Crypto-Bridge and Olympic: Two Examples of What’s Wrong in Crypto

I’ve written at length about the most recent developments in the industry when it comes to scams and hyperinflation-inducing masternode coins. Both of which are not helping convince anyone new to enter cryptocurrency, thus keeping any potential growth indefinitely sidelined.

Most individuals currently involved in trading digital currency shudder at the idea of government regulations being laid upon the industry. The threat of Big Brother watching and telling you what you can and cannot do is a kiss of death according to some hardcore crypto-lifers.

At the end of the day though, we are not giving governments much of a choice. We continue to scam each other out of millions of dollars, hack into exchanges and steal even more. Most simply sit idly by while all this happens, just hoping that they are not next on the target list.

It needs to stop. Real change will only occur when it comes from within, from people who are here, day in and day out, observing and reporting about the industry. They are watching and working each day to make cryptocurrency a safer place to invest for everyone.

Watchdog groups are starting to pop up. In Discord, there is the Crypto Scams server. A small group of people who have come together to educate potential investors of any nefarious projects they have come across. My hope is that groups like this continue to grow and start holding projects and developers accountable.

That’s my mission here. To shed light on something that anyone with even a shred of character would see as wrong or unethical. In the words of a fellow crypto friend, “It’s about time someone held these people accountable!”

Olympic (OLMP)

Where to begin with this one? I found OLMP through a fellow community member who told me about a masternode coin that was being rebranded and revived. I looked into it. The website was incomplete, the use case was questionable, but I was forgiving because they were a project in flux and the expectation was “they were working on it.”

I had a few Ethereum(ETH) laying around so I messaged one of the admins and negotiated a trade for some coins in exchange for my ETH and maybe a piece promoting their project. This probably isn't the piece they were anticipating.

It was not long after that the cracks in the coin started to show.

The OLMP Team is comprised of four people, well three. No, four. We will get to that in a minute.

Anyway, hyperinflation was on the horizon. Tiered masternodes were in place, they don’t work but people are attracted to them. A team member of mine started running the numbers. More than 100,000 coins were entering circulation each day. When he brought this to the attention of the OLMP team, they assured him “demand for coin is good, no worries.”

It was not long after that they banned him from the server for “spreading FUD.” Which is a scapegoat argument that server owners use to ban anyone they want if the users speak out of line. Trying to educate the team on their impending problem got him the boot.

The rumors begin.

Word started to spread that Arman and the developer, OlympicCoin, were the same person. Check their website. Dev is listed as Davit Hewitt. No such person exists. A damning situation, but by crypto-standards, most saw it as a mere shoulder-shrugging offense. Then people started to ask…

“Arman, are you and OlympicCoin the same person?” Banned. Another asked. Banned. And another. Banned. Within seconds, every person who asked was banned from the server.

While this was happening, Arman was on the popular exchange, Crypto-Bridge buying huge sums of OLMP coin, trying to pump the price up. You can see his activity here. Again, in crypto, this just isn’t that big of a deal apparently since no one seemed to care at the time.

After watching the OLMP Discord server for a few days, and the account run by Arman on Crypto-Bridge, I decided it was my turn to ask the same question.

“Is it true that you and OlympicCoin Dev are the same person?” Yeah, I was immediately banned as well. Surprise, surprise.

After that, my involvement with OLMP was pretty minimal, as you would expect. I would get reports back from people I knew about what they were up to. What futile changes they were making to try and save the coin, stop the hyperinflation, etc. Pretty common stuff for a floundering project that had lost 95% of its value in about a month’s time.

Then a new development…

Crypto-Bridge

Crypto-Bridge is one of the most popular destinations for new masternode coins. The exchange has good volume, lots of users, a fairly easy to use interface, and the listing fee isn’t that much compared to other larger exchanges.

However, almost every exchange has policies in place that project owners need to abide by. And if they don’t, their coin will be delisted from the exchange. This is something that is a no-brainer for exchanges, acting as a moderator between buyers and sellers. Of course there should be a list of dos and do nots that projects must follow.

Unfortunately, Crypto-Bridge does not seem to care. More on that later.

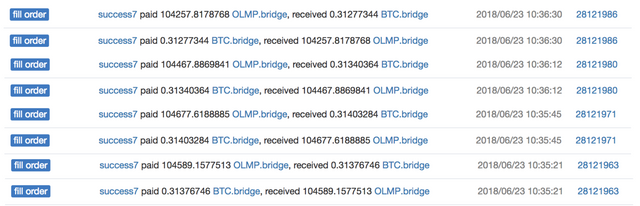

Another teammate of mine sent me a message and told me to look at the trading history of a user on Crypto-Bridge. Because it’s a decentralized exchange, all user trades and transactions are recorded on the blockchain. The username was ‘success7’, activity here. He said, “tell me if you see anything weird with this user’s trades.”

There it is.

An endless number of trades back and forth to themselves. 100,000 coins at a time. But why would anyone do that?

Volume Manipulation

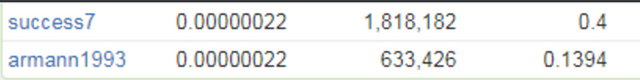

A gross infraction by any means. A couple weeks ago, the 24 hour trading volume for OLMP was around .5 - 1 BTC. In the past week, the volume has ballooned overnight to a range between 15 - 30 BTC. A 3,000 - 6,000% increase in volume.

Did the coin get featured on a major Youtube channel or podcast? Did they partner with someone like Verge or Tron? Did they launch a major marketing campaign?

No to all three of those questions. Nothing has changed in that time.

The only change was the appearance of user ‘success7’ and their endless string of trades to themselves. Lately, they dialed it down to just 30 coins at a time, maybe out of fear of being noticed. Too late.

Another bombshell.

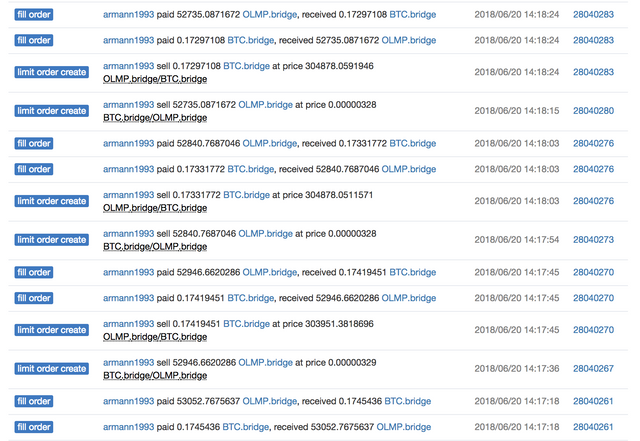

I started seeing these little coincidences in the trades. Line for line, Arman and success7 having identical orders.

And once we dig further into Arman's own account on Crypto-Bridge here, we see even more of the same volume manipulation that success7 is doing.

The chains in the link start to solidify. Arman and the Dev, OlympicCoin are the same person. Arman was artificially pumping the price of the coin. Arman and ‘success7’ are the same person, both manipulating the trading volume of the coin.

But why go through all that trouble?

CoinMarketCap

In the crypto world today, everyone is jockeying to get listed on CoinMarketCap (CMC). It’s another way to show the world you are legitimate. One of the most common requirements communicated to coin teams is their trading volume must be above a certain amount in order to be considered. Last heard, it should be above $100,000 USD daily volume.

Are you starting to see the whole picture now?

Arman, and his team, have been grossly manipulating the daily trading volume in an attempt to get their project listed on CMC. It is unethical, it is manipulative, and it is another example of the leaders of projects sacrificing industry legitimacy for their own personal gains.

So as an advocate of stopping scams and injecting a bit of integrity into cryptocurrency, I took our findings to Crypto-Bridge.

Time for Action

Exchanges are a gathering place for users to trade. Centralization in a decentralized industry. Crypto-Bridge is one of those new ‘decentralized exchanges’ meant to fight the centralized aspect of exchanges. For example: like Bithumb, that got hacked again just a few days ago.

I sent a couple messages to people in charge. No response. Surely an exchange of this size has to have some terms of use to safeguard its users from manipulation like this.

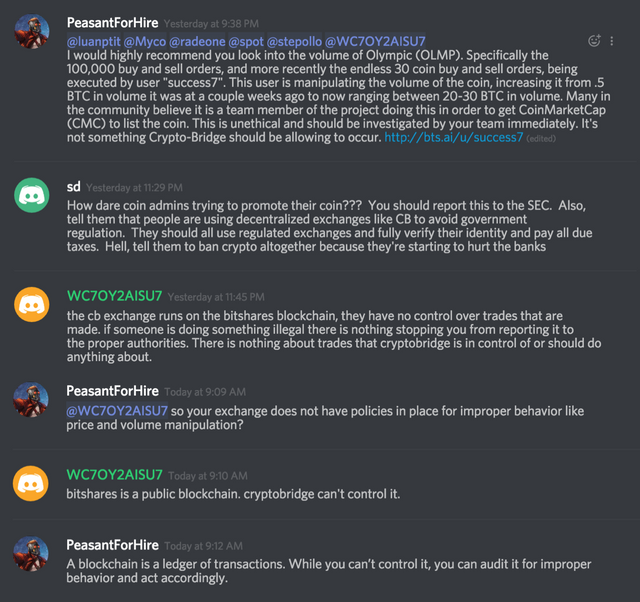

Then I posted in the Crypto-Bridge Discord Server. This was the extent of the conversation:

Not only does the Crypto-Bridge team not understand the extent of which this is a problem, they don’t seem to care. Opting for the “we can’t control the blockchain” reasoning for not holding their project owners to even basic ethical practices.

When a coin is manipulating its daily trading volume, and the exchange on which they are doing the manipulating does not care, these project leads and exchange owners are putting thousands of unknowing investors directly in harm’s way.

It’s poor leadership from the team and the exchange. Especially from an exchange that hosts so many new coins that are trying their damnedest to build a community and a demand for their coin.

Exchanges should be held to the highest of standards because every day, investors entrust millions of dollars to them, and they should have the confidence to know that they are being taken care of.

Final Note About Olympic

If you own some OLMP coins, you will want to take a serious look at these addresses.

http://explorer.olympcoin.io/address/QPyxN3T3u8cNsrugQvTsdDK9xyUHZHZUYM

sent to

http://explorer.olympcoin.io/address/QaJjALEcS3Hey6FcR4G2SWCm5oqhfDRtQj

Timestamps look strange?

Another team member of mine found these and dug into the code. OLMP appears to be suffering from the same Novacoin exploit that so many coins have discovered and remedied over the past few weeks. Coins like Apollon (XAP) and Flea Coin (FLEA).

This exploit allows people to manipulate timestamps and collect a significant number of rewards while orphaning those rewards in other investor’s wallets.

This is still happening in OLMP. When you bring it to the attention of the team, they tell you that, “addresses can be used as a pooling address for multiple masternodes and there is nothing to worry about. No exploits here, please keep investing.”

You start to wonder if their behavior is more a product of incompetence rather than manipulation…

In the game of cryptocurrency scams and exploits, the answer usually falls somewhere in the middle.

Very interesting article. The interesting thing about cryptocurrency is that it’s transparent, if you know where to look. But it’s the wild Wild West in terms of anybody giving a dam about theft, scams and manipulations.

You make some good observations about market manipulation and also the lack of responsibility. Many people feel or act as if people who are scammmed are ignorant and therefore responsible for the fact that others scammed them. We need to realize that taking candy from babies isn’t the babies fault, it’s wrong. We need to collectively start protecting ourselves and our “babies” from these crimes. I think that articles like yours and information available on the discord is a good place to start.

Good article, I am following you.

Nice article, bro!!

Please upvote: https://steemit.com/free/@bible.com/4qcr2i