to Customer (C2C) trading market, which facilitates fiat-to-cryptocurrency trading. Also, it provides users with the opportunity to buy and sell digital assets from one another using fiat currencies. It currently supports the following fiat currencies: British Pound (GBP), Chinese Renminbi (CNY), Vietnamese Dong (VND), Russian Ruble (RUB) and Thai Baht (THB).

XRP and BCH are joining four other cryptocurrencies on the C2C: bitcoin (BTC), Ethereum (ETH), Tether (USDT) and Litecoin (LTC). They are also paired with the five fiat currencies detailed above. The C2C trading platform facilitates a convenient and accessible way for its users to trade cryptocurrencies using common fiat currencies.

Technical Review – BCH/USD

BCH/USD daily chart.

Support for BCH/USD is currently noted in the $139-$138 range, where the lower acting trend line of the pennant is tracking. A failure of this holding would rule out the bullish technical set up, and BCH/USD could then be forced to give up the gains from 17-19th February. The price would then return down to the consolidation levels before the most recent bull run.

To the upside, resistance is observed just above at the upper trend line of the pennant, $142. A breakout here would likely invite another wave of buying pressure. The target for the bulls could be the high area of 2019, up around $180 territory. Further to the north, the $210-$250 price range is another target area, BCH/USD last traded here between 20-24th December 2018.

Happy Trading!