Partying like it's 1999

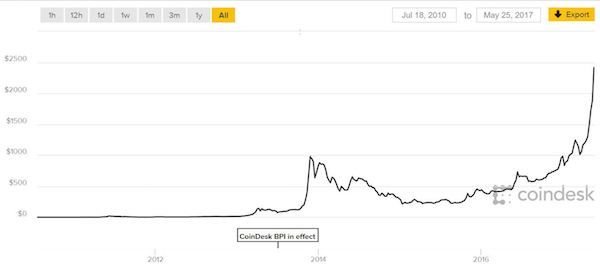

History does not repeat itself, but it does spiral and echo the past. History tells us that crypto will crash soon and crash hard.

Most people are only focused on the trading of cryptocurrencies and most people have no idea what the flux is going on. And while they are mesmerized by the market rollercoaster rides, there is something more seriously wrong on a foundational level.

Most of the trailblazers in the cryptospace are too young to remember partying like it's 1999, or were not even born yet. The party did not end well, and it took over a decade for startups to gain legitimacy again.

There is one particularly startup that's legendary for the wrong reasons: WebVan. They raised almost a billion dollars from the top VCs. They relied on strategic theories from consultants. They built a sprawling infrastructure before doing any customer testing or business development. They defined epic fail.

In the dotcom boom, companies can raise money on just a business plan. Engineers believed that if they build it, people will use it. Yet the dotcom bust did not wash away these cardinal startup sins.

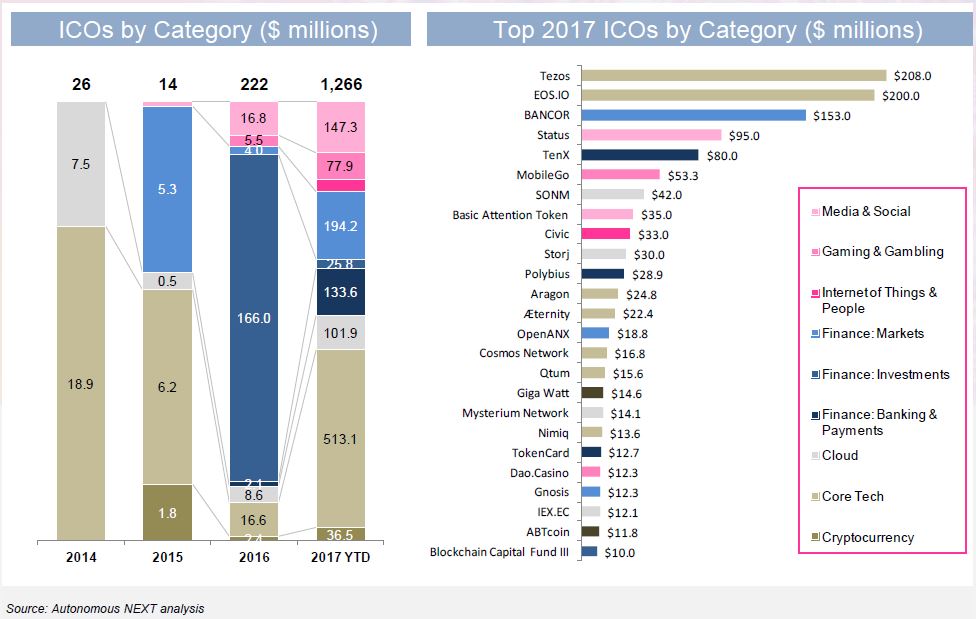

Today in cryptoland, investors are the ICO (cryptocurrency vehicle), and the business plan called a "whitepaper", which is arguably worse: engineers are not businesspeople and a technical paper is not a substitute for a business plan. Not to mention the quality of some of these "whitepapers" — would you raise millions of dollars with your undergrad thesis? Yep, didn't think so. Yet that's what we are seeing.

The worst part is the unsubstantiated confidence. The "crypto-jihadis" think blockchain will overthrow the present state of affairs and bring about a new world order. They do not know technocracy cannot thrive without capitalism. Corporates and consortiums think their power alone would spawn useful applications. They do not know how to execute, some don't even know what they are talking about. In a tornado, even pigs can fly.

Hence, this is why most ICOs are scams: scamming the public, scamming themselves, and maybe a hybrid of both! Everyone thinks these are Amazon and Google, but how do you know they are not Netscape, Yahoo, AOL, Lycos, Excite, or AltaVista?

So what can be done?

To all the dreamers and builders out there: plan for the post-apocalyptic crypto-world, not for 1999. Don't build until you have a customer development model and business model. Don't raise ridiculous amount of money on a pipe dream. Don't be greedy, be sustainable. Make the change you want to see in this world. Don't die.

Ideas are easy. Execution is hard. Continuous operation is what separates the winners from the losers.

To everyone else: don't bet the farm. Gamble responsibly.

Great read. Love this kind of brain food!

I don't necessarily think that the crypto crash is as guaranteed as you make it out to be, though. I like to think of it like a college degree in the United States: it's not at all a requirement, but definitely a nice to have. As time goes by, it'll become more popular, more of an asset, and face harder barriers to entry. It will divide people into haves and have not.

Eventually there will be talk of a "bubble"--maybe in 20 years?--but st that point there will be even more clearly defined "winners" and "losers." The thing is, which exchange that'll pop, and why, is completely unpredictable.

Likening investing in any ICO other than BTC to gambling is accurate, and you've got some awesome theory and analysis here. Great stuff!

Thank you for reading!

A word of caution about a college degree: firms are only now warming up to the idea that academic smarts != workplace smarts. However, if you ever want to consider overseas placements, a college degree is prerequisite to a work visa.