The Future of DApps

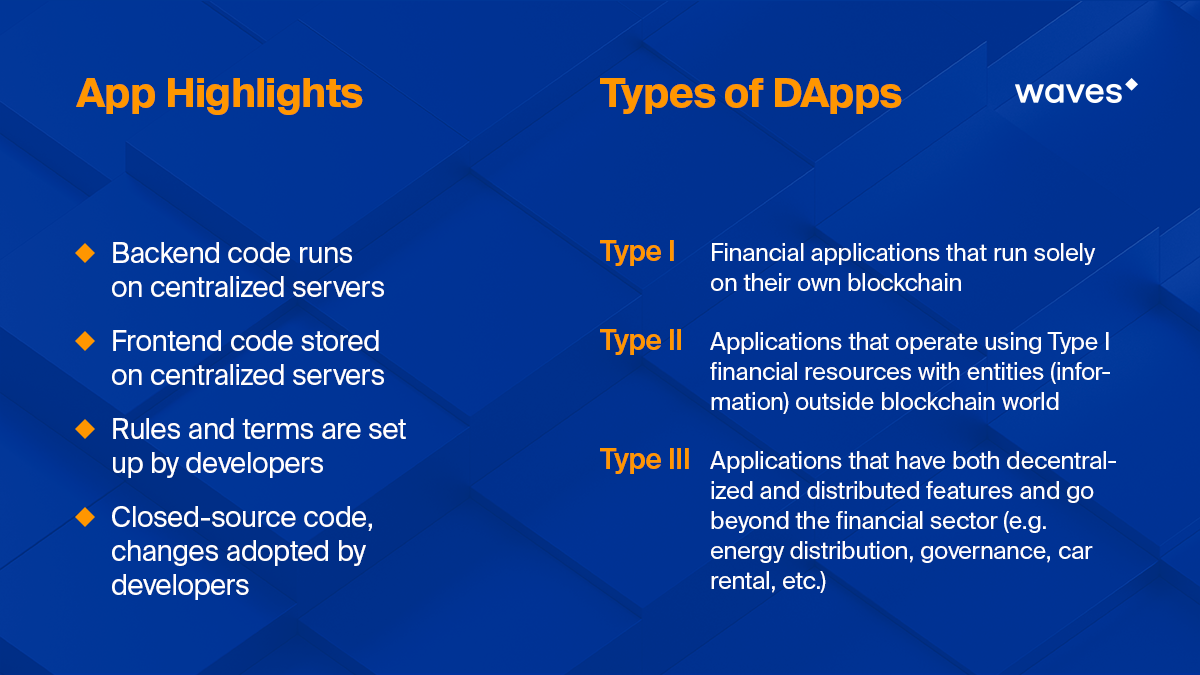

DApps are not necessarily laptop or mobile applications, as some might think. Decentralized Applications imply a wider meaning. They can be identified as a tool set that can be scaled and applied to any phenomenon. Cryptocurrency systems like Waves or, for example, a decentralized food delivery system are both DApps. The only difference between them is the Type of DApps to which they are related.

Type I

These are solely financial DApps that utilize their own cryptocurrency (Waves, Bitcoin, etc.) and operate strictly within the blockchain world. Simply put, these are world-famous cryptocurrencies as we know them.

Type II

These DApps go beyond the blockchain world, but are used solely for financial purposes. For example, an ICO or a blockchain-based customer loyalty programme are Type II DApps.

Type III

Currently, there are numerous initiatives developing and implementing these types of DApps. Type III DApps perfectly illustrate the notion that, besides money, you can literally tokenize everything. Blockchain provides astonishing capabilities for customer/business relations, since the system itself is hard to undermine, so any actions that take place within the blockchain are easily traceable. The information is securely distributed between different nodes, making hacking or scam attempts pointless.

Type III DApps are destined to change the world as we know it both for customers and businesses. With DApps, any sphere of our lives will become far more secure and comfortable than today, also providing passive incomes.

For example, imagine a DApp that connects all insurance companies and their customers in one decentralized system. Suppose that some services in your insurance plan are about to expire, or you just don’t need them anymore (e.g. you sold a car, so have no need for vehicle insurance anymore). The DApp distributes these services to those who really need them, and you get a reward for it in a form of a token. With such a DApp insurance businesses can significantly reduce operational costs and adapt their products more effectively to the needs of the market, while attracting more customers, since there’s a built-in reward system. Another example will be owning a solar or wind facility for your home or business. With an energy distribution DApp you can transfer an energy surplus to those who need it and get a reward in exchange.

So, in the next five years we will see significant changes in:

- Finance and banking

- Healthcare

- Taxi and car rental services

- Energy distribution

- Real estate

- Food delivery

- Cloud storage

- Music services

- Governance

- Education

- Advertising

- Human Resources

- Betting and gambling

- Labour reward

Obviously, this list will expand further, incorporating spheres that seem today untokenizable at first. Currently, the most obvious and rapid changes are taking place in the following spheres:

- Identity authentication

- Finances and banking

- Voting

- Governance

- Logistics and Supply Management

Identity authentication stands out in this list. Together with smart contract mechanisms, it is one of the backbones for DApp market development.

Identity Authentication

We put identity authentication first for a reason. ID authentication, based on blockchain technology, provides a set of diversified, universal and standardised tools for the rest of the blockchain world, whether finances, governance, real estate or advertising. For example:

- ID authentication for cryptocurrency accounts

- Protection of your social media accounts

- Protection of your financial accounts (e.g. a user app for your bank) and financial data while using e-commerce

- Storage and utilization of other personal data (medical, insurance, etc.)

- Effectively secured e-signature

- Simplification of KYC validation

Conventional ID authentication solutions are time-consuming, vulnerable to scam attacks and expensive. Currently, your personal data exists in many incarnations, being stored in multiple centralised systems. Every time an entity, whether an online shop or a governmental institution, demands typical information from you (like home address, e-mail, ID number, etc.), you have to transfer this information.

It does seem unreasonable, but right now the whole ID authentication process is duplicated each time you want to open a bank account or simply register on a site, consuming your time and the time of the service provider you apply to. Moreover, any of the servers, where your personal data is stored, can be hacked. Each year identity theft scams cost American consumers billions of dollars. A noble attempt of Estonian authorities to digitalise citizenship, elections and all other bureaucratic procedures turned into a train wreck: due to a chip flaw, passwords of 760,000 e-cards were exposed to hackers.

On the contrary, blockchain-based identity authentication systems are far more secure, universal and low-cost. Among their benefits are:

- Private keys generation by a third-party

- Multi-level authorization

- Identifying information stored by the user, not by the entity

- Significantly reduction in KYC process costs and efficiency of identity verification procedures

- Universal access to customer data for entities (businesses)

In the ideal world in which we will hopefully be living in the next 5-10 years, you won’t have to distribute your personal data every time you sign up for something. Any process, whether issuing a driver’s license or opening a bank account, will be swift, taking just a few days (or maybe even hours), since the process of personal data distribution will be universal and there will be no need to store the data on centralised servers and run KYC procedures every time. You just provide a combination of your biometric data, a private key, or e-signature, and that’s it.

Obviously, blockchain identity authentication is the driving force for the widespread implementation of all other DApps, meaning they will be a day-to-day reality for any consumer.

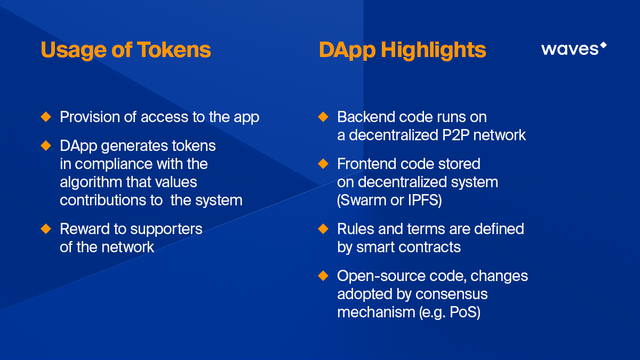

Smart Contracts

The next big thing after identity authentication that directly influences the evolution of DApps, is smart contracts (blockchain ID authentication uses them as well). They are reliable mechanisms that make exchange of digitised information with certain conditions secure, fast and transparent.

Smart contracts are evolving together with the blockchain. In the near future Waves will have one of the most effective smart contract mechanisms ever: they’ll be be able to meet any parameters possible, whatever the amount, variations and combinations, opening fascinating perspectives for the creation of any kind of consumer DApps, all of which are supposed to make our everyday lives easier.

Voting and Governance

Besides the financial sector, identity authentication, powered by smart contract mechanisms, is making its way into voting and governance. So far, digitisation of these spheres has not been progressing well, as many expected. Besides the Estonian ID cards precedent that we already mentioned, there are lots of other unsuccessful examples.

Before blockchain technology started to tap into our lives, any attempt to make voting or other bureaucratic procedures more open and accessible was prone to fail, since there was no solution to the inevitable security issues. With blockchain, voting and governance not only will become more transparent and user-friendly, but also super secure.

Logistics and Supply Management

Shipping and supplies are quite a headache for many customers and companies. Right now large corporations, among which are Walmart, FedEx, Maersk, General Motors, Proctor and Gamble, etc., are teaming up with developers in order to include blockchain solutions into the companies’ structure.

Everything is a DApp

Blockchain-based services in finance, logistics/supplies, voting and governance, underpinned by powerful identity authentication tools and smart contracts, are making it to the top of the DApps list right now. Yet, these spheres are not the only ones that are being decentralized and tokenized. We do have to admit that, due to the relative novelty of the technology, even the top 5 (finances, voting, governance, ID authentication, logistics and supplies) do not look pretty (we deliberately put gambling and betting systems aside, since they don’t completely fit into the subject of the article).

If we exclude the implementation of blockchain solutions by large companies and take a look at DApps that ran an ICO, we’ll see that only few of them have made it big so far, but that’s just the way it is — the strongest survives, meaning the one that has the most consistent product, that meets market requirements and is capable of further evolution. This applies to everything. There are some good examples of DApps in advertising, labour reward, human resources, and internet browsing software. Other services — like car rental and taxis, food delivery, even healthcare — are being decentralized moderately, without obvious success, but it’s just a matter of time before we will see revolutionary examples.

Join Waves Community

Read Waves News channel

Follow Waves Twitter

Subscribe to Waves Facebook

All in One application

This comment has received a 0.30 % upvote from @booster thanks to: @pritam20.

Wow, great piece guys! Very well written and definitely interesting material :-)

Almost 11th of April ;-)

Great article, thanks for sharing. I've hit the upvote button for you!

If you are looking to get hold of some crypto without investing or mining, look into https://www.crowdholding.com. They are a co-creation platform were you get rewarded for giving feedback to crypto startups on the platform. You can earn Crowdholding's token as well as DeepOnion, ITT, Smartcash and many other ERC-20 tokens.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvote this reply.

This post, with over $50.00 in payouts, has used the following bid-bots.

booster payout in the amount of $49.87 USD.

smartsteem payout in the amount of $47.47 USD.

promobot payout in the amount of $36.28 USD.

appreciator payout in the amount of $34.23 USD.

postpromoter payout in the amount of $33.03 USD.

jerrybanfield payout in the amount of $19.18 USD.

frontrunner payout in the amount of $0.08 USD.

For a total calculated bidbot upvote value in the amount of $220.14 USD.

This information is being presented in the interest of transparency on our platform.

Please consider the long term effect on our platform before using bidbots!

You can read more about how bidbots are affecting our platform here.

This comment is by no means a judgement of your work @wavesplatform, only an earnest appeal that we might all work together to build a great platform by letting the community curate our work and not bidbots.

@Transparencybot is a non-profit initiative, please consider supporting it and the transparency it brings to our platform.

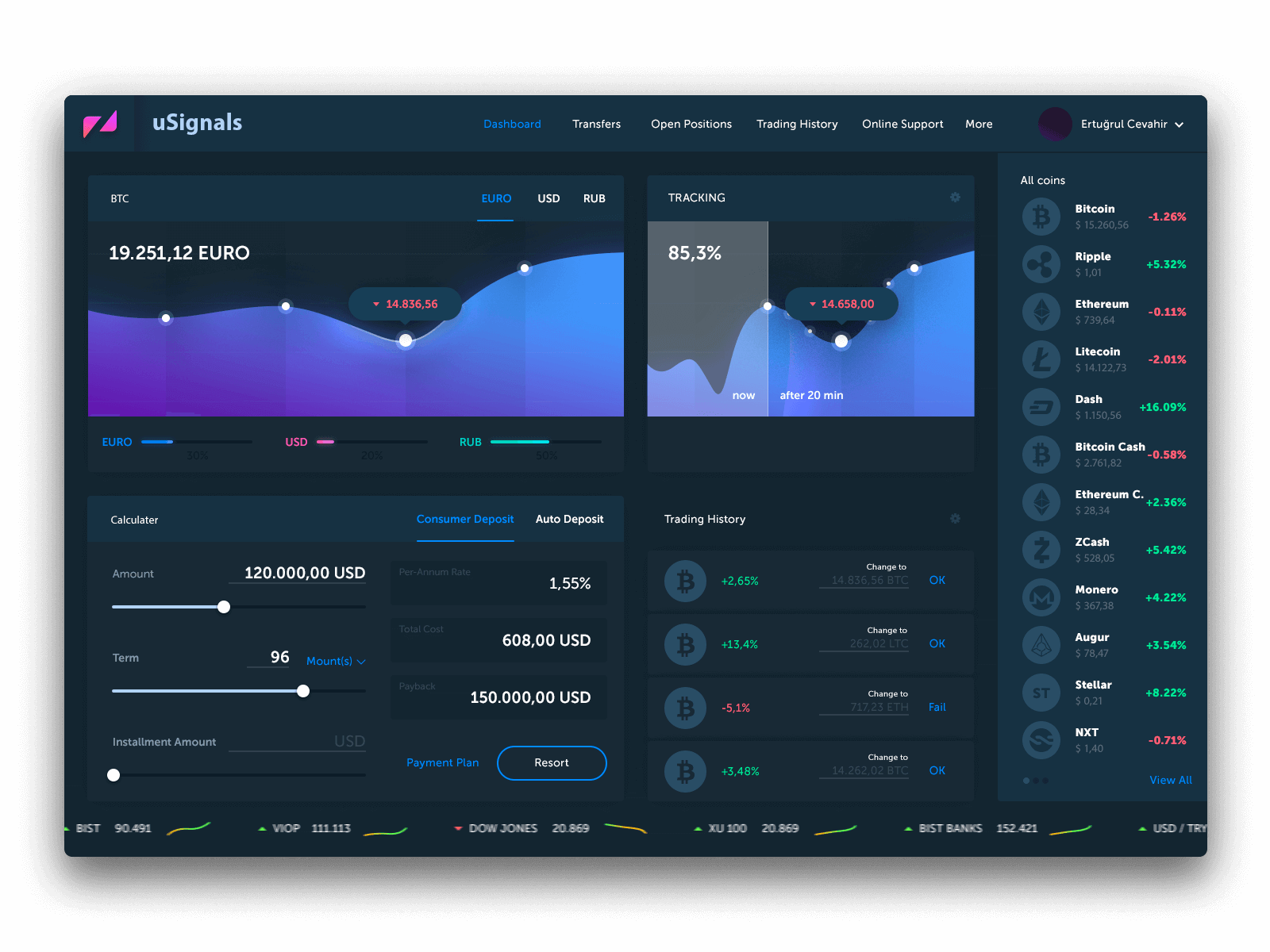

best app for view cryptocurrency stats and signals https://usignals.com

This post has received a 44.85 % upvote from @booster thanks to: @wavesplatform.

Good luck guys!!

We need MORE Dapps we can actually use

good article. thanks for putting the list together.

the ID lookup of a person cannot be decentralized. The government will handle all ID lookups in one way or the other. It stands to reason that a Dapp will not become a trusted authority for official or quasi official purposes.

decentralization by itself is not the right answer for everything. A trust deficit is not the primary problem to solve in a coin less blockchain.

Now if we assume that a coin less blockchain can solve the worlds energy problems by using random computers across the world instead of expensive data centers, then ... certain Dapps could be great problem solvers.

trust deficits don't exist today with captive customer/vendor bases. in some of the verticals mentioned in the article (especially insurance), the company knows the customer as well as the participating service provider. in these cases blockchain is just a replacement tech