BITCOIN Market Update: Friday 12th, 2018.

Hi traders, let's look at the Bitcoin (BTC) and Ether (ETH) markets.

Bitcoin.

The price of Bitcoin dumped over 4% yesterday and is now back into what we believe is the next market cycle's accumulation range.

This is based on the structure of the market today...

...and back in 2015.

.png)

Shorts spiked on this occasion and we expect them to pile back up into what we dubbed the "short squeeze zone" and get rejected there.

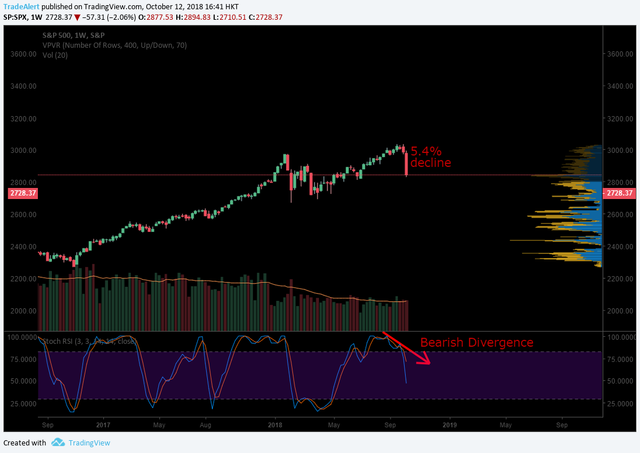

The X-factor could now be coming from the broader market, the S&P500 dumped 5.4% yesterday with surprising synchronicity with the Bitcoin market.

For all this talk about Bitcoin being uncorrelated to any other asset, this property was due to exceptional (abnormal?) bullish conditions in the crypto market itself.

What is clear is that Bitcoin did not show the spike that propelled gold when the S&P tanked yesterday.

.png)

Thus it remains to be seen if this assumption of Bitcoin being a non-correlated refuge market would hold true in a broader bearish market or if (as risk capital) it would end up being pulled out first in case of a financial crisis.

Ether.

Ether (like most large and mid-cap crypto-currencies) is slave to Bitcoin and shows complete correlation to its price.

From a technical point of view though, Ether could be in the process of forming a double bottom... but only a blessing from Bitcoin would allow the pattern to complete.

From a fundamental point of view, the upcoming DevCon IV this October...

...followed by the announcement of Joe Lubin as the keynote speaker at the SXSW festival in Texas next March

... are likely to create some positive buzz for Ethereum and could give some well needed price boost to Ether.

Strategy.

- We're keeping an eye on the equity market for signs of correlations.

- Shorting the Bitcoin market will become an option only if for whatever reason $6000 USD is broken below with volume then successfully retested as resistance.

- In the meantime we're not trading these chops and have no reason to believe that this last dump will necessarily trigger a break down from market structure below $6000.

What is your strategy traders?

Until next time,

FØx.

This content is for informational purposes only and does not constitute financial advice.

If you liked this article, make sure to show some love by up-voting or following the blog. You can also follow us on Twitter at F0xSociety.

Buy Digital Assets: Coinbase

Buy Digital Assets: Coinbase

Keep your Crypto Safe in a Hardware Wallet: LEDGER NANO S

Keep your Crypto Safe in a Hardware Wallet: LEDGER NANO S

Published on

by FØx

SXSW festival in Texas next March

awesome

Yep! :)

https://www.sxsw.com/

Great one as usual @tradealert !

Have a great Friday and Weekend.

Posted using Partiko iOS

You too man :)

Have a nice one!

Visiting Portugal so not much posting coming in this weekend :)

Posted using Partiko iOS

Enjoy!

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by FØx from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.