Flash crash on cryptocurrency market, ie how to make $380 million

Flash crash on cryptocurrency market, ie how to make $ 380 million

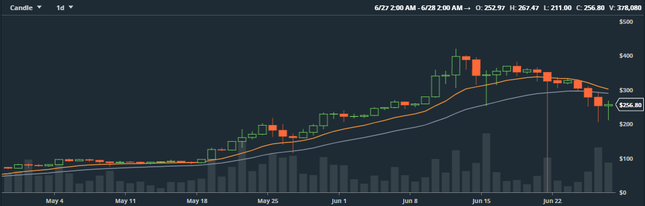

Ethereum, the second most popular cryptocurrency after Bitcoin, ranked last week the so-called „Flash Crash”. Within a dozen or so seconds ETH rate dipped from $ 317 to $ 10. Many point out that the whole situation was planned and someone made a good start on it.

Everything was happening last Wednesday at one of the GDAX cryptocurrency exchange. There was a lot of ethereum sales in one order that could be referred to as AAP (at any price)." The cryptowalist course, which was worth $ 319, was dived to 10 cents in a dozen or so seconds, sweeping all purchase orders along the way. It was because a lot of participants in the stock market used the leverage, and with such a sharp decline, margin calls were activated, closing positions automatically.

The first sales order lowered the ethereum course from $ 317 to $ 224, but subsequent orders closing the leveraged positions pushed the course down even further, activating another closing position and shoving the cryptocurrency course almost to the bottom. Even after the $ 100 event leveraged for the entire event, after a sudden drop of less than $ 50, they automatically had to close. All the supply was absorbed only at the level of 10 cents, where orders were already waiting.

There is reasonable suspicion that this could be manipulation

Today, the cryptanalyst market is not controlled in any way. In fact, the idea of cryptocurrency itself is reduced to the lack of control. Once a transaction on a wallet can not be undone, because such are the assumptions of cryptanalyst operation. The only rules that apply on the market are the rules of individual exchanges. It resembles a "free American" American stock exchange in the nineteenth century, where price manipulation and various types of 'corner' or co-operative were standard.

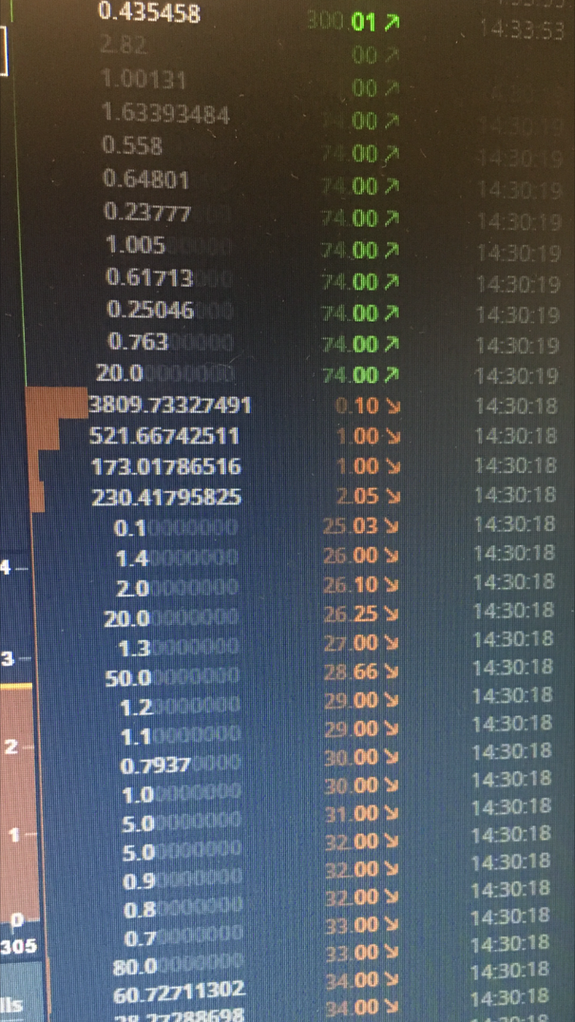

Suspicious are also big orders and setting up with buying at the levels of one dollar and ten cents. These price levels do not appear to be random. According to a sheet of transactions made at that time, the last as usual offers were waiting for $ 25. Subsequent offers, which have been exhibited at the aforementioned levels and in large concentrations, appear to have been set intentionally and much earlier, "argues the foundation's representative.

How much capital was needed

The cryptanalysis course immediately rebounded and fell back to the value close to the pre-collapse. From the list of transactions, it is clear that at 10 cents, someone bought more than 3809 units of Ethereum, while at the rate of 1 dollar bought over 694 units. Another 230 units were bought at $ 2.05. All in all, they had to spend just over $ 1,500 on these orders, and after a while their owners could already have an ethereum worth over $ 1.4 million. Although the ethereum course has not had the best run in the past 7 days and its value has dropped by nearly $ 100, it's still a lot of money.

Even as limited to the execution of a 10-cent order for which $ 380 was spent, the owner could have sold ETH at a price of more than $ 1.1 million. If someone made such a deal, it could not be excluded that it was the most profitable transaction in the history of any market.

The media almost drowned last week's events as the "multimillion dollar trade." Although it is difficult to accurately determine what capital would be needed to complete an operation.

In social media, there have been suspicions of manipulation or other illegal activities. However, GDAX has strongly denied this. "Our preliminary investigation did not show any breach of regulations or takeover of accounts. However, we understand that the whole event could be frustrating for our customers. (...) We are going to continue our investigation and inform customers of its results, "said Adam White, owner of Coinbase, which is owned by the stock exchange. White also added that the concluded deals are final and will not be withdrawn, but the stock market has decided to lend to investors who have suffered losses as a result of flash crash.

I like your steem name

thanks!

I'm sure someone made an absolute bucket load from this