Bitcoin Futures Report Shows Bullish Sentiment Is In the Air

Bitcoin Futures Report Shows Bullish Sentiment Is In the Air: @wahabali

CFTC Report: Bitcoin Futures Contracts Are Overwhelmingly Bullish This week

Related reading on @wahabali: Why Venezuela's New National Cryptocurrency El Petro Will Fail

Related reading on @wahabali: Why Venezuela's New National Cryptocurrency El Petro Will Fail

My YouTube Channel: YouTube Channel

My YouTube Channel: YouTube Channel

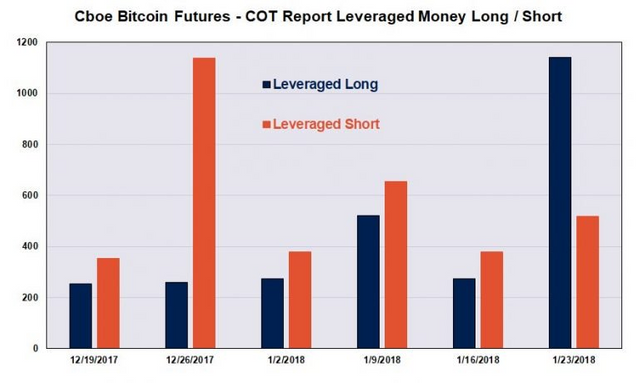

The presentation of the current fates markets originating from Cboe and CME had brought a ton of buildup and overheated exchanging to cryptographic money markets. Following the dispatches bitcoin's fairly estimated worth spike to $19K per BTC however since the new year, the cash has seen a 40 percent misfortune in esteem. Since the bitcoin subordinates items started, the Commodity Futures Trading Commission (CFTC) has distributed reports on Cboe's market execution. Since December the CFTC's reports demonstrate that fates merchants were wagering against the cost of BTC, showing bearish assumption and spot costs took after the agreement forecasts. This past Friday's CFTC information recounts an alternate story as the agreements are overwhelmingly bullish — meaning Cboe brokers anticipate that the cost will rise.

The current week's CFTC report expresses that utilized positions demonstrate 1,142 contracts are 'long' (wagering the cost will rise) while just 518 contracts are 'short' (wagering the cost will drop). The information conspicuous difference a distinct difference to the weeks earlier when Cboe contracts wager much more 'short' as contract checks demonstrated shorts overpowered aches 4 to 1. Indeed, even news.Bitcoin.com's week after week exchanging investigator, Eric Wall, has an indistinguishable slant from he writes in his latest report:

I trust we are going to break out from a broadened time of union. I'm opening a medium-sized long position (sparing some of my exchanging balance in the event that we do get a shot at ~$8k).

'Shorters Prepare to be Routed'

The feature writer Miko Matsumura from the Evercoin blog as of late composed how he trusts people who short bitcoin markets ought to be reasonable — particularly the individuals who don't have 'skin in the diversion.' For example, Matsumura says that most fates brokers particularly the ones exchanging Cboe and CME items are generally just "theorists" who simply observe the value activity. Most don't comprehend that the constrained drawback to shorting is there's a great deal of devotees and people who see a purchasing opportunity amid value plunges, Matsumura includes.

"Where the individuals who short bitcoin are frail since they don't really trust in the estimation of Bitcoin — This implies a considerable lot of them figure the esteem can "go to zero" — What they don't see is a multitude of HODLers, and a mass of individuals who can hardly wait to get into bitcoin at enormously reduced costs," clarifies Matsumura.

Bitcoin speculators, you're protected. Examiners whether me-excessively beginners or prospects exchanging individuals shorting bitcoin, plan to be steered.

Matsumura's illustration can be affirmed by late financial specialists getting singed endeavoring to short GBTC's stock and the a huge number of dollars exchanged from Bitmex, Bitfinex, and Okcoin brokers attempting to wager against bitcoin's esteem each day. Right now most use merchants are wagering long crosswise over conventional crypto-trades. Bitfinex use positions today demonstrate 26,982 long contracts and just 18,226 short transfers (59%L – 40%S). The current CFTC reports recording bitcoin prospects contracts hung on Cboe show dealers are likewise not willing to ceaselessly wager against bitcoin — And this week standard bitcoin subsidiaries merchants originating from Cboe are anticipating a bitcoin value inversion is up and coming.

What do you think about fates contracts overwhelmingly wagering that bitcoin's cost will rise? If you somehow happened to wager at this moment how is your present viewpoint towards the cost? Short or long? Tell us in the remarks beneath.

Source

All in all, what do you consider this? Just offer your perspectives and considerations in the remark area beneath.

Upvote For More Details >>> @wahabali

Yes, as we know, Bitcoin appeared in 2009, and over 9 years of its operation( trade)... that the authorities would pay less attention, legalized in mainly Japan...as time went on... who row on bitcoin earned a lot of money...many did not believe this... and here are scammers - hackers quickly figured out how to "earn" this currency...and that's when 17 Dec 2017 he stood up to the mark 19500...it is here that he surprised everyone!!!...once all stirred, bitcoin stirred the whole World! Where was all this before? Why the authorities of all countries are not created during its own laws, its own rules of operation with cryptocurrency?...and because many think that bitcoin is a "Scam", bubble, pyramid...so it is easier to say than to understand, to learn, to understand...It's a new technology now blockchain and bitcoin - it's the 2nd aspect of the same system!!!... And therefore, when authorities in their fields realized that many in bitcoin got rich...started to apply its own laws...the first came from China and South Korea...and 17января bitcoin fell to a label 9148...this is thanks to an experienced, large , professional investors it does not fall below 9000...and after 17 January he is above the mark 13000 was raised, because he is waiting for authorities what they decide...of course they have now begun their work...The Finance Ministry published a bill on bitcoin...and other countries have their own rules...but nerves do not iron at all , you need- to settle in a single position regarding cryptocurrencies...Of course, after all the turmoil and razberi we expect the GROWTH of BITCOIN!!! GOOD LUCK TO ALL!!!