The blockchain tech stack is evolving - diversify your portfolio

Most investors will tell you about the importance of a well-diversified portfolio and how you should never go all in on any single asset. This is good advice for most of us and makes even more sense in the unregulated cryptocurrency market, where volatility is high and most of the current projects are believed to have a short lifespan. While investing in nascent technologies like blockchain will always carry great risk, there are a couple of measures you can take to help reduce the gambling aspect of it and better manage risk within your crypto portfolio.

When I first started investing in cryptocurrencies, I decided to go all in on Ether, the native currency of the Ethereum blockchain. It made sense to me at the time as it was the technology I had been following the closest and that seemed to have the most going for it. There were big name companies joining the Ethereum Enterprise Alliance, and it had the most developers and the largest user community out there. And when taking into account that almost every ICO out there was building their project on top of Ethereum, the upside seemed massive. What I didn’t realize at the time was that I had also fallen into the trap of becoming a part of the Ethereum community on Reddit and Twitter myself, adding to my already strong confirmation bias.

The concept of fat protocols

I then came across Joel Monegro’s (now with Placeholder, back then with Union Square Ventures) article about Fat Protocols, which really resonated with me in explaining how the blockchain tech stack encourages innovation at the protocol layer to a much larger extent than was the case with the Internet. Monegro explained how investing in the few shared Internet protocols like TCP/IP and HTTP had never made a lot of people rich; it was the applications built on top of them that created most of the wealth. However, he said that with blockchain-based protocols, the value of the protocol will always grow faster than the combined value of the applications built on top of it.

The basic idea is that investing in a decentralized application (dapp) token can be compared to investing in a startup company. The chance of failure is high, even more so in the blockchain space, with its many inexperienced, post-ICO, newly rich teams and entrepreneurs. Investing in a protocol token, on the other hand, means you diversify across all applications that will be built on the protocol, drastically increasing your winning chances. This has made it a popular strategy among risk averse crypto investors, myself included, once I realized I was becoming an Ethereum fanboy.

We can use Ethereum to illustrate the concept of fat protocols. There are more than a thousand dapps being built on top of Ethereum right now, and many of them raise funds through an ICO and issue their own token. However, a dapp built on Ethereum has to spend Ether (calculated in Gas), to function at all. So, following Monegro’s thesis, and using Metcalfe’s Law, the demand for Ether is set to increase as more dapps get built and gain real world adoption, appreciating Ether’s value accordingly, while at the same time presenting it as a relatively low risk investment vehicle.

Currently the second largest currency by market cap, many expect Ether to dethrone Bitcoin (whose market dominance is at an all-time low right now) during 2018. It’s also worth noting that, at the time of writing, Ether’s market cap is at around $92 billion, while the combined market cap of all tokens built on top of Ethereum, is roughly $30 billion, so this certainly seems to support the theory of fat protocols.

The term fat protocols was coined (no pun intended) back in 2016 though, and with a complex blockchain technology stack in constant change, betting on protocol tokens alone doesn’t guarantee you great returns anymore. Because, what is a protocol, really? While most will agree on the definition of the word — being a data exchange standard, a set of rules that defines how unrelated objects can communicate with each other (in our case, nodes on the network) — what decides whether what you’re building is technically a dapp or a protocol? In his article from October last year, Jake Brukhman, cofounder of CoinFund, states that in many cases, it can be both.

Where does a protocol begin and where does it end?

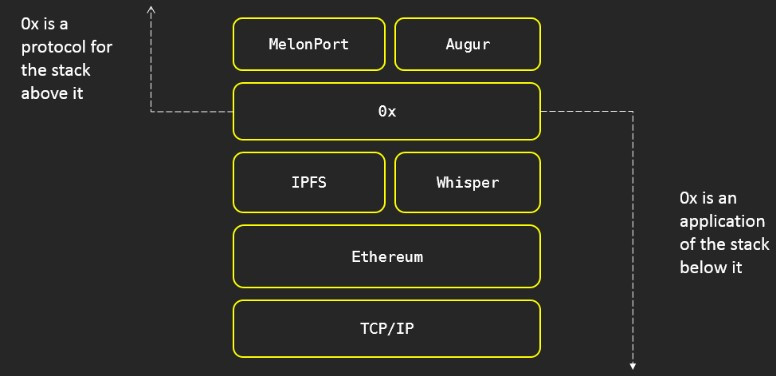

Brukhman makes a comparison to the Internet architecture, where HTTP sits above TCP/IP, making HTTP an application of TCP/IP, while at the same time being a protocol for websites and applications built on top of it. Similarly, on a blockchain like Ethereum, we have Ethereum itself as the base protocol. Then there’s an increasing number of other protocols, each serving a different, usually quite specific, purpose. A few examples are IPFS for file storage, Whisper for communication between dapps, and 0x for decentralized token trading. If we look at 0x, it serves as an application of Ethereum while also being a protocol for other dapps and platforms, like MelonPort and Augur among others, which are building (parts of) their service on 0x.

Above: A small selection of the Ethereum stack. Credit goes to Jake Brukhman; I simply adapted one of his images to make it relevant for my example.

How many protocols before the tech stack gets too fragmented?

A result of the protocol fatness is that everyone wants to extract as much of the value creation as they can. So we have gotten ourselves a currency war, with hundreds of cryptocurrencies and tokens competing for world (or at least industry or vertical) dominance. Many of these small, often open-source, teams are building what they hope will become base protocols, the building blocks that are going to form the new back end of the Internet. Common for all of these teams is the belief that their technology is superior and what everyone else should be building on.

You may prefer to invest in protocols that sit lower in the stack, often referred to as infrastructure projects, or in front-end dapps with a more specific and limited use case. Perhaps you prefer to diversify vertically, in various dapps and protocols living on the same blockchain. Or you may be of the opinion that real diversification only happens when investing horizontally, in different base protocols. The fact is, it’s possible most of these protocols and their blockchains are going to fail, leaving us with a one-blockchain-to-rule-them-all scenario. It’s also possible multiple efforts will succeed and we’ll have a myriad of interoperable chains and protocols (which seems most likely when looking at the current landscape). Both approaches are likely equally risky from an investor point of view.

To add to the uncertainty, you run the risk of investing in a project that seems to fit perfectly within your diversification strategy, only to have it announce, after the ICO, that it’s moving to another blockchain, like Kik is planning to do with its Kin token, moving it from Ethereum to Stellar.

One of the smartest things we can do in this unclear market is step up our own due diligence and base investments on solid project fundamentals. This will put us in a better position to pick the emerging winners than most crypto investors.

Note: None of the above should be considered as investment advice. I own small amounts of various cryptocurrencies, but I’m neither a financial advisor nor an investment professional. I am just a simple hodler, hoping that one day, some of the coins in my possession will moon and take me with them.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://venturebeat.com/2018/02/17/investing-in-cryptocurrencies-understand-how-to-diversify-your-portfolio/

Congratulations @trondbjoroy! You have received a personal award!

Click on the badge to view your Board of Honor.

Congratulations @trondbjoroy! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!