Why I believe established cryptocurrencies provide a strong safety net during fiat collapse

It's been a long known fact that gold enabled an extra form of freedom for people in the past and today. The reason for it is pretty simple: when you're holding gold in your hand, you're holding an asset that can be exchanged for every fiat currency in the world.

This means that with gold, you have the freedom to go anywhere in the world, trade it for fiat currency and buy whichever items you need.

However today we live in an exciting world, which is rapidly changing away from these fiat dominated exchanges into a new world where fiat currencies do not have such a strong grasp on people's lives and freedoms.

In this post, I will not address extra details about the different cryptocurrencies such as: inflation, total coin supplies and so on. What I will touch base upon is a simplistic version showing proof that today, cryptocurrencies give people a similar amount of freedom, though unlike gold, you don't need to carry the asset with you on your person at all times. This gives you liberty to travel from one area to another whilst not having to leave all your assets behind.

A second thing I will be addressing is how cryptocurrencies can provide a safety net for people if their local fiat currency reaches a point of mass inflation, as we see happening in Venezuela right now.

Why do cryptocurrencies provide us with freedom of travel?

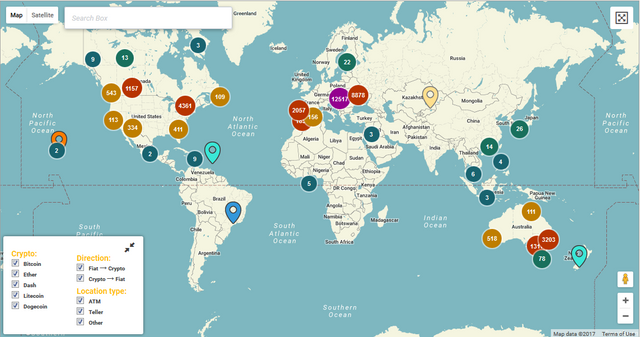

https://coinatmradar.com/ provides a map, showing where you can buy/sell/use your cryptocurrencies. This means you can travel to these areas, sell off your Bitcoin (BTC), Ethereum (ETH), Dash (DSH), Litecoin (LTC) and Dogecoin (DOGE) into the local fiat currency and be on your way. No need to request foreign fiat currencies from your local bank, waiting for that bank to acquire it and ship it to that local bank in order for you to get your hands on it. (Some banks do provide bank accounts in some foreign fiats as well, but the majority of people will not have these accounts readily available.)

This means, you can store your BTC, ETH, DSH, LTC, DOGE coins in your own wallet, use them to purchase a travel ticket and be on your way if you have the required paperwork in order to do so. This is quick, easy and convenient. No more carrying a stack of foreign fiat on you while traveling, no opportunity for thieves to steal it from you, …

There are still some problems with this system today, as in, exchanging your cryptocurrency into fiat has a conversion fee which as of today is very high, though as more and more countries will be looking into making cryptocurrencies a legal payment method, it is very likely that these fees will drop in the future to what they are in between fiat exchange fees that banks request.

Why do cryptocurrencies provide a safety net during a fiat collapse?

To aid in answering this question, a real life example will be used. The Venezuelan Bolivar is experiencing rapid inflation. Prices of every product are going through the roof and it is getting worse every week.

When researching the inflation numbers, there is a big difference between the official exchange rates and the black market exchange rates. This happens because the official exchange rate has been artificially kept way lower than the actual inflation rates that they are experiencing. Unfortunately, the local people are forced to use the black market exchange rates to purchase products since these follow the actual inflation of the local Bolivar.

For this example, only BTC, ETH, DSH and LTC were used, since as of today, these are the more established coins out there. (The map does show that DOGE can be used as well, but it only has 5 locations globally, all of which are in the United States of America. For this reason DOGE was not included.)

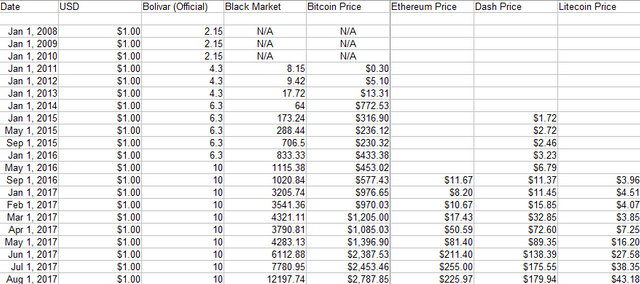

When we retrieve the information about the rapid inflation and the price points of BTC, ETH, DSH, LTC and insert it in a simple spreadsheet, we get the following information:

If you care to look these prices up for yourself, these are the links to the data:

- Venezuelan Bolivar: https://web.venezuelaecon.com/

- Bitcoin: https://99bitcoins.com/price-chart-history/

- Ethereum: https://www.tradingview.com/chart/?symbol=BITFINEX:ETHUSD

- Dash: https://www.worldcoinindex.com/coin/dash

- Litecoin: https://www.investing.com/currencies/ltc-usd-chart

The selected data spans over a time period from January 1st, 2008 until August 1st, 2017. Since the rapid inflation of the Bolivar only seemed to have started between 2010 and 2011, there is no data available before then for the black market value, which represents the value of the local fiat to the people who use it on a daily basis.

As a representation and to make it easier for everyone reading it, the spreadsheet represents the value of the Bolivar compared to $1.00 USD. On January 1st, 2011, $1.00 USD would have returned 8.15 Bolivar. However on August 1st, 2017, $1.00 USD would have returned 12,197.74 Bolivar, the Bolivar has lost its value by a factor closing in on 1,500. This is an incredible amount of inflation over just a 6.5 year time span. Just imagine buying a loaf of bread at a given local store for e.g. 1 Bolivar on January 1st, 2011, a similar loaf of bread in that same store by August 1st, 2017 would have cost close to 1500 Bolivar.

The spreadsheet also shows the values in USD of BTC, ETH, DSH and LTC respectively on those specific dates.

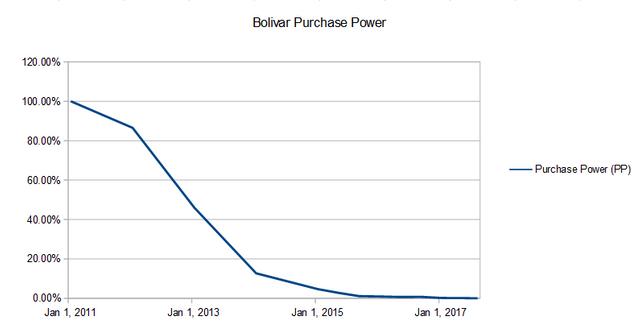

This spreadsheet shows that the purchase power of $1.00 USD on January 1st, 2011 only carries 0.067% of its purchasing power by August 1st, 2017 when converted to Venezuelan Bolivar (or when spend in Venezuela to buy local products). If all of your assets were stored in Venezuelan Bolivar, you'd have lost approximately 99.933% of your capital in 6.5 years time.

- What would the purchasing power of those people be if they had invested their fiat money into these established cryptocurrencies?

The answer to this question reveals an entirely different picture about established cryptocurrencies.

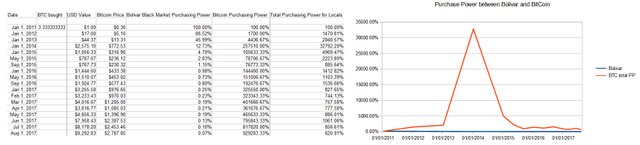

For the sake of this test, let's assume that the local people using the Venezuelan Bolivar had spend $1.00 USD on each cryptocurrency in its early stages and review what their purchasing power of that $1.00 USD would be on August 1st, 2017.

Bitcoin:

With $1.00 USD, on January 1st, 2011, a total of 3.33333333 BTC could have been purchased. The value of those BTC on August 1st, 2017 was approximately $9,292.83 USD, since BTC rose from $0.30 USD to $2,787.85 during that time span (and it is even more today).

Next to it, the rapid inflation of the Venezuelan Bolivar is shown over the same time span, the value of it had dropped 99.93% during that time span, reducing its purchasing power to buy goods.

The column to its right shows the value increase of BTC in % over the same time span, BTC has risen 929,283.33% in value.

The last column represents the purchasing power of the locals, who had invested $1.00 USD into BTC on January 1st, 2011, at a given date. This is calculated by multiplying the purchasing power of the Bolivar by the purchasing power of BTC (the local would have to sell their BTC to Bolivar in order to buy goods).

In Bitcoin, the purchasing power of the locals is 6.2 times greater on August 1st, 2017 as it was on January 1st, 2017. This means that Bitcoin grew 6.2 times faster than the Venezuelan Bolivar inflated during mass inflation. At no point in time would the locals have been any poorer than where they would have started.

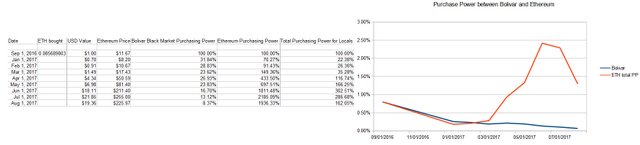

Ethereum: (Please note that on the graph on the right hand side, the %'s do not start at 100%, but instead they start at the % of purchasing power the Bolivar had at the approximate starting point of Ethereum, the same goes for Dash and Litecoin as well)

In Ethereum, a total of 0.08568980 ETH could be purchased for $1.00 USD on September 1st, 2016.

The purchasing power for the locals buying ETH would be 1.62 times greater on August 1st, 2017 as it was on September 1st, 2016. Please note that the locals would have lost extra purchasing power on top of the inflation in the early stages of their investment! Ethereum was not yet established during that time, but a nice recovery occurred once it did become established. It should also be noted that the local only regains their original purchase power when the graph representing the ETH purchasing power reached a higher level than its starting point.

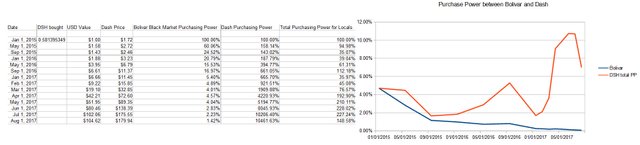

Dash:

In Dash, a total of 0.58139535 DSH could be bought for $1.00 USD on January 1st, 2015.

The purchasing power for the locals would be 1.48 times greater on August 1st, 2017 than it was on January 1st, 2015. Again it is clear that the purchasing power had significantly dropped due to the inflation of the Bolivar when Dash was still in its early stages until the coin got established. Though at no point in time was keeping Bolivar over Dash a beneficial option.

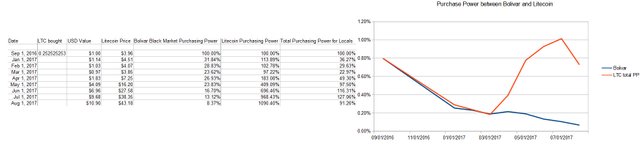

Litecoin:

In Litecoin, a total of 0.25252525 LTC could be bought for $1.00 USD on September 1st, 2016.

The purchasing power for the locals would be 8.68% LOWER on August 1st, 2017, than it was on September 1st, 2016. This means that over that period of time, the Venezuelan Bolivar inflated faster than Litecoin increased in value.

Does this mean that Litecoin was a bad investment? No it doesn't, the bad investment is using the Venezuelan Bolivar, which has lost 91.63% of its value. If the locals had not purchased Litecoin, their purchase power would have dropped by 91.63%, compared to only 8.68% if they had purchased Litecoin. That's still more than 10 times stronger!

It appears that even though the purchasing power in local fiat has decreased dramatically (a staggeringly 99.93% between January 1st, 2011 and August 1st, 2017), the purchasing power for the locals fared much better if they had invested into cryptocurrencies.

Also lets not forget that the cryptocurrencies could be spend in different countries as well! (Even though the number of countries today seem limited, these mechanisms are only in their infancy today and will more than likely continue to expand.) This means that in the case that the local area became too dangerous to live and those people had to seek asylum elsewhere, they would still have been able to spend their money in the country they requested asylum at.

Conclusion:

Established cryptocurrencies provide us with with lots of mobility. It is easy to relocate from one area to another. There is no need to have your funds transferred from one bank to another in case it does not have any offices where you are moving to. It is completely functional and on-the-go-ready.

In a case of rapid inflation of any fiat currency, the value of BTC, ETH, DSH, LTC is not immediately affected since they are also traded in different fiat currencies. This helps retain purchasing power to the affected people. Thus in the case your local fiat currency goes down, your cryptocurrency will just be worth more of your local fiat currency. Just like when the USD drops in value, you get more USD for your EUR investment and vice versa.

By no means am I claiming that cryptocurrencies are unable to drop and inflate at massive rates themselves. This was the case with the investment in ETH, which lost almost 30% of its value before it became established. Once these coins did become established, they did seem to be able to provide a strong safety net (in case the local fiat currency goes down) by providing the holder with the most important asset of all in a crisis situation: enough time to evacuate thanks to a stronger purchasing power.

Congratulations @thoughtsoncrypto! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP