Ethereum Co-Founder: “Wall Street Will Pump Trillions of USD into Crypto”

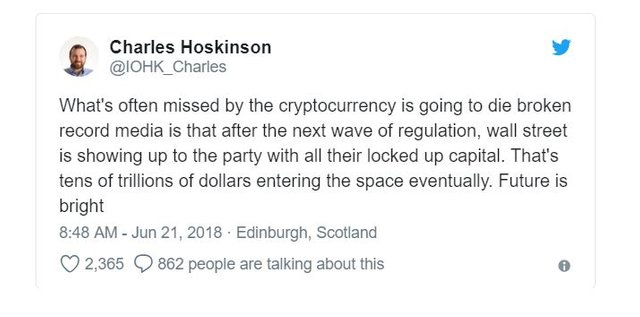

Charles Hoskinson, co-founder of Ethereum and founder of Cardano, said on Twitter that critics would overlook the massive number of institutional investors waiting to pour their money into cryptocurrency.

According to Hoskinson, Wall Street is ready to invest “tens of trillions” of dollars after the “next wave of regulation.”

The statement is so remarkable in my view, because Charles Hoskinson is usually not known to publish bullish statements on the cryptocurrency market and its price evolution.

Hoskinson, the founder of IOHK and Cardano, is known for putting technology’s evolution and the benefits it brings to humanity to the forefront. In this respect, the statement from my point of view is quite exceptional and worth all the more.

Wall Street is waiting

Over the past few weeks was reported that many of Wall Street’s big players are waiting to enter the crypto currency market, pumping large amounts of institutional money into the marketplace.

The largest stock exchange in the US, the Nasdaq led a few weeks ago from that Bitcoin and Ethereum could soon be traded on the Nasdaq.

Coinbase and Coinbase Custody are working with the SEC to develop a service to store cryptocurrencies to the highest security standards. In addition, Coinbase Prime has created an environment that is specifically tailored to the needs of institutional investors.

With the hardware wallet manufacturer Ledger, as well as Nomura and Global Advisors, three well-known companies have come together to develop a stock exchange called Komainu, which is only approved for both large investors and institutional investors.

In London, at the end of May, a new crypt currency exchange LMAX Digital was launched, which is only accessible to institutional investors. On this platform, established cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Ripple and Bitcoin Cash should be tradable.

As Charles Hoskinson notes, Wall Street is literally waiting to “pump tens of thousands of trillions” of dollars into the crypto market after the “next wave of regulation”. At present, cryptocurrencies represent only a small fraction of the world’s assets at around $ 250 billion, while other assets hold trillions of dollars.

Would you like to learn more about cryptocurrencies and always find out about the latest cryptoNews, latest ICOs & the most profitable Top Coins? Then CLICK HERE, FOLLOW ME and don't forget to Upvote article!

Marko Vidrih

Image via shutterstock