Bitcoin: The Market Drops, Mixed Signals Everywhere

Warning: My analysis today starts off with a bit of a rant on the overall market. If you're just interested in technical analysis, feel free to skip down to the black bitcoin logo.

Let me start by reassuring you that I'll always be 100% honest with my audience. I decided to start posting crypto market analysis on Steemit because I couldn't believe what some of the other analysts on here were saying. Without mentioning any names, there are some who lead their audience to believe the market is going up, when the truth is they have no idea. Some play on emotions rather than giving the unbiased truth. Why? Because if someone can get you excited, you're more likely to follow and upvote them. Conversely, if someone makes you feel negative about your investment, you're more likely to just move on and find a different, more positive post.

Without mentioning names, I read one very popular Steemit analysts post yesterday that suggested bitcoin was heading to $10K. In my opinion, this was not only irresponsible, it was morally wrong. Was it possible bitcoin was going to hit $10K? Sure...but NOT probable. It was just as possible, if not more so, that bitcoin was going to drop. They new it and still played on their followers emotions.

As I said, the dirty little secret is, positive crypto analysis drives more followers and more votes. Honest analysis, that may be negative at times, is less likely to result in an upvote ...and some on Steemit have no problem exploiting this. Personally, I don't want votes if I have to lie or tell half truths to get them. With that said, please know I'll never, EVER, tell you less than the whole story.

Technical analysis is never 100%, but it can usually give us a general guide as to which path a given asset might take. Let me be the first to admit the crypto market in these past few weeks has been extremely challenging to predict. I think I've been very clear about that. I've been saying for weeks that the market's been putting out many mixed signals...and I don't just mean technically.

When trying to predict any asset, a good analyst will look at 4 different kinds of analysis.

- Technical Analysis (a given asset's chart trends, elliot wave, historical behavior, etc)

- Fundamental analysis (a given company's team, product, supply/demand, finances, etc)

- Qualitative Analysis (surveys, market sentiment, emotional responses, etc)

- Macro/Micro Analysis (an overall economy's health, who will invest, who won't invest, govt regulations, etc)

When I say the market is sending mixed signals, what do I mean?

-Technically: We can see positive and negative signs all throughout the charts as I've been pointing out for weeks. There are logical paths in either direction that both make sense. Due to the market being so young, we don't have big historical samplings to take. We don't know how the crypto market reacts in different situations yet because it hasn't been tested for any substantial amount of time.

-Fundamentally: We're seeing more advances this year by top crypto companies than we did last year by a long shot. New partnerships, technological innovations like lightening network, EOS and others preparing to launch their main-net, etc. Nearly every reputable crypto company has advanced greatly in 2018. The technology is moving at record pace. If this was all you saw, you'd think prices would be skyrocketing...but prices are dropping.

-Qualitative: You've got many people excited, but hesitant to put more money in the market because they got burned during the drop from $20K. Others still think crypto is a scam. They want to see it used consistently in the real world before they're sold. Then you've got people like Warren Buffet spreading FUD all over the media. Emotions are scattered.

Micro/Maco Analysis: This is where the biggest negative is found. Crypto is obviously a global market. Some nations economies are doing well while others aren't. The US is not the center of the world, but it does have a big impact on the global market. Right now the US economy is doing very well, but regulatory uncertainty is preventing new money from entering the market. Crypto needs new money to grow. Hopefully the SEC will get their stuff together and give us some answers so the market can move forward.

You can see predicting the crypto market right now is much more complicated than almost any other asset class. I just wanted to give you a little insight into why the market is behaving the way it is at the moment. With that said, let's get onto my technical analysis for bitcoin.

Technical Analysis:

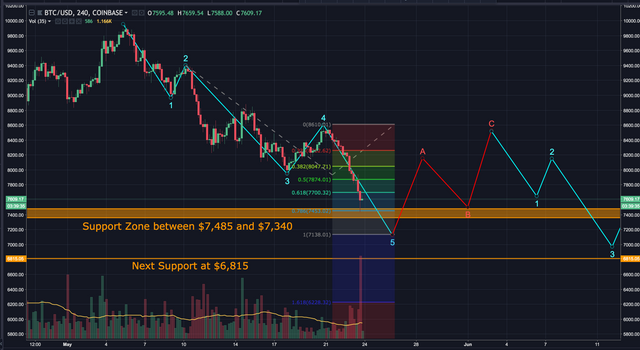

My bullish count was invalidated yesterday. My bearish count could still be valid, however, the drop to below $7,500 has lowered the probability of that being accurate. I can see about 10 possible counts that may be valid...but I've narrowed it down to 3 that I believe are the most likely.

The first I eluded to yesterday. It's called a WXYXZ pattern. This pattern connects 3 ABC corrective waves, separated by 2 failed impulse waves (denoted by X). While this is temporarily bearish, the overall pattern is bullish. If this count is correct, it may look like this:

The second count is bearish. It has bitcoin completing 5 waves down. The target for wave 5 would be approximately $7,135. If this count is correct, it may play out like this:

The third and final scenario is bullish. It has bitcoin completing it's WXY pattern with an ABCDE correction. In this case, Bitcoin would currently be completing wave E. There's a descent level of support between $7,485 and $7,340. If this count is correct, I'd expect wave E to bounce somewhere in that support zone and start an impulse wave up. This is NOT my primary count, but it is a possibility. Here's how it may play out:

Looking at the 4 hour RSI, it's very oversold. It hasn't looked this weak since mid January.

The 1 hour RSI is also fairly oversold. This suggests we may see a rise in price, at least temporarily.

The 4 hour MACD is remaining within the wedge we've been watching. Remember as it gets closer to the apex, a major breakout up OR down becomes likely.

The 8, 21 and 55 day EMA's are remaining in the bearish order we've discussed (8 bottom, 21 mid, 55 top). They're also fanning out, which denotes weakness in the market. We can also see the price has dropped way below the 8 day EMA.

If you're unfamiliar with how to use EMA's, reference my post on the topic here: https://steemit.com/cryptocurrency/@workin2005/simple-effective-strategy-to-buying-and-selling-market-trends

Finally, looking at the 4 hour chart, we can see the bollinger bands are stretched extremely tight. If you're unfamiliar, bollinger bands are volatility bands placed above and below a moving average. The bands automatically widen when volatility increases and narrow when volatility decreases. They typically give you an idea where the support and resistance zones are located. Like a rubber band, they usually can only be stretched so far before the price gets pushed back towards the center. Either the price is going to rise, or the bollinger bands will readjust. Depending on which one happens, it may be telling for the overall trend. If the price gets pushed back up, the market may be bottoming out. If the bands readjust, we may be in for another drop.

BIAS:

Short Term: Neutral to Bearish

Longterm: Very Bullish

I hope this has been helpful. I’d be happy to answer any questions in the comment section below. Thanks for stopping by.

If you found this post informative, please:

Disclaimer: I am NOT a financial advisor and this is NOT financial advice. Please always do your own research and invest responsibly. Technical analysis is simply a guide. It doesn’t predict the future. Anyone that claims they know exactly what’s going to happen is foolish, lying or both. Technical Analysis should only be used as a tool to help make better decisions. If you enter a trade, I recommend having a stop loss and sticking to it. You will loose at times. The key is to have more wins than losses. With that in mind, I wish you great success.

If you don’t have an account on Binance, I STRONGLY recommend getting one. They’re usually the first to get reputable coins, have excellent security and second to none customer service. You can sign up here free of charge: https://www.binance.com/?ref=16878853

The Market High Drops.

Wow, really honestly wrote. Like everyone else, we know this "popular steemit crypto steemian" and I really appreciate you being upfront about the facts. I've only been in crypto for about a year, but I wish the stuff you wrote gained as much popularity as.. other cryptos TAs and prevented me from investing foolishly, but as you said, giving bad news might give you as many upvotes, but you definitely earned mine sir!

Thanks @austinponten. I appreciate the kind words.

By June 4th, the other popular Steemit analyst will be taking his crypto analysis off of Steemit to a subscription based program, leaving you as the sole credible analyst that I've run across on this site. I applaud your wisdom and straightforward 'call it as you see it' approach. Your analysis goes into much more depth, covering multiple scenarios, which gives the reader the likely range of outcomes. And you state your bias, thanks for that too. I agree everything you've said here. I noticed EOS broke out of the doldrums this morning, with their mainnet launch out one week. Do cover that if you would, my favorite holding. Most excellent analysis.

Thanks my friend. My girlfriend is having a minor procedure today, so I'm with her at the hospital. Will try to post analysis on BTC and EOS if I can.

Very well said @workin2005.

Good analysis, as ever. I have to say, I expected the drop below 8k, because of the cboe futures expiration and now I read the news that the US Department of Justice will be investigating crypto market manipulation. If they somehow come to the conclusion that the market isn't manipulated then I'l be very surprised, because it seems so obvious to me. I'm not sure where the lower support level is at the moment (7,1, 7,2?), but Bitcoin must respect this, otherwise we'll have no market structure. If we get down there, I think we'll see more big money pumped into Bitcoin again, as we did on April 12th, but hopefully this won't prove to be another pump and dump. I've read that large sell orders will be waiting at around the 9,7 mark. We both agree that regulatory measures are very much needed and long overdue.

Thanks @sandwichbill. The investigation into market manipulation is also long overdue as is the regulatory framework. There seems to be descent support around $7K.