Fundamental analysis framework of cryptocurrency: How to find THE hidden gems in this bear market

Hey fellow Steemians,

Sometimes we have to accept the facts of life: the recent bear market of cryptocurrency is a headache that's been haunting many of us. Nothing can be more frustrating than seeing the profits I used to make got evaporated like air. The winter of crypto is cold and ruthless, and sometimes made me feel heartbroken, like losing my favorite toy or breaking up with my beloved girl.

But is this the end of cryptocurrency? Although my emotion frustrates me, my rationality tells me quite the opposite: Blockchain and cryptocurrency are still at the early stage and have a long way to go. The reason why the market is dipping is simple as hell: any market runs by circles. There are times things are going up, and there are times things are going down, just like the seasonality of nature. Actually right now the bear market creates perfect opportunity of buying the truly great coins at a huge discount. Then the question becomes how to find the great coins and make the best return on your investment?

That question leads to today's topic: I'd like to share with you guys the framework I've been using to perform the fundamental analysis of cryptocurrency projects. This framework has help me invested coins that gave me more than 50x returns, such as Cardano, Power Ledger and so on. Hopefully that could help all of us to find the hidden gems in the current market. So let's cut to the chase straightforward.

Rule of thumb: Cryptocurrency is a high-risk and high-profit asset class, and things are going even more extreme if we target the coins with really low market cap, like below $100 million or even $50 million. But those are the exact coins that have the potential of 100x returns or even higher. The fundamental analysis will help us maximize the profit yet minimize the risk.

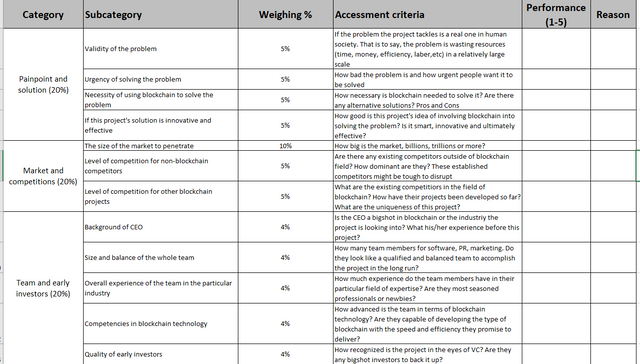

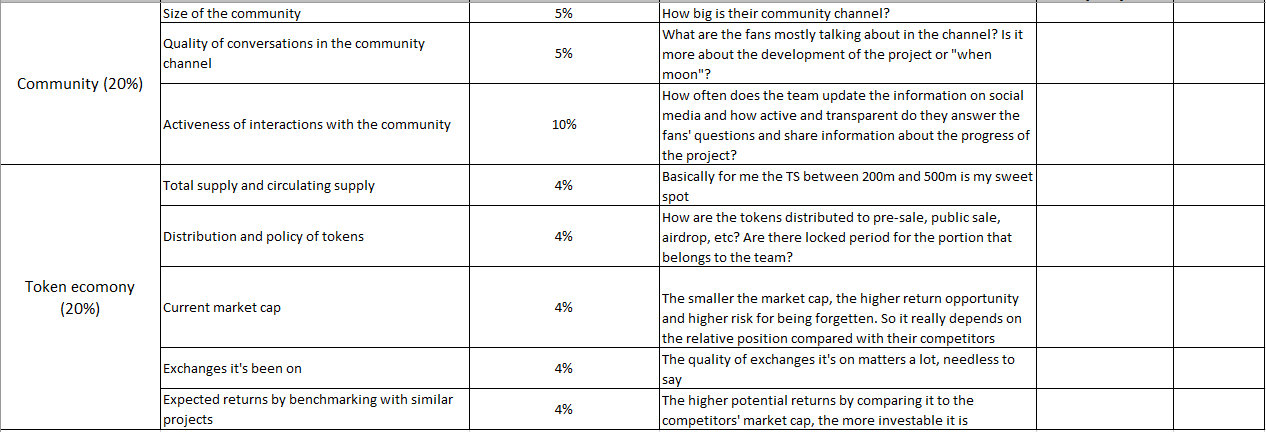

The table below is the fundamental analysis framework I've been using to find the hidden gems. I don't know how to insert a table in the post, so let me know if you need the Excel template.

Evaluating a project takes time and efforts. It takes at least 10 hours for me to go through all the fields in the table, and sometimes I had to consult experts in the particular field for the validty of the problem, or ask a lot questions in the Telegram channel in order to get the facts of the project. It's not an easy job, especially in the current bear market. However, the potential returns for your hard work can be huge. Everyone can be a VC investor if they perform the analysis in a scientific and objective way. I will show how I evaluated Steem and gave it a superstar rating in the near future. Yes, I am very bullish on Steem, and that's part of the reason why I joined this community.

Please share your thoughts on the framwork in the comments and let's polish our skills together. And good luck with your investment journey in cryptocurrency!

Your friend Bo