This Year Will Be Different, And It’s Your Fault

2017 saw the cryptocurrency industry truly explode into public consciousness. I wrote a little bit about what happened here. About all the factors that led to the build up and the eventually tumble at the end of 2017, beginning of 2018.

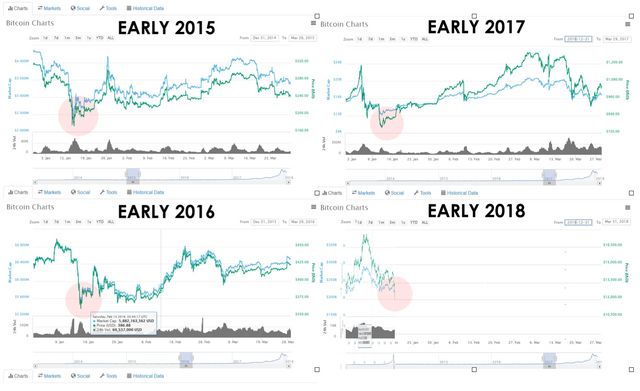

But every year, we have seen a recovery. We have seen the market stabilize and grow beyond the previous year’s all time highs. This was a common picture shared among investors during the price falling at the beginning of 2018.

Myself and others have dubbed it ‘Crypto Winter’. That time of year from December to February where the markets take a downward trajectory. We presume that it is due to the fact that crypto investors around the world are extracting fiat currency in order to pay for gifts and to travel with their families and friends.

The length of this downtrend is due to the fact that cryptocurrency is a global industry, which means Western holidays and Chinese New Year span a three month period. If December through February is Winter, then invariably March through June is Crypto Spring.

This is the time of year where the downtrend is supposed to stabilize and we finally see some new growth. Living in multiple platforms from Facebook and Twitter to Discord and Telegram, I watched as many ‘veteran’ investors said the following:

“The prices will come back after the Chinese New Year.”

Chinese New Year ended on February 16th.

“The prices will come back after the Tax Deadline.”

The deadline for taxes was April 15th.

Youtubers and Podcasters predicted that the price of Bitcoin would be back to $10,000 by the end of May. But it’s not. Bitcoin is currently sitting at $7,700 with not a lot of strong indicators that growth is coming. In fact, recent Technical Analysis I have seen isn’t bullish on Bitcoin at all; that we might see it fall lower.

Even more ‘experts’ predicted that Bitcoin will reach an new all time high ($19,900 approximately) before the end of the year, maybe even coming close to $25,000.

Honestly, I don’t think that’s going to happen. Those grandiose predictions are fun to read but very few of us believe them. A lot of damage was done to cryptocurrency in 2017, beginning of 2018. And that damage is going to take a long time to heal.

We saw the explosion of Coinbase to help newbies enter the market for the first time. We saw mainstream media cover cryptocurrency on a daily basis. And we saw the highest profile collapse of a platform since Mt. Gox in the form of Bitconnect.

But all those newbies entered the market when the price of Bitcoin was already at an unsustainable level. They FOMO-ed before they knew what FOMO was. They lost money the moment they put their bank information or credit card into their account.

And the mainstream media was chomping at the bit the moment the market turned downward.

But those of us who have been in the market longer than nine months knew that retraction was coming. When Bitcoin crossed $10,000, we knew this growth was unsustainable. When it crossed $15,000 we knew it wasn’t going to end well for everyone getting involved.

And when the market bottomed out two months later, at $6,100, we knew there were millions of new investors who would never touch cryptocurrency again. Through all of that, we could still find hope in the industry and a path to recovery.

However, so far, we have done nothing to show the public that we are ready to be taken seriously.

Scams

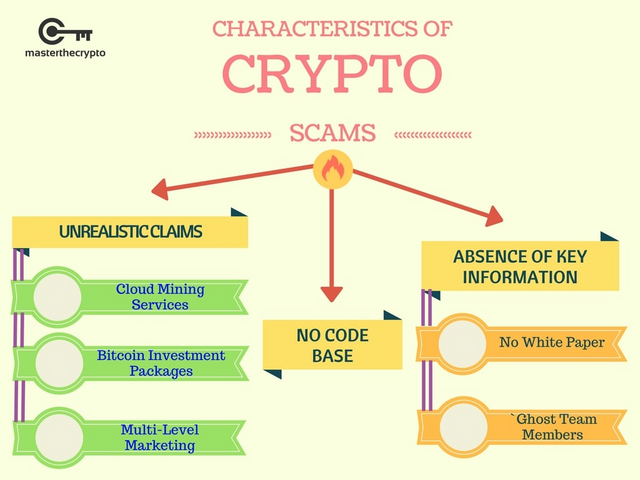

Scams infest blockchain technology to the point that even serious investors can’t trust their own means of detecting unsafe investments anymore.

We know the usual scam indicators; little to no information, an anonymous team, a lack of a use case, etc. We have a general guideline for how to evaluate projects to make sure we’re not acting too irresponsibly with our digital currencies.

But now, none of that matters because the scams continue to evolve. Before it was lending platforms. Then ICOs that would raise huge sums just to never see the light of day. Then the lending crowd tried moving into ‘staking platforms’ without much success. Now, they have gone from desperate to repugnant.

The new scam: Development Team Desertion.

The new trend in crypto in general is Masternodes. Personally, I think it is a good trend that will continue for some time. Proof-of-Work (PoW) is too resource heavy and Proof-of-Stake (PoS) will become the majority as we move closer to mass adoption.

Investors have gotten smart enough to avoid sketchy looking projects before putting their money into them. But now, none of those filters and techniques matter.

We see these projects with great websites, a solid use case, a visible team; checking off most of the boxes for a relatively safe investment. So you put your money into it. You get your coins. You set up your Masternodes or staking wallets. The community is engaged. The team is active in Discord and other forums. The coin is listed on a couple exchanges. It has good volume. You are getting good rewards.

Your faith in cryptocurrency flickers back into existence.

Then you wake up one morning a few weeks later and the team is gone. The price on the exchange is down 80% and dropping. The community is dumbfounded and talking about trying to revive the coin through a community take-over even though none of them know how to code.

This is our new normal. Everyday I hear about another project that the developer(s) deserted and left the community holding coins that will never earn them enough rewards for them to break even. And in a zero-sum game like crypto, the Devs walk away with their pockets turned out with digital currency.

Congratulations, you have a few more Bitcoins in your wallet.

And you are the reason why we as an industry have stagnated. Your selfishness has assisted with killing the momentum that has been building over the last few years, that could have been used to introduce more people to blockchain technology.

At the end of the day, Bitcoin dominance is below 40% and the day-to-day investor is heavily involved in the alt-coin market. A market that greedy, fickle developers have gone to great lengths to spoil for those who don’t have advanced knowledge of the coding languages required to start their own currencies.

If you’re a developer or project leader, understand that you don’t just represent yourself. In an emerging industry like this, that is being scrutinized and criticized on all traditional fronts, your actions matter now more than ever.

You represent every project team and every developer in the industry. Every time you screw people over, it makes people less willing to believe in any project, regardless of how well-intended that team actually is.

And as you degrade that opportunity for people, you degrade the entire industry. If you truly believe in blockchain technology, then accept some personal responsibility, rediscover some semblance of a moral compass, and understand that you are a representative of cryptocurrency to the entire world.

And right now, the world thinks you're an asshole.

Excellent write-up, thanks for sharing. As a former Bitcoin holder (now moved to ETH and similar coins), last winter's explosion in value was the nail in the coffin for that portion of my portfolio. While the current stagnation is far from reassuring, I expect the annual hype train to pick up its fair share of passengers again. 10,000 doesn't feel like an unrealistic number by EOY, but if we come close to 19,000 again I would be extremely surprised. This isn't taking political focus and legislative action into account, which could have massive impact and entirely behind closed doors to the average investor.

Thank you. I hold ETH as my store of value as well. I think with the right circumstances, $10,000 is easily reachable. Unfortunately, some damage is irreparable and it will take significant time and favorable future legislation for the price of Bitcoin to approach $20,000 again.

Altcoins are almost always a flash in the pan, any anyone who knows anything about investment could tell that Bitcoin's price was in a bubble. But the people who jumped in because of FOMO want a scapegoat to blame, and you're right that the Bitcoin cheerleaders don't tend to offer a realistic analysis, smearing all of us with their public behavior.

All we can do is carry on , choose carefully, and let time prove us right.

Yeah, alt-coins do have a usual 'temporary'ness to them. Some have more staying power than others, that's for sure. We continue to do good work and hope more people see the potential instead of the problems. Thanks for commenting.

The Steem Pope strives to make the kind of substantive comments he desires from others!

This is a great article and there's a lot of truth in it.